A beginner's guide to Solana crypto (SOL), the fast, secure and extremely scalable blockchain.

Solana is a blockchain featuring extremely fast transaction speeds.

When more nodes come on board as part of the network, Solana aims to solve what they call the trilemma, by also offering security and censorship resistance.

If they hit their goals, the Solana crypto network certainly has the potential to provide the open infrastructure required for global adoption.

The Solana crypto project allows businesses to focus on their core value propositions and not worry about whether their blockchain infrastructure can handle the throughput.

Something that those building products and dApps on the Ethereum network can no doubt attest to stressing over.

By building on Solana, businesses the pitch is that you longer have to choose between scalability, security and censorship resistance.

Solana has solved the trilemma without the need for sharding or layer-2 solutions.

Sounds pretty hot, right?

Almost like its Solana summer or something!

Let’s now jump right into our comprehensive Solana guide, starting with an introduction below.

Introduction to Solana crypto (SOL)

We introduce Solana crypto (SOL), the fast, secure and extremely scalable blockchain.

Solana was primarily created by current CEO, Anatoly Yakovenko.

The former Qualcomm and Dropbox engineer was originally launched in 2017, but it wasn’t until March 2020 when the Solana (at the time, called Loon) mainnet was launched.

The Solana protocol

The solution to the trilemma that the team often speaks about, comes on the back of the Solana protocol.

Designed to facilitate decentralised application (dApp) development, the Solana protocol introduces a combined proof-of-history (PoH) and proof of stake (PoS) consensus.

You can see the protocol’s scalability simply by looking at the current transactions per second (TPS) running through the network.

Currently, Solana supports 50K TPS while producing new blocks every 400 milliseconds.

While the number of nodes may currently be limited and somewhat centralised when compared to Ethereum, there is no doubting Solana’s speed and efficiency.

Any dApps looking fed up with Ethereum’s expensive and slow transaction speeds can certainly weigh up the pros and cons of making the switch to Solana.

The SOL token

The native cryptocurrency of the Solana network and ecosystem is the SOL token.

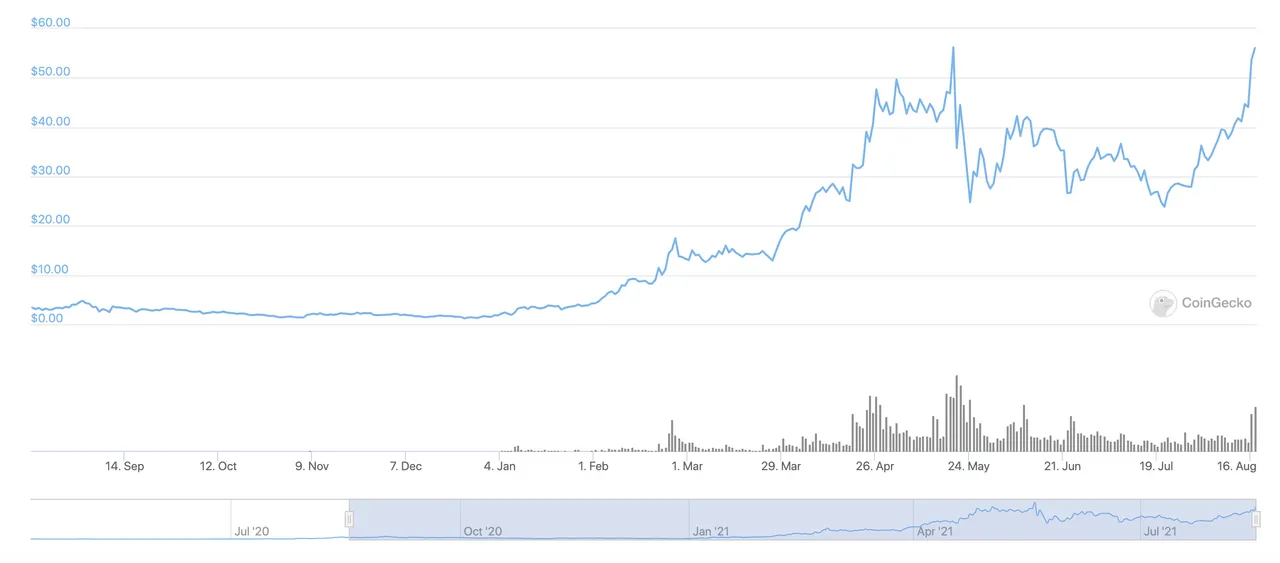

Rocketing up the market cap rankings to 10th on CoinGecko, Solana (SOL) consistently ranks in the popular and trending sections of the site.

