There will be blood...or will there be? There is a lot of speculation, but we cannot be certain.

Changes are coming – this much we know. There have been many discussions about what will happen, what won’t happen, and what might happen, but nobody really knows. Anyone claiming that they know what will certainly happen is a fool and/or a liar. Let’s look at what’s possible.

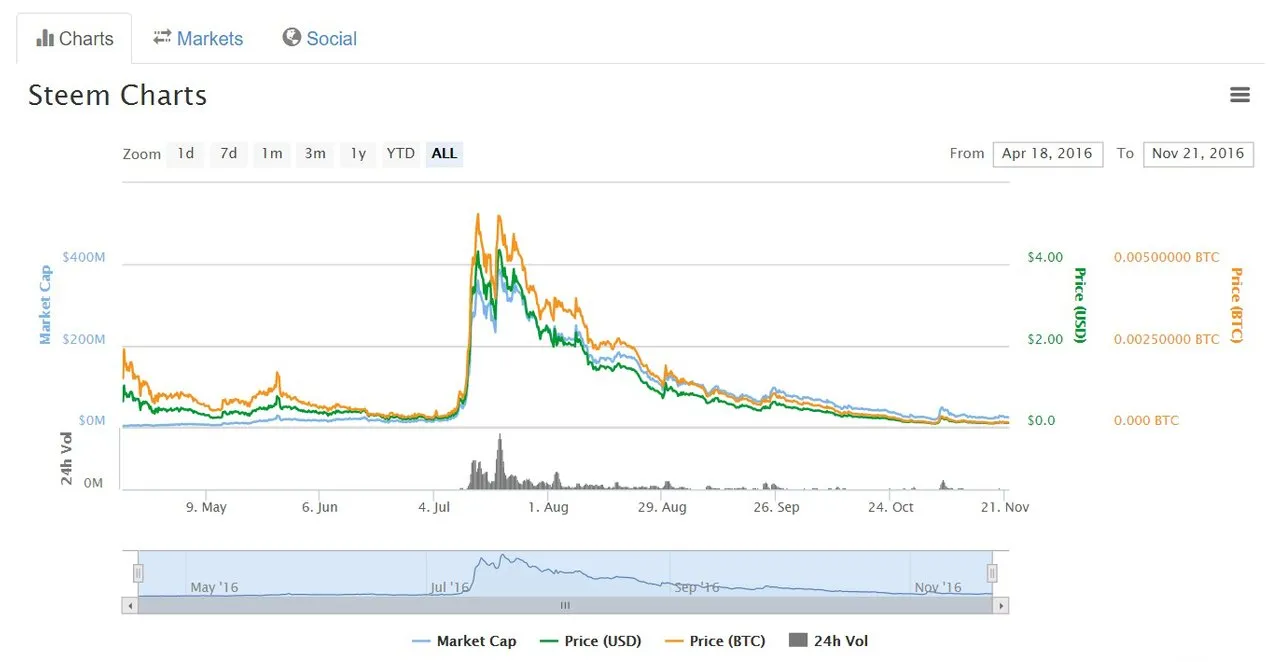

The Great Dumpening of 2016

There are a lot of people expecting widespread power downs and a large dump of Steem on the external markets once the new hard fork is implemented. Changing the power down schedule from 104 weeks to 13 weeks will definitely have an impact on current stakeholders. It’s a significant change in the Steem economics and it would be reasonable to expect some significant changes in economic behavior by anyone holding Steem. So, what can we reasonably expect?

There are many large stakeholders that have been powering down their Steem Power holdings over the last several months. It should not be surprising to see them continue to power down. The difference after the hard fork would be that they can exit their long position at a much quicker rate. All other factors being the same, this would likely drive the Steem price to new lows. This can cause other long-term investors to panic and want to begin cashing out some or all of their holdings as well – and force the price even lower.

The shorter timeline for withdrawing Steem Power will also provide an opportunity for other users and investors who were not powering down to begin withdrawing their holdings. Those people who had no intention of remaining invested in the platform and just want the money in their pocket will have the chance to take the money and run. If this happens, it will also add to the downward price pressures.

The important thing to do here is to remain calm. Investors exit short and long positions all the time. It’s a natural function of markets. Not all investors want to continue growing their long positions. Not all users on Steemit even want a long position. They will sell until they have reached a target for their holdings that makes them comfortable. There’s nothing wrong with this and there’s no reason to panic if we see the price fall after the hard fork. It’s not a sign that the fork was a mistake or that nobody wants to be invested and the project is going to fail.

