Hi Everyone,

Considering the serious threat that Covid-19 poses to our physical health as well as our social, financial and economic health, I am putting together a series of posts that will investigate the impact this virus is having and will likely to have in the short, medium, and long run. I am not a medical doctor or a scientist. I am an economist. I will be using my economics background to analyse the expected impact this virus will have on our lives. This series of posts will cover the following.

- Identifying the threat

- The fragility of the world we live in

- Impact on prices and quantity of goods and services in absence of Government Intervention

- Actions taken or could be taken by Governments

- Possible Impact of Government intervention on the economy

- The social costs of Covid-19 and responses to it

- Winners and losers from the outbreak

- The road ahead (positive vs. negative scenarios) and what we could learn

In Part 7 of this series, I will be investigating the likely winners and losers from the Covid-19 pandemic and responses to combat the pandemic. So far, the focus of this series has been on costs of the pandemic and the responses to it. These costs can be expected to be high and wide spreading. This could give the impression that everyone will be worse off because of the pandemic. I believe the vast majority of people will be worse off but there will be people and businesses who will benefit from the pandemic.

Who will be the biggest losers from the Covid-19 pandemic?

I believe the following groups of people will be most negatively affected by the Covid-19 pandemic.

- The elderly

- Self-employed

- Small businesses

- Low to medium wage employees

- Small to medium sized airlines

- Tenants and landlords

- Countries that rely heavily on oil exports

The elderly have the highest health risk from the Covid-19 virus. According to Statista, Covid-19 has a fatality rate of almost 15% for people over 80 and a fatality rate of about 8% for people between the ages of 70 and 79. From these statistics, we can estimate that people over 70 are 40 times more likely to die if infected with Covid-19. These figures can be expected to be revised as more data is collected.

Many of the elderly may have high long-term financial risk as well. The Government stimulus and support packages are likely to be funded by an increase in money supply. This will cause an increase in inflation, which will erode the value of their savings. The elderly mostly do not earn additional income to compensate for this loss in income (Theodore Torda 1972).

Many self-employed and gig workers do not have large reserves of money to weather a prolonged period of shutdown. Self-employed workers do not have support from an employer. If financial support is not offered or does not reach them in time, they could be forced into poverty. They will struggle to pay for essentials such as accommodation, food, and energy. According to the World Economic Forum, almost 70% of gig workers have no income, only 23% have some form of savings and 89% are looking for new forms of income.

Small businesses, like the self-employed, often do not have large reserves of money to weather a prolonged period of shutdown. There is a high chance many small businesses, even ones that were successful during normal economic conditions, will go out of business. Some Governments may choose to support small businesses but this support could be in the form of loans that could become difficult to repay if the economic recovery is slow.

Many employees are being laid off because businesses are cutting back on staff to reduce costs or have closed down permanently. Many low-income earners are working paycheck-to-paycheck and have accumulating very little savings. People in these circumstances will greatly struggle if they do not receive additional financial support by either their employer or the Government.

The airline industry has been hit particularly hard by the Covid-19 restrictions and lockdowns. Several airlines have gone out of business before sufficient support could be offered, such airlines include Flybe, Trans States Airlines, Compass Airlines, and Virgin Australia (Business Insider). Many of the larger airlines can be expected to survive, as they are likely to receive Government support.

Tenants and private landlords could both be hit quite hard by the Covid-19 pandemic. Tenants are often low-income earners who have chosen to rent instead of buy a home; this is likely because they are unable to afford the downpayment or the repayments on a mortgage. As mentioned earlier in the post, low-income earners are likely to be hit hard by Covid-19. If tenants are unable to afford to pay their rents, private landlords could have financial difficulties if they have a mortgage on the property they are renting out. It is common for people to own several houses, which rely on rental income to cover mortgage payments. If private landlords do not have sufficient savings or not given sufficient financial support, they could lose their property to foreclosure. A high number of foreclosures could cause property markets to crash, which would negatively affect all property owners in these markets.

