Helpless citizen - the taxpayers deserve a resolution, isn't it ?

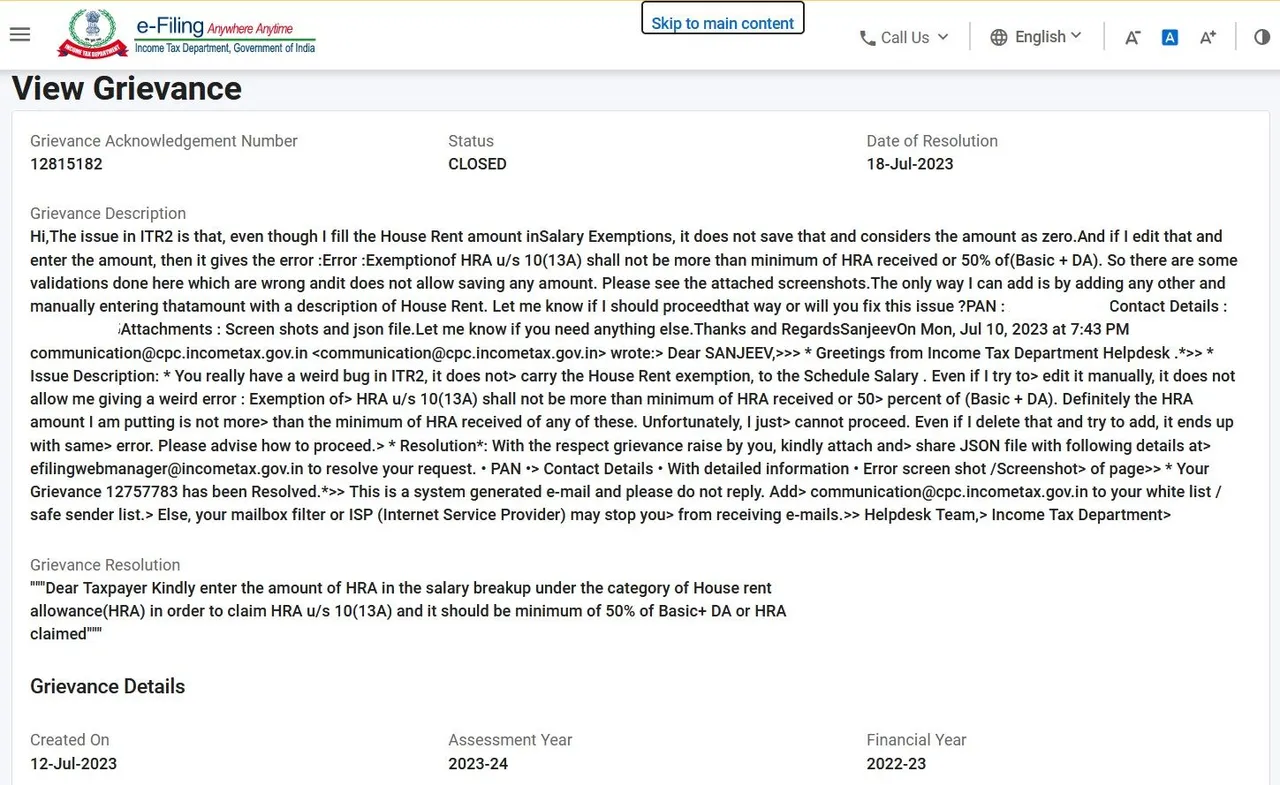

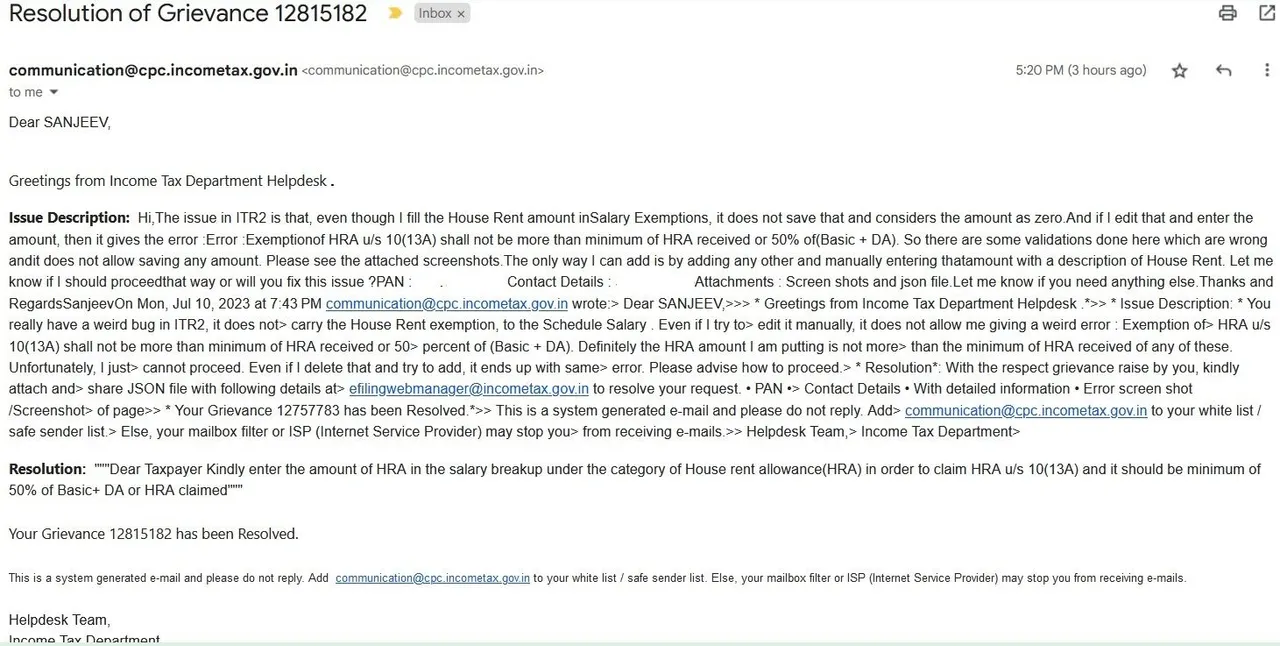

As I wrote in my last post, I had been waiting for a solution from the Income Tax department on the issue I have been facing. And to my surprise they resolved the query saying "Dear Taxpayer Kindly enter the amount of HRA in the salary breakup under the category of House rent allowance(HRA) in order to claim HRA u/s 10(13A) and it should be minimum of 50% of Basic+ DA or HRA claimed". The mail version is this, identical to what I see on their portal.

Did you even read my grievance ? I already mentioned this : even though I fill the House Rent amount in Salary Exemptions, it does not save that and considers the amount as zero.And if I edit that and enter the amount, then it gives that error..... And even I attached screenshot of that. Don't you understand plain English ? Even a lay man would would figured out that what they advised has already been tried out. And unfortunately it just blocks me to move forward. There is one workaround about which also I put in the ticket : The only way I can add is by adding any other and manually entering that amount with a description of House Rent. Let me know if I should proceed that way or will you fix this issue ? But it seems they have not looked at it in details and given a very very disappointing and unprofessional response. You have my number , did you even bother to call me once ? This is why I told in my last post : we are helpless citizen who is accountable to fill this in time (and also ensure to make sure you have no tax due) which is July 31st, barely couple of weeks left.

