Buying Crypto

Have you ever had to buy cryptocurrencies using fiat? If you are here on Steemit, you probably have, unless of course, you are completely brand new to crypto. Most of you will have to agree with me that the first time you buy crypto, you go that moment of uncertainty, where fear strikes you and you wonder if you are gonna lose your fiat and never get your crypto. Of course, after two or three transactions you don't really think much about losing out but you still worry none-the-less, anything can happen, it never gets easy.

Ever since the first cryptocurrency exchange was created, (there is a debate as to which one it was exactly), but I will use the first one that I came across when I was doing a bit of digging, bitcoinmarket.com, thousands of centralized or decentralized exchanges have been created. Some have stood the test of time but some of them have long bitten the dust. The biggest of those that have fallen so far is Mt. Gox. If you've been in crypto for a while, you probably know a bit about Mt. Gox, or at least you have heard the name being mentioned somewhere. Yes, I mean the one that has caused a lot of crushes on the crypto markets.

If you don't know about Mt. Gox, it was the biggest crypto exchange when it went offline and filed for bankruptcy in 2014. The reason, well, it's not exactly clear what really happened but it's believed that hackers managed to steal about 850 000 Bitcoin (no doubt the biggest bitcoin hack in the history of cryptocurrencies so far) from the exchange's hot wallets. That's about $240 million at that time and about $5.2 billion in today's rates. Though the exchange was the biggest on at the time, there was trouble in paradise long before the hack happened. The details are beyond the scope of this article, but if you are of a curious nature, you may find this article interesting.

Exchange hackings

Not meaning to scare you here is a list of exchanges that have been hacked (not exhaustive):

- Exchange: MtGox

Amount: 850,000 BTC - Exchange: Cryptsy

Amount: 13,000 BTC and 300,000 LTC - Exchange: Mintpal

Amount: $3,200,000 (3,894 BTC) - Exchange: Bitstamp

Amount: 19,000 BTC - Exchange: Bter

Amount: 7,000 BTC - Exchange: Bitfinex

Amount: 120,000 BTC - Exchange: Nicehash

Amount: 4,000 BTC - Exchange: Coincheck

Amount: 523,000,000 NEM - Exchange: BitGrail

Amount: 17,000,000 NANO

Should I go on? No? Okay, I think I have scared you enough so I will stop right here. I think you get the picture. If you still don't then maybe the thousand words in the following image will clarify things for you. It's too late in the night for me to type a thousand words so I'll let the picture do the talking.

Let's cut to the chase, centralized exchanges are not safe, I repeat, they are not safe. Did I say don't use them, no, did I say use decentralized exchanges, not at all. All I'm saying it, never trust a centralized exchange, you could lose all your money in a very short space of time. Bigger exchanges don't eliminate the risk, I think they actually amplify it. Hackers have the biggest incentive to hack them, they will get billions if they are successful.

What about decentralized exchanges? Decentralized exchanges are certainly a much safer option. You don't store your crypto on the exchange and they use blockchains, hence there are no central servers to be hacked. They operate on a 'peer-to-peer' fashion, and users have total control of their funds. Decentralized exchanges are probably the future of crypto exchange, but there are some major drawbacks. These exchanges are relatively new compared to centralized exchanges and their potential is yet to be realized. Most of them are just barebones and therefore present a steep learning curve for the users. They are unnecessarily complicated, to say the least. Some of them offer terrible User Experience which has been their downfall.

Introducing StreamDesk

Please watch this short introductory video:

In a bid to solve the problems faced by a majority of crypto buyers and sellers, Streamity created StreamDesk, a decentralized, "P2P exchange that protects both buyer and seller from fraud by utilizing smart contracts to escrow transactions."

StreamDesk is Streamity's primary component. Streamity aims to create multiple solutions to problems in the crypto space. Streamity has partnered with a few projects to make sure their project is a success, these include

- NEM

- for smart contracts

- for smart contracts - EOS

- for smart contracts

- for smart contracts - IT Test

- aids in development

- aids in development - Civic

- to assist with KYC.

- to assist with KYC.