World oil prices have crashed (The Guardian). People in countries that heavily rely on exporting oil to support their economy could greatly suffer. These countries would include Venezuela, Russia, Brazil, Nigeria, Iraq, and Iran (Business Insider and oilprice.com). The prices of crude oil can be expected to remain low as long as demand for activities that consume oil remains low. The duration of the Covid-19 lockdowns will greatly determine how long demand for oil will remain low.

Who could benefit from Covid-19 and the responses to combat it?

The Covid-19 pandemic is having a massive impact on the world. The majority of people are suffering in some form. However, there are also some people, businesses and groups of people that stand to gain from this pandemic. I believe the following stand to gain from the Covid-19 pandemic.

- Big Pharmaceutical Companies

- Central Banks

- Governments

- Market Speculators

- Some large companies

Big Pharmaceutical Companies

A health crisis is a great opportunity for pharmaceutical companies to make a large profit. This is because there will be a significant increase in demand for pharmaceutical products such as drug treatments and vaccines.

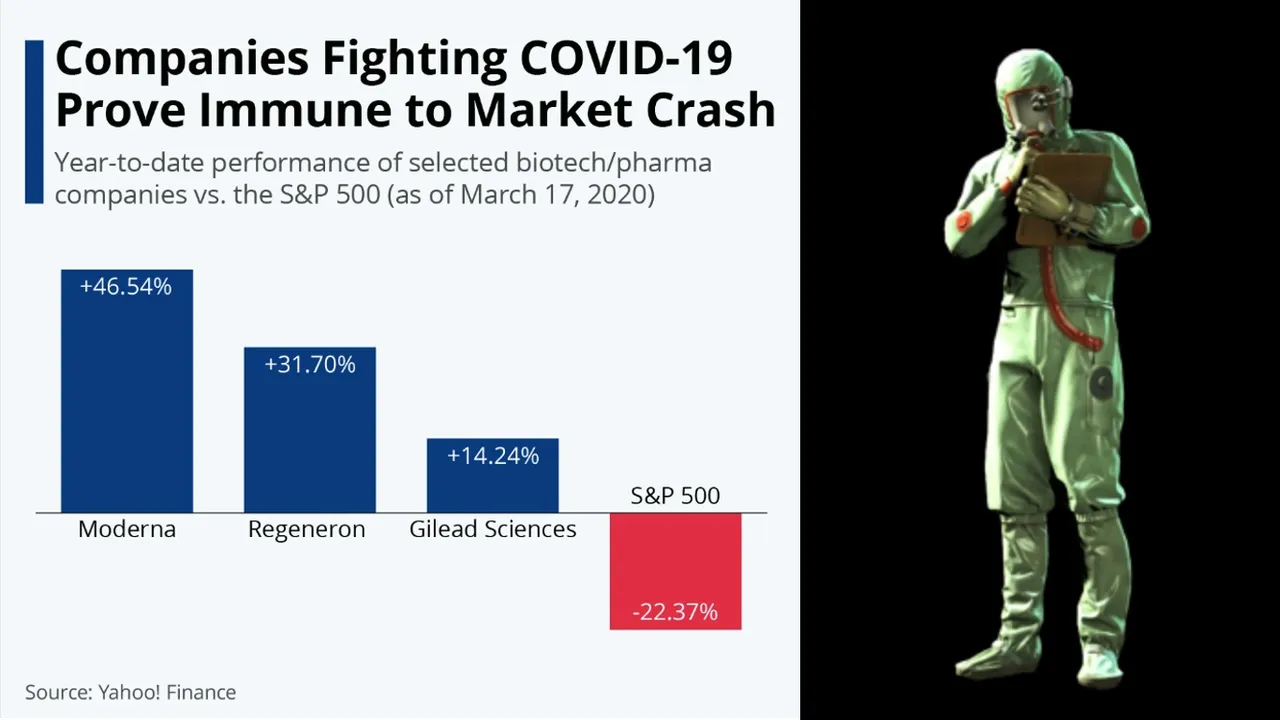

According to Drug Target Review the largest pharmaceutical companies are developing Coronavirus vaccines. An article from CNBC, reveals that the market for vaccines has grown by about 600% over the past two decades (i.e. 2000 to 2020) to about US$35 Billion in 2020. Some of the largest pharmaceutical companies that are developing vaccines experienced a jump in share price when the rest of the share market was falling sharply (Statista). Figure 1 compares the share price of 3 pharmaceutical companies to the S & P 500.

