Source: hacked.com

Steemians,

Today we'll shed light upon one of the most controversial currencies. The currency that started as a promise has lost more than 60% of its value and has been rocking the bottom of the ocean ever since, despite constant developments. A lot of action takes place behind the scenes and this coverage you do not want to miss.

Since Ripple is the kind of coin that we can write a book on it, I will try to touch as many subjects as possible, but I will try to deepen only the most important. We will talk about the team and the general idea of the company. We will provide data on currency and technology and some things to consider.

Ripple is known as one that creates waves of news and publications, but one day it cost them dearly after the giant company (Coinbase) denied the XRP (Ripple) will be added to its platform after countless false publications claiming the opposite. The currency that was in crazy momentum crashed, and despite constant reports of partnerships and companies that integrate Ripple's system, the company is still not able to rise above the surface of the water.

Ripple means ...

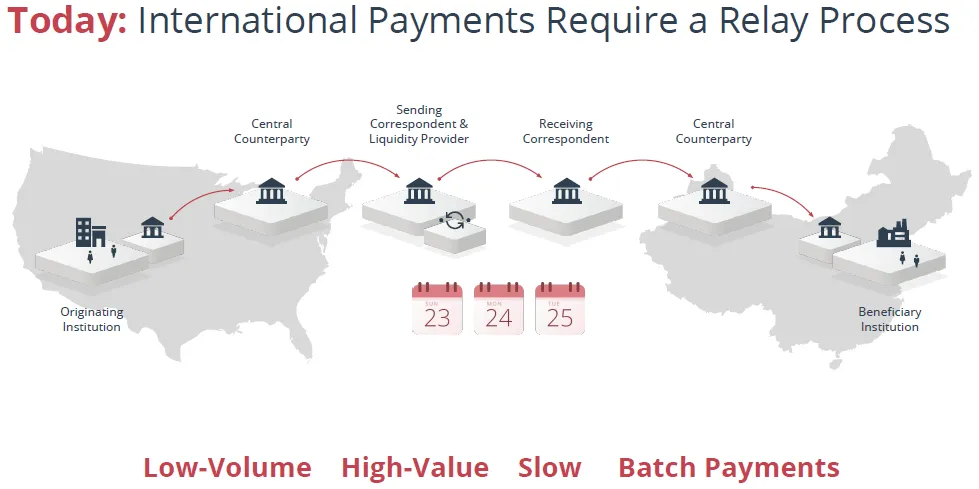

Ripple, a company that offers a solution for a fast, cheap and safe global money transfer. What distinguishes it from the current system? Today, sending money abroad takes 2-5 business days (not including Weekend and holidays). Average sending fee for December 2017 according to a report of "World Bank" is 7.09%. I'll say it again - 7.09% (!) Means that if you want to send $ 1000 to a relative of yours abroad consider that only $ 929.1 will survive the journey. Conversely, with Ripple, it will cost you less than a cent (0.00001 XRP) and at a speed of 4 seconds!

Behind Ripple there is a team that is considered one of the most promising in the world of crypto, led by CEO Brad Garlinghouse, a graduate of Harvard University and a former vice president of Yahoo. Ripel managed to raise about $ 93.6 million through a small number of investors to set up the company.

XRP Numbers

About 100 billion XRP coins were created. Currently, only 39 billion are on the market. And the rest are among the founders of the company. Just a minute ... What ?! Yes, the company holds 61 billion coins, but .. Ripple closed 55 billion coins with an automatic lock that would release a billion XRP each month for 55 months in favor of the company and eventually these coins would be released to the market. This move is intended to provide confidence to investors and banks that Ripple will not sell all this quantity one day and will bring down the market. The rest of the company's staff and initial investors hold 16 billion Ripple for its own use.

The currency currently stands at $ 1.14 to XRP, reaching a high of $ 3.30 after a wave of rumors about the currency combination. Perhaps $ 1.02 appears to be low compared to the peak of the currency, but at 18.2.17 exactly one year from today the value of the currency was $ 0.0063, leading to the conclusion that the currency made an annual increase of 16,190%. I know what goes through your mind while you see this data. And it starts with - "What if ..."

Ripple's Technology

Ripple's technology consists of two main platforms.

1. Xrapid

This is Ripple's flagship platform and enables the cheap and fast transfer of funds between banks/people. Xrapid is responsible for financial liquidity between accounts by the following process: User 'A' pays a dollar> User 'A' receives XRP according to the amount paid> User A sends through the Xrapid platform (the Ripple Blockchain) - XRP to user 'B' which is elsewhere in the world> User 'B' receives the XRP and converts back to the dollar.

2. Xcurrent

It is the system that is responsible for processing the data of the financial transfers for a secure and reliable transfer of money. The system can also be used for Fiat (physical currencies - USD / EUR / NIS) and not only for XRP switching.

The process is conducted as follows: The system combines customer information, transfer amounts, and geographical location of the two customers participating in the transfer> The system verifies that the data is correct and compares them> The system performs the transfer.

Ripple does not require the use of both platforms to work. Therefore, Ripple markets them as separate products that can be purchased by banks and financial institutions.

The Partners

Ripple signed a cooperative agreement with more than 100 financial companies and banks. Some of them are considered leaders in the field of money transfer. Only about a week ago, it was reported that Ripple signed with LianLian, the Asian company with a market value of $ 672 billion, and yesterday it was reported that UAE Exchange has signed a contract with Ripple. UAE is the largest money transfer company in the Middle East and is responsible for 6.7% of the global money transfer industry.

It's important to note

Some of the companies that entered into an agreement with Ripple purchased only the Xcurrent platform, which is not a platform related to the transition and acquisition of Ripel, so it is important to understand that this kind of integration should not directly affect the price of the currency.

Yet, in an interview with Yahoo, Brad, CEO of Ripple, touched on the issue and said it was only the beginning of the marathon. In the interview, it was hinted that in the future the companies that purchased the Xcurrent system will also buy Xrapid in the future.

Also worth noting, all XRP transfer fees are burned, meaning that the number of currencies that exist decreases (currency value increases). This doesn't sound significant given that the fee is so low. When Ripple will be more popular, the number of transfers will be measured in millions and then this value gets very serious.

Liquidity

Perhaps one of the most important issues that investors have not yet noticed about Ripple is that once companies that signed with Ripple will start using Xrapid, they will allow direct conversion of Fiat currencies into XRP, making Ripple an accessible currency for investors.

Bloomberg report published about a week ago

The report shares data on Futures contracts. I will not explain what a futures contract is, but in general, the report dealt mainly with the fact that the number of bets on the rise in the price of Bitcoin (bulls) is higher than 1:3 compared to those who think it will fall(bears). What is very interesting is that towards the end of the report it was noted that the betting ratio on the rise in prices at the Ethereum is 1:12 and Ripple is 1:18! In other words, only 1 out of 18 bet on a fall in Ripple prices.

Summary

Well, as we have seen, Rippel certainly has a solid idea of solving an existing problem. The number of the company's partnerships is increasing, and so is the number of those interested. There is a lot of uncertainty at the moment due to the huge fall of the currency since the beginning of the year. But very soon people will begin to understand what is happening in the company and it will not be possible to ignore the facts on the ground and understand that something big is brewing here.

To say the least, this is a very unpopular company among the Crypto and is considered the black horse of the digital market in terms of the values it represents. But it is very important to me to say that Ripple is a company with very large potential in the long term and I recommend that every serious investor in the market investigate their currency in depth.

An amazing week for everyone!

If you like what you've read, Check out some of our recent posts: