Is a massive, unprecedented stock market crash nearly upon us? While several analysts have often posed the question, this draconian idea has taken on more urgency in recent times.

In early October, the Dow Jones suffered a pummeling, with virtually all sectors falling victim to a fierce correction. Subsequent trades did nothing to alleviate those fears. Even when the Dow has clawed back some of the earlier losses, technically, the broader markets appear vulnerable.

Additionally, we’ve heard financial experts warn that certain elements suggest that a market crash is necessary. For one thing, the major indices have enjoyed largely unfettered access to record-setting highs. As any investor knows, sentiment must go through bullish and bearish phases. Sustained trajectory in any one direction represents exuberance, not equilibrium.

On the flip side, we’ve endured multiple calls for the “big one,” yet we haven’t seen anything justify those forecasts. Outside of 2008, the benchmark indices have not incurred a lasting market crash. Given this context, should investors buckle up, or is this another false alarm?

Here are two contrasting scenarios:

Why We’re Headed Towards a Massive Market Crash

It’s important to note that a market crash doesn’t just happen because prices are “too high.” Whether something is fairly valued or not is first of all subjective. More importantly, valuation is relative to a key metric or benchmark.

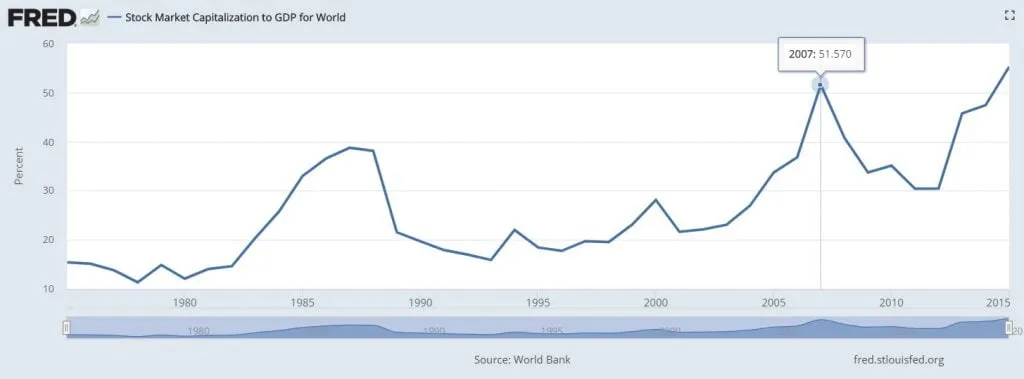

While mainstream technical analysts focus on overbought conditions, I believe a more effective approach is considering economic factors. The Federal Reserve Economic Data features analyses that track stock-market capitalization to both national and global GDP. The results were eye-opening.

In 1987, capitalization of all stocks against worldwide GDP hit 38.8%. It dipped slightly lower in 1988, then completely tanked in 1989. Recall that the latter year was the time when Japan’s Nikkei 225 index collapsed, and has still yet to recover.

In 2007, total capitalization to global GDP hit 51.6%, apparently the first time this has occurred. In the prior year, the metric was only 36.8%. Of course, we all know what happened next.

So have we learned our lesson to not let speculation run wild? Nope! Remarkably, in 2015, capitalization to worldwide GDP hit over 55%. The World Bank – which originally developed this report – does not provide an update beyond 2015.

Perhaps the real figure is in the 60% to 70% range, which is not something you want to advertise.

Why This is All Fear-Mongering

Those who claim that we have no reason to fear have history working with them.

Since the 2008 financial crisis, many critics have blasted the Obama administration for greenlighting inflationary monetary policies. How many Infowars articles or Zero Hedge pieces have we read warning about impending doom?

As well meaning as those publications were, their forecasts have not yet come to fruition. Such unavoidable facts bolster equity bulls, who claim that this is nothing more than a much-needed correction.

And what about the capitalization-to-GDP metrics? They’ll probably claim, so what? Excessive capitalization against fundamental economic indicators also means nothing in and of itself. Cryptocurrencies went bonkers in 2017. Yes, a market crash eventually occurred, but the sector itself remains viable.

This segues into another point: for an unprecedented market crash to occur requires victims. For instance, if cryptocurrencies do completely meltdown, will that take down the world economy? No, because the number of crypto-investors is relatively small.

While a market crash now will obviously lever huge consequences, we may not see a 2008-style fallout. This is because fewer people are participating in stocks, especially Millennials.

The victims of the next market crash will once again be the baby-boomer types. All we may see is merely a wealth transfer, not an apocalypse.

Original Article Available HERE