Hi Everyone,

Considering the serious threat that Covid-19 poses to our physical health as well as our social, financial and economic health, I am putting together a series of posts that will investigate the impact this virus is having and will likely to have in the short, medium, and long run. I am not a medical doctor or a scientist. I am an economist. I will be using my economics background to analyse the expected impact this virus will have on our lives. This series of posts will cover the following.

- Identifying the threat

- The fragility of the world we live in

- Impact on prices and quantity of goods and services in absence of Government Intervention

- Actions taken or could be taken by Governments

- Possible Impact of Government intervention on the economy

- The social costs of Covid-19 and responses to it

- Winners and losers from the outbreak

- The road ahead (positive vs. negative scenarios) and what we could learn

In Part 8 of this series, I will take a look at what could happen to society and the economy after the Covid-19 pandemic. There are several possibly scenarios. The scenarios many countries are heading towards appear quite grime. However, these scenarios do not necessarily need to play out. If we can learn why societies and economies are so vulnerable and what can be done to make these economies more resilient, we could soon become better off.

The path many economies are heading down

In part 7 of this series, I discussed the groups of people and businesses I believed would benefit from the Covid-19 pandemic. Those that benefit the most from the pandemic are most likely to have the most influence over shaping the economy after the pandemic. Unfortunately, those that can be expected to benefit the most are likely to cause more harm than good.

More Government control

As discussed in Part 7, Governments have gained greater control over their countries during the pandemic. It is unlikely that countries will give up all of the additional control and power they have obtained. Technology used for surveillance during the pandemic such as mobile applications and drones will be used for crime prevention and anti-terrorism. I would expect that tracking and tracing will continue but at the discretion of authorities and agencies for reasons, they probably would not openly disclosure.

Another concern and possible outcome of Covid-19 is mandatory vaccinations. Work towards developing a vaccine was one of the first steps taken to combat Covid-19. It is also likely that not all the Covid-19 measures will be relaxed until after a vaccine is available to the public. If that is the case, the vaccine could become mandatory by law for all people or all people within particular age groups. It is also possible that workplaces will require all employees to have vaccines before they can return to normal working conditions. The vaccine could become mandatory for people travelling to particular countries. Whatever the case, the most likely outcome is that many people will be given the Covid-19 vaccine even if they do not want it.

Governments can be expected to gain more control in regards to laws and regulations but are likely to lose control in regards to ownership of assets and factors of production. Comprehensive financial responses will put many Governments into substantial debt. Governments will struggle to make interest payments on this debt. A likely response will be sale of Government assets and privatisation of industries. This is likely to result in formerly owned Government sectors becoming dominated by a few large businesses.

Domination of markets by large businesses

Large businesses have several key advantages over smaller businesses that give them a significantly better chance of surviving the Covid-19 pandemic; Part 7 explains this further. An economy dominated by a few large businesses will result in less competition and businesses will be able to influence the market price for their goods and services. Therefore, businesses can set higher prices and obtain higher profits.

Large businesses have some advantages that could be passed on to the consumers. Large-scale production can lead to economies of scale, which will lower costs, which could then lead to lower prices. Profits can lead to increased investment, which could also lead to lower costs. However, any reduction in cost would only be passed onto consumers to increase profit. If the lower prices enables businesses to address different consumer groups in the same market, it is possible there will be an increase in price discrimination.

