Hi Everyone,

Considering the serious threat that Covid-19 poses to our physical health as well as our social, financial and economic health, I am putting together a series of posts that will investigate the impact this virus is having and will likely to have in the short, medium, and long run. I am not a medical doctor or a scientist. I am an economist. I will be using my economics background to analyse the expected impact this virus will have on our lives. This series of posts will cover the following.

- Identifying the threat

- The fragility of the world we live in

- Impact on prices and quantity of goods and services in absence of Government Intervention

- Actions taken or could be taken by Governments

- Possible Impact of Government intervention on the economy

- The social costs of Covid-19 and responses to it

- Winners and losers from the outbreak

- The road ahead (positive vs. negative scenarios) and what we could learn

In Part 4 of this series, I will be looking at how Government intervention could attempt to address the economic problems created by the Covid-19 pandemic and the responses taken to address the pandemic.

What are the economic problems?

Most of the economic problems are being caused by the response to Covid-19 rather than Covid-19 itself. A typical response to Covid-19 has been social distancing. Social distancing for many countries involves some or all of the following measures.

- Forced closure of shops and businesses not selling essential items.

- Banning events that involve some form of gathering.

- Forced confinement of people to their homes.

- Imposed social distancing of 2 metres between employees of businesses that still operate.

- Greater restrictions on travel in and to other countries.

- Requirement of additional equipment such as masks, gloves, googles and gowns for some businesses.

As discussed in Part 3 of this series, these measures affect both demand and supply. Demand and supply affect price and quantity of goods and services sold. Any sudden changes in demand and supply can create problems. A sudden increase in demand can lead to shortages and/or an increase in price. A sudden decrease in demand can lead to lost revenue, which could lead to some firms reducing production and other firms to close permanently. A sudden decrease in supply can lead to shortages and/or increase in price. A sudden increase in supply can lead to a decrease in price and possibly a reduction of revenue for existing firms and the creation of more monopoly power for larger firms that may have initiated the price reduction.

For most goods and services, the response to Covid-19 will create an initial sudden reduction in both demand and supply. Several factors will determine the extent and duration of the change in demand and supply as well as how long it will take for demand and supply to return or close to return to levels prior to Covid-19. Part 2 of this series elaborates on these factors.

What types of economic problems will the responses to Covid-19 create? Typically, in economics, one effect leads to another, which leads to another. The responses to Covid-19 could lead to the following chains of events.

- Reduced demand reduces revenue for businesses

- Restrictions such as forced closures reduces revenue for businesses

- Inefficiency in production caused by restrictions leads to increased costs and lower profit margins.

- Reducing capacity to reduce costs leads to increased unemployment.

- For some businesses, loss of revenue and increased cost could lead to permanent closures.

- Permanent closures leads to even more unemployment.

- Increased unemployment leads to lower income.

- Increased unemployment could have an effect on wealth and resource distribution.

- Lower income will reduce tax revenue.

- Lower tax revenue will reduce the Government’s ability to spend and pay existing interest on debts.

- Increased unemployment will increase Government expenditure on unemployment benefits, thus further reducing expenditure in other areas.

- Lower Government expenditure could lead to lower quality Government services and neglect of infrastructure.

- Difficulty to repay interest could negatively affected a countries credit rating and ability to borrow.

- Lower income could lead to some people not meeting rental or mortgage payments on homes, which could lead to eviction or repossession of homes.

- A default higher rate on home loans could lead to a crash in the housing market.

- Lower income from unemployment may lead to social unrest and social problems.

- Addressing social problems caused from unemployment will put further pressure on Government resources.

- As income continues to fall, so will demand for goods and services.

- Lower demand for goods could lead to more firms going out of business and more unemployment and the downward spiral continues.

This chain of events is a grim scenario, which does not even include the additional chaos that could be caused in financial markets if the Covid-19 pandemic persists. For developed countries, events could be far worse and even result in famine. Considering that many countries are likely to be heading towards a very negative chain of events, Governments will intervene to attempt to prevent these events from panning out or at least mitigate the impact of them. At the time of writing this post, many countries have initiated stimulus and financial relief and support packages.

What can the Government do?

There are several strategies a Government can adopt to attempt to reduce the economic impact of the response to Covid-19. These strategies will vary depending on the duration of the implemented Covid-19 responses. The following are some of the strategies a Government could apply in attempt to ease the economic impact.

- Apply a less stringent and less costly response to the virus.

- Do nothing to address the economic impact.

- Target businesses that are most likely to fail.

- Target people most that are most financially vulnerable.

- Target small businesses and low earning self-employed.

- Target businesses most affected by the virus and implemented measures.

- Offer a broad stimulus package to all businesses.

- Offer a broad stimulus package to all residents or citizens.

- Provide full bailouts to businesses considered ‘too big to fail’.