All of this hype surrounding Solana crypto has obviously helped the price of SOL, with the cryptocurrency about to eclipse its all-time high of $56.20.

SOL has a maximum supply of 489 million and a current circulating supply of 26 million tokens.

Use cases for the SOL token include:

- Being passed to nodes in exchange for validating the network.

- Performing micropayments of fractional SOLs known as lamports.

- Staking to earn rewards.

If you’re interested in a deep dive into Solana’s SOL token distribution, the team publishes official transperancy reports that are worth a look.

Something we go over a little later ourselves.

With that introduction out of the way, let’s now head into the meat of our guide to Solana.

How does Solana (SOL) work?

Of all the blockchains currently in operation in the cryptosphere, Solana stands out as the most technologically advanced of all. Solana's network has the potential to deliver transaction speeds exceeding those presently achieved by the current large payment processors. In so providing this scalability solution by using many new technological advances, Solana has not overly compromised decentralization or security, bringing it one step closer to solving the blockchain trilemma.

HOW DOES SOLANA (SOL) WORK?

The usual conversation of how a cryptocurrency coin/token works begins and ends with a discussion concerning consensus. But with Solana, this is simply not the case. While consensus is part of the inner workings of Solana, other new and innovative technologies are at work here and must be addressed in the simplest fashion possible (absent all the techno-babble).

1. CONSENSUS MECHANISM (DPoS):

The consensus mechanism utilized by Solana is Delegated Proof of Stake (DPoS). Validators are utilized within the Solana protocol to process the system's transactions, and are chosen based upon their network holdings. Validator's earn compensation for processing system transactions and adding those transactions to the blockchain. However, any ordinary holder of SOL tokens may delegate their holdings to any one of the Validators, earning the holder an easy percentage of the Validator's profit. By allowing this delegation, everyone with any interest in Solana may take part in network security, and, more importantly, the holders of any interest in Solana have a say in which node(s) are best to validate transactions for the network.

The DPoS consensus system used by Solana has been found to be much faster than its regular PoS counterpart. Currently the Solana system processes blocks every 2.34 seconds, but bench tests have demonstrated block approval times are possible at 1.60 seconds. Each Ethereum block is generated at a rate of 1 per approximately every 13 seconds, so Solana is demonstrably faster, showing the reasoning for the growing interest in the DPoS consensus model.

2. PROOF OF HISTORY:

In an effort to make it's blockchain more decentralized, Solana employs a Proof of History (PoH) system whereby transactions are timestamped to assist in proving the prior events processed before the latest state is broadcast to the network. As the transaction entries are timestamped sequentially, time is saved as the transaction moves through the system as revalidation of each hash function is no longer required in each stage of the processing function. Within the Solana system, this function is known as 'Verifiable Delay Function'.

3. TOWERBFT:

Validators vote on ledger accuracy prior to finalization of the state of the ledger before entry to the blockchain. Once a validator votes, that vote is locked and timestamped. At that point, Validators can not make a different vote on a subsequent blockchain version that does not show the records of previous votes. TowerBFT (which is Solana's proprietary version of PBFT - Practical Byzantine Fault Toleration system found in other DPoS blockchains.) allows consensus to be reached absent transactional latency (time it takes for a transaction to move through the system, start to finish). As well, as communication between the nodes and the system chain is necessary to reach consensus, the TowerBFT system reduces messaging overhead in the system as timestamping renders the same moot.

In the simplest format, Tower BFT is a mechanism which records all prior consensus votes allowing Validator's to reference them instead of having to run the whole transaction chain thereby speeding up the validation process.

4. GULF STREAM:

Gulf Stream eliminates the need for an on-chain mempool. Gulf Stream functions so as to permit transactions to be forwarded to Validators prior to finishing the current block approval.

5. TURBINE:

Turbine is a blockchain broadcasting program that functions to break down data into smaller pieces. These smaller 'packets' of data may then be transmitted to the various nodes more quickly and with a corresponding saving of bandwidth.

