A beginner's guide to Litecoin (LTC), the peer-to-peer cryptocurrency and open-source project that was an early Bitcoin spin-off.

Litecoin is decentralised money, free from censorship and open to all.

It allows anyone to send low cost private, secure, borderless payments to anyone else, anytime and anywhere.

Litecoin was created in 2011 by Charlie Lee, a former Google employee, to be a more efficient and faster version of Bitcoin.

Today, Litecoin is among the top 10 cryptocurrencies by market capitalisation and has a loyal following of users and investors.

If you're new to the world of cryptocurrencies and are looking to understand Litecoin, this beginner's Litecoin guide is for you.

We'll explain what Litecoin is, how it works, and why it's gained so much attention in recent years.

We'll also explore some of the key advantages and disadvantages of investing in Litecoin, as well as some practical tips for buying, storing, and using this cryptocurrency.

Introduction to Litecoin (LTC)

One of the main reasons why Litecoin has gained popularity among cryptocurrency enthusiasts is its speed and efficiency.

Unlike Bitcoin, which takes 10 minutes to process a block of transactions, Litecoin takes just 2.5 minutes.

This makes Litecoin a more practical option for daily transactions, as it allows for faster confirmation times and lower transaction fees.

Litecoin also uses a different mining algorithm than Bitcoin, which means that it's easier for users to mine with basic computer hardware, making it more accessible to a wider range of users.

Overall, Litecoin is a powerful cryptocurrency that offers a number of advantages over other digital currencies.

Whether you're interested in using crypto to buy goods and services, or simply want to invest in a promising asset, this guide to Litecoin will provide you with the knowledge and tools you need to get started.

So let's dive in and explore the world of Litecoin.

Is Litecoin a fork of Bitcoin?

One of the most common questions that people have about Litecoin is whether it's a fork of Bitcoin (BTC).

The short answer is yes, Litecoin is indeed a fork of Bitcoin.

However, it's important to understand what this means and how Litecoin differs from its predecessor.

A fork is a software upgrade that creates a new version of an existing blockchain.

In the case of Litecoin, Charlie Lee, the creator of Litecoin, used the Bitcoin codebase to create a new blockchain with some key differences.

The main difference between Litecoin and Bitcoin is the hashing algorithm used to mine the coins.

Bitcoin uses the SHA-256 algorithm, while Litecoin uses Scrypt.

This means that the mining process for Litecoin is less resource-intensive and can be done with simpler hardware compared to Bitcoin.

Additionally, Litecoin has a block time of 2.5 minutes, compared to Bitcoin's 10 minutes.

This means that transactions on the Litecoin blockchain are processed faster than on the Bitcoin blockchain.

Litecoin also has a different total supply compared to Bitcoin, with a maximum supply of 84 million LTC compared to Bitcoin's 21 million BTC.

Despite these differences, Litecoin still shares many similarities with Bitcoin.

Both Litecoin and Bitcoin are decentralised, peer-to-peer cryptocurrencies that use a blockchain to store transactions.

They both also have a finite supply, which gives them a deflationary aspect that many investors find attractive.

In conclusion, while Litecoin is indeed a fork of Bitcoin, it has evolved into a unique cryptocurrency with several distinct features that set it apart.

How does Litecoin (LTC) work?

Litecoin, like all cryptocurrencies, is built on a decentralised peer-to-peer network that allows users to send and receive transactions without the need for intermediaries such as banks or payment processors.

The Litecoin network uses a blockchain to store and verify all transactions on the network.

When a user sends a transaction on the Litecoin network, the transaction is broadcast to all the nodes in the network.

These nodes then verify the transaction and add it to a block of transactions.

Once the block is verified by the network, it is added to the blockchain and becomes a permanent part of the ledger.

This process is known as mining, and users who participate in mining are rewarded with newly created Litecoin as an incentive to maintain the network.

Litecoin’s Proof of Work Consensus Mechanism

Litecoin uses a consensus mechanism called proof-of-work (PoW) to validate transactions and create new blocks on the blockchain.

PoW works by having miners compete to solve a complex mathematical problem, with the first miner to solve the problem receiving a reward in the form of newly created Litecoin.

In order to participate in the mining process, users must invest in specialised hardware and consume a significant amount of electricity.

This process ensures that miners have a financial stake in the network and are incentivised to act in its best interests.

One of the advantages of using PoW as a consensus mechanism is that it is inherently resistant to attacks.

In order to take control of the network, an attacker would need to control a majority of the network's hash power, which is extremely difficult and expensive to do.

However, PoW also has some drawbacks.

One of the biggest issues is that it is very energy-intensive, with some estimates suggesting that the Bitcoin and Litecoin networks combined consume more energy than some countries.

