You can believe in mysticism or you can follow data. I'll take the latter, but staying true within the Austrian economics framework, I recognize the imperfections of data in economic forecasting. We're not solving an engineering or chemistry equation with constants.

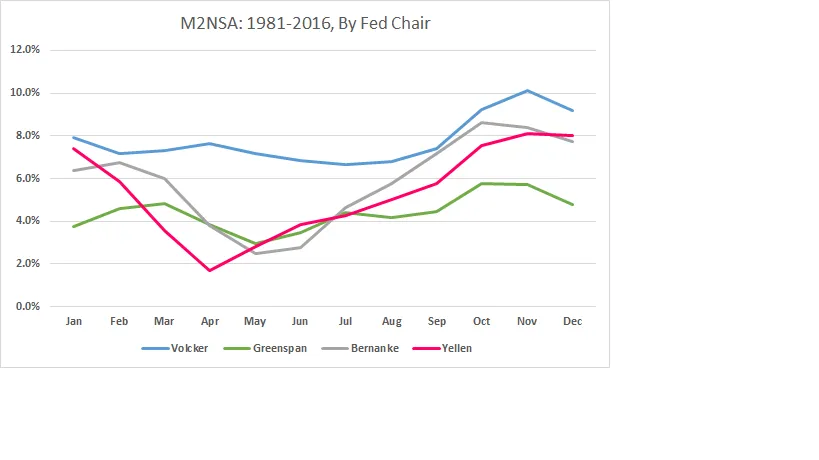

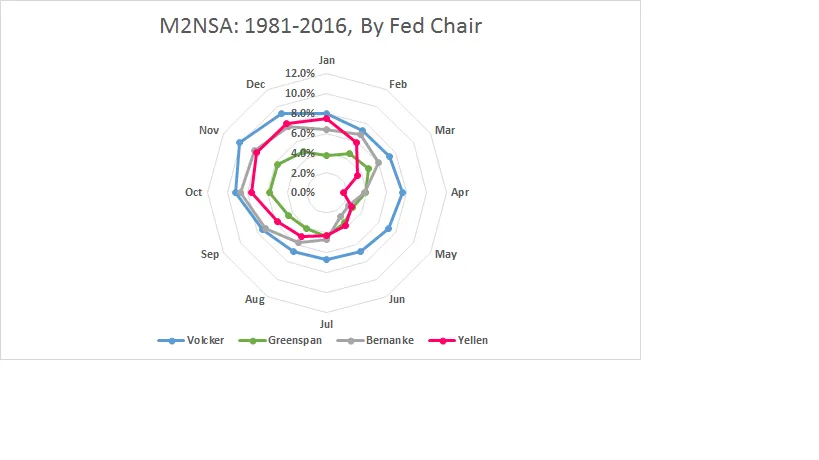

As many in this forum may know, money supply growth has a tendency to slow during the summer months. It is money supply growth orchestrated by banks' credit expansion, not some seven year Hebrew cycle, that accounts for misallocations of capital, which leads to unsustainable booms and the inevitable bust. The U.S. economy remains firmly in the manipulated boom phase, as indicated by the long-term unemployment trend, a strong housing market, and stock market highs. Following Austrian Business Cycle Theory, these highs in housing and the stock market - the capital goods sector - are leading the way before inflation hits at the consumer level. But this doesn't mean that a stock market correction cannot be ahead of us in the coming months.

I've pulled M2, not seasonally adjusted, weekly data from the St. Louis Fed's website. Then, I averaged for the 13-week period, as displayed on the weekly H6 report, Table 2, column 10. Next, I added a column to show the Fed Chair during the respective period. The data runs from March 30, 1981 (13 weeks after the first available data on January 1, 1981) through July 25, 2016.

Recognizing that lower money supply growth cannot support the capital structure, with growth in the 3.5% range, is this enough to carry the stock market forward until money supply growth ticks up again in the fall months, as is historically true?