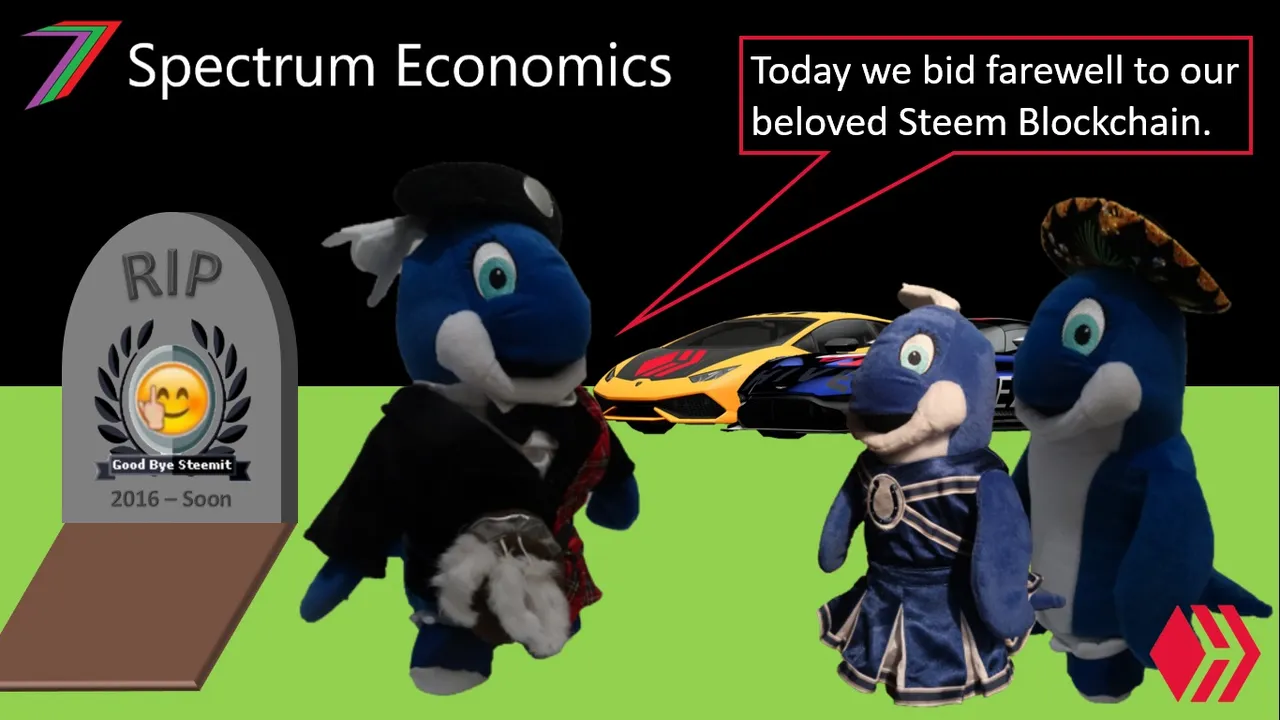

Hi Everyone,

Technically Steem is alive. It has a price and a market cap and it can be bought and sold on exchanges. However, currently, for most exchanges, you will not be able to move your Steem between the exchange and your account. Steem HardFork 23 has caused this lack of mobility. HardFork 23 removed Steem, Steem Power, and Steem Blockchain Dollars (SBD) from over 60 accounts. This was done based on some proclaimed crimes against the Steem Blockchain; this excuse is explained in the post Steem Consensus Witness Statement : Hardfork 0.23 (Codename: New Steem). I personally believe the funds were taken out of spite for the creation of the Hive Blockchain and for tiffs that occurred prior to the creation of Hive. Most of the targeted accounts belonged to Hive witnesses or accounts that contained substantial amounts of Steem. Altogether over 23 Million Steem was taken. Bittrex (a cryptocurrency exchange) is currently holding the 23 Million Steem; it is unclear what will happen next.