To be clear – it’s possible that we will see a very large spike in accounts that are powering down. It could even look pretty grim for several weeks or a couple of months until a majority of those stakeholders have fully exited their positions or reached a level of investment that satisfies them.

It’s also possible that there won’t be a mass exodus – that long-term investors won’t feel trapped in a two-year lock-up and that they will feel more confident in the economic changes. The inflation rate will be much lower and the timeline for cashing out will be much shorter. Also, powering down will likely reduce one’s holdings at a greater rate than can be accumulated by inflation and various rewards, so large stakeholders cannot power down while mostly retaining the same level of holdings in their account. This may actually provide enough disincentive to stop them from powering down further.

Honestly – we don’t actually know what’s going to happen. We can only speculate at this point, but a sell-off is probably more likely than not. As far as Steem prices go, we should not be surprised if we see new lows after the hard fork.

The Great Awakening of 2016

Regardless of whether The Dumpening happens, it’s very possible that we also have The Awakening of Steem and Steemit. Steem’s inflation rate has been a very contentious issue for users, investors, and potential users and investors alike. There has been a lot of misunderstanding of inflation, but the mere perception of inflating the currency at such a high rate was causing a lot of concern. With that concern being mostly eliminated, we could very well see a lot more interest in the Steem currency.

If we have learned anything about cryptocurrencies over the last few years, it’s that they can be extremely volatile on nothing more than speculation alone. A currency at $0.10 today can easily spike to $20 tomorrow and $250 next week, then return to $0.10 a few days later. It would be very possible to see the Steem price spike after the hard fork or even after the announcement that the code is ready for review by the witnesses and community.

Just as I mentioned that we should not panic if the price falls, we should also not get too excited if the price quickly jumps through one or two levels of resistance. As stated, The Dumpening may not happen and prices may not fall, but that doesn’t mean that everything has been fixed and that the price will only go up from here. There is still a lot of development needed and a lot more adoption is necessary with both Steem and the various interfaces using the currency. Changing some of the economics isn’t going to make Steem the next Bitcoin.

That being said – the changes could very well lead to mid- to long-term price stability. With the continued development of different interfaces, this could bring in a new wave of investors and users, which could – in turn – lift the prices of Steem even higher. It’s very possible that we can see a scenario where the hard fork and the announcement of a new interface could give Steem and Steemit momentum into the end of the year, despite any increased desire to power down and sell from some of the larger stakeholders.

If the Steem price can show resilience, even in the face of large stakeholders exiting their positions, it would be a strong indicator to potential users and investors that the platform has a very solid footing in the crypto markets and that there is a great deal of confidence in the currency and platform going forward. This would be a huge boost for the perception of both Steem and Steemit.

Again – we don’t know if any of this will happen, but we should not be surprised if it does...or disappointed if it doesn’t.

Thoughts and Concerns

There are a couple of things that I want to mention as briefly as possible. I know that attention spans are getting shorter, so here they are.

1. The announcement from @ned and @dantheman.

Both Ned and Dan announced that they would not be powering down their personal stake during the first three months after the hard fork. While I think that this is a good idea – as the founders and the owners of Steemit, Inc. – I don’t think that this announcement is as good as everyone has thought.

I do believe that, generally, owners/founders of a project or company should not be cashing out while it’s still in development and while they’re still asking others to invest and fund development. The announcement that they have stopped powering down and selling is welcomed news. However, announcing that this will be halted only for a specified amount of time isn’t exactly beneficial. It only serves to raise more questions, such as:

Why three months?

Will the selling continue after those three months are over?

Will selling only resume if the markets are more stable?

What will be the purpose of resuming the selling?

Will this be used for project development? If so, why would you postpone selling if it’s needed to further develop the platform?

It may also affect how well the markets can price Steem. If their announcement is taken as fact that they will resume selling in three months, then it’s possible that this will be factored into the near-term interest of Steem and its price. If there is uncertainty about whether or not selling will actually resume or how much selling will take place, then we may not get any meaningful price discovery until that occurs, so they’re only delaying the inevitable. I don’t particularly like these types of announcements because they can often leave markets in limbo, especially at the low volumes we’ve been seeing and especially with such a large stake in play.

It would have been better to either continue powering down as they were or to explicitly state how much would be powered-down and sold – and when. Uncertainty is generally negative for markets and investors, and that’s where we’re mostly left with the announcement. Again, this wouldn’t be as much of a big deal if not for their rather large stakes. A little more transparency about why they have been powering down and where that money is going would have been a much more useful announcement, in my opinion.