Additionally, PoW can lead to centralisation, as mining tends to be dominated by a small number of large mining pools.

Despite these concerns, Litecoin continues to use PoW as its consensus mechanism.

The network is designed to reward miners for maintaining the integrity of the network and to promote decentralisation by making mining accessible to a wide range of users.

Overall, understanding how the Litecoin network uses consensus to maintain the integrity of its ledger is an important part of understanding how the network works.

By using a consensus mechanism that is resistant to attacks and incentivises users to act in the best interests of the network, Litecoin provides a secure and reliable way for users to send and receive transactions without the need for intermediaries.

What is Litecoin (LTC) used for?

Litecoin was created as a faster and more efficient alternative to Bitcoin, with a goal of providing a reliable and secure way for users to send and receive transactions.

As such, one of the primary uses of Litecoin is as a means of payment for goods and services.

Means of payment for goods and services

Many merchants and online retailers accept Litecoin as a form of payment, including popular platforms such as Etsy, Overstock, and eGifter.

Additionally, Litecoin can be used to purchase a variety of products and services, including electronics, clothing, travel accommodations, and more.

Store of value

Another common use case for Litecoin is as a store of value or investment opportunity.

Like Bitcoin, Litecoin is a decentralised asset with a finite supply, which means that its value is largely determined by market demand.

As such, many investors view Litecoin as a hedge against inflation and a way to diversify their investment portfolios.

Other uses for Litecoin

In addition to its use as a means of payment and investment, Litecoin is also used in various blockchain applications and services.

For example, some decentralised finance (DeFi) platforms use Litecoin as collateral for loans or as a liquidity pool for trading.

Additionally, some online gambling platforms allow users to place bets using Litecoin.

Finally, some users simply use Litecoin as a way to experiment with and learn about blockchain technology.

Litecoin's open-source code and active developer community make it an attractive option for developers and enthusiasts who are interested in building decentralised applications or contributing to the development of the network.

Litecoin (LTC) vs Bitcoin (BTC)

The main difference between Litecoin and Bitcoin is LTC’s speed and efficiency.

As mentioned earlier, Litecoin has a block time of just 2.5 minutes, compared to Bitcoin's 10 minutes.

This means that transactions on the Litecoin network are processed much faster than on the Bitcoin network, allowing for faster confirmation times and lower transaction fees.

Litecoin also uses a different hashing algorithm than Bitcoin, which makes it more resistant to mining with specialised hardware such as ASICs.

This helps to keep the mining process more accessible to a wider range of users and promotes decentralisation.

Overall, the Litecoin network is designed to be a fast, efficient, and secure way for users to send and receive transactions without the need for intermediaries.

By using a decentralised network and a blockchain to store and verify transactions, Litecoin provides a transparent and tamper-proof ledger that can be trusted by users around the world.

Whether you're looking to use Litecoin for everyday transactions or as an investment opportunity, understanding how the network works is an important first step.

Litecoin (LTC) pros and cons

When considering investing in any cryptocurrency, it's important to weigh the potential benefits and drawbacks.

Litecoin (LTC) is no exception, as it has its own unique set of advantages and disadvantages compared to other cryptocurrencies.

In this section of our guide to Litecoin (LTC), we'll explore five pros and cons to help you make an informed decision about whether or not it's the right investment for you.

Pros of Litecoin (LTC)

Faster transaction times: Litecoin has a faster block time than Bitcoin, which allows for faster transaction confirmation times.

Lower transaction fees: Due to its faster block time and lower demand, Litecoin often has lower transaction fees compared to Bitcoin and other cryptocurrencies.

Strong development team: Litecoin has an active and experienced development team, led by creator Charlie Lee, who continues to work on improving the network.

High liquidity: Litecoin is one of the most widely traded cryptocurrencies, with high liquidity on many major exchanges.

Decentralised and secure: Like Bitcoin, Litecoin is decentralised and uses a strong proof-of-work consensus mechanism to ensure the security of the network.

Cons of Litecoin (LTC)

Limited use cases: While Litecoin can be used for payments and other applications, its use cases are still somewhat limited compared to more versatile cryptocurrencies like Ethereum.

Vulnerability to market fluctuations: Like all cryptocurrencies, Litecoin's value can be highly volatile and subject to significant market fluctuations.

Energy consumption: Like Bitcoin and other proof-of-work cryptocurrencies, Litecoin requires significant energy consumption to maintain its network, which can have environmental implications.

Potential for centralisation: While Litecoin is designed to promote decentralisation, there is always a risk of centralisation as larger mining pools can gain significant control over the network.

Limited adoption: While Litecoin has been around for several years and has a strong user base, it still has limited adoption compared to more established cryptocurrencies like Bitcoin and Ethereum.

Why did Charlie Lee sell his Litecoin?

