Candlesticks

Candlesticks are tools used by traders to tell what is going on in the stock market. They are used for technical analysis and represent the price action in the market at a specific period of time. These tools can be used to give a trader information about the direction that the price is moving in the market or has moved in the past.

Candlesticks consist of a body and two wicks. Sometimes, candlesticks have only one wick. Other times, they have no wicks at all. There are many different candlestick patterns that give traders useful information in order to make a successful trade in the market. Of course, using candlesticks are not always 100% accurate but they are very good indicators if used correctly.

The body

The body of a candlestick is shown in the image above. As you can see there are two different candle sticks. One of them is green and the other one is red. Depending on the color of the candle stick the trader can tell if the stock price was rising in price or falling in price during a specific time period.

The green body candlestick

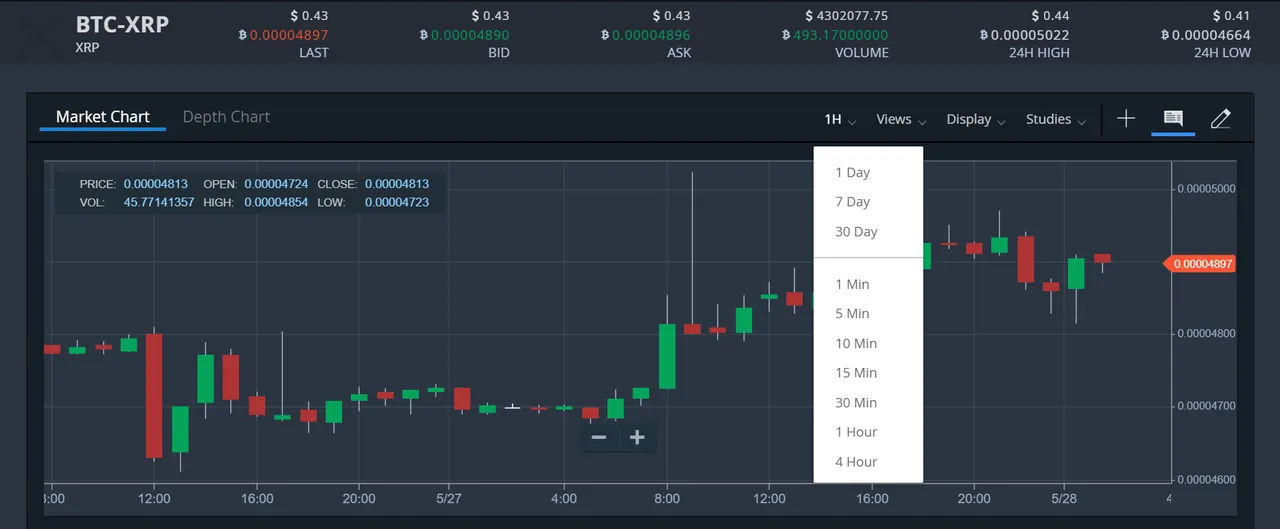

The green candlestick represents a rise in the price of a stock or cryptocurrency within a specific time period. The time period can be minuets, hours, days, months or years. If you look the candle stick chart in the header image above you will notice there is a drop-down menu that shows different time periods that can be selected. Depending on the time period selected, that time period is represented in each candle stick on a candle stick chart. For example, if you look at one candle stick in the candle stick chart in the header image above, it represents the price action of one hour.

If you look at the image above you will notice it says 'closing price' with an arrow pointing to the top of the green candlestick. That means that the closing price of the stock was in an upward position after the end of the time period. On the other hand, the bottom of the green candlestick says 'open price' with an arrow pointing to the bottom of the body. As you may have figured, that represents the price at the begging of the time period the candlestick represents.

The red body candlestick

The red candlestick represents a drop in the price of a stock or cryptocurrency within a specific time period. When a candle stick is red, that means that the market had an downtrend in price. If you notice in the image above, the arrows pointing at the top and bottom of the red candlestick have the words 'opening price' and 'closing price' but it is opposite of the green candlestick. That is because the closing stock price ended at a lower downward trend in market price in the time period.

The Wicks

The wicks of the candlestick are also known as shadows or tails. The wicks tell the trader information about how high or low the price action of the market during the time period that the candlestick represents. In other words, these parts of the candlestick show the highest and lowest prices before the closing price of the time period. This information can be very useful because it shows the trader who was more in control of the market during that time.

For example, if there is a long wick at the top of a red candlestick, that means that there was a lot of buying pressure in the market before the close. However, because the body of that candlestick is red, the buyers were not successful at controlling the market at the time and the price closed lower than the highest price of the stock or concurrency during the time period that the candlestick represents.

Conclusion

Candlesticks can be very useful technical analysis tools for trading on the market if used correctly. Of course, even if they are used correctly, they are not a 100% way to be successful in the market because of volatility and unknown things that are going on in the market behind the scenes. However, they are good indicators and can provide information to help traders make an educated bias or guess of whether the market trend will head toward higher or lower prices. Candlesticks tell a story and if you understand how to read the body and wicks of the candlesticks in a candlestick chart, that story can help you be successful in trading.