I saw a post on the Kelly Criterion recently on Steemit and resteemed it, because by pure coincidence I was looking at the Kelly formula myself only recently. Warning, this post is a little maths heavy...

I won't go in to details as that other post by @johnleequigley1 did a really good job, but in summary the Kelly Criterion or Kelly Formula is used to find the optimal risk size for any kind of fixed odds bet, that enables you to increase your capital at the quickest optimal rate.

If you want to understand it in more detail after reading the post I resteemed, then have a look at the Wiki page (lots of maths, be warned...).

Disclaimer part - I looked into using this formula some time ago and dismissed it, as it suggested unrealistic risk levels for the systems I was trading at the time. However, I understand the logic of it and reminded myself to go back and look at it again in more detail in the future. It can be a very high risk strategy with some seriously large drawdowns (despite being a good system) so it's definitely not for the faint hearted or risk adverse. Use with caution !!!

The formula is used to calculate the maximum amount of risk you should use if you know your win probability and average risk reward ratio.

But it got me thinking, what if you already know how much you want to risk on each trade, but need to work out the optimum risk reward or win probability instead ? Well I've transposed the formula and am presenting the results below purely as fast lookup tables.

Anything outside these values you'll have to work out for yourself (I'll provide the formulas).

Ps, I've written the formulas as how they would appear in an Excel spreadsheet or similar (with brackets) that aren't necessary in standard mathematical notation.

In addition, the formulas have unusual ranges, for example if you win 65% of your trades, then the value you need to enter in the formula is 0.65, not 65. Likewise, your percentage of capital you risk on each trade is expressed as a fraction, 5% risk is entered as 0.05 in the formula.

How much capital to risk on each trade ?

If you know your percentage win rate, and also your average risk reward, then this is the formula to calculate your optimised risk percentage.

F=(P(R+1)-1)/R

Where

F = the amount of capital to risk on each trade, expressed as a fraction (0.28 equals "28%")

P = probability of your winning trades, expressed as a fraction (0.65 equals "65%" win rate)

R = the first number of your average risk reward ratio, ie 2:1="2", 5:1="5" etc.

Example, your trading system has a probability of winning 65% (0.65) of the time, and your risk reward ratio is an average of 1.5:1, and you want to calculate what fraction of your capital (F) to risk on each bet.

F=(P(R+1)-1)/R

F=(0.65+1)-1)/1.5

F=(1.65)-1)/1.5

F=0.65/1.5

F=0.433

or 43.3% of your capital (!!!)

