Flash loans are facilitated by smart contracts on DeFi platforms and allow users to borrow funds for a short period of time, typically less than few seconds. The loan is automatically repaid at the end of the agreed upon period, with the borrower returning the exact amount of funds that they borrowed. The use of smart contracts and automation in the process allows for fast and efficient borrowing and repayment, without the need for traditional financial intermediaries such as banks.

Source

One potential use for flash loans is in arbitrage, where a trader can borrow funds to take advantage of price differences in different markets. For example, a trader could borrow funds to buy an asset on one exchange at a low price, and then sell the asset on another exchange at a higher price, pocketing the difference as profit.

Source

Flash loans can also be used for liquidity provision, where a user can borrow funds to provide liquidity to a market in exchange for a fee.

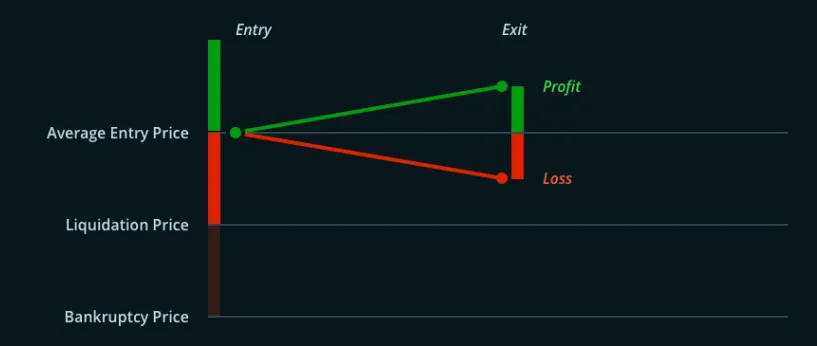

Overall, the use of flash loans in DeFi offers a new level of flexibility and efficiency in financial transactions. However, it is important for users to carefully consider the risks involved, as flash loans do not require collateral and can result in significant losses if the borrower is unable to repay the loan. It is important for users to carefully assess their financial situation and risk tolerance before utilizing flash loans.