The answer to all your key questions around Charlie Lee selling his Litecoin (LTC).

On December the 20th, 2017, Charlie Lee sold all of his Litecoin.

Citing a perceived conflict of interest and personal reasons, Lee let both the Litecoin community and the world know at the same time via this Reddit post.

While it may have been the right decision in Lee’s eyes at the time, the Litecoin community certainly felt betrayed that their leader sold his stack at what was at the time, all-time highs.

This section of our Litecoin (LTC) guide answers some of the key questions around the sale and finally looks at where LTC is now compared to when Charlie Lee sold his Litecoin.

Was Charlie Lee’s Litecoin investment really a conflict of interest?

Whether it actually was or wasn’t is irrelevant.

The thing is that Charlie Lee felt that his Litecoin investment was a conflict of interest and therefore felt he had to sell.

Lee has consistently said that he did not sell for any personal gain, instead selling to eliminate the risk that he could sell at any time.

Seen as Litecoin’s Satoshi Nakamoto, the perception was that he had to have a large, which unlike Satoshi’s, could be dumped on the market at any time.

After selling his Litecoin, any perceived conflict of interest was removed and the project could become truly decentralised.

Did Charlie Lee have a big LTC stake?

Funnily enough, Charlie Lee continues to deny that he actually had a significant stake in Litecoin.

This of course makes the impression of risk we spoke about in the section above completely mute.

But rationality has never been one of the strong points of a market and as you’ll soon see on the chart, the price of Litecoin took a massive hit at the time!

If this was truly the case, then by selling his Litecoin, Charlie Lee couldn’t have actually moved the market itself.

But the rest of the market didn’t care and this is what hurt long term Litecoin HODLers the most at the time.

I mean what did Lee expect to happen here?

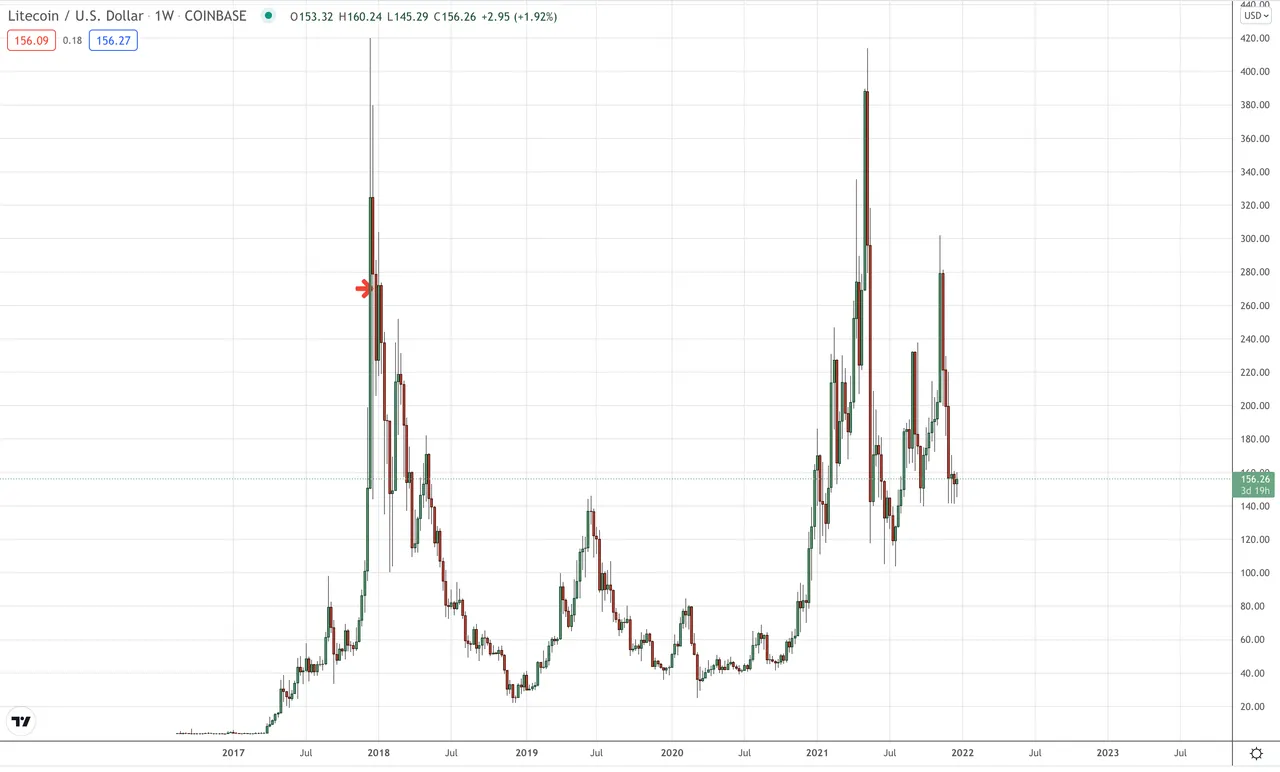

Has the price of Litecoin recovered since Charlie Lee sold?