- Provide universal basic income.

- Combination of some of the above

Applying a less stringent response to the virus might be effective at reducing the economic costs if the less stringent response is effective. If the less stringent response were considerably less effective than the stringent response, we would be faced with both a higher death toll and a higher economic cost. The higher economic cost would be caused by the return to the stringent measures, which would be required to remain in place longer than they were previously.

Doing nothing is an option. The absence of Government intervention would initially lead to great economic hardship to many. All of the previous Government interventions, which have stretched the natural business cycle to prevent recessions, would magnify the extent of this hardship. However, the market should eventually be able to correct itself. The most resilient businesses would survive by being able to adapt and innovate to reduce costs in this new environment. Doing nothing would be incredibly unpopular because of the initial hardship. This hardship is likely to create many offer problems such as more crime, more suicides, more stress related illness, and a considerable drop in standard of living. Any Government adopting a ‘do nothing’ strategy is unlikely to be re-elected. Therefore, I do not think any Government will willingly adopt a ‘do nothing’ strategy.

The Government could target businesses most likely to fail. This strategy would reduce the number of businesses failing. This approach would require criteria to determine, which businesses are most likely to fail and the extent of support to be offered. Having criteria could raise questions regarding the fairness of support offered. Businesses that are not helped are likely to struggle especially if the pandemic persists; this could result in an increase in unemployment. After the pandemic, some of these businesses could rehire the workers they released. The extent of the cost of this strategy will be determined by the duration of the pandemic and the criteria put in place.

The Government could target people who are the most financially vulnerable. This strategy could be effective at preventing people from falling into abject poverty. This approach would apply to low income people and families, low earning self-employed workers and some charities. This approach, by itself, would create minimal stimulus to the economy. Many businesses are still likely to fail. Many others are likely to downsize. Unemployment is still likely to increase. The market will be required to recover by itself.

The Government could target low earning self-employed people and small businesses. These groups of people often provide valuable services and are profitable under normal circumstances. However, they do not have large reserves of money to weather a prolonged period with minimal revenue. This form of targeting involves minimal involvement in the broader system. This approach, by itself, would create minimal stimulus to the economy. Many of the medium and large businesses are likely to struggle, which could lead to higher unemployment.

The Government could target businesses most affected by the virus and implemented measures. This would involve helping a wide range of businesses that have greatly reduced earning capacity or increased costs of operation. This strategy could be considered fairer than just helping businesses with a high risk of failure. This approach would also require criteria to determine, which businesses have been most affected and the extent of support to be offered. Drawing a cut-off point could be difficult. In the medium and long run, this approach could become expensive, as the list of businesses meeting the set out criteria is likely to increase if the pandemic measures are still not relaxed.

A broad stimulus package to all businesses regardless of the how each business is affected by the pandemic and measures would be relatively easy to administer. However, substantial support for all businesses will become very expensive very quickly. An alternative approach would be to provide small possibly, one off payments to all businesses. However, smaller payments may not be sufficient for businesses to maintain their level of operation and some businesses will still be forced to close. Unemployment is likely to increase and the Government may struggle to support them.

A broad stimulus package could be focused on people rather than businesses. All residents or families could be given a sum of money. The money will help those financially vulnerable to survive. Those that are less vulnerable could use the money to stimulate the economy and this additional demand could help some businesses survive. A key problem with this strategy is how much money should be given. Too little will not make a difference and too much will not be sustainable if the pandemic continues. This strategy might not prevent many firms going out of business, as they will not be supported directly. However, this strategy interferes less with the functioning of markets than business orientated stimulus packages. It is also likely that larger businesses will be more likely to survive because of their resources rather than their efficiency. A post pandemic world could become more dominated by larger businesses.

There are several businesses often referred to as ‘too big to fail’. These could include large banks, large automobile companies, large oil companies, large airlines, large manufacturing companies, large cruise lines, and leisure and entertainment companies (Yahoo Finance). Some experts believe the failure of these companies would be disastrous for the economy. These companies are considered embedded in the economic system. Failure could cause the system to collapse around them (Investopia). Governments support for these companies could prevent this economic catastrophe. Supporting these very large companies will be very expensive. This will result in less money being available for those that need it the most. Designating companies or industries as being 'too big to fail' creates complacency and moral hazard. Moral hazard occurs when businesses are not held responsible for their actions, as they are guaranteed support when things go wrong or when they make bad decisions. The extent and duration of the economic cost of ‘too big to fail’ companies failing is debatable. Several academics have argued against the idea of ‘too big to fail’; see papers from Imad Moosa and David Tarr.