2. Know your comfort level with your investment.

It’s important for all of us to remember that this is still a very young project, so we’re likely going to see a lot of volatility and a lot of changes being made that we may not want or even understand. If you’re investing your own money into Steem, then you need to be sure that this is money that you’d be willing to lose if the worst-case scenario were to unfold. Businesses fail all the time. Cryptocurrencies fail all the time. You need to protect yourself against these possible failures.

Being a good investor is more than just picking the right investment and choosing the right amount to invest. It also includes knowing when to cut your losses. Don’t lose all of your investment just because you were worried about losing some of your investment. If things are looking bad and you are no longer comfortable with taking losses, then get out. Live to fight – or invest – another day. It’s like that famous philosopher once wrote:

You've got to know when to hold ‘em.

Know when to fold ‘em.

Know when to walk away.

And know when to run.

All of this applies to Steem. Even those users that have not invested actual money into the currency or the platform should consider how much stake they have. Not all investments are about money. Many of us have invested a lot of time and energy into creating content and building the community. We need to consider how much of our rewards we want to keep in our Steem wallets.

We’re going to see a lot of movement – probably a spike in volume on the price charts after the hard fork. If you want to reduce your long-term holdings – or increase them – to a level where you’d feel more comfortable, then do so. If you’re holding for the long-term because you truly believe in Steem and the various development projects, then don’t fret over the short-term volatility. Watching price charts all day will likely just make you sick. Don’t do it. Just check in occasionally and go with your intuition. Enter or leave your positions when Steem reaches your target prices.

If you really believe that Steem will be worth $1.00 next spring, then don’t panic because the price fell from $0.11 to $0.09. If you truly believe that Steem will be worth $5 or $10 in the next year or two, then don’t worry about the price fluctuating in a range between $0.05 and $0.50. If you believe the price is cheap and you’re comfortable with the amount of money you want to invest – and possibly lose – then don’t be scared off by a spike downward. If you have reservations and are not confident in Steem or Steemit, then you probably shouldn’t be putting your own money into this.

Here are a couple of clichés for you: Trust your gut and don’t put all of your eggs in one basket.

That’s simple investing advice that can be universally applied.

What will you be doing, @ats-david?

I’m glad you asked.

I’ve been powering up most of my post rewards over the last month and a half. I think that there is a lot of upside potential with Steem, especially if this hard fork is received well. All indications point to that being the case. I will likely continue to power up as I have been.

If the price falls through the recent support after the hard fork, I’ll probably be more inclined to convert some of my Steem Dollars to Steem and power some of that up as well. My personal bet is that Steem will likely be worth more than $0.10 at some point in the next couple of years than worth less. It will probably go lower before it goes higher, however. I’m OK with that and I’ll make my decisions as I evaluate the markets and the development of Steem interfaces.

I’ve recently started working with @steemsports as a presenter and will also be engaging the community further with another popular project that will be revived. An announcement for this latter project should be coming within the next week. I also plan to use Steem and Steemit for my business once it’s operational, particularly for international payments to my farmer friends in Central America.

There’s a lot going on and there are plenty of untapped markets for this experiment to grow. I know that I’ve questioned the development of Steemit recently and I would still like to see things moving on this platform a little more quickly – such as creating basic profile pages and features. But don’t get the wrong impression: I’m in this for the long haul and I will continue looking for ways to use this currency and platform in my own life and within my circle of friends and business partners.

Closing Thoughts

If users and investors want to leave the platform, then let them go. There is a far greater risk of abuse from toxic users and investors who are locked into a long-term investment than from those who can cash out and leave in a relatively short time frame. As stated by other users, this ability to enter and exit long positions on a shorter timeline also allows for quicker price discovery. This is needed – and combined with the other changes, I believe this hard fork will be a net positive for Steem in the long-run.

There may be blood. There may not be blood. We could see The Dumpening or we could see The Awakening. It’s actually quite likely that we’ll see both. If you can look beyond the horizon, none of this may bother you. If you’re only concerned about what’s in front of you, then you may be swayed by what could turn out to be proverbial blips on the radar. It’s all a matter of perspective and it’s mostly based on one’s immediate wants or needs in life.

There’s no meaningful prediction to be made here. There’s no right or wrong answer concerning how we should act or react to what’s coming. Do what feels right for you. Do what makes you happy. Just make sure that it’s an informed decision and that it’s not made in a panic or based on pure emotion. On that note...

The Forking is coming. Good luck!

Follow me: @ats-david