I believe Steem to be dead because it has lost its credibility as a blockchain and investment. If HardForks can be used to seize funds from any account at the discretion of one person or entity, funds cannot be considered safe to stake. Why would anyone stake his or her tokens with such a possibility? The only reason to buy Steem would be in anticipation of a price pump. In this case, Steem would only need to stay on the exchanges.

Steem was on the deathbed before HardFork 23

HardFork 23 was not the decisive blow to Steem. The decisive blow came when exchanges powered up customer’s funds and decided to give Steemit Inc. control of the Steem Blockchain. The community rallied within hours to create a stalemate for control of the blockchain. If it wasn’t for a few large account holders who decided to hold the community ransom, the original Steem witnesses could have regained control. Instead, the Hive Blockchain was created. Steem accounts were copied to the Hive Blockchain and they were airdropped the same number of tokens that they held on Steem. Several accounts were excluded from the airdrop. These were the Steemit Inc. accounts and the accounts of those that supported the Steemit takeover with their witness votes. After the creation of Hive, most witnesses disabled their Steem witnesses and many large stakeholders began powering down their stake. Steemit Inc. obtained full control of Steem and most of the community choose Hive to migrate their efforts to Hive.

A blockchain has very little benefit or value if it completely lacks decentralisation. It would resemble a database run on a single server. Hive is significantly closer to being decentralised than Steem. This is one of the reasons most of the community and now many of the former Steem DApps are migrating to Hive. The State of the DApps rankings tell the story of the fall in the number of DApps as well as the popularity of the remaining Steem DApps. Steem has also fallen dramatically in the Global Public Blockchain Technology Assessment Index. It ranked 5th in February 2020 but only ranked 15th in April 2020.

Cause of death is more of a problem than actual death

Failure of cryptocurrency projects is not something new. Steem was ranked quite low in terms of Market Cap and therefore, its failure should not be significant to cryptocurrency. However, what is significant is how it died. Steemit Inc. taking control of the Steem Blockchain was the core reason for Steem’s failure. This was possible because of the involvement of exchanges that held significant amounts of their clients Steem. This involvement by the exchanges is far more significant to cryptocurrency than the failure of Steem. The buying and selling of cryptocurrencies mostly occurs on exchanges. Therefore, large exchanges normally hold very large quantities of many different cryptocurrencies. This puts many other blockchains at risk of being taken over by exchanges. Blockchains using proof-of-stake and delegated-proof-of-stake would be more vulnerable as stake dictates governance.

HardFork 23 was made possible because of the exchanges handing control of the Steem Blockchain to Steemit Inc. If HardFork 23 results in permanent removal of funds from the 60+ Steem accounts, the reputation of cryptocurrency, in general, will be negatively affected. The extent of this negative effect, will depend on how much attention Steem and this HardFork receives. Cryptocurrency is new to many people, if owning cryptocurrency is perceived risky because funds can be removed based on a whim, mass adoption is going to become significantly more difficult. Likewise, if the funds are returned to their rightful owners, cryptocurrency would look significantly more secure. There would likely be minimal long-run damage to the perception of security of holding cryptocurrency.

Is Hive completely safe?

Hive is considerably more decentralised than Steem ever was because there is no equivalent to Steemit’s massive stake. However, Hive may not be immune to a centralised threat. An outside entity could buy large quantities of Hive from exchanges and/or buy several large accounts directly. This new entity could have influence with exchanges, which could lead to yet another take over. This might seem unlikely but if it did happen, the existing DPoS system on Hive is as vulnerable as the DPoS system on Steem. Blockchains need to be more resilient to external threats such as exchanges and/or need to change their relationship with exchanges so that they cannot pose any threat to a blockchain’s governance.

More posts

If you want to read any of my other posts, you can click on the links below. These links will lead you to posts containing my collection of works. These 'Collection of Works' posts have been updated to contain links to the Hive versions of my posts.

Future of Social Media