Providing universal basic income is another approach that could be adopted to support all people during the pandemic and beyond. Unlike, the other approaches discussed, universal basic income would be a long-term plan that would continue beyond the pandemic and even the recovery period. Universal basic income would ease the hardship of harsh economic downturns. However, it would not help struggling businesses survive nor would it provide incentive for businesses to not layoff workers. Universal basic income would also require some form of permanent sustainable funding.

It is possible that a combination of strategies could be used. These strategies could be used simultaneous or at different stages of the pandemic. It is possible the strategies could change with the level of pandemic responses and measures. When stricter measures are implemented, the support provided by the Government could be more extensive than when some measures have been lifted.

Loans versus grants

Government support can come in the form of loans or grants. Loans require the people or businesses supported during the pandemic to eventually pay back the money they have been loaned. Normally, the loan repayment will require the payment of interest. Therefore, being supported now comes at a price in the future. Loans are likely to prolong the financial strain on those helped long after the pandemic ends. This approach could lead to businesses failing later rather now. Grants do not require repayment. Therefore, once the pandemic is over, people and businesses supported during the pandemic will not be put under any additional financial pressure and will be able to use their resources to rebuild. The financial support granted will still need to be recovered, this could lead to either increasing taxes or reducing other Government expenditure.

Tax breaks and other payment holidays

Governments could provide businesses and individuals with tax breaks and deferrals on other payments. Tax breaks should be relatively easy to administer, as they are direct payments to Government. Other payment deferrals would be more complicated as these are likely to be payments to private individuals or companies. Tax breaks will offer only minimal relief to businesses with low profits and low-income earners. Deferral of other payments will come as some relief but Government will need to pay on behalf of businesses and individuals. This will add further to their expenditure.

Expansionary monetary policy

I have not included expansionary policy as a Government response as for many countries, Governments do not control monetary policy. Instead, monetary policy is controlled by the Central Bank. Expansionary monetary policy is intended to stimulate the economy by lowering interest rates by lowering the cash rate by increasing the money supply. The lower interest rates, reduces the cost of borrowing and therefore could stimulate investment, which will help the economy recover. In the case of Covid-19, lowering interest rates will not help. The economic slowdown has been caused by the restrictions and not a lack of investment. Business response to monetary policy are typically lagged and therefore any impact would be felt much later. However, the lower interest rate could help firms repay Covid-19 loans, if that is one of the Government’s chosen strategies. For many countries, interest rates are very low, further reductions will most likely have little impact on investment. Investment is more likely to respond to perceived opportunity rather than lower cost of borrowing.

What if the pandemic ends soon, is Government intervention needed?

Even if the social distancing lasts for a short time, some people will experience some economic hardship if they are no longer being paid; this is because many people are living from paycheck to paycheck. Even a short period with no or greatly reduced pay will pose a problem. This group are likely to consist of those forced to take leave without pay, self-employed, contract and gig workers. There are several ways the Government can help these workers. The Government could pay the workers directly a percentage of the money they would be earning; the United Kingdom Government are offering to pay up to 80% of workers’ salaries (BBC). Alternatively, the Government could offer grants to employers to keep staff employed and continue to pay them during the period of closure. Workers that have already been laid-off could apply for unemployment benefits.

Funding Government Intervention

Whatever intervention the Government puts in place, it will need to be funded. Ultimately, the taxpayer funds all Government expenditure. This can occur immediately by collecting taxes now or later by borrowing and paying back loans and the interest later with future taxes collected.

Increasing taxes during the pandemic is not feasible. Collecting new taxes would be time consuming and costly. There is a limit on how much could be raised as most businesses are heavily impacted by the pandemic and could not afford to pay more tax. Raising taxes or creating new taxes would be exceedingly unpopular at this time.

The next option is to borrow. Governments can borrow by issuing Government bonds or directly from international financial institutions. Raising money from issuing bonds could also be time consuming. It would likely be difficult to find buyers for these bonds during the pandemic. Issuing bonds might cover some of the stimulus packages and could be used to help businesses rebuild at the end of the pandemic. Raising money through bonds would also face less public backlash than an increase in tax. Borrowing from international financial institutions could be possible for some developing countries (World Bank).

Another option is quantitative easing or possibly quasi-quantitative easing. This approach involves the Central Bank buying Government bonds. In short, this involves increasing the money supply and injecting it directly into the economy. This is likely to be the quickest method of raising sufficient money to pay for any Government support and stimulus packages as many Central Banks are able to create money (i.e. debt) at will. Vastly increasing the money supply runs the risk of causing or increasing inflation. Inflationary pressure may not be significant during the pandemic itself but is likely to be a problem after the pandemic and could make the economic recovery difficult and prolonged. My analysis in Part 3 of this series, indicates that higher prices are likely if the pandemic continues even without an increase in money supply.

