The TRAIN Law, the Donor, and the Deceased

It is the goal of the government to collect larger revenues to boosts its services to the people. One major solution the current administration found is amending the 20 year old tax code. The amendment set forth by this new law has an objective to make taxation a simple, fair, and efficient. One of the provisions in the old tax law that will be amended is the transfer taxes on donation and estates. Let us try to see what are the major changes of the new tax law on donation and estate taxation.

Overview

Donation is the act of gratuitously transferring the property or rights motivated by the liberality of the giver (donor) in favor of the receiver (donee) who accepts it.1

1Transfer and Business Taxation, 6th Edition Valencia & Roxas

Estate is the sum of a person's assets – legal rights, interests and entitlements to property of any kind – less all liabilities at that time. The issue is of special legal significance on a question of bankruptcy and death of the person2

Donor's Tax

Donation is the willful act of the donor to transfer his rights/properties to the donee for free. Donation to be valid needs to satisfy the 4 essential elements.

- Capacity of the donor

- Donative Intent

- Delivery of the gift

- Acceptance of the donee

The donee has the capacity to donate. It refers to the condition and legal competence of the donee to enter a valid contract since donation is a contract. Moreover, the donee must have a donative intent. It is the willful intent of the donee to legally transfer such rights/property without any consideration. Furthermore, the donee needs to deliver the gift either actually or constructively. The completion of the gift requires physical delivery. Lastly, the gift must be accepted by the donee in order to have a donation. One must remember that in the Civil Code a donee is not obliged or cannot be forced to accept the gift of a donor. It is so because of the reason that there are people who do not want to have a debt of gratitude.

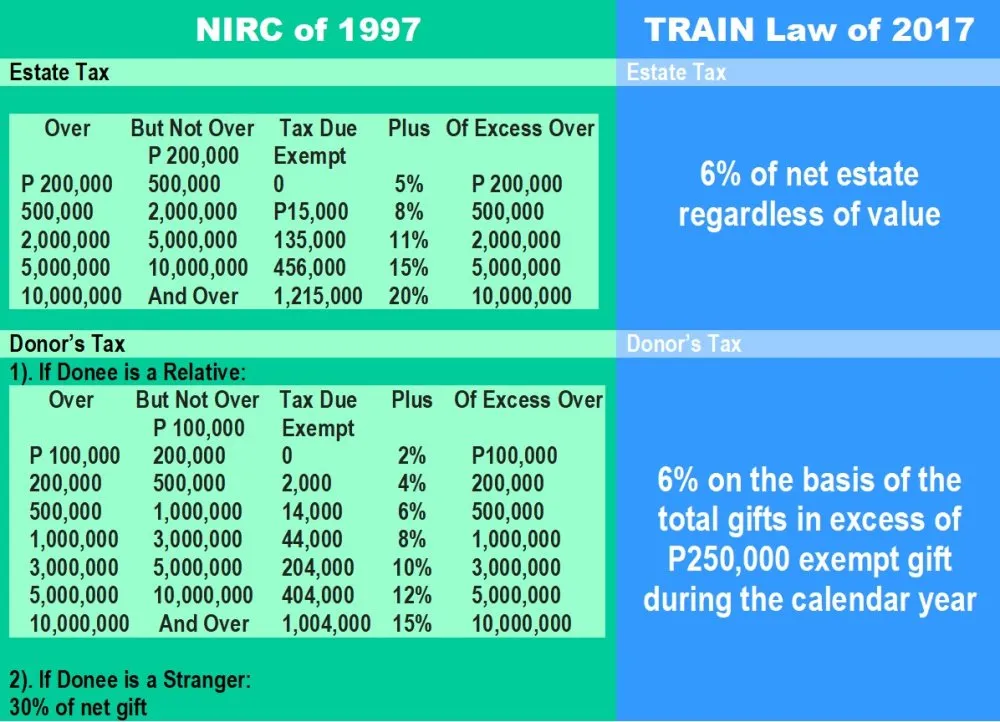

Old Tax Code

The old tax code is very disturbing. In the old law, taxing the donation needs to be classified if it is donated to a relative or a stranger. Moreover, the old law in donation has the flat rate and the tabular rate.

There is a donation to a relative if the donee is within the 4th degree consanguinity in the collateral line. In simple words, it is only up to the first cousin to be considered a relative. Children of the first cousin are already in the 5th degree and are considered stranger for tax purposes. All other else beyond 4th degree are considered strangers.

| Deductible Items | Old Tax Code | TRAIN LAW |

|---|---|---|

| DOWRY | Deductible up to 10, 000 | REMOVED |

| Encumbrances | Deductible | Deductible |

| To NGO | Deductible | Exempted |

| DImunition | Deductible | Deductible |

| To Government | Deductible | Exempted |

TRAIN Law

Under the TRAIN Law, all donations whether to relatives or strangers are treated under the flat rate of 6%. Things have been made simple. Another also is that Dowry exemption of 10, 000 is removed.

Donations in excess of 250, 000 [100 000 in the old] are now subject to 6% flat rate.

EXAMPLE| Donations | TRAIN LAW |

|---|---|

| Car to Son 50 000 | 50 000 |

| House to Daughter 200 000 | 200 000 |

| Land to Neigbors 300 000 | 300 000 |

| Total Donations | 550 000 |

| Taxable Donations | 300 000 |

| Tax Due | 18 000 |

In Excess of 250 000

Estate Tax

Estate Tax is the tax imposed on the transfer of property of the deceased to his heirs. Basically, even when you die you will still have to pay taxes. Estate tax is a very broad topic. It is so detailed that it can twist your brain.

To simplify everything, let us just focus on the new changes.

- Estate Tax has now a flat rate of 6% same as donor's tax.

- The standard deduction is now Php 5 000 000 [ 1 000 000 in the old]

- Funeral expense (maximum up to 200, 000) , Judicial Expenses, Medical Expenses (maximum up to 500, 000) have been removed.

- 10, 000, 000 allowed deduction for family home. [up to 1 000 000 in the old]

- Estate tax return showing a gross value exceeding 5 000 000 [ 2 000 000 in the old] shall be supported by a statement duly certified by a CPA.

- Time for filing shall be within 1 year [ 6 months in the old] from the decedent's death.

- Payment by intallment - in case the available cash of the estate is insufficient the estate may be allowed to pay by installment for 2 years without any civil penalties and interest.

The things enumerated above are the major changes brought by the new tax law for observance. Everything has been enumerated to be simplified or else if discussed thoroughly might result to a more complex and mind blowing incident.

Sources:

- R.A. 10963 TRAIN LAW

- https://pinoygeektivist.wordpress.com/2018/01/06/2017-amendments-to-the-national-internal-revenue-code-by-the-train-law/

- bir.gov.ph

PS: Please correct me if I am wrong. I am open to corrections. Comment down any violent reactions, questions, and the likes. Feel free to comment because it is free.

Your Lovely Accountant Steemian