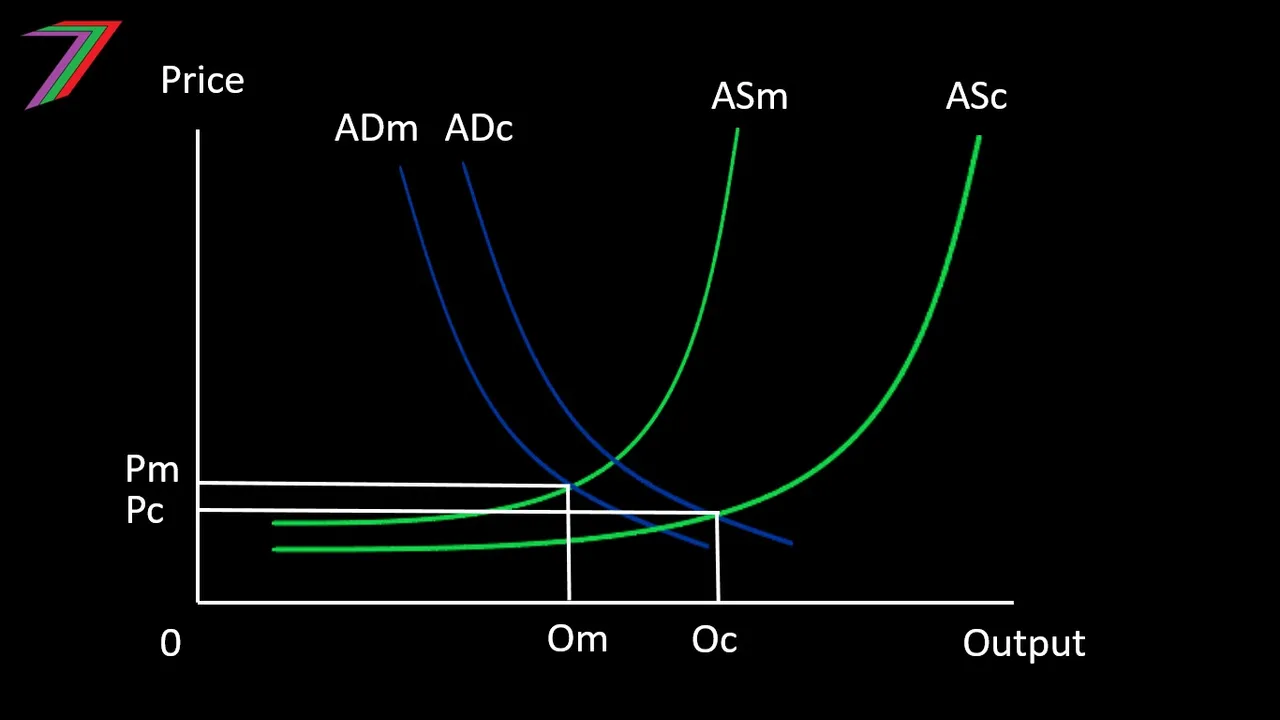

The most likely outcome is that reduced competition will lead to higher prices, lower quantities, and reduced capacity. It is also likely that less jobs will be created, thus pushing down wages. Lower wages will lead to lower demand, which will further reduce quantity produced. Figure 1 compares an economy where businesses have more monopoly power with an economy that has more competition.