6. SEALEVEL:

Sealevel permits the Solana protocol to execute smart contracts running in parallel. Multiple smart contracts that are similar in content may be leveraged within the same protocols. This running of similar contracts in parallel allows for simultaneous execution with minimal negative network effects.

7. PIPELINING:

Pipelining works to improve block validation times within the system by assigning different streams to input data to different system hardware based on specifications. By operating in this fashion, blocks are quickly validated and reproduced across the various system nodes.

8. ARCHIVERS

Archivers is a data storage protocol used by the Solana system. All of the information contained on the Solana blockchain may be reproduced by each node limited only by the node's hardware constraints. Archivers then download the validator's data and make the data available systemwide.

9. CLOUDBREAK

In essence, Cloudbreak constitutes the systems account database. Details on this innovation are quite confusing so simply put, Cloudbreak allows the system to improve previous data duplications by allowing the data to be read and written at the same time.

CONCLUSION

The Solana blockchain is moving closer to an optimum solution to the blockchain trilemma.

While Solana has not fully solved the trilemma, the nine proprietary systems set forth herein working in tandem have produced remarkable throughput with minimal negative effects on security and decentralization.

For those interested in a more technical view of the above mentioned nine system technologies, a starting point would be the Solana whitepaper.

What is Solana (SOL) used for?

First, there was Ethereum.

Then there were Layer 2 solutions for Ethereum.

Then there is Solana.

This section of our guide to Solana will answer the question of what Solana (SOL) is used for.

Background to Solana

First There Was Ethereum

With 2880 dApps written for it as of June 2020, Ethereum's dominance of the dApp space was at 81.7949%.

Then There Were Layer 2 Solutions

One consequence of that dApp dominance is high traffic and the congestion and gas fees that come with it. To alleviate that congestion plus its costs, a number of blockchain solutions have come about to form a Layer 2 over Ethereum (among them, THORChain and Polygon).

Then There Is Solana.

Just as ETH is used to pay for transactions on Ethereum, SOL is used to pay for transactions on Solana.

Like Ethereum, Solana is a blockchain meant to serve as the basis for a development platform for dApps. Solana was designed as a development platform which can fill in the gaps in Ethereum. Keeping in mind the Layer 2 solutions used to offload burdens from Layer 1 Ethereum, Solana provides significant innovations at its Layer 1. One of these innovations is its "Proof of History" consensus algorithm (PoH).

Despite the basic similarities between Solana and Ethereum-- development platforms which happen to have a cryptocurrency to fuel transactions-- Solana and Ethereum fill different niches. Rather than being an Ethereum-killer, Solana is actually more complimentary in that it fills the gaps present with Ethereum.

SOL can be used not only to pay gas fees but also for payments where SOL is accepted. In this way, SOL is similar to ETH and BTC (as well as HIVE and even DOGE).

What is Proof of History?

Most people would expect raw timestamps to be used to as part of mining a block to be added to a blockchain. If a network controls all the clocks, they all need to be in synch. If the clocks are controlled by various groups (as in a delegated proof of stake network), enough clocks have to be in synch for the timestamp to be rcognized as official. Either way, it can be a resource-intensive operation just to confirm the timestamp to be used. It can take too much work, so to speak.

Enter Proof of History, a variation of Proof of Stake.

The purpose of PoH is to prove that a transaction took place before some event; in this case, the event is another block.

Think of PoH as the blockchain equivalent of a "proof of life" photograph taken to show that someone was alive (or at least present) as of the date indicated by the front page of the newspaper shown in the photograph. It may take too much work to agree on the time a transaction took place, but it should be easier for nodes to find agreement that a transaction took place before another one.

Just as PoS was a major time-saver over PoW, PoH is supposed to be a major time-saver over PoS and PoW.

Uses for Solana

1. Creating dApps for Mobile Devices

Solana is a blockchain, and it has its own cryptocurrency (SOL). Additionally, Solana is a development platform developers can use to crate apps for mobile devices. At the moment Solana can be used by programmers using the well-established programming languages C and C++ ("C" plus plus) as well as the relatively new language Rust; over time, Solana will be available for use by other programming languages.

2. Decentralized dApp Development

As of publishing time, Solana.com notes that there are 302 dApps in its ecosystem. Most dApps revolve around cryptocurrency-oriented activities such as wallets, exchanges, explorers, DeFi. On the creeative side there are 22 NFT dApps including a marketplace. There are even dApps for dating and fantasy sports. These dApps (not to mention those in the works for future release) provide additional use cases for the SOL token.