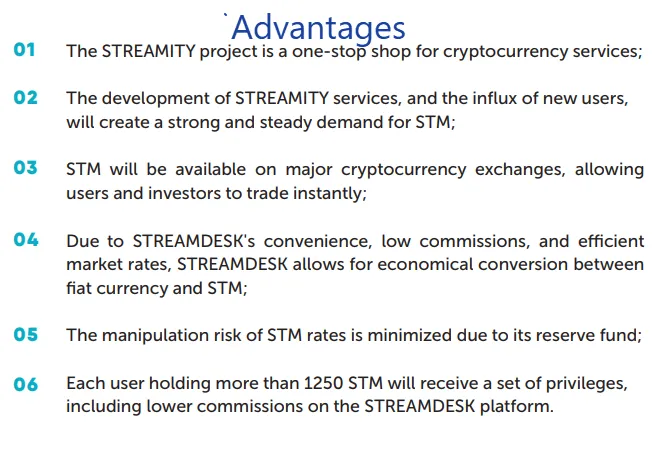

Here are the advantages of Streamity

How does it work?

I will try to put this in words. But before I do, allow me to point out that StreamDesk is already available in Alpha and you can sign up and start taking advantage of the platform's technology. At present, the Fiat payment gateways that are implemented are Paypal and Yandex Money. I was told in their telegram channel today that more payment gateways are being worked on and they will be added soon. For now, you are only able to buy Eth and probably Eth based tokens from the platform.

So what you would do is sign up on StreamDesk.io. You will get a welcome email and a link to begin the verification process. To verify yourself you need to uplaod a picture of your government issued ID document and a selfie of you holding your ID document. Once you've been approved you may begin to trade on StreamDesk. The crypto prices are fixed and they are based on the average of major exchanges. On the Dashboard, you will see a list of buy and sell orders. You click on the one that satisfies your needs. If you are buying, you either create a buy order by filling in the necessary information on the form or by choosing a sell order that matches your requirements.

- Request to buy

- You receive a notification that you requested to buy

- The seller receives a notification that you want to buy from them

- They are asked to confirm the sell order

- Once confirmed a smart contract is triggered that locks the said funds in the wallet.

- A payment link is sent to you the buyer.

- Make the payment through your preferred payment method from the ones offered.

- If payment is successful a smart contract releases the crypto to you.

What can be safer than that?

I have to mention that you can purchase membership fee packages that allow you certain privileges according to the chart below. Anything over the package limit is charged according to membership level on a percentage basis.

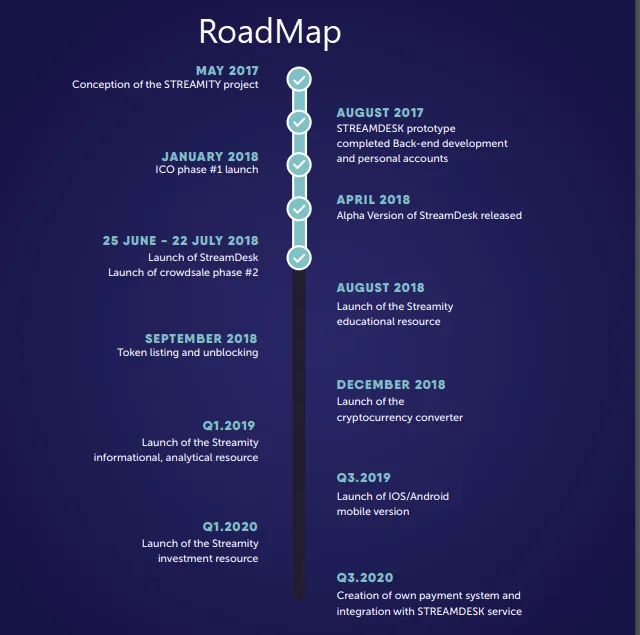

The Roadmap

The team is working really hard they have already met a reasonable amount of the objectives on the roadmap.