Final Thoughts

Governments could intervene in many different ways in an attempt to avert a major economic crash. Most of the strategies will require substantial funding. Many Governments do not have the money available to fund economic support directly on a large scale. It is most likely many Governments will be turning to their Central Banks to provide (print) the money needed to provide support.

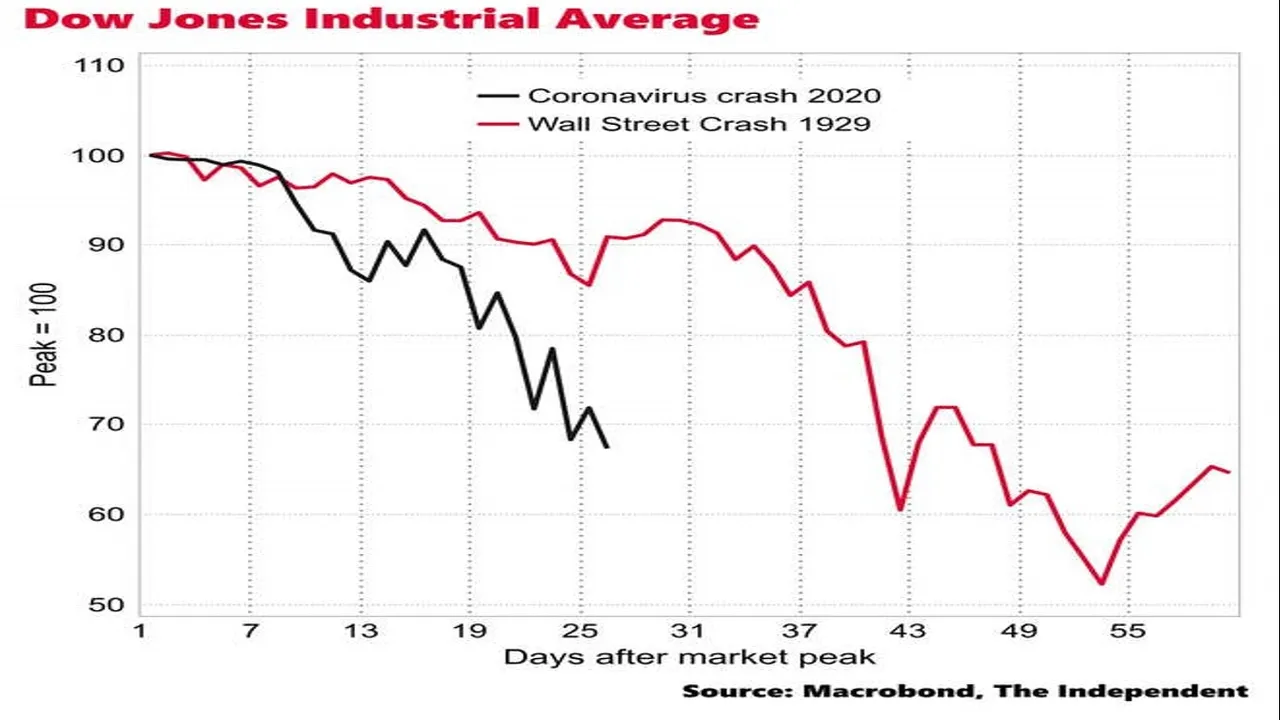

Even if large sums of money are pumped into the economy, it might not prevent the economic crash. The USA have initiated a US$2 Trillion stimulus package but are also experiencing a large increase in unemployment (Reuters). The Dow Jones Industrial Average has initially plunged faster than during the great depression of 1929 (Independent), see Figure 1.

Figure 1: Comparing Covid-19 Crash to Great Depression Crash

Source: Independent, accessed 12/04/20202

Since the report from the Independent, the Dow Jones Industrial Average has shown some sign of recovery; it has climbed over 25% from the 23 March 2020 low of 18,592, see Figure 2.

Figure 2: Down Jones Industrial Average 2020 YTD

Source: Google, accessed 12/04/2020

This could be a positive sign or it could be a dead cat bounce, which will see profit taking before another large plummet. Even during the Great Depression, the stock market had a few bounces before continuing to fall.

The stock market is not a great indicator of the performance of the economy and is subject to speculation and manipulation. In Part 5 of this series, I will explore the possible impact on the economy of some of the discussed Government intervention.

Other Relevant Content

I do not write extensively about macroeconomics, as I specialise in microeconomic theory and analysis. However, I have several posts and videos that you might find useful if you want to understand a little more about macroeconomics and the effects of Government intervention.

Macroeconomics - Fiscal Policy and Monetary Policy

Macroeconomic - Fiscal Policy and Monetary Policy Dtube Video

Trade, money, debt, waste, and power

Taxation – Dark Side of Economics #2

More posts

If you want to read any of my other posts, you can click on the links below. These links will lead you to posts containing my collection of works. These posts will be updated frequently.

Future of Social Media