Figure 1: Big Pharma vs. S & P 500

Source: Statista

In just a few months since the beginning of the outbreak, Covid-19 vaccine trials have begun in the United Kingdom (Telegraph). An experimental vaccine could be ready by September 2020 (Telegraph). According to the History of Vaccines, a vaccine can take between 10 and 15 years to develop. The Covid-19 vaccine is being pushed through much faster. This raises the question of the side effects and the extent of the side effects from the vaccine. Pharmaceutical companies are likely to profit from the treatment of these side effects.

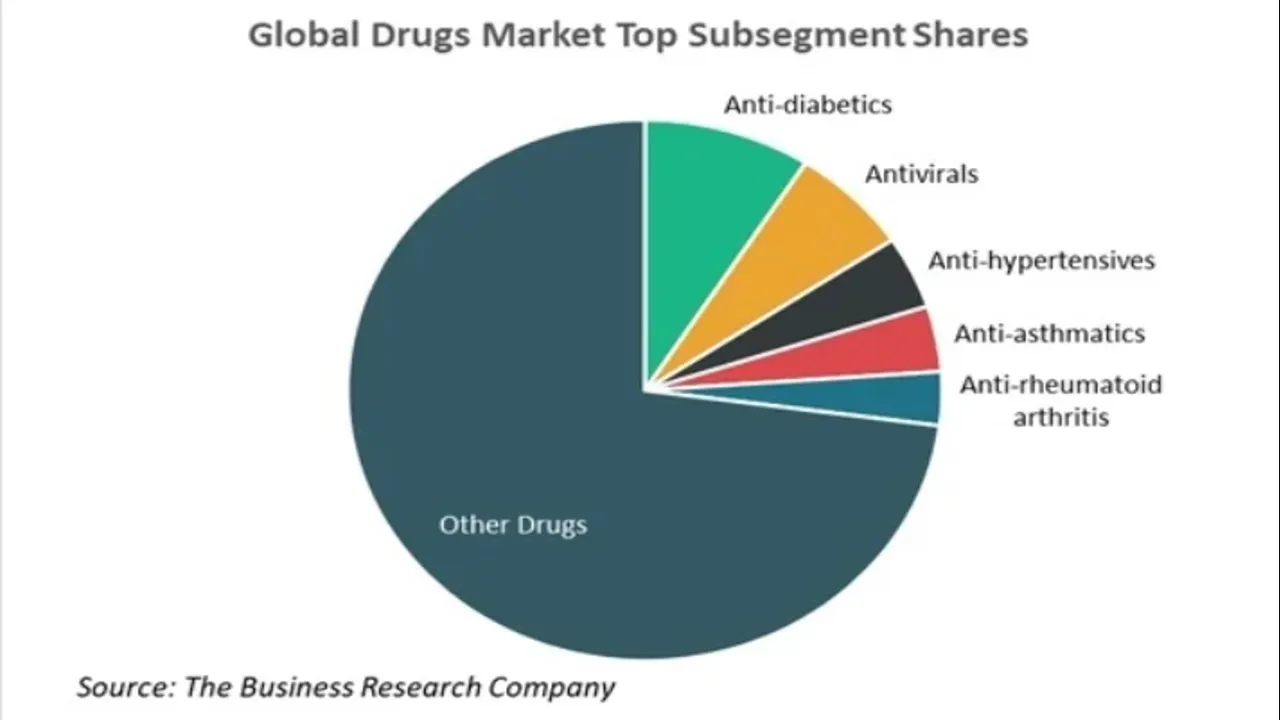

Pharmaceutical companies also profit from the sale of drug treatments. Anti-viral drugs have the second largest market share in the global drug market (Market Research); see Figure 2 below.

Figure 2: Global drug market segments

Source: Market Research

Many pharmaceutical companies are also developing anti-viral drug treatments for Covid-19. Many of these treatments are repurposed from treating other illnesses and diseases. Many of these are currently being trialled (World Economic Forum).