3. Decentralizing dApp Purchasing

For someone who is not a fan of iPhones or Apple more broadly, one of the greatest disadvantages of iPhone is its reliance on the Apple App Store. For all practical purposes, there is no other place an iPhone user can visit to download an iPhone app.

(It's not much better for Andorid apps, although it's possible to obtain apps from non-Google Play sources. Either way, it's a centralized experience controlled by companies known for controlling people's data.)

Solana can be used to provide by mobile dApp developers to provide a decentralized app store experience.

4. Microtransactions

All transactions involving a credit card-- whether at a store, using a personal computer, or via mobile device-- involve processing fees. Sometimes the fees are tacked on to the transaction, sometimes there are built-in; but always they are present. Even a small percentage or a fixed fee can add up over the course of a year. We know that credit card companies need to profit from those fees in order to stay in operation, but sometimes it feels painful to pay that fee.

Transactions made using Solana cost less than USD 0.01-- less than a cent. Microtransaction fees can go directly to the developers of a dApp, or to service providers accepting payments in SOL. When transaction volume is large, that's a lot of SOL being collected.

5. Tokenized Stocks

While it is possible to purchase 1 share of a publicly-traded stock-- or even fractional shares of one-- the process for doing so is not as easy as it should be. Firms which have such programs don't publicize them because most of their money is made from the trade of larger bundles of stock to other institutions or to high net-worth individuals.

One way to make stock purchases more accessible to people with more-limited resources is by selling tokenized stocks. Tokenized stocks are digital assets that can be listed on cryptocurrency exchanges. It's like turning shares of stock into fungible tokens for sale.

Digital Assets AG, a token issuer based in Switzerland, has done exactly this by using Solana to launch its stock-tokenization infrastructure. Among the tokenized stock offerings are Facebook, Google, Tesla, Netflix, and Nvidia. Tokenized stocks are an excellent way for investors the world over to access the U.S. stock markets. Since tokensized stocks are crypto assets sold at a cryptocurrency exchange, they are available for purchase or sale 24/7/365.

Final thoughts on what Solana (SOL) can be used for

Rather than being developed as a payments system like Bitcoin and Dogecoin, Solana was developed as a developer platform like Ethereum. Solana currently has 302 dApps operating on its blockchain, and that number is expected to grow. Solana is built to scale well, something Ethereum has trouble doing despite dominating the dApp space at over 80%.

Solana is used for developing dApps for mobile devices. Thanks to its use of microtransactions, it removes the pain associated with payment via credit card. While not feeless, the fees of less than USD 0.01 make Solana a good choice for making dApps with in-app purchase capability.

Microtransactions also make it possible to provide an alternate source of mobile dApps. Solana can be used to make decentralized app stores which can rival the centralized stores offered by Apple for iPhone and Google for devices using Android.

Tokenized stocks allow investors from all over the world to have access to stocks listed on U.S. stock exchanges by offering them as digital assets on a cryptocurrency exchange. Unlike their paper counterparts, tokenized stocks are available 24/7/365. Swiss-based Digital Asset AG (DAAG) used Solana to set up an infrastructure for offering tokenized stocks such as those for Facebook, Google, Tesla, Netflix, and Nvidia.

Solana (SOL) vs Ethereum (ETH)

In this section of our Solana guide, we are going to compare two blockchains:

- Solana (SOL), and

- Ethereum (ETH)

This guide is meant to show you an unbiased comparison of blockchains in the discussion.

Solana vs Ethereum comparison table

The below table shows you the comparison points between Solana (SOL) and Ethereum (ETH).

