This proposal is part of an ongoing effort to rework and adjust our LP incentives to ensure that we're creating value for the SPS DAO and our token. There are pools that some feel are being significantly overpaid for the value that they provide to our community. If a proposal does not pass, nothing will change until if/when a new proposal is made and passed. Please provide feedback during the preproposal phase as it relates to this particular pool's proposal.

If this proposal passes, the SPS DAO will stop the inflation being paid to the SPS:WETH liquidity pool on SushiSwap, which is currently 1,000,000 SPS per month. We recently reduced the inflation to this pool slightly, but it is still the worst performing pool in the ecosystem by a very large margin.

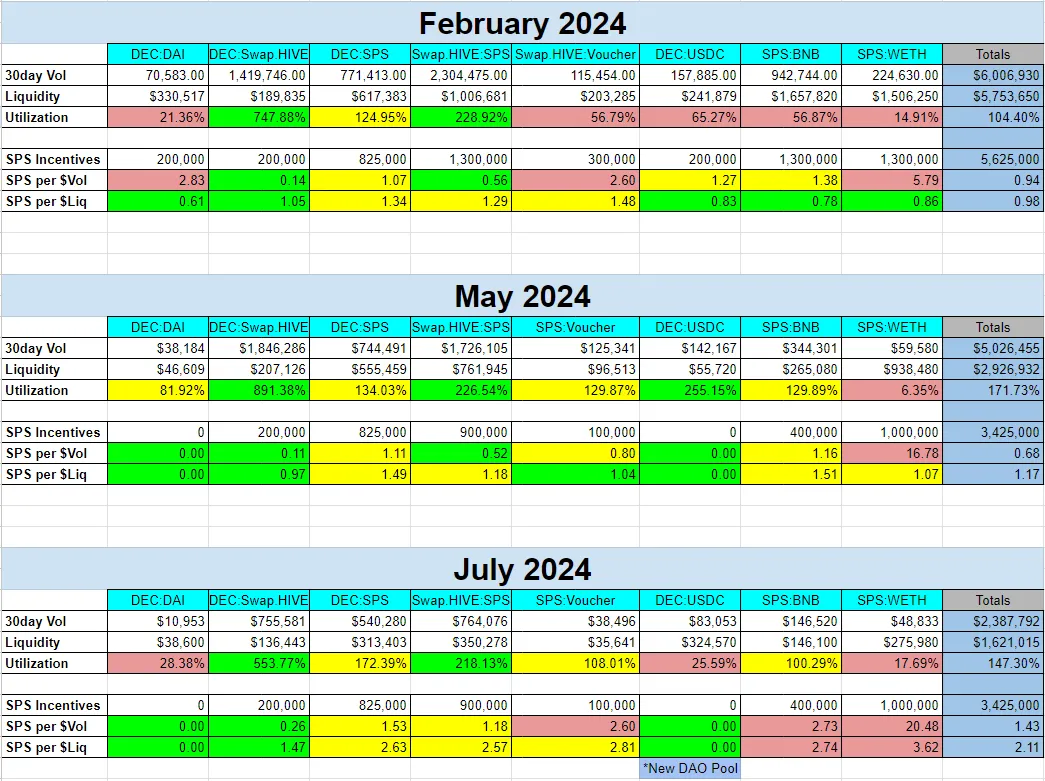

Chart comparing before and after recent LP cuts for all pools:

To offset this loss of liquidity and exposure on the Ethereum chain, the SPS DAO will establish a v3 liquidity position on Uniswap with an infinite range and 1% fees. The SPS DAO will deploy 50 of its Ethereum tokens and an equivalent dollar amount of SPS at the time of pool creation to this new v3 position.

To provide the amount of SPS required to build the position the treasurers will send SPS from the BSC wallet to the BSC reserve wallet and then remove the same amount of SPS from the ETH reserve wallet and send it to the active DAO wallet on the ETH chain where the v3 liquidity position will be created. Put simply, the Treasurers will bridge the SPS tokens without the use of a third party intermediary to avoid fees and excessive bridge exposure.

Pros and Cons

The goal of this proposal is to eliminate the large amount of inflation being paid to the worst performing pool that the DAO is currently supporting while turning that expense into potential long-term revenue generation for the DAO. Since the SPS token doesn't get much volume on Ethereum, it may not be a significant amount of income, but cutting the 1,000,000 SPS per month that is currently being minted for the existing pool is in itself a reduction in overall expenses.

The main potential con for this proposal is that we're likely to see some more SPS tokens sold off from the ETH pool when incentives stop. That said, if the liquidity providers are going to sell the tokens when we stop paying them, then we can save the roughly 35,000,000 SPS inflation that would be paid out to the pool over the next 35 months and skip to the end result without printing the extra tokens as the DAO has enough funds to take over the pool.