Yes, the price of Litecoin has recovered, but boy did it take a hit at the time.

Check out the following Litecoin weekly chart with the point that Lee sold marked by the red arrow:

From $275ish, all the way down to $20 is one heck of a fall and you can see why the Litecoin community and fellow HODLers may have felt a little hard done by when their leader sold out.

But just like the rest of the market, you can see that Litecoin has since recovered.

Litecoin has resumed its bullish trend and has now firmly etched itself as a top 20 coin by market cap.

Charlie Lee still sold higher than the current prices, but it’s at least respectable now.

Where is Charlie Lee now?

Charlie Lee is still heavily involved in Litecoin, working as the Managing Director of the Litecoin Foundation.

While he may have sold his coins, he never actually stopped driving the project forward.

With price now back to where it is and Litecoin clinging to its place in the top 20 coins, I wonder Charlie Lee truly regrets selling his stack at that time.

There’s no doubt that with a little more communication and transparency, he could have held onto his stack in some way shape or form and eased the market’s fears.

But I guess we’ll never truly know now.

You know what they say about hindsight…

Is Litecoin dead?

Given the constantly evolving cryptocurrency market, it's natural to question whether or not Litecoin (LTC) is still alive.

While Litecoin has faced its fair share of challenges over the years, it's important to understand that the cryptocurrency is far from dead and continues to evolve and adapt to changing market conditions.

One of the key factors in Litecoin's continued relevance is its active and experienced development team.

Led by creator Charlie Lee, the team continues to work on improving the network and addressing key issues like scalability and transaction fees.

Additionally, Litecoin has been the testbed for implementing key upgrades such as SegWit and the Lightning Network, which have helped to address some of these challenges.

Does Litecoin have a future?

In terms of adoption, Litecoin has also seen growth over the years, with a growing number of merchants and platforms accepting LTC as a form of payment.

Additionally, Litecoin's high liquidity and active trading volume suggest that there is still significant interest and demand for the cryptocurrency among investors and traders.

However, it's important to note that Litecoin is still facing challenges in terms of market competition and shifting user preferences.

With the rise of newer cryptocurrencies like Ethereum and DeFi applications, Litecoin's use cases may be limited compared to more versatile alternatives.

Additionally, regulatory pressures and environmental concerns around proof-of-work cryptocurrencies could also pose challenges to Litecoin's continued growth and adoption.

Overall, while there are certainly challenges and limitations to consider, it's clear that Litecoin is still a relevant and promising cryptocurrency with a dedicated user base and active development team.

Whether or not it has a long-term future will depend on its ability to adapt to changing market conditions and address key challenges in the years to come.

Should I buy Litecoin (LTC) in 2023?

When considering whether or not to invest in Litecoin (LTC) in 2023, it's important to weigh the potential risks and benefits of the cryptocurrency.

While there are no guarantees when it comes to cryptocurrency investments, there are a few key factors to consider that could impact Litecoin's value in the coming year.

One factor to consider is Litecoin's historical price performance.

While past performance is not a guarantee of future results, Litecoin has generally performed well over the years, with significant gains seen during periods of market growth.

Additionally, Litecoin's faster transaction times and lower fees compared to Bitcoin could make it an attractive option for those looking for a more practical cryptocurrency for everyday transactions.

Another factor to consider is Litecoin's development roadmap.

As mentioned earlier, Litecoin has an active and experienced development team that is constantly working to improve the network and address key challenges.

In the coming year, we can expect to see continued development and improvements to the network, including potential upgrades to the mining algorithm and improved scalability solutions.

However, it's also important to consider the potential risks and challenges facing Litecoin.

Like all cryptocurrencies, Litecoin is subject to market volatility and could experience significant price fluctuations in response to changing market conditions.

Additionally, Litecoin's limited use cases and potential regulatory pressures could impact its adoption and growth in the coming years.

Ultimately, whether or not to invest in Litecoin in 2023 will depend on your personal investment goals and risk tolerance.

While there are certainly potential benefits to investing in Litecoin, it's important to approach any cryptocurrency investment with caution and do your own research before making any decisions.

Additionally, diversification across multiple cryptocurrencies and other asset classes can help to mitigate risk and improve your overall investment strategy.

LeoFinance Crypto Guides.

Why not leave a comment below and share your thoughts on our guide to Litecoin (LTC)? All comments that add something to the discussion will be upvoted.

This Litecoin (LTC) guide is exclusive to leofinance.io.