| Solana (SOL) | Ethereum (ETH) | |

|---|---|---|

| Solana Project was started in 2017 by Team led by Anatoly Yakovenko and in 2020 the token was released. | Ethereum (ETH) project was started in 30th July 2015 while the whitepaper for ETH was released in 2013. | |

| Solana has 489 million SOL tokens in Market while 260 million are already into the distribution. Meanwhile 10.46% of tokens are under the control of the Solana Foundation. | Ethereum (ETH) marketcap has $365,186,415,050 of coins. Currently 117,046,619 coins are in market circulation. | |

| Solana project makes use of the Proof of History consensus mechanism. This consensus is designed for the scalability and usability of the blockchain. | Ethereum was deployed with the Proof of Work mining consensus. Since 2021 they have started rolling out consensus mechanism similar to the Proof of Stake. | |

| Solana supports smart contracts with faster confirmation times. It supports dApps, NFT and the smart contracts on it's ecosystem. | Ethereum supports the smart contract through it's Virtual machine and supports dApps, NFT and the multi-layer implementation on it's ecosystem. | |

| Solana supports Rust as it's solana specific chain language. And alternatively supports C as another language. | Ethereum makes use of the Solidity as a primary Language and is deployed on VM. | |

| Solana is scalable upto the 50,000 Transactions per second. It has 400ms block time. | Ethereum's TPS rate has been pretty variable (currently between 15 to 30 TPS) and is expected to change after the ETH 2.0 upgrade is complete. | |

| Solana enforces it's token standards and allows extensions through solana program library. | Ethereum has multiple token standards - ERC-20, ERC-721 and ERC-1155 and expected to have more as 2.0 upgrade is finished. | |

| Solana currently offers 7% APY for the staking rewards. You can stake through popular exchanges and the wallets. | Ethereum 5% per year. You can stake ETH through officially supported marketplaces. | |

| Solana is potentially useful for projects where faster transactions and the scalability is important. It is expected to be used in marketplaces, exchanges, financial smart contracts and dApps. | Ethereum's ability to support multi layer infrastructure has been used in various tokens, NFTs, dApps and smart contracts. |

Final comparison

Solana's faster transaction time per second and the block time is ideal for the financial smart contracts and the dApps.

It happens to solve different use cases than Ethereum.

Meanwhile, Ethereum continues to dominate the market with it's dApps, smart contracts and NFT project implementations for various use cases.

Is Solana decentralised?

With so many questions surrounding the decentralisation of the Solana network, we take a look at the token distribution numbers to make a call.

Each month, the Solana Foundation issues a transparency report.

These reports shows current and projected token distribution and network activity, while also updating investors on general happenings.

This section of our Solana guide takes a look at these token numbers at the end of 2020, to see just how decentralised Solana is.

Spoiler alert: Solana is not decentralised.

How decentralised in Solana?

Let’s dive straight into the Solana transparency report for December 2020.

Simplifying things right now, we have a token distribution of:

- Total unlocked tokens: 435,361,717

- Simple agreement for future tokens: 176,949,616

- Employees and service providers: 48,134,011

- Founders: 31,250,000

This also doesn’t include the fact that those 31,250,000 tokens earmarked for Solana’s founders, is actually only half of their share.

The other half will still continue to unlock on a monthly basis.

This means that around 60% of SOL tokens are in the hands of founders, early contracted investors, employees and the like.

Making them all essentially insiders under the control of a central authority, or at least having an extremely vested interest in towing the line.

Judging by this token breakdown, the numbers show Solana is actually extremely centralised.

Running a Node on Solana is extremely expensive

Using the token distribution numbers above, we can determine that over half of the total supply is owned by insiders in some way shape or form.

With over two thirds of SOL tokens currently staked, this means that the network is being run entirely by the select elite.

That is not decentralisation.

Adding to Solana’s centralisation woes, is the fact that it’s extremely expensive to run a node on the network.

It literally costs thousands of dollars in hardware to setup, run and maintain a Solana node.

As a result, there are just not enough truly independent nodes running on the network to act as validators.

Nobody is doubting the fact that the Solana network is fast and secure.

But the initial team have not decentralised, and do not plan to decentralise the Solana network in any way shape or form.

With the SOL inflation rate set to keep serving those same insiders who already have such a huge stake in the network, the centralised status quo looks set to remain.

Final thoughts on whether Solana is decentralised

It’s important to note in this final section of our guide to Solana that the issue of network decentralisation is never black and white.

Everyone is going to have a different level of comfort when it comes to the compromise between decentralisation and performance of a blockchain network.

When it comes to Solana, if you’re all about performance at the expense of true decentralisation, then this is the network for you.

If you’re not willing to compromise on the fact that nodes running Solana are controlled (or highly influenced) by a central entity however, then it won’t be.

There’s no right or wrong here and whether you choose to use Solana or invest in the SOL token on the back of what you’ve read here today, is entirely up to you.

What is Solana Season and Solana Summer?