Central Banks

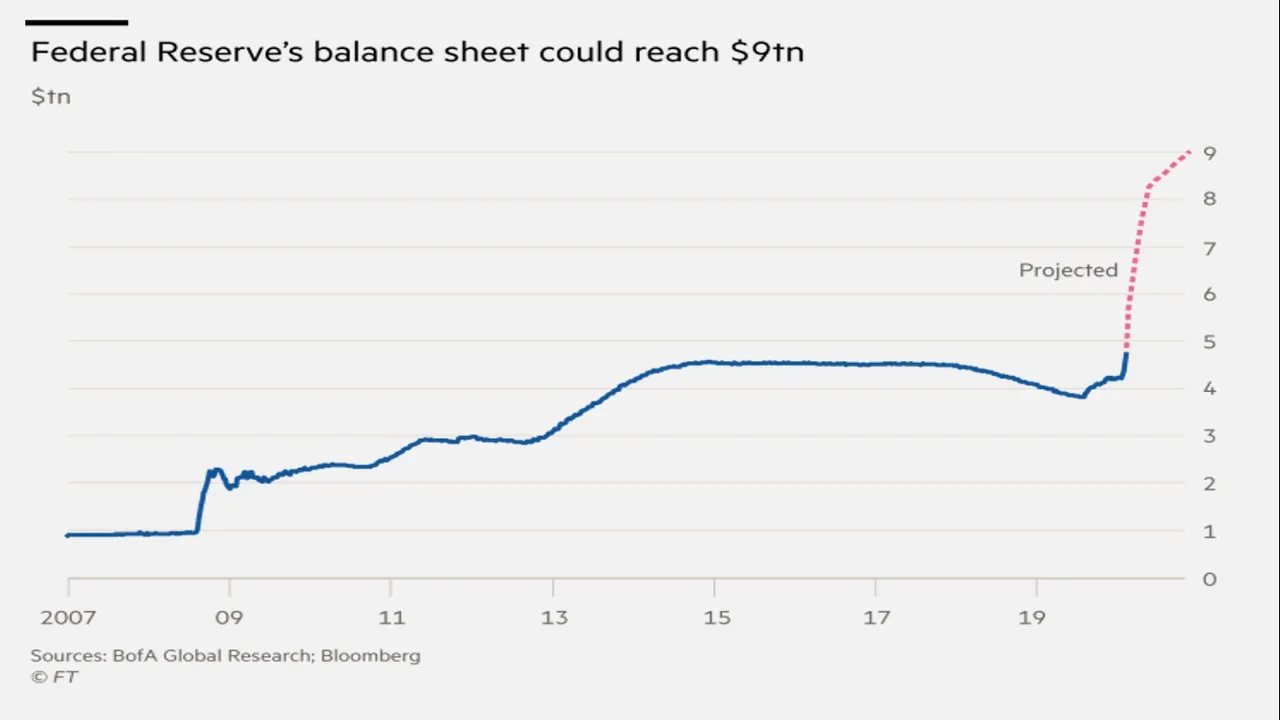

The Covid-19 pandemic lockdowns are beginning to cause economic hardship to many. Governments have responded by offering financial support to people and/or businesses. These responses are expected to require substantial funding in a very short time. Obtaining money from the Central Bank can be expected to be the main source of funding. Central Banks can create money at will and use this money to buy financial assets such as Government or corporate bonds. This will increase the total monetary value of the assets the Central Banks hold, see time series data for the Federal Reserve Balance in Figure 3.

Figure 3: US Federal Reserve Balance from 2007 to present

Source: Financial Times

Financial assets generate revenue from interest. Therefore, increasing the value of financial assets held will result in an increase in revenue earned. The revenue is then used to pay expenses, the Government Treasury, private banks for holding reserves, and shareholders in the form of dividends. Some Central Banks are owned, at least partly, by private entities. Figure 4 contains the reported percentage of profit distributed as dividends to shareholders of several Central Banks.

