Arbitrage is the practice of buying and selling assets in different markets or exchanges in order to take advantage of price differences. In the world of cryptocurrency, this can be a lucrative strategy for traders looking to make a profit by buying low and selling high.

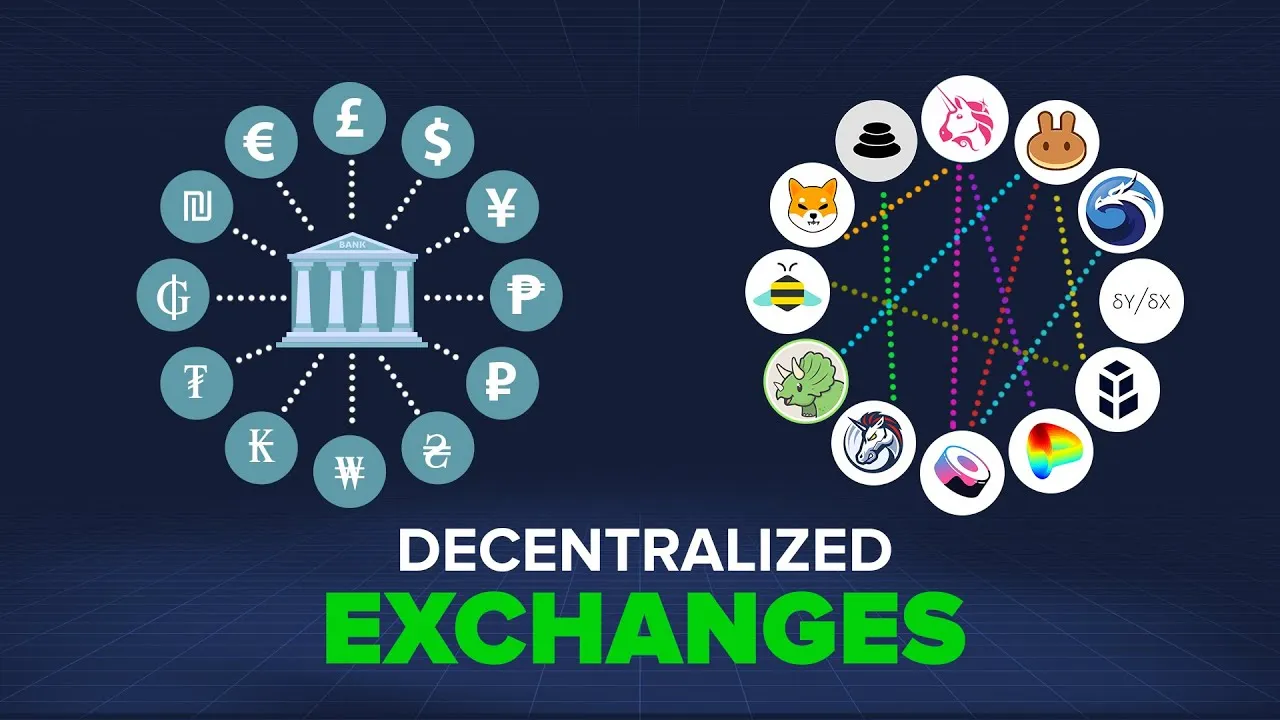

One key aspect of successful arbitrage trading is having access to a reliable and efficient decentralized exchange (DEX). DEXs are online platforms that allow users to trade cryptocurrencies directly with each other, without the need for intermediaries like central exchanges. This makes them a popular choice for traders looking to avoid the high fees and strict know-your-customer (KYC) requirements of central exchanges.

As mentioned is previous Journey 12, flashloan work best in high liquidity dex. So let's continue!

So, what is the best DEX for arbitrage? The answer to this question depends on a number of factors, including the trader's location, the assets they are interested in trading, and their preferred trading strategy. Here are a few DEXs that are widely considered to be among the best options for arbitrage traders:

Image Source

Uniswap: Uniswap is a decentralized exchange built on the Ethereum blockchain that is known for its high liquidity and low fees. It utilizes a smart contract-based automated market maker (AMM) system, which allows traders to easily buy and sell a wide variety of assets. Uniswap is particularly popular for arbitrage traders due to its large user base and the fact that it is accessible from anywhere in the world.

Image Source

Bancor: Bancor is another decentralized exchange that utilizes an AMM system to enable trading. It is known for its fast transaction speeds and user-friendly interface, which make it a popular choice for traders of all levels. Bancor also offers a wide range of trading pairs and supports a variety of cryptocurrencies, including popular assets like Bitcoin and Ethereum.

Image Source

Kyber Network: Kyber Network is a decentralized exchange that allows traders to easily swap between different cryptocurrencies without the need for lengthy registration processes or KYC requirements. It is known for its fast transaction speeds and low fees, which make it a popular choice for arbitrage traders. Kyber Network also supports a wide range of assets, including ERC-20 tokens and stablecoins.

Ultimately, the best DEX for arbitrage trading will depend on the individual trader's needs and preferences. It may be useful to try out a few different DEXs and see which one works best for you.