Well that escalated quickly...

And it still has a higher market cap than Hive... lol.

The problem with LUNA is the debt ratio.

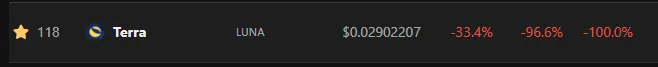

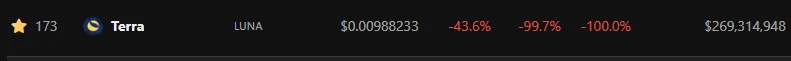

See look at that I step away for an hour and the price is down another 70%. LUNA is the perfect example of a death-spiral in action. I never thought I'd see such an obvious case. This is bad... this is REAL BAD.

LUNA can't live without intervention.

Just a few days ago LUNA's debt ratio was like 80%. For every dollar of UST debt LUNA had like $1.20 in reserves backing it up.

- Then it was 100%

- Then it was 500%

- Then it was 1000%

- And now it is 4400%

All in a matter of 3 days.

LUNA can't pay back the debt using conversions.

The money simply does not exist.

LUNA needs VC intervention or even more likely to sever the peg.

There's also a very good chance that LUNA forks to a snapshot point before three days ago and "airdrops" everyone's tokens back to them before it was inflated to the moon. No matter what happens this is a situation most dire. I prefer the fork method because VC intervention just creates more centralization and ownership of the network. However that will completely kill UST and everyone who has value there.

Types of crypto death spirals.

There are surprisingly many types of death-spirals in crypto. I was beginning to think they were just pure alarmism because they never actually happen.

Type #1: Bitcoin Mining Death-Spiral.

In this situation (in theory) Bitcoin Black Swans and loses a bunch of value. Then miners have no financial incentive to keep mining, which makes blocks get mined exponentially slower. This causes a panic which dips the price and increases the mining time even more. So on and so forth until Bitcoin dies or bottoms out.

This is an interesting one because Bitcoin measures time in blocks. We might think that Bitcoin would just adjust the mining difficulty lower to make sure that blocks get mined in this situation, but Bitcoin would never make it "two weeks" to the adjustment because "two weeks" is actually however many 10 minute blocks two weeks is (6 per hour; 144 per day; 2,016 per two weeks). If no one is mining Bitcoin anymore because the energy cost is higher than the reward, two weeks never happens. The only solution to this problem is a hardfork that changes how the difficulty change works, which isn't a big problem (and has already been solved by Digibyte technology) but Bitcoin would lose a lot of reputation and value in the short to mid term.

Type #2: Collateral Liquidations.

Many algo coins (like DAI) are really a derivative of another asset. When MAKERDAO/DAI first launched the only way to mint DAI was to lock Ethereum in a CDP contract and pull stable coin DAI out of it to be paid back later. This is essentially longing Ethereum because if the price of ETH crashes the position will get liquidated to pay back the DAI.

The death spiral happens when a Black Swan event pushes liquidity lower than the debt owed back. For example, if a couple billion dollars of ETH needs to be liquidated to pay back the DAI loans, but there aren't enough buyers at the current price, then ETH will spiral lower, creating more liquidations. In this case there wasn't enough liquidity on the market to prop up the debt and everything crashes. MakerDAO has some killswitches in place to prevent this from happening and will also print out MAKER to pay off bad debt should this happen (and it has happened at least once to my knowledge).

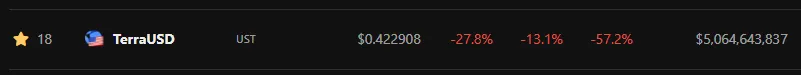

Type #3: Token Conversions.

This is how HBD and UST work. The governance token can be destroyed or created to mint the stable coin or pay back the debt. HBD is much safer than UST because our debt ratio is capped at a 10% haircut in addition to a 3.5 day average of the price being used to mint/destroy the token. LUNA/UST has none of these safeguards in place, and billions of tokens were printed at the current market price.

Now we see the outcome of LUNA's flawed model. The price has crashed 99.9% in days and the debt ratio has ballooned over 4000%. Even with over a billion dollars worth of Bitcoin collateral backing it up, this was just a drop in the bucket and didn't help the situation at all.

Both type 2 and 3 of the death spiral scenarios revolve around pegging stable coins with thin liquidity pools. Obviously this is a very flawed way to provide elasticity and stability to a market because more often than not the volatile asset ends up getting dumped at the bottom. Pegging a stable asset with a volatile asset just makes the volatile asset more volatile. Everyone celebrates the higher highs but no one wants to pay for it on the way down. Classic crypto tokenomics. LUNA/UST was the ultimate example that will be showcased in the history books for decades.

Sharks smell blood!

Another huge problem with the LUNA debt ratio is that short-sellers know it's basically impossible for LUNA to pay back the debt. This is true no matter what the price of LUNA is a this point. That means that short sellers can basically short LUNA at any price with the reasonable assumption that it will just keep dipping lower and lower. Now that one entity has exploited the terrible tokenomics, everyone is doing it, and there are no signs of it slowing down. Without serious intervention the value of LUNA and UST should drop to basically zero over the course of the next few weeks. Sad times.

Conclusion

The market is very depressing right now, but there's a lot to be learned and a lot of work still yet to be done. Crypto is in its infancy, after all. That being said, bear markets are for building. We see the biggest developments and evolutions when we are the most under threat. I'm excited to see what we come up with this time around. A full blown recession is right around the corner, and we can only hope that crypto will outperform the stock market over the next 18 months. I think we will, but you know me; ever the permabull no matter what happens. Crypto is already oversold at this level. Hopefully that will flip into an advantage rather than a liability after the dust settles.