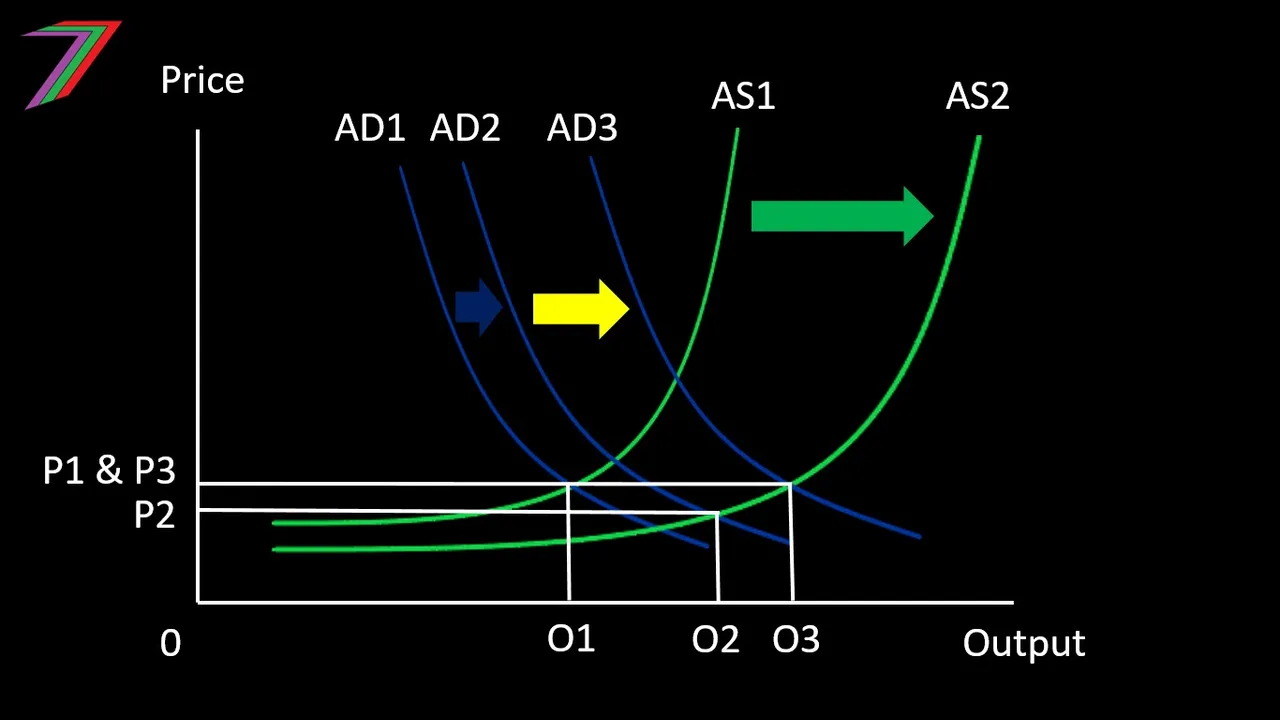

Figure 1: Monopoly Power vs. Competition (Macroeconomic view)

Note: AD-AS models have been used to explain macroeconomic impacts, see Part 5 for an explanation of the AD-AS model.

Where: ADm, ASm, Pm, and Om are demand, supply, price and output respectively in an economy where businesses have more monopoly power. ADc, ASc, Pc, and Oc are demand, supply, price and output respectively respectively in an economy where there is significant competition between businesses.

Will large businesses be able to hold onto their newly acquired market dominance? This will depend on the extent of barriers to entry. A few examples of barriers to entry are as follows:

- High initial capital outlay

- Legal barriers such as patents and copyrights

- Supply chain relationships

- Control over strategic assets

- Economies of scale

- Access to technology

- Predatory pricing

Formerly competitive markets should be more likely to see the emergence of new businesses as small businesses have previously managed to overcome the barriers to entry. It is also possible that after Covid-19, barriers to entry could be raised. This could be initiated by existing businesses through control of the supply chains or predatory pricing. The Government could place legal restrictions and requirements that make it difficult for small businesses to start, especially if these restrictions raise start-up costs. Many countries are likely to experience inflation from increasing money supply, this will further add to the costs of entry.

Hyperinflation

If Covid-19 financial support and relief is funded primarily by increasing the money supply, there is a high chance of high inflation once the demand for goods and services starts to increase. The extent of inflation will depend on several factors; these factors include:

