Svandis is a decentralized system consisting of the research world (analysts external researchers), development of the community Svandis (external developers, scientists data) and the holder of the token, the customer and the points of participation (traders, analysts, hedge funds and institutional investors, excluding trading companies, venture capital funds, contribution to the sale of tokens, exchanges). Svandis is expected to be one of the major beneficiaries of the current innovation of world-class veterans.

Svandis is ready to solve problems where no exact solution is available by advertising their products for a larger digital trading community.

WE TRANSFORM DATA TO VALUABLE INFORMATIONIn a time of excessive data, volume does not always mean value. In Svandis we are revolutionizing the way you receive information. By taking the most effective solution than the traditional market and adapting to market demand crypto, our platform provides the tools you need to make trade decisions and investments more knowledge in the turbulent world of digital assets.

Language

processing Natural language processing will be used to identify cryptocurrency market trends using a variety of information

Machine Learning

Svandis develops a machine learning algorithm to increase the speed and accuracy of data in the Svandis ecosystem

Correlation

analysis The automatic process analyzes the correlation between price indicators and variables that are accessible to all users.

Recently, the decentralized economy has become a place of great achievement for all crypto-currency users, which is becoming increasingly popular. This has ensured that many people choose to participate in a decentralized economy. Insofar as there is exponential growth in the number of crypto-assets, together with the discovery of a new token, also known as a first-munting offer (ICO), investors start to doubt the legitimacy of this offer due to recent fraud.

Market watchers also expect to migrate sales token tools to own equity to bridge the gap between employees and shareholders, giving owners of the tokens rights similar to those rights reporting, voting rights, pro-data tracking on the right , liquidity preference, exit and dividend participation etc. In November 2017, the estimated number of accounts on the Coinbase platform for digital exchange assets amounted to 13 million users.According to Reuters, the total number of hedge funds doubled on digital asset trading in February 2018.

Despite the fact that many companies want to bridge the gap, there is still no expertise to help merchants and investors choose the trade token, looking for offers credible and reliable initial coins (ICO) to invest. Professional news services for feedback and updates are still a major challenge. This makes the activity of investors boring and time-consuming.

In their 11th annual hedge fund and annual investor survey (EY), it was revealed that the hedge fund industry spent about $ 2.3 billion annually on blockchain technology that led Svandis to take bold steps in institutionalizing crypto-assets.

COMMUNITY INVOLVEMENT

ECOSYSTEM

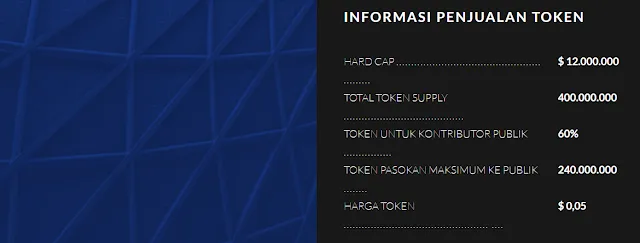

TOKENVERKOOP

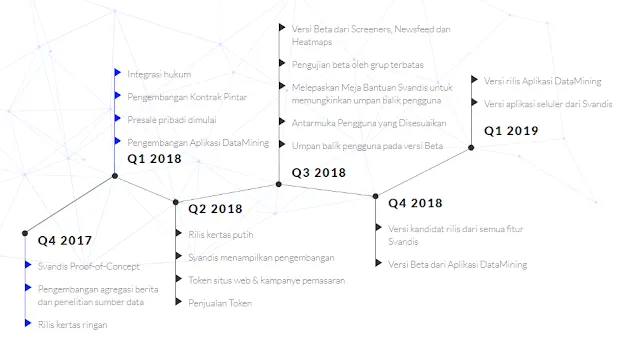

ROAD MAP

TEAM

ADVISORY

For more information, please click below:

Website: https://svandis.io

Telegram: https://t.me/svandis_chatroom

Twitter: https://twitter.com/svandisio

USERNAME: jackbangor91

BTT PROFILE: https://bitcointalk.org/index.php?action=profile;u=1762924

ETH: 0xE1A8b563857484228567aeCbc0781600931508E9