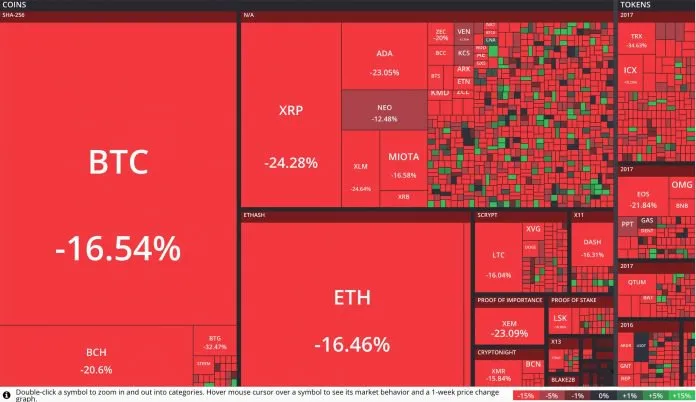

crypto bloodbath leaves altcoins swimming in a sea of pink / Crypto Bloodbath Leaves Altcoins Swimming in a Sea of Red , everybody glancing at their blockfolio app on tuesday morning would were in for a rude awakening. with each single cryptocurrency drowning in a sea of red, rookies might have been forgiven for feeling a little queasy. a drama-stuffed day, dominated with the aid of bad information from south korea and china, noticed bitcoin fleetingly kiss four figures on some exchanges earlier than rebounding sharply. on wednesday, btc fell to $10k another time, becoming a member of altcoins which might be mired within the pink

bitcoin hits rock backside

2018 is scarcely older than a fortnight and already it’s shaping up to be extra motion-packed, exhilarating, and every so often terrifying than the preceding yr. so far january has witnessed the rise of vaporware, billion dollar market caps gained and misplaced, and xrp upward thrust as much as threaten the rippening earlier than slinking lower back to its nook. at its lowest factor on tuesday, ripple got here near the dollar mark, down 65% from its january excessive.

even as some buyers panic sold and others hodled for dear lifestyles, a few tried to journey the waves that noticed bitcoin buffeted each which manner. as a minimum one dealer called it right, noting the previous support line that bitcoin could bounce off, and so it proved to be. 100 million tethers were launched into the fray in what one trader dubbed crypto’s “quantitive easing”, unleashing a inexperienced candle that quickly spared bitcoin’s blushes. despite clawing its manner again over $11k and maintaining $eleven,2 hundred for some hours, as of wednesday 9am (nyt), btc is close to 4 figures all over again.

altcoins haven’t fared so nicely either. just 3 of the cryptocurrency pinnacle one hundred published profits on tuesday – or 4 which includes tether – with quantstamp, neblio, and ethos the handiest winners. bitcoin finished the day down 15%, while alts including verge, ripple, and tron all shed over 20% of their price. tron, which as soon as occupied a niche within the pinnacle 5, is now all the way down to 14th and fading fast.

new 12 months, new low

bitcoin is a capricious beast at the fine of instances, but it’s been extra erratic than ever because the turn of the yr. rumors of a south korean crypto crackdown have proliferated for weeks, however up to now they’ve been simply that. seeking to hose down the state’s enthusiasm for cryptocurrency – a motion that as many as 1 in 25 south koreans are believed to be actively involved in – would require extra than the disapproval of a few ministers.

for as long as the asian markets dominate bitcoin buying and selling volume, south korea, japan, and china will serve as the tail that wags the dog. love it or not, westerners are beholden to the motion of markets beyond their attain, and there's little they are able to do to mitigate that in spells of uncertainty other than to migrate into the safety of usd tethers and wait it out.

neo is going loco

t seems fitting that a coin named neo need to start the new year with its greatest run up to now. on monday it changed into the handiest asset within the cryptocurrency top one hundred to be within the inexperienced. despite dipping since, neo, collectively with gas, the gasoline used to run smart contracts on the network, has been a unprecedented ray of light amidst the doom and gloom. the “chinese language ethereum” is ultimately proving its really worth, with a string of icos launching on the community this month, and a degree of facet-chain and ecosystem developments in the works which might be justifying neo’s newfound valuation.

in 2017, there have been simply most important neo icos, for qlink and crimson pulse. 2018, in comparison, has 20 penciled in already. ethereum, january’s other constant performer in the crypto pinnacle 10, has similarly been buoyed by way of the spate of icos within the works. token data reports that $570 million turned into raised through 23 icos within the first two weeks of 2018, and a complete of 60 token sales are launching this week – the very best stage considering that october.

if ancient signs are something to go by way of, bitcoin will rally and end the month higher than it commenced earlier than occurring to experience some other bumper 12 months. there may be greater ache to undergo though before the clouds raise and bitcoin can start eyeing another all-time excessive. ari paul’s prediction, ventured final week, may not be so outlandish in the end:

what do you observed is the main reason for bitcoin dipping this week? allow us to realize in the feedback section beneath