Figure 4: Average annual dividend payments as a share of total profit distribution, 1994-2014 (unbalanced)

Source: VOX

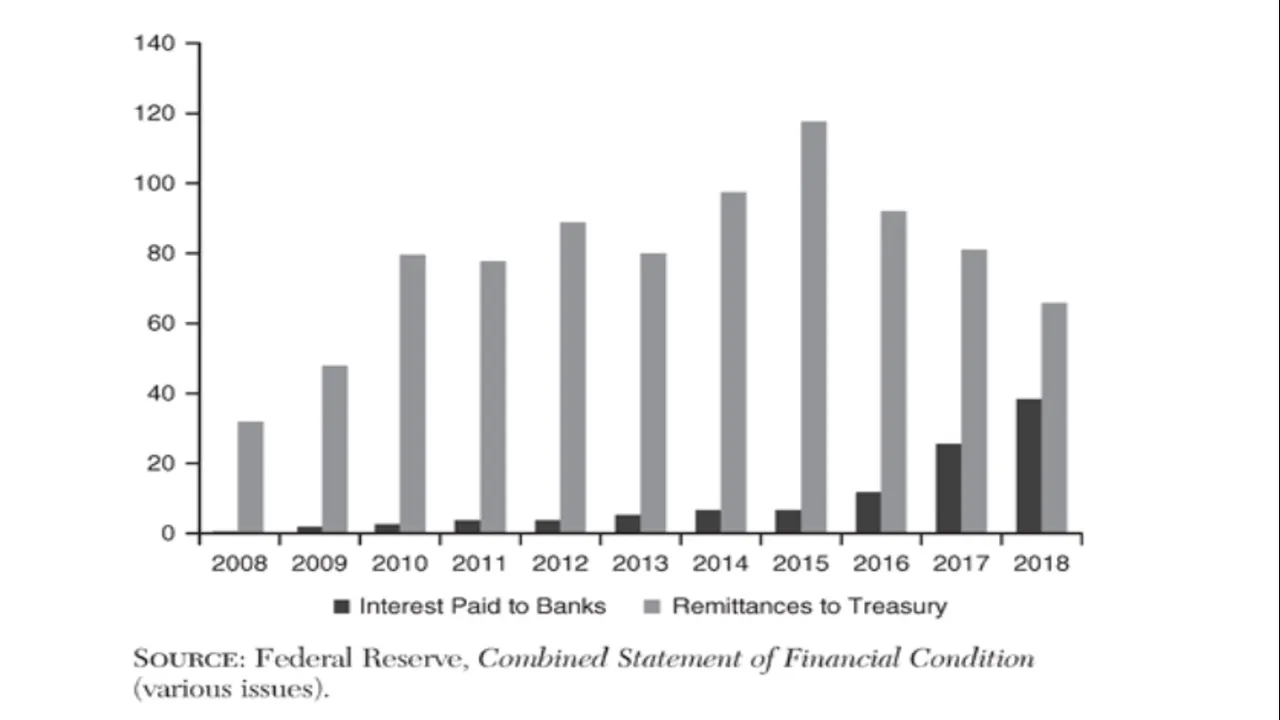

In the context of the Federal Reserve (Central Bank for the USA), since the 2008 financial crisis, interest payments to private banks has increased. The interest payments increased because of the increase in the federal discount rate and the increased reserves private banks held with the Federal Reserve caused by actions relating to Quantitative Easing. As the interest payments increased, remittances to Treasury fell; this became apparent from 2015 onwards, see Figure 5.

