I don't know if the recent price surge of STEEM has to do with re-enabling of deposits and withdrawals for it and other cryptos on the bithump exchange, but the timing coincides too much to consider it has no influence, especially considering the price STEEM was when it was disabled (above $1).

It still is around 96 cents according to coinmarketcap.com, which offered good possibilities of arbitrage for those interested, but with a high risk of course, because this looks like an unnatural pump, and you know what follows after that, don't you?

Anyway, this pump of the STEEM price released some pressure from the debt ratio, which is now around 9%, from over 10%. Don't celebrate yet, because in case of a dump, we go back to the same spot, or a little worse.

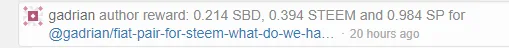

Because the debt ratio improved, today I received the first liquid payment which included SBD after a while:

Normally, I prefer a combined SBD/STEEM/SP reward.

But if a dump follows to bring the price of STEEM back the level where it was before the pump, then we'll find ourselves in the same situation with the price, only with more debt (more SBD). And that would not be good for Steem obviously.