- The extent of spare capacity in the economy

- Elasticity of aggregate demand

- Elasticity of aggregate supply

- The ability of supply to recover after Covid-19

- Interest rates

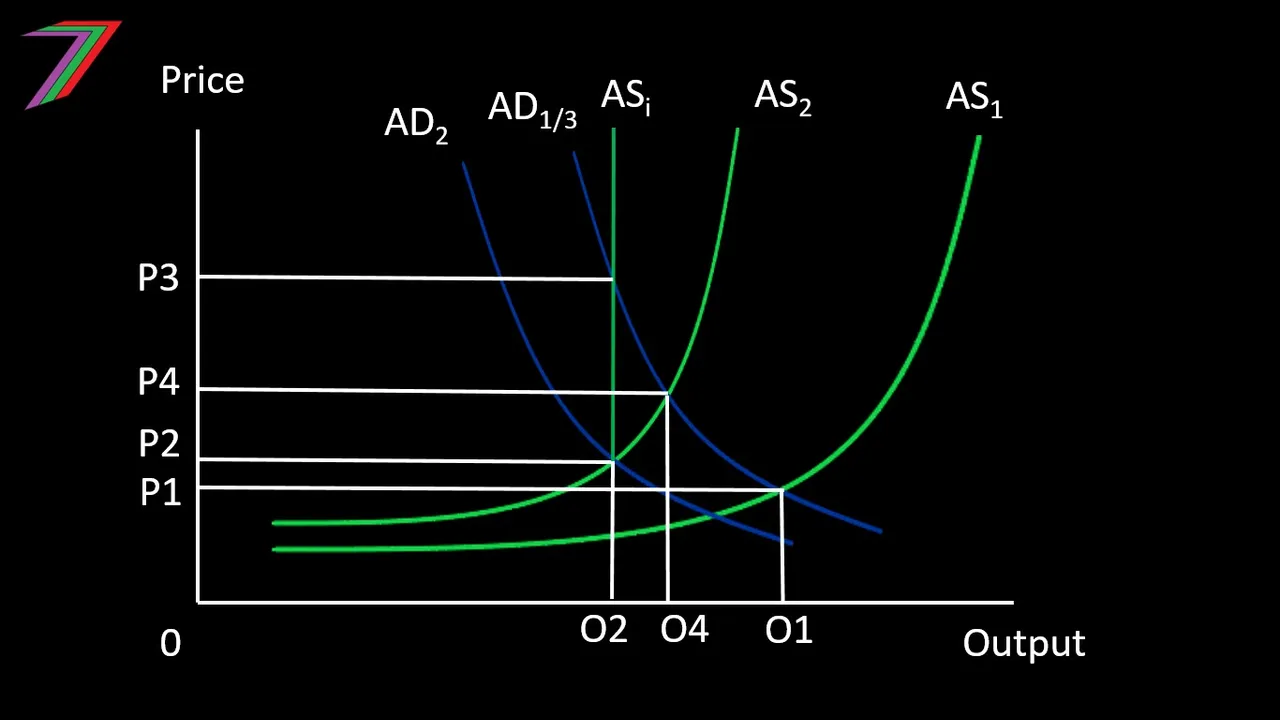

A worst-case scenario for inflation would be inelastic demand and supply, an economy with almost no spare capacity, very low interest rates, and a large percentage of businesses failing. Figure 2 describes a worst-case scenario.

Worst-case scenario for inflation from increased money supply

Prior to the Covid-19 pandemic, price is P1 and output is O1. As a result of Covid-19, demand falls from AD1 to AD2 and supply falls from AS1 to AS2. Output decreases to O2 and price increases to P2. Money supply is greatly increased; therefore, demand increases but supply does not and is initially unresponsive (i.e. ASi). Therefore, output remains at O2 but price increases to P3. Eventually, supply can partly respond to the increased demand but many businesses remain closed for good. Output increases to O4 and prices decreases to P4. Reduced demand for the currency in foreign exchange markets could further add to inflation.

Slave to debt and work

Covid-19 pandemic can be expected to increase private debt. Some countries are offering support in terms of loans. These loans will be expected to be paid back with interest. This will mean that many people will be living on tight budgets and more people will be living from paycheck-to-paycheck. It will be very difficult for people to save for the future or have reserves when their flow of income has been reduced or stopped. If support is given in terms of grants, there will not be the problem of repaying loans but it is likely repayments will come in the form of increased taxes. Higher taxes could have a similar effect of reducing the ability to save.

Many economies, because they are frail and vulnerable, are being greatly affected by Covid-19 and the measures used to combat it. Increased debt or increased taxes to repay debt will make the economy even more vulnerable to events and shocks such as Covid-19.

An alternative path that could be possible

Covid-19 is causing great hardship. The path many economies and societies are heading towards is likely to bring even more hardship for many years to come. This does not have to be the outcome. We can learn from what has happened so that society and the economy can be more resilient in the future.