Figure 5: Interest payments and remittances to Treasury

Source: CATO Institute

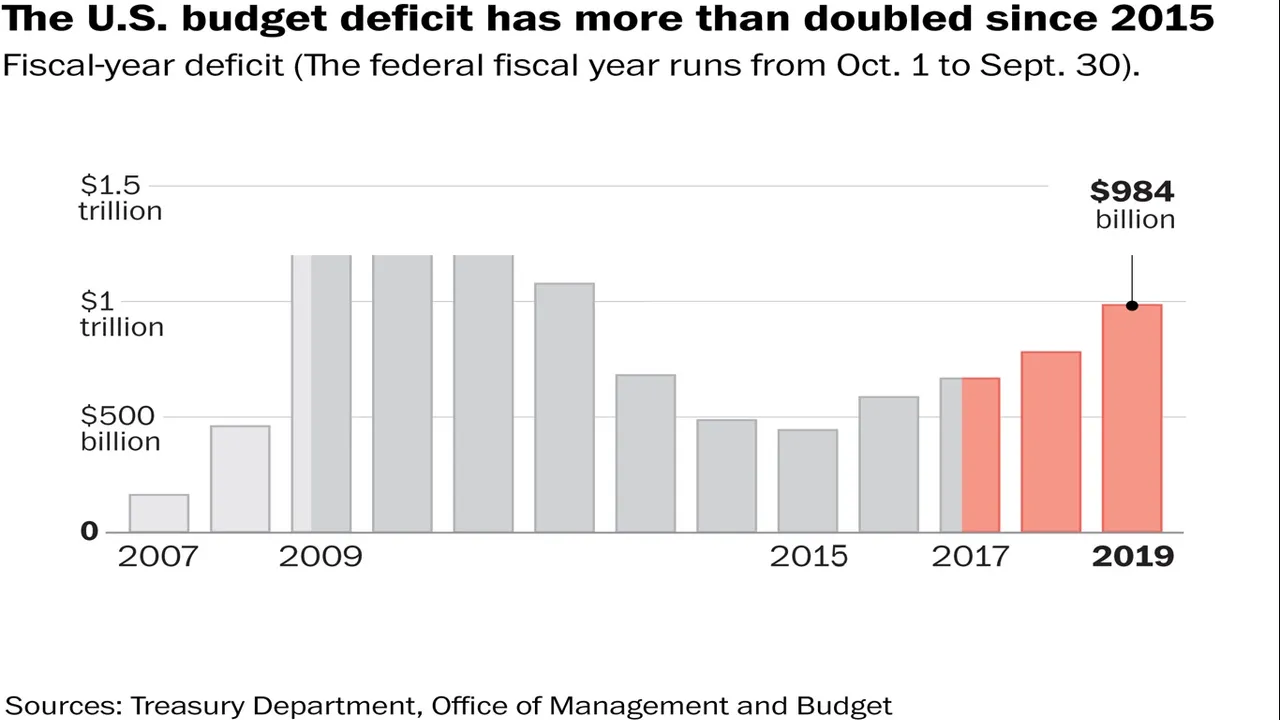

From 2015 to 2019, The US Budget deficit has more than doubled and this resulted in the debt increasing as a percentage of Gross Domestic Product (GDP). See Figure 6 for the US Budget deficit increase and Figure 7 for the increase in debt.

Figure 6: US Budget Deficit

Source: Washington Post

Figure 7: US Debt

Source: Bloomberg

The fall in the federal discount rate and increase in the value of financial assets will initially increase the value of remittance to the US Treasury. However, this will only be temporary. Once the discount rate increases, the amount paid on reserves to private banks will increase and the remittance to the US Treasury will fall again. However, the amount of debt will still be enormous and the Government will have less income to meet interest payments.

Eventually the Government will need to find ways to cover the interest payments as well as reduce the debt to a more reasonable percentage of the GDP. A highly likely outcome is the privatisation of State owned assets (Global Research).

If Central Banks hold more assets and own more Government debt, they will also have more influence over the Government. This is even more noticeable for international debt. The International Monetary Fund and the World Bank will be lending a trillion dollars or more to countries with the most vulnerable economies (IMF). These massive loans can be expected to come with conditions, which will enable the IMF to gain considerable influence over the governance of countries that have received these loans (The Guardian). These countries will also need to find a way to payback this debt plus interest.