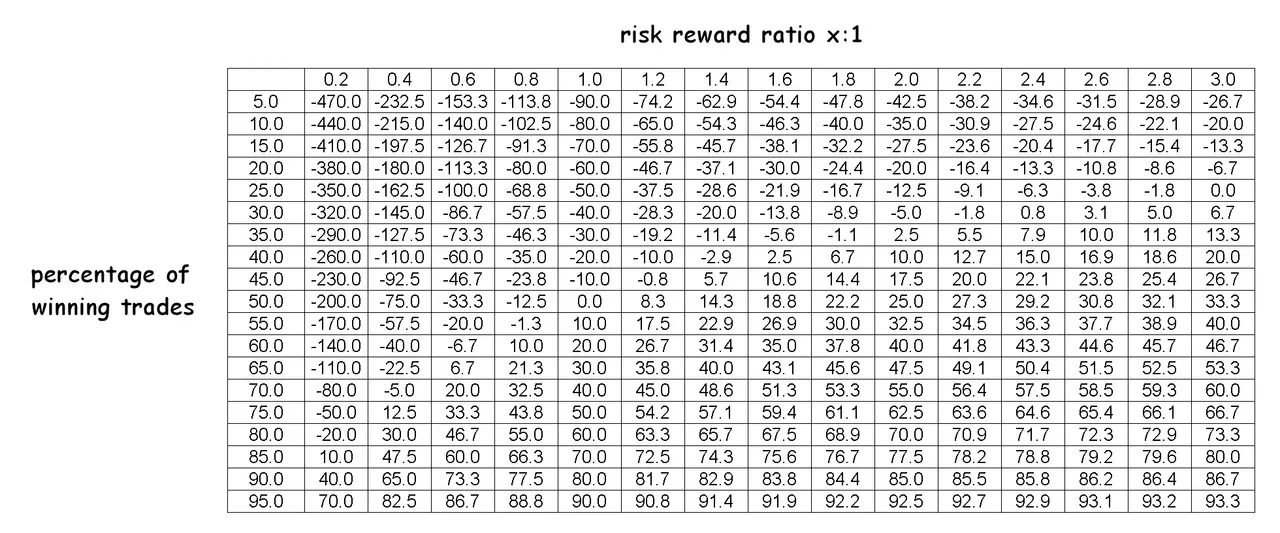

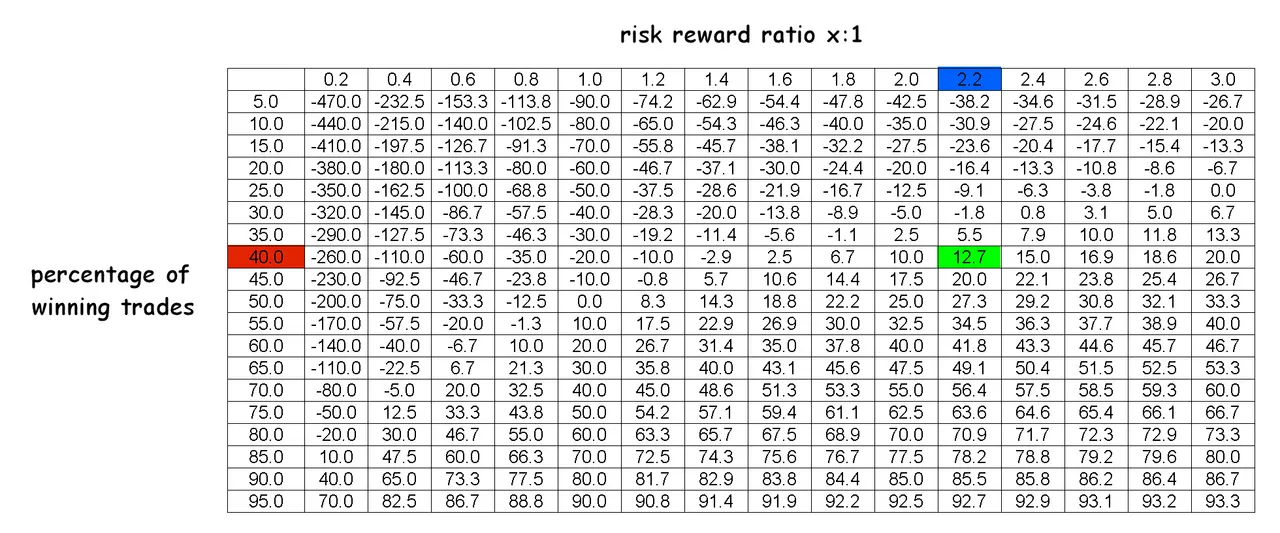

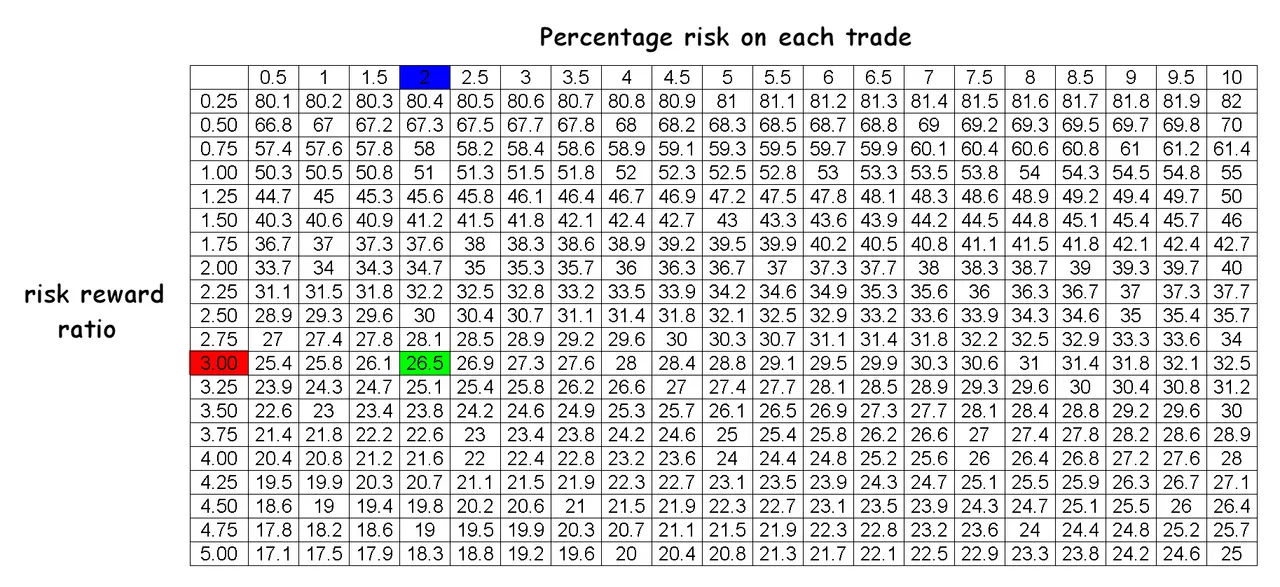

See, I told you it was scary !. Not all values are that extreme, here is the lookup table with 'nice' numbers.

So for example if your risk reward ratio is 2.2:1 (Blue) and your winning probability is 40% (Red) of your trades then according to the Kelly Criterion you should risk 12.7% (Green) of your capital on each trade. If your answer is a negative number however, your system will lose you money in the long run.

