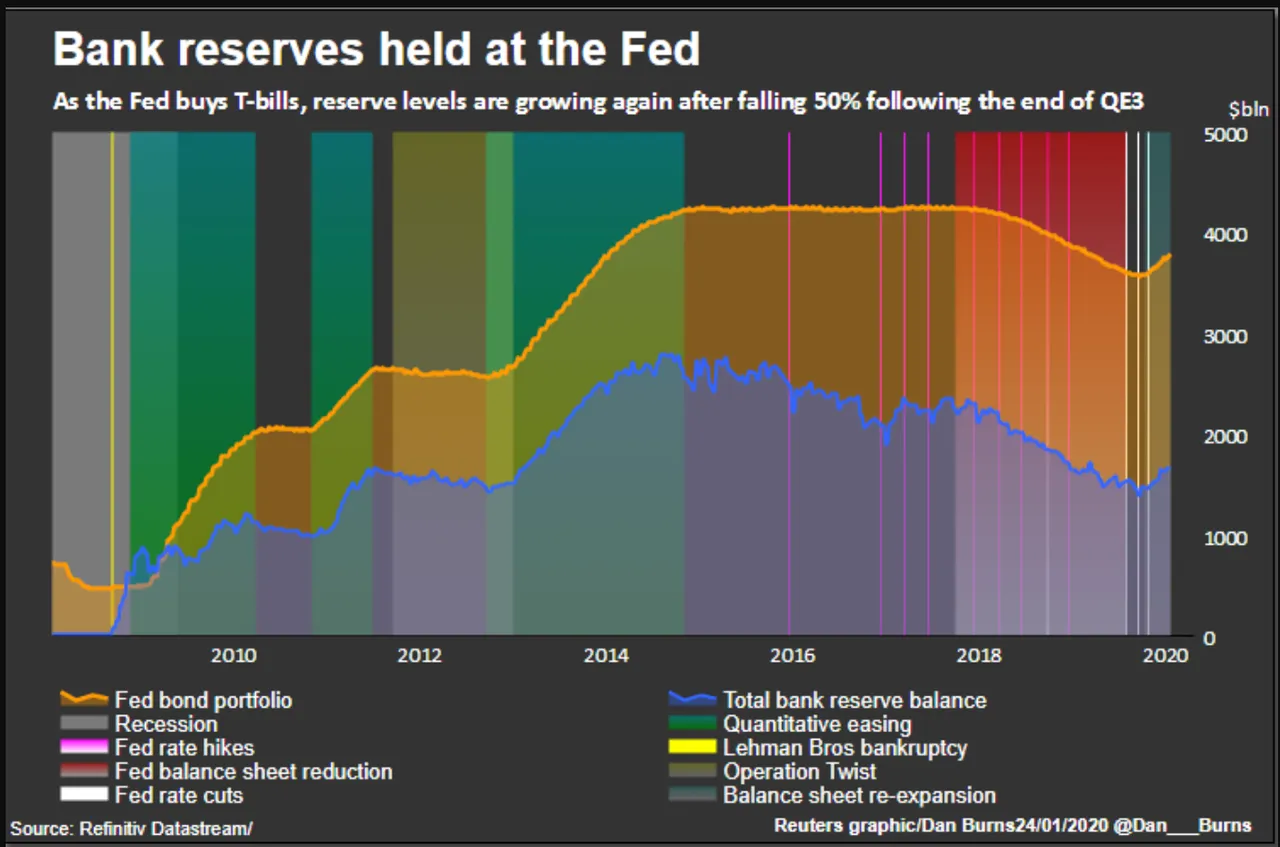

The Federal Reserve has been printing USD and buying 60 billion of US Treasury bills a month since last fall and the process continues with no set end in sight. A side effect of all this printing is the debasement of all the other dollars that were printed previously.

One has to ask: If the economic numbers of the USA economy is so great, then why is this necessary?

This is Quantitative Easing (QE), QE Lite or just plain old market intervention/manipulation to keep the current debt based, paper money fiat financial system afloat, in the past this has been used to jumpstart the economy after a recession by pushing down long-term interest rates. Such low rates should be a good reason for banks and businesses to take out loans to expand business and thus the economy. However, instead what seems to be happening is that corporations have been buying back their own stock (which causes their stock to rise) or issuing low-quality corporate bonds-- the increasingly visible homeless situation and piking auto loan defaults etc. in the USA is pretty good evidence to suggest that the central banks economic stimulus is not trickling down to average American citizen.