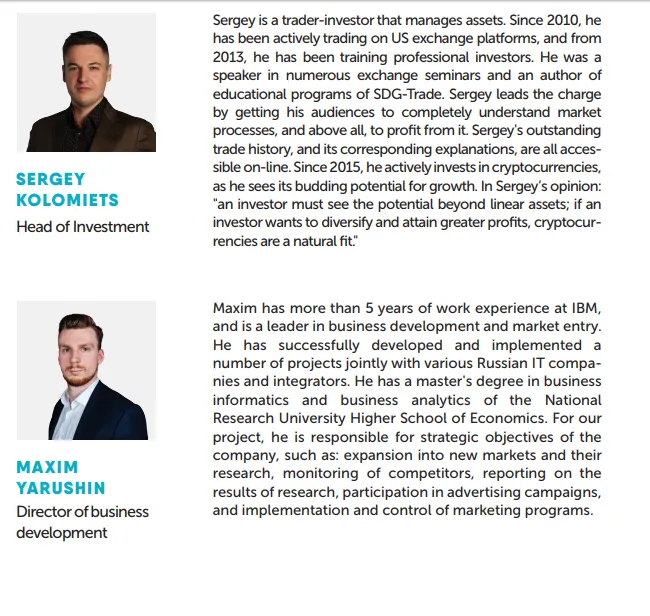

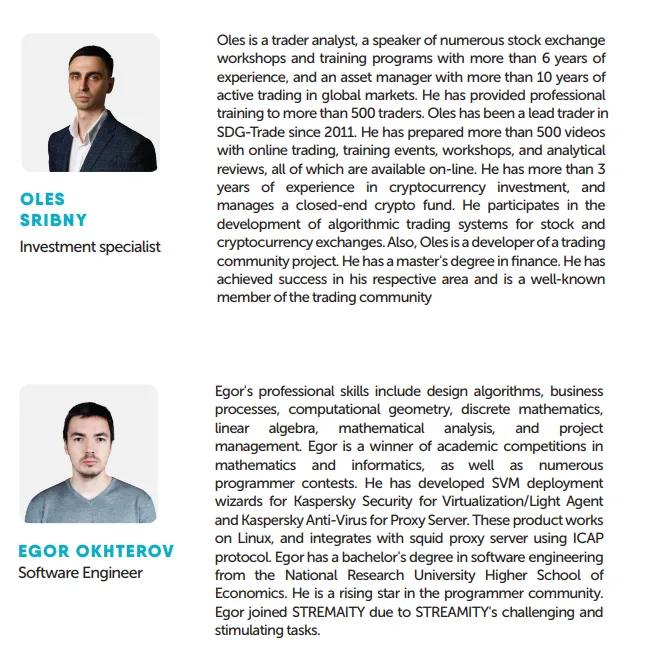

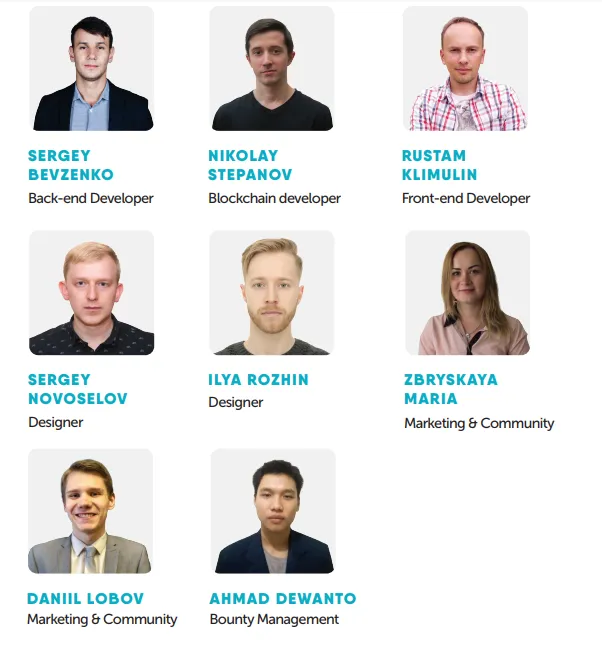

The Team

They have a great team working tirelessly to achieve the goals they have set.

Source

Note: Most of the images where extracted from the Streamity whitepaper and website

More info

If you want to find out more about Streamity check out their website. If you want to give StreamDesk a try, here's the link. For technical details and the nitty gritties of how this works read the whitepaper.

Their Youtube channel has loads of informative videos if you like them you may subscribe to their channel.

Disclaimer

This is not financial advice. Do your own research and do not invest in crypto money that you cannot afford to lose. In other words, do not use your child's school fees, rental, and money to pay the bills and money for any of your expenses. Only use money that has no specific purpose whose value is not life changing should you lose it.