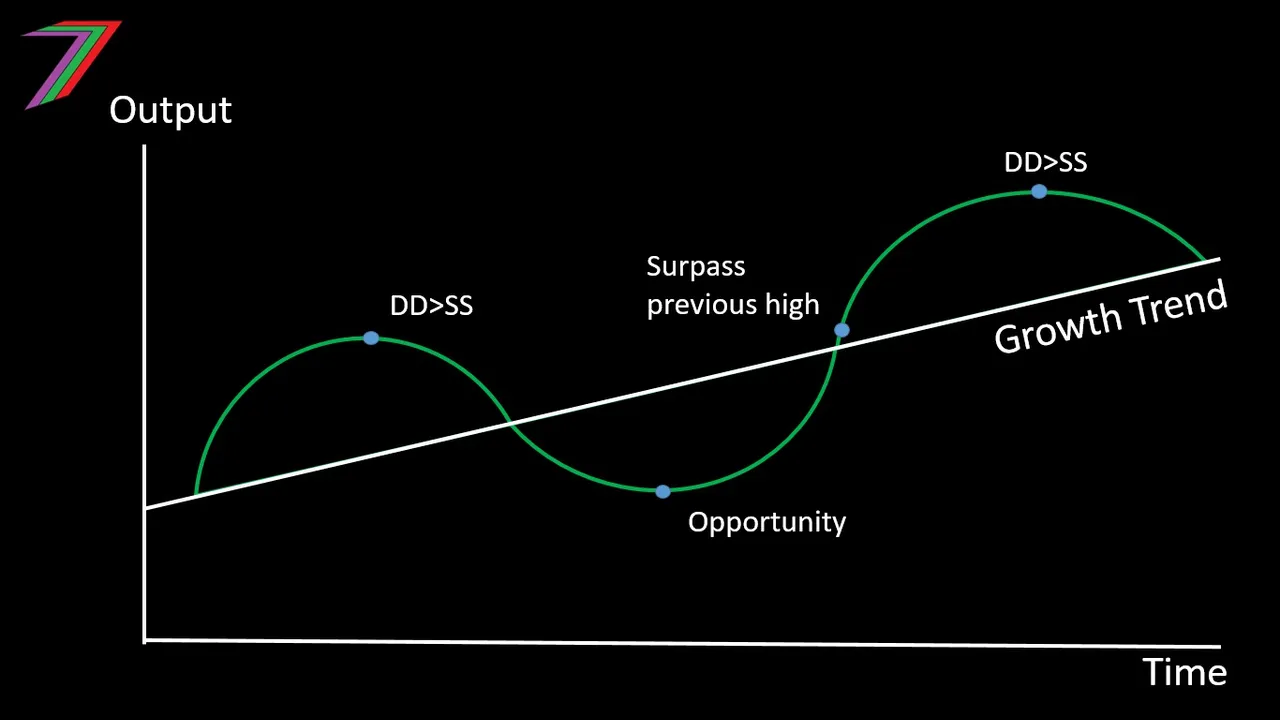

Reduce Government intervention

I believe Government intervention is one of the main the reasons that economies are vulnerable. Greatly reduced Government intervention would eventually increase the resilience of the economy. The natural business cycle would perform automatic corrections when needed. Figure 3 contains an example of how the economy's business cycle would operate in the absence of excessive Government intervention.

Figure 3: Business Cycle

If demand increases faster than supply, price will increase. The increase in price will reduce the quantity demanded for goods and services. This will cause output to fall, unemployment to increase and prices to fall. Lower prices creates opportunities to invest and thus creates employment. Increased employment increases demand but not price as the economy has spare capacity. Output will surpass the previous high and continue increasing until supply struggles to meet demand. This will cause inflation and the cycle begins again.

Reserve currency (US Dollar to cryptocurrency)

Arguably, there is a need for a global reserve currency. It performs several functions.

- It acts as a yardstick for which all other currencies can be compared against.

- It is used to price goods sold internationally in a single currency.

- It facilities trade between countries offering a single trading currency.

- It can be used to peg currencies in order to maintain their value.

- It can be used to value and pay international debts.

The US Dollar is currently the global reserve currency. There are several problems with using the US Dollar as the reserve currency. The US Dollar is a fiat currency; it is backed by nothing more than faith. A reserve currency should be backed by something of value such as gold. The supply of the US Dollar can be increased at will. This dilutes the value of reserves held in US Dollars by other countries. Having the US Dollar as the reserve currency gives the USA a big advantage over other countries as the demand the for US Dollars will always remain high as other countries will always need reserves of an alternative currency. If the USA continues to use Quantitative Easing to stimulate their economy, the US Dollar will become an unreliable and volatile reserve currency.