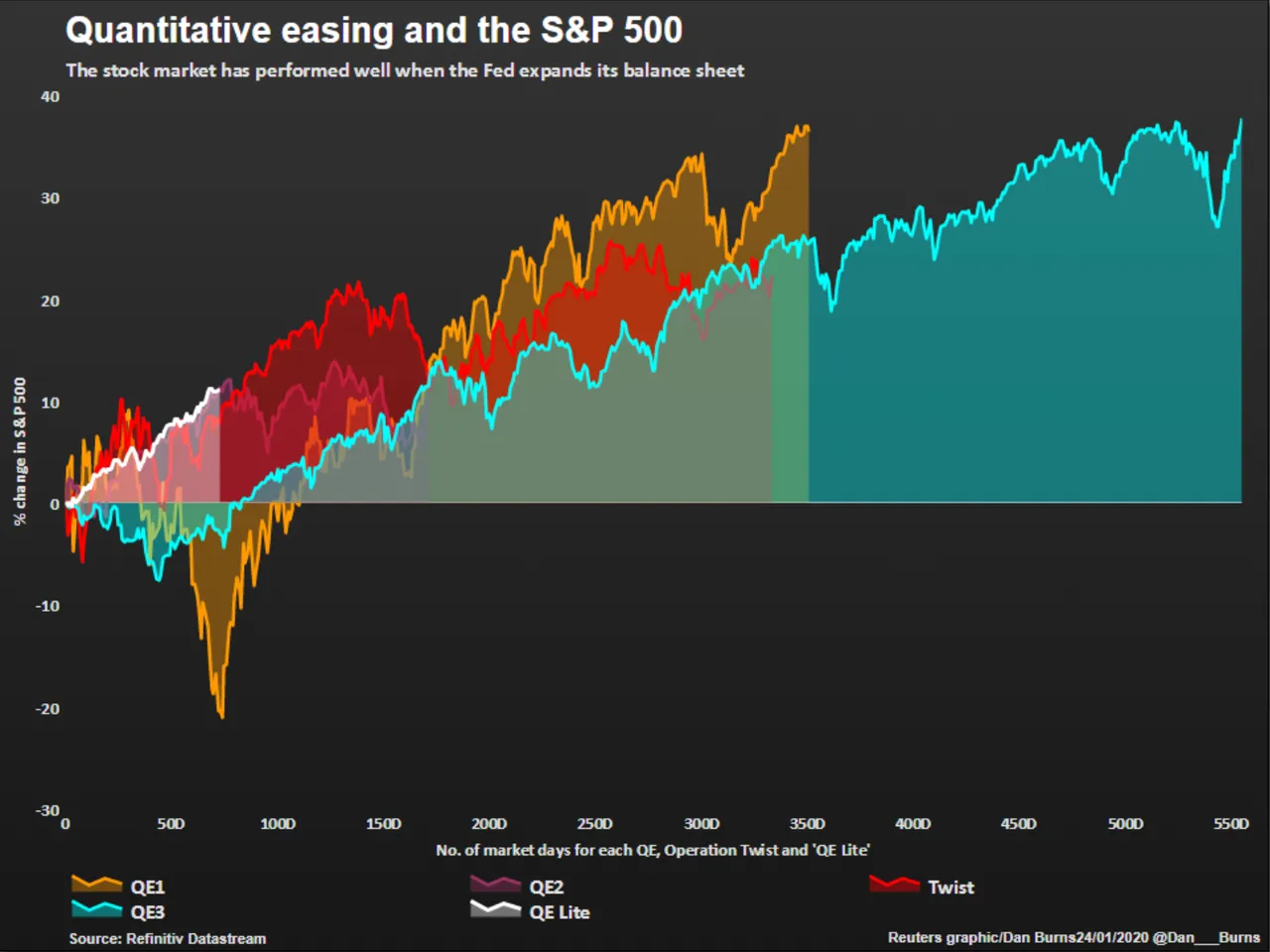

Since 2010 the rise in Fed’s balance sheet has mirrored the increases in the US stock market, who still believes this is pure consequence?

The concern is what happens when this cash infusion slows down or stops?

Interesting to note that the central banks of Switzerland and Japan for instance are not restricted to buying government debt, they can even purchase stocks directly. Thus why the central bank of Japan owns 75% of all stocks in that country (so much for a free market). And how you have the more than $1 billion worth of seven companies: Apple, Alphabet (which owns and controls Google), Microsoft, Facebook, Amazon, Johnson & Johnson, and Exxon. So if you happen to own these stocks you might be thinking this is great, my stock when up, but how much of the current stock price is due to the demand caused from the printing out of thin air Swiss paper money etc?