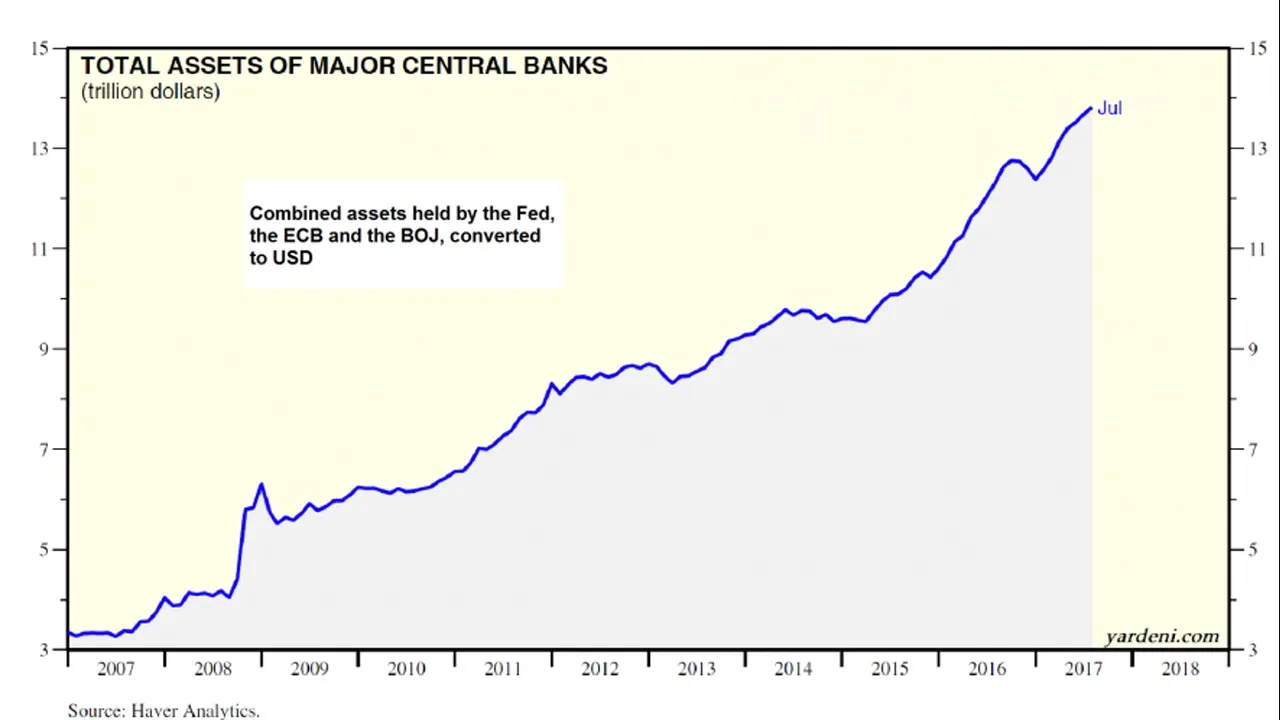

Central Banks have been consistently increasing the value of assets held for more than a decade. Figure 8 contains the combined value of assets for the Federal Reserve, Bank of Japan, and the European Central Bank.

Figure 8: Value of assets of the Federal Reserve, Bank of Japan, and the European Central Bank.

Source: SNBCHF

We can expect these numbers to explode over the course of 2020.

Government

As explained in the previous section, Governments are on the losing end in terms of wealth. However, the Governments’ loss of wealth is actually the people’s loss of wealth. Most Governments are more concerned about control and authority.

The fear of the Covid-19 pandemic has increased people’s willingness to accept increased authority from Governments. Governments have implemented new laws limiting people’s freedom with little or no debate or resistance. For example, the United Kingdom have implemented several new regulations and acts, which has given them more power over people and businesses.

Two such regulations and acts are as follows.

- Health Protection (Coronavirus, Restrictions) (England) Regulations 2020

- Coronavirus Act 2020

Health Protection (Coronavirus, Restrictions) (England) Regulations 2020 includes the following (Quick Summary)

- Requires businesses deemed non-essential to close.

- Requires people to remain in their homes unless they have a ‘reasonable excuse’ to leave home.

- Bans public gatherings of more than two people.

- Gives police authority to fine people on the spot and/or remove them forcibly if they do comply with directives.

Coronavirus Act 2020 (Quick Summary)

- If a person is deemed potentially infectious, police are authorised to direct or remove that person to a place for screening and assessment where they can be held for 48 hours.

- If a person has a confirmed case of Covid-19, they can be quarantined for up to 14 days.

- The police may use reasonable force and enter any place in exercising the powers given by the Act.

Source: Sidley

Many other countries have placed similar restrictions and laws as well as given police additional power to ensure people follow these restrictions. The pandemic could set a dangerous precedent for future Government actions.