Solana Season is a marketing campaign from the team, featuring a hackathon designed to expand the blossoming ecosystem.

There’s no denying the hype surrounding Solana during the latest crypto bull run that we’re in the midst of.

If you have talked about Solana on Twitter and tried to hashtag your post, you would have noticed the project’s Solana Season and Solana Summer promotions.

Our Solana guide has been designed to answer some key questions around the project, so let’s jump right in.

Solana Season

It always makes me laugh when projects talk about seasons.

Like, do you guys even science bro?

If you talk about it being Solana Summer, then you know that half the world is in winter, right?

You’re just isolating half the entire planet.

Anyway, that debate is for another time and place haha.

So onto what we’re here in this blog for - The SolanaSZN Hackathon!

The Solana Season Hackathon featured over 13,000 participants and over 350 project submissions from different builders across the globe.

While the hackathon officially ran only from May 15 - June 7th, the Solana Season crypto meme is still well and truly alive on Twitter.

You can browse the full list of Solana Season Hackathon projects yourself, but the clear winner and main project worth talking about in this section, is Zeta.

Zeta

Zeta’s mission is to provide the Solana ecosystem with a bulletproof options platform, such that anyone can hedge, speculate and take opinions on a limitless variety of market movements.

Coming from a forex trading background, I’m certainly no fan of binary options trading platforms.

But I can’t help be excited for the fact that this stuff is now being built on decentralised platforms, rather than hosted by scammy offshore brokers.

Final thoughts on Solana Season

While all activity is good for a project and crypto as a while, it’s hard to say whether the Solana Season and Solana Summer promotions have been a success.

Just like we’ve already spoken about in this guide to Solana, the projects we’re seeing are thin and don’t actually change a whole lot.

When you compare these platforms to what we’re seeing being built on truly decentralised platforms like Ethereum (and even BSC) daily, there is really no comparison to be made.

Solana Summer or not, I’m still a bit underwhelmed.

Solana (SOL) pros and cons

Solana (SOL) is a highly useable platform, providing lightning quick processing times attractive to both smaller individual users as well as large scale enterprise users.

In this section of the Solana Coin Guide let's investigate the pros and cons surrounding this project to gain insight into the viability of this protocol.

Solana pros

- Solana is a lightning fast network thanks in part to its unique proof of history (PoH) consensus coupled with proof of stake (PoS). The protocol is able to stream transactions quickly without giving up security by eliminating the wait for global consensus. When hardware options improve, it is estimated the Solana system will get even faster transaction times.

- Delegated staking is available for the Solana native token, SOL.

- The protocol is designed to be highly resistant to censorship.

- Transaction fees (gas) in the network are extremely low.

- Solana is open-source and permissionless allowing for greater and more widespread adoption of it's technology.

- Although there are presently fewer than 200 validators for the system, there exists low barriers of entry to become a validator.

- The Solana ecosystem is interoperable with Ethereum.

- Solana finds support in the cryptosphere from several large players such as Alameda Research and FTX Exchange.

- For users concerned with the security of their data, Solana utilizes zero-knowledge proofs which provide an additional privacy layer in transaction processing.

- Sharding technology is utilized in Solana to ensure a high degree of scalability.

- Use cases for Solana are not limited to the financial sector but extend to other sectors such as the legal sector, the retail sector and the insurance sector.

- Through Solana's fair distribution system, everyone in the system has an equal opportunity to earn tokens while at the same time protecting the ecosystem from exploits from centralized entities.

- Solana has a distributed network of nodes utilized which node operators are chosen by way of blockchain voting.

Solana cons

- A review of the Solana white paper demonstrates that there is no clear roadmap for the project. The project leaders have found no value in producing a roadmap (or for that matter any prediction at all relative to the project’s future) until such time as the project produces tangible results.

- Due to the limited number of validators, Solana may still be viewed as being centralized in nature.

- By focusing on the issue of scalability, Solana has relegated itself to a position where it will not process transactions as quickly as other chains that already are producing this effect.

- The project leaders are less than transparent when it comes to information concerning chain operations. This lack of transparency is seen by some as disconcerting when attempting to assess the credibility of the project for investment purposes.

- Due to a lack of working products within its ecosystem, many see Solana as an unprofitable venture.

- There exists little traction for the Solana project due to its low existing user base.