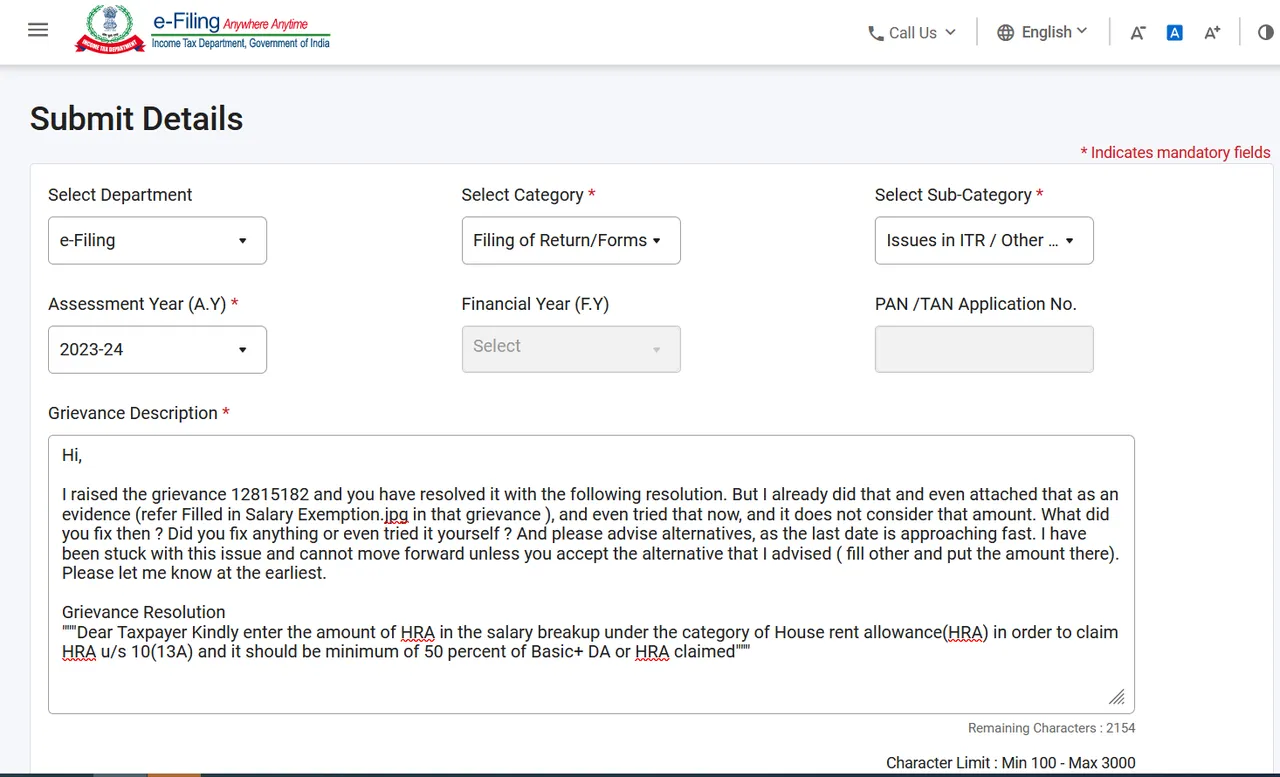

So with much disappointment I filled another grievance today, and now I will try to explore ways to bypass their validation based on my knowledge of how things work. They have a way to generate the final json file, so may be edit that and try to upload. Worst to worst, I will go ahead with the workaround. I know they may come back later to justify why I did so, but these posts will be a testimony to the fact that you should have fixed the issue at the first place making the process easy and smooth. They asked for a feedback on the resolution and I have given a 1 star rating with similar comments - this is absolutely an evidence of very poor quality measures in the software that you developed. We often talk about accountability in various metrics in Software development and it feels like they lack it.

Did any of you use the ITR-2 FORM to fill your income tax with a House Rent component ? If yes, can you help me please ?

And by the way I learned about a new thing on tax on leave encashment coming under Sec 10(10AA)-Earned leave encashment, will write about it in my next post.

copyrights @sanjeevm - content created uniquely with passion for #HIVE platform — NOT posted anywhere else! #HIVE is my only social diary - my blog is my life.