As I stated earlier, this system can have account devastating drawdowns. If you had a 95% win rate and you had a 3:1 risk to reward, then Kelly suggests risking 93.3% of your capital on a single trade ! Sure, you have a 95% chance of success, but if it's one of the 5% losing trades then your account is almost wiped out in one go...

Well, you're all grown ups (hopefully) and can make decision for yourselves, so on with the transposition part.

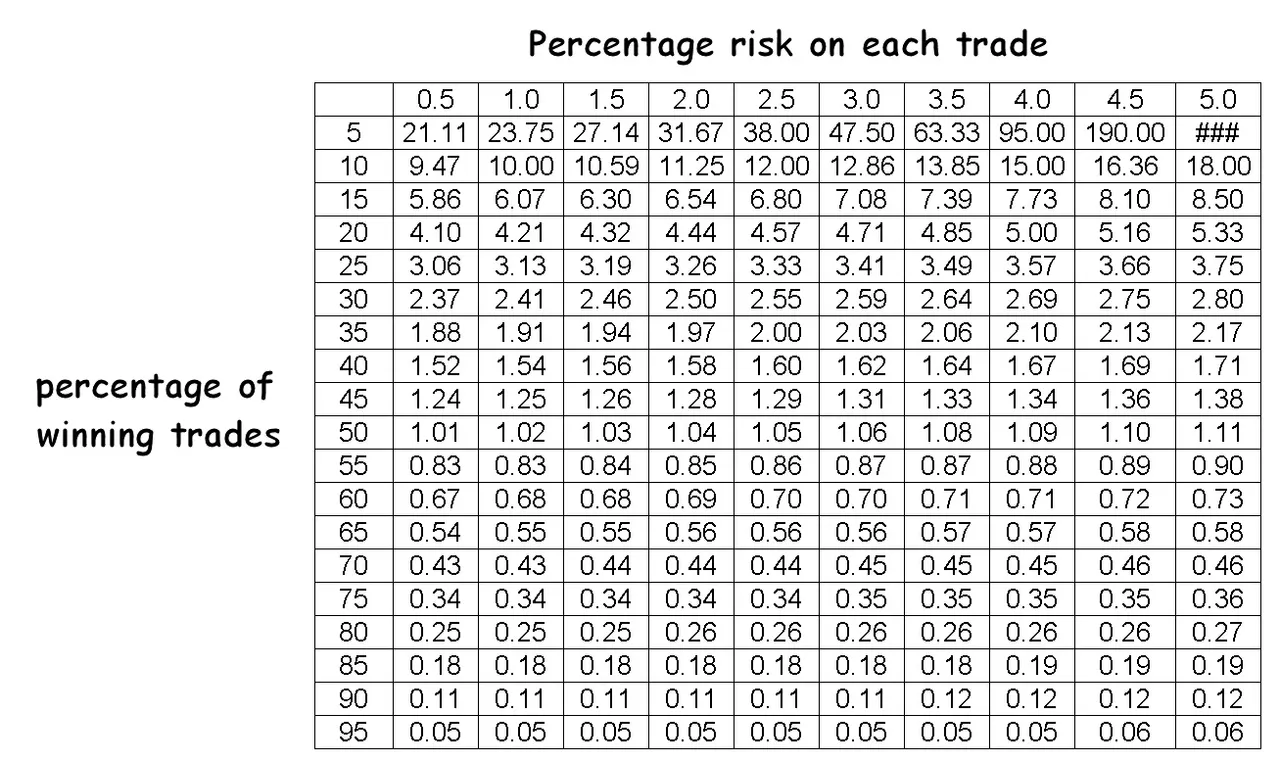

What percentage of trades do I need to win ?