- A satisfactory functional hardware set-up for Solana is more costly than other chains.

- The project is still in Beta, and many items still await launch on the Solana Beta Mainnet.

Are there more Solana pros than cons?

It is Solana's goal to provide a highly scalable network for use by financial institutions and other general businesses. However, many users presently see no need for the Solana project due to its lack of working products. In this regard lack of a proper roadmap further aids user perception as to the need for Solana. These factors, coupled with Solana's low user base, make it very difficult for any future increase in value to happen until said factors are satisfactorily addressed.

The information herein contained is presented for educational purposes only and should not be considered investment advice. Prior to making any investment, it is highly recommended that you do your own diligent research. And remember, never invest more than you can afford to lose.

Should I buy Solana (SOL) in 2021?

Combining Proof of Stake (PoS) with a unique Proof of History (PoH) consensus mechanism allows Solana (SOL) to provide a fast, safe and efficient network for its users.

In this subsection of our Solana Coin Guide let's give a look into the factors to be considered in a decision on whether or not to invest in Solana (SOL) in 2021.

WHY YOU SHOULD BUY SOLANA (SOL)

- The blockchain trilemma is a true thorn for blockchain technology (Speed, safety and decentralization). Solana is taking the trilemma head-on and if successful could provide a hefty payout in the future.

- Solana operates as an ultra efficient blockchain using far less energy which permits it to be able to pass on some of the lowest transaction costs to its users.

- There are currently more than 250 projects based on the Solana system.

- Solana has a low total supply.

- investors may stake their Solana coins in cold storage wallets earning a huge reward (more than 20,000% since launch).

- Solana has actual real world use cases as it allows for instant payments to businesses and due to its high security, users need not worry about credit card compromise

- Solana has entered into several high profile partnerships including: Circle (USDC), Chainlink, and Kik (Kin).

- Solana processes more than 1000 transactions/second compared to Ethereum's processing speed of 14 transactions per second. Theoretically, Solana's maximum throughput is a huge 50,000 transactions/second.

- Since its all time low in 2020, Solana's price has appreciated more than 6000%, outperforming both Bitcoin and Ethereum in this regard.

- At the time of the writing of this subsection, per CoinMarketCap, Solana is reasonably priced at $43.24 (August 13, 2021 @ 11.19 EDT). As stated above Solana has a low circulating supply of 284,432,517.33 SOL giving Solana a market capitalization of $12,213,117,261. The maximum number of coins for supply is 501,620,948 SOL translating into a fully diluted market capitalization of $22,082,593,237. Solana is currently ranked the number 11 cryptocurrency by CMC.

WHY YOU SHOULDN’T BUY SOLANA (SOL)

- Solana is a very young enterprise without much history evident.

- In addressing the blockchain trilemma, Solana uses eight different very complicated technologies. These technologies have not totally solved the trilemma (but has moved the solution forward).

- The Solana team has yet to hit all its goals and milestones which has impeded the movement of Solana into the mainstream. Serious price appreciation in the Solana (SOL) coin is dependent upon the team meeting its goals.

- Overall ecosystem growth of Solana is dependent on the team meeting its goals and approaching as near as a technically practicable solution to the blockchain trilemma to cement its use case position.

FINAL THOUGHTS ON BUYING SOLANA

This subsection has provided you, the potential investor in Solana (SOL), with the key elements to consider in reaching a final decision on this token. In reaching a final investment decision many differing opinions should be sought out. Reliance on one source is highly discouraged.

It is a given that every individual investor possesses a different present financial circumstance, tolerance for risk, and investment strategy. These must be weighed in light of the factors and information above provided in finalizing any investment decision.

Please keep in mind that while these price predictions paint a rosy future for Solana (SOL) as an investment, they are just that - predictions. No one has a crystal ball that can guarantee future performance. As such, as a potential investor you may take the prediction for what it is, as the same is no guarantee of future price performance of Solana (SOL) due to the volatility of the cryptocurrency markets.

Please remember, this subsection of the Solana Coin Guide is merely a starting point and should not be deemed a substitute for doing your own diligent research. And as always, never invest more than you can afford to lose. Good luck!

LeoFinance Crypto Guides.

Why not leave a comment below and share your thoughts on our guide to Solana crypto (SOL)? All comments that add something to the discussion will be upvoted.

This Solana crypto guide is exclusive to leofinance.io.