The above problems would apply to almost all other national currencies. The reserve currency should be a currency that does not belong to any particular nation. The supply of this currency should not be controlled by any particular agency or organisation. The currency should offer stability so that the market can determine the price of goods and services without distortions from price fluctuations of the reserve currency.

Many cryptocurrencies could offer the above accept for stability. Small market caps is the main reason cryptocurrencies fluctuate in price. This has led to further fluctuations because of market speculation. Bitcoin has a market cap of about US$140 Billion (Coingecko, accessed 27/04/2020) The US Dollar has an M2 (M2 contains circulates notes and coins as well as bank deposits) circulation of over US$16 Trillion (Trading Economics, accessed on 27/04/2020). Bitcoin has a market cap of less than 1% of the value of the M2 circulation of US Dollars. If bitcoin became the reserve currency, it would become considerably more stable as the market cap would be much larger.

Change the perpetual motion economy

In Part 2, I identified the requirement for the economy to be in perpetual motion as a major source of vulnerability. The system is not designed to be put on pause. This would not necessarily be the case, if the economic system contained far more slack. This would require people to hold more savings and businesses to have spare capacity so that they can increase output when needed without experiencing significantly higher costs. Figure 4 contains an example of an economy with spare capacity.

Figure 4: Economy with spare capacity

For this type of economy to function, it would require an increase in both technology and efficiency. Increased efficiency will enable workers to produce more output per an hour of work. The increased efficiency should enable people to work less hours while still increasing the output produced (i.e. O1 to O2). People would receive higher incomes and demand would increase but by a lesser extent than the capacity to increase output. This would cause deflation (i.e. P1 to P2). This deflation could be eliminated by increasing the money supply in line with increased capacity. The increased money supply could be used to fund provision of public goods and services.

This type of transformation would be difficult in a materialistic world. People are likely to continue working the same number of hours or even more hours in an attempt to increase their income. This would increase competition for work, thus forcing wages down. Lower wages would force more people to work more hours to maintain their level of income, thus lowering wages even further. Lower wages provides businesses with less incentive to invest in technology and improve worker efficiency. This would decrease the opportunity to increase wages in the future.

Blockchain economy

The existing economic systems are failing. A blockchain economy could be the solution. Government intervention has caused more damage than good to the economy and society. However, the economy cannot fully function based purely on market forces. There would likely be market failure and some goods and services would not be produced. Goods and services that cause negative externalities would be over produced and good and services that cause positive externalities would be under produced. The blockchain economy could fill that gap.

A country could replace their national fiat currency with a decentralised cryptocurrency. The citizens of the country, instead of a centralised Government body, could determine the distribution of newly created coins. The blockchain economy would work into the idea of creating an alternative to the perpetual motion economy. Using the blockchain as a national decision-making tool and allocator of resources would require a sophisticated plan in order for it to be implemented and operationalised effectively.

Final Thoughts

The Covid-19 pandemic and the measures taken to combat it, will greatly affect the economy and society for years to come. The period immediately following the pandemic can be expected to be difficult. Those that stand to gain from the pandemic are also those that have contributed greatly to the vulnerability of the economy and society. It is likely that even after we see some sort of recovery, the economy and society will be even more vulnerable than it was before the pandemic. We could see more Government authority, more debt, more markets dominated by large businesses, and higher inflation.

On a more positive note, the collapse of the economy could provide opportunities for a fresh start. The collapse highlights many of the flaws with the existing system. These flaws and the problems they have exacerbated should provide impetus to provide an alternative system. I believe we need an economic system that has considerably less Government intervention, more small businesses and entrepreneurs, a move away from materialism towards quality of life, and a greater role for blockchain solutions and cryptocurrency in the economy.

This brings me to the end of this eight part Covid-19 series. I have covered the areas that I believe to be most important based on the information I had at the time of writing these posts. The Covid-19 pandemic is far from over, the full implications and their magnitude is still unknown. Economic analysis can provide a hint of what could happen if certain actions are taken. I intended this series to help offer some insight into the economic and social circumstances we are likely to face because of the pandemic and all other actions relating to the pandemic.

More posts

If you want to read any of my other posts, you can click on the links below. These links will lead you to posts containing my collection of works. These posts will be updated frequently.

Future of Social Media