Say you always risk 2% of your account on each trade (bad idea, another post sometime..) and you know that you always make 3 times what you lose, ie a R:R of 3:1, then what percentage of trades do you need to win in order to be optimal ?

The formula for that is

P=((FxR)+1)/(R+1)

where

F = the amount of capital to risk on each trade, expressed as a fraction (0.02 equals "2%")

P = probability of your winning trades, expressed as a fraction (0.65 equals "65%" win rate)

R = the first number of your average risk reward ratio, ie 2:1, 3:1, 0.5:1 etc.

From our example numbers,

P=((FxR)+1)/(R+1)

P=((0.02x3)+1)/(3+1)

P=(0.06+1)/4

P=1.06/4

P=0.265

or 26.5% win probability

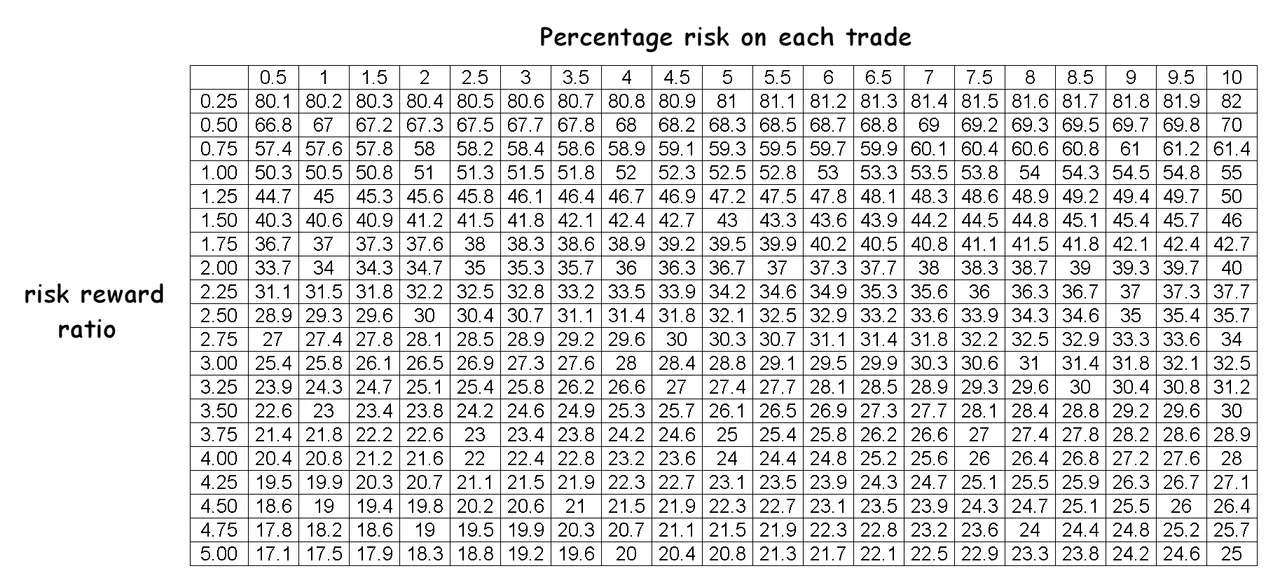

Here's the lookup table for that.

So using our numbers from before, with a 2% risk on each trade, with a 3:1 risk reward ratio, you need to be winning 26.5% of your trades.