The Covid-19 pandemic has provided Governments a reason to track and trace people’s activity and movements. Google has developed the capability to track the movement of people in 131 countries. They will release community mobility reports, which will chart movement trends to categories of locations as well as percentage changes. Google did not provide information regarding which agencies or businesses would have access to disaggregate data (Telecom TV). It is highly unlikely that surveillance by Google will stop after the pandemic, thus giving Governments potentially more control over the people.

The Covid-19 pandemic is increasing the usage of drones for monitoring and surveillance. For example in Connecticut, USA, police are testing a new drone that can monitor social distancing and if people are showing symptoms of Covid-19 such as fever or coughing (Independent). These drones could be used or adapted to collect other information about people, which would be reported to Government agencies or even private companies. It seems unlikely that funds would be pumped into these drone programs just for Covid-19 and then are terminated after the pandemic.

Market Speculators

The Covid-19 pandemic is destabilising the economy. Share prices have fluctuated wildly in March and April 2020. Rapid price changes provides speculators with great opportunities to make a quick profit.

The Dow Jones Industrial Average has had some of the largest single day losses as well as some of the largest single day gains. Figure 9 contains the Dow Jones Industrial Average for one year from April 2019 to April 2020.

Figure 9: Dow Jones Industrial Average (April 2019 to April 2020)

Source: Google, accessed 23/04/2020

The price fluctuations in recent months are noticeably larger than in the previous 10 months. Figure 10 contains the top 20 single day market gains as well as the top 20 single day market losses.

Figure 10: Top 20 single gains and single day losses (Dow Jones Industrial Average)

Source: Wikipedia

The Covid-19 pandemic has brought about 3 of the top 20 single day losses as well as 3 of the top 20 single gains in the history of the Dow Jones Industrial Average. Other countries have also experienced some wild share market price fluctuations. Figure 11 contains the Financial Time Stock Exchange (FTSE) 100.

Figure 11: Financial Time Stock Exchange (FTSE) 100 (April 2019 to April 2020)

Source: Google, accessed 23/04/2020

Some large companies

Not all businesses are going to struggle because of the Covid-19 pandemic. Businesses that operate largely online stand to profit. Amazon’s share price has increased by over 25% this year and Netflix’s share price has increased by almost 30%. Companies like Amazon and Netflix rely on direct online sales or subscriptions. Whereas, some online companies such as Google obtain revenue from online advertising, which is likely to be reduced from temporary business closures.

Large supermarkets such as Walmart and Costco have also weathered the pandemic quite well with share prices increasing by over 5%. Large supermarkets may incur some additional costs from inefficiency caused by social distancing but are still able to profit from remaining open when most other retailers are forced to close.

The companies that are labelled ‘Too big to fail’ will benefit from the pandemic even if they incur huge losses. ‘Too big to fail’ companies are likely to include large banks, large automobile companies, large oil companies, large airlines, large manufacturing companies, large cruise lines, and leisure and entertainment companies (Yahoo Finance). ‘Too big to fail’ status will result in large companies not being held accountable for making bad or high-risk decisions. This is referred to as moral hazard.

The businesses that survive the pandemic with a minimal increase in debt can be considered as winners. Many businesses, small and medium in particular, will not survive the Covid-19 economic crisis. The surviving businesses will have a good chance to flourish, as they will face less competition.

Final Thoughts

When analysing an event, it is always interesting to look at who stands to gain the most and who stands to lose the most. For a tragic event such as Covid-19, we are surrounded by news of those who have suffered. There is far less focus on those who stand to gain. However, there are always those that stand to gain even from some of the most tragic events.

Understanding who gains and why they gain from a particular event can sometimes lead us down the path to understanding why a particular event has occurred and possibly even the source of the event. If an event has been perpetrated, it is more likely to have been perpetrated by those who stand to gain rather than by those that stand to lose.

In Part 8 of this series, I will look ahead at the possible outcomes of the Covid-19 pandemic and the imminent economic crash triggered by the measures used to combat Covid-19. I believe the outcomes could vary quite considerably depending on the actions we take now and the actions we take in the near the future.

More posts

If you want to read any of my other posts, you can click on the links below. These links will lead you to posts containing my collection of works. These posts will be updated frequently.

Future of Social Media