Let's get right down to the point.

Calling Bitcoin "gold 2.0" is an insult. It's like calling artificial intelligence "Calculator 2.0" or calling a smartphone "Pager 2.0". It is a ridiculous nothing-statement forged by people trying to explain a very complicated technology to the masses, and the analogy falls flat on its face over and over again and no one seems to question it; Least of all Bitcoin maximalists.

What are the properties of gold?

Gold has already failed miserably as a currency. It's deflationary nature ensures that it will not allow for economic growth or the ability to alter value creation in a healthy way. The only way to get more is to mine it, and mining is a quite expensive and a risky business. Those who get it, tend to horde it, and this hurts money velocity and causes economic stagnation.

Likewise, Bitcoin will also fail as a currency because of its inherent deflationary nature (which is even more deflationary than gold; and out of shear delusion and greed this is celebrated). But then again I'm not here to talk about how Bitcoin and gold are similar, am I? You "mine" it using energy/hardware and it's deflationary, the similarities end there.

What was gold supposed to be?

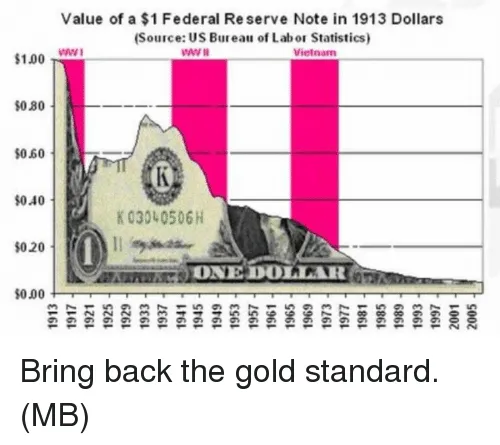

It was supposed to be the ultimate hedge against inflation.

The ultimate store of value.

How'd we do?

Meh, not terrible!

We can see that gold has retained most of its value in the past 40 years, but it is also extremely volatile and is not inversely correlated with the dollar like it should be.

When we zoom out and try to chart gold vs USD we can see pretty clearly that there are only a few good exit points for gold over decades past. Most of the time gold seems to be chronically undervalued with sporadic pumps that will bring it back to life. The derivatives market has done a great job of artificially manipulating this asset and keeping the value proposition suppressed.

Returning back to the gold standard would crash the economy instantly. We are way past the point of no return on that front. Currency can not be backed by gold because gold is deflationary, and fiat and all of the infrastructure we've built upon it depend on inflation and growth. Sorry gold bugs, not gonna happen. Sorry Bitcoin maximalists, not gonna happen.

Characteristics of money.

- Store of value.

- Medium of exchange.

- Unit of account.

Classically trained economists will tell you you'll need to pick two of these and sacrifice the third. These days gold is an okay store of value and an okay unit of account, but an extremely poor medium of exchange. We live in a digital world now, and the only way to represent gold digitally is with derivatives, and derivatives are blatantly manipulated by institutions and only a ghost representation of the original asset backed by the promise of untrustworthy institutions.

Gold is very heavy. Even when in coin form, the medium of exchange of gold is lacking. A gold coin is worth a lot of money and can not be divided into smaller gold coins. This makes the divisibility a problem. When's the last time you paid with something using gold? Like me: Probably never in your entire life. Gold coins are antiques; worth more than the gold itself.

What about Bitcoin?

Bitcoin is clearly not a store of value. Calling it that is an insult. Rather, it is a unicorn asset that solves a mathematical networking problem thought to be impossible to navigate. It is doubling in value every year quite consistently (currently worth around $23k). It doesn't store value; it generates value via network effect at an alarming rate.

The main reason why comparing Bitcoin to gold is offensive is that gold is gold and will always be gold and can never be digital. Meanwhile Bitcoin will never be physical. They exist in two completely separate realities.

Bitcoin is programable money.

So while gold is gold and will always be just gold. Bitcoin and forks of Bitcoin (the cryptoverse as a whole) can be programmed to do exactly what we tell it to do. To compare this to gold in any way is just... ridiculous. There is no comparison.

But I haven't even gotten to the ultimate argument yet. The thing that makes crypto superior to every other medium of exchange on the planet is that it is impossible to counterfeit. This is something that gold, paper, or digital fiat could EVER hope to achieve. Since the beginning of time if something was valuable, someone was going to find a way to fake it and turn a profit. You can't do that with crypto. Thousands of nodes are all maintaining the ledger simultaneously. No one's going to pull a fast one on the Bitcoin network, and if they somehow did it would be painfully obvious and transparently flawed. Shadowbankers beware! Crypto is infinitely easier to verify than any other valuable asset on the planet.

Robust Redundancy: Crypto Compliments Gold and Silver

Another ridiculous thing about this whole debacle is that calling Bitcoin Gold 2.0 implies that once Bitcoin goes mainstream, gold is going to lose all its value proposition. Again, this is ridiculous, as I have laid out in the post linked above.

If I was a crypto millionaire, I would definitely be diversifying into gold and silver. Not as an investment, but as a hedge in order to have an actual PHYSICAL asset that will retain its value. Bitcoin is an abundance technology, and it would be foolish to think that a bunch of new money libertarian/anarchist millionaires weren't going to buy gold/silver with their gains.

In fact, I maintain that so much physical gold and silver is going to be purchased within ten years that the derivatives market is going to be exposed for the fraud that it is. The emperor has no clothes: All of the physical PMs are going to be scooped up off the market, and no one is going to want that digital garbage that doesn't actually represent PMs.

How do I know this?

For the same reason you can't peg crypto to physical assets or supply chains. There is no way to securely peg a physical asset to a digital one. It requires too much trust, and that trust ultimately becomes exploited and corrupted over time. We have already reached peak corruption in this regard. People will either buy physical PMs (likely linked to crypto in some way like a Bitcoin logo minted on it) or they will buy digital crypto. A bridge between these two worlds is totally a pointless and counterproductive centralized attack vector. The idea only exists out of ignorance and our projections of the legacy economy onto crypto.

DEFI

SoV, UoA, MoE. Remember when economists claimed we could only have two of these and not all three? Well that is also becoming an antiquated statement with yield farms. It's obvious now that hyperinflationary yield farming is the solution to storing and even generating value while at the same time providing a stable base for Unit of Account measurements.

MoE

It's also extremely noteworthy that the entire cryptosphere is working together to build infrastructure that strengthens the medium of exchange variable across all tokens on the planet. For example, whenever a Bitcoin debit card emerges, that helps every token. Even though only Bitcoin can be spent on the card, it is trivially easy to turn any crypto into Bitcoin, so this infrastructure increases the value proposition in the medium of exchange department for every crypto indirectly. This is a silver sliver deck. The synergy and open source nature of crypto can be witnessed and experienced everywhere. There is no competition, and anyone who says otherwise is wrongfully projecting venture capitalism onto the space.

Conclusion

Comparing crypto to precious metals is an insult and a gross oversimplification. The Internet is not a printing-press 2.0. Precious metals will never be anything other than what they already are. Meanwhile crypto is evolving exponentially and creating systems of extreme synergy and exponential gains that can not be tamed by the legacy markets and derivatives. Bitcoin ETFs are nothing to worry about. Crypto explodes across all barriers and borders.

The value proposition of Bitcoin has nothing to do with scarcity and everything to do with security, networking, and 100% authenticity guaranteed. However when when we compare to Bitcoin to other cryptos we can easily see that the only thing BTC has over them is security and first-move advantage. At the same time, this perceived competition is an illusion, as Bitcoin's security and value proposition can only benefit the other networks in the cryptoverse.