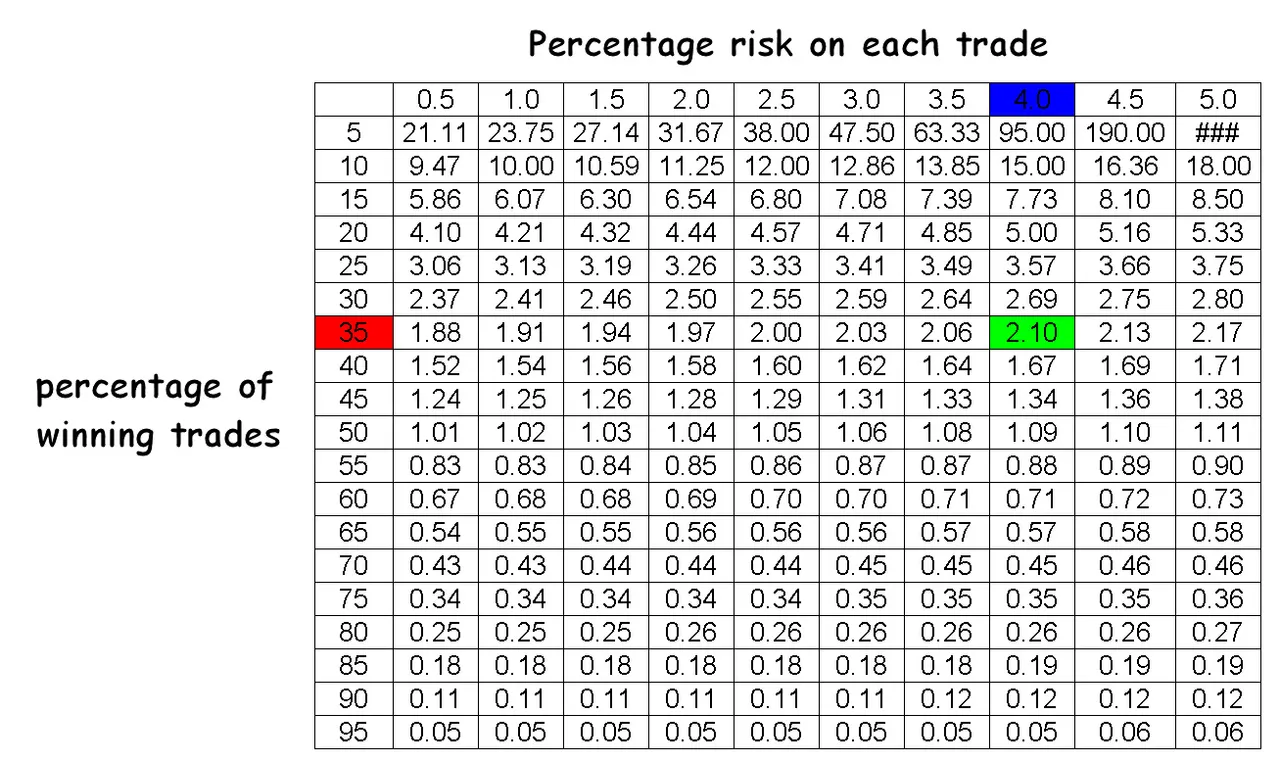

Finally, onto the last table

What risk reward ratio do I need to achieve ?

Say you like to always risk 4% of your capital on each trade, and you know that you win 35% of the time, what risk reward do you need to be optimal ?

The formula for that is

R=(P-1)/(F-P)

where

F = the amount of capital to risk on each trade, expressed as a fraction (0.04 equals "4%")

P = probability of your winning trades, expressed as a fraction (0.35 equals "35%" win rate)

R = the first number of your average risk reward ratio, ie 2:1, 3:1, 0.5:1 etc.

From our example numbers,

R=(P-1)/(F-P)

R=(0.35-1)/(0.04-0.35)

R=-0.65/-0.31

R=2.1

or 2.1:1 risk reward ratio.

Here's the lookup table for that.

and using our numbers from before, with a 4% capital risk on each trade with a 35% chance of winning, you need a minimum 2.1:1 risk reward ratio.

So that's it really. Hopefully you should have a good feel for what values 'work' around trading when using the Kelly Criterion. Bear in mind that the Kelly formulas work for all types of bets and wager, where you have a percentage of capital to risk, a risk reward ratio and a percentage chance of winning. It equally applies to casino games, poker, horse racing, football bets, anything.

I DO NOT recommend using this formula for stock trading unless you really understand maths, probability and risk management, the above information is for demonstration purposes only ! Just for fun though, look up your own trading statistics on the tables and see how far you are from optimal !

As a final note, my maths is terrible, so if in any doubt please check the formulas and correct me if I made a mistake somewhere !

Header image credit : sbo.net found via Google image search, no affiliation.

About me -

I'm a full time financial trader, mostly in Forex and Commodities. I write for fun and try to help beginner traders get started, avoiding all the mistakes that I made. I'm always happy to chat or discuss ideas so please just give me a shout in the comments !

100% of anything I earn from this post will be donated to a Steemit charity or worthy user.