I quote this because it encapsulates the fact that the contents of this article may be unsettling compared to the other articles that I normally write. I still feel compelled to write this article because I've been exploring the financial world for the last four years and it's definitely given me a more complete view of the world. I want to share some of what I've come across with you guys.

I'm also going to write about cryptocurrencies like Bitcoin in the future and to understand why Bitcoin and other cryptocurrencies may continue to rise, it's critical that you understand the contents of this article. I hope that you find this topic interesting and that it inspires you to do your own research afterward.

Now with that said let's begin.

We all know that you and I don't control, our employees don't control it, the companies that they work for don't control it. So who does? Where does it even come from in the first place?

I'll give you a hint: Money does not come from the government.

It's a seemingly obvious question that's never asked or taught in schools for some reason. Unfortunately, most people's lives are basically dedicated to money. It's all people ever worry about or talk about. We go to school to learn basically how to go to university to learn the skills to get a good job so that we can trade hours of our lives all for this thing called money.

So why wouldn't you want to know where the money comes from and who issues it?

Today in this very special article you're about to find out the answers to a question of who controls all of our money.

People today can tell something isn't quite right with our financial system but they just can't put their finger on it. Some people think it's the failure of Government and others think that it's a failure of capitalism itself this article should clarify a few things.

The year 1694 and England had just suffered through 50 years of war exhausted the English government needed loans to fund their political means. Brainchild of Scottish banker William Paterson it was decided that a privately owned bank that could issue the money to the government out of thin air was to be the solution. This was the very first modern central banking system in the world. Central banking is more influential than laws, governments, and politicians but strangely not the focus of the general public.

Fast forward to the early 20th century and after two failed attempts a group of bankers wanted to put a central bank in the United States of America.

It was December of 1910 and Senator Nelson Aldrich ordered a private train car in New York with six others. The six were not to be spotted by any news reporters to avoid questions, their destination Jekyll Island off the coast of Georgia. The meeting went for nine days and from that, they created the Federal Reserve System.

This is all documented and a matter of public record, some of them went on to write about the meetings in the personal biographies. Here is a quote from Frank Vanderlip, president of the National City Bank of New York February 9th, 1935 in The Saturday Evening Post.

The six men that Nelson Aldrich brought together included the head of banks, branches of government such as the Treasury and some of the richest people on earth at the time. To give you an idea of how rich they were in 1910, these six men represented a quarter of the world's worth.

The bankers told the American public that the purpose of the system was to stabilize the economy and to stop the grip of the Wall Street banks over America. The problem was the guys that wrote the bill were the very same people they said they'll stop. If they succeeded it will give a small group of men the ability to create money from nothing and loan it to the American government with interest.

So why was it done in secret?

Because the American people didn't want a central bank. Back then unlike today, people knew what central banks were and understood them very well. Everywhere a central bank went there will be wealth inequality, wild swings between economic booms and paths and after each pass, those at the top of society mysteriously came out richer while everyone else got poorer. Europe was a running example of this at the time.

The Federal Reserve was originally drafted as the Aldrich bill but when it came into Congress they recognized them as Aldrich named and smelt a rat. The bankers needed better cover, they decided to send two millionaire friends to carry the bill to quell the suspicions of Congress and renamed it the Federal Reserve Act.

Next, the bankers set out to fool the American people through disinformation. In the newspapers of the day, the bankers screamed and protested against the new Federal Reserve bill it would ruin the banks they exclaimed. The average person read the protesting articles of the bankers and thought to themselves if the bankers hate it, it must be good and then they ended up unknowingly supporting a Trojan horse.

The bankers also fooled Congress by putting clauses in the bill that limited their power only to remove them once the bill was passed. A double head fake of the public and Congress was all it took. The bill was passed on December 23rd, 1913 while most of Congress was out on holiday and with that, a small group had complete monopoly over the issuing and creation of American money.

Today the Federal Reserve is the most powerful entity in the United States and they're not ashamed to admit it either. Here is former Fed Chairman Alan Greenspan in an interview:

In addition to this it seems that the Fed can't even be touched by investigating parties. Transcript from US Senate Session (Who's keeping Track of The Fed ?(2009)).

So what does all of this have to do with me you might be asking. I don't even live in the US. Well, two reasons number one the central banking model from the Bank of England and the United States has now been put in all countries and even consolidated power in parts of Europe as the European Central Bank or ECB. This unites separate countries under one economic policy.

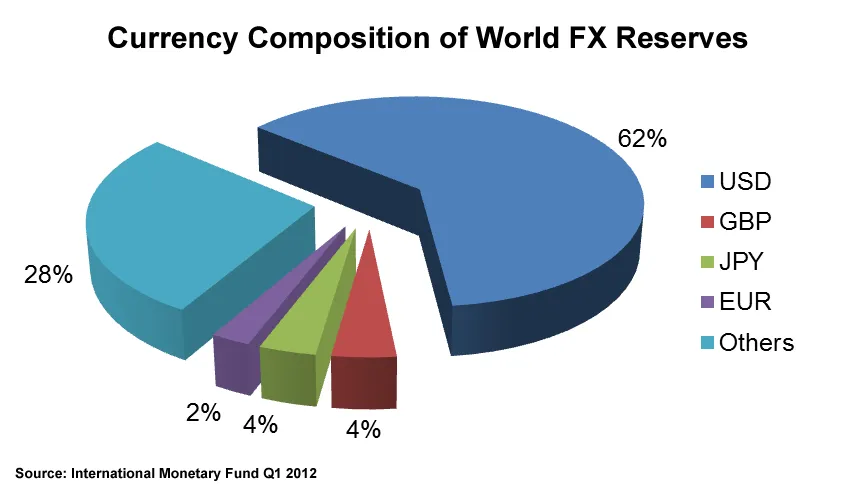

The only places in the world that don't have central banks are North Korea, Iran, and Cuba. In 2000 this list suspiciously included Afghanistan, Iraq and Libya and number two since the end of World War II the US dollar has been the reserve currency of the world. This means that all central banks hold US dollars in their reserves, in other words, all other currencies are backed by the US dollar. This directly links to your country to the Federal Reserve's monitoring policy in America, more on this later.

When the post-world War two monetary system called the Bretton Woods system was created all US dollars were backed by and exchangeable for gold a byproduct of this was that currencies used to be very stable in relation to each other.Quote by Mike Maloney(Investor & Monetary Historian)

For that all the countries the exchange rates were fixed in year after year you could predict what prices were going to be you could start a business elsewhere know if you were you know you could calculate profits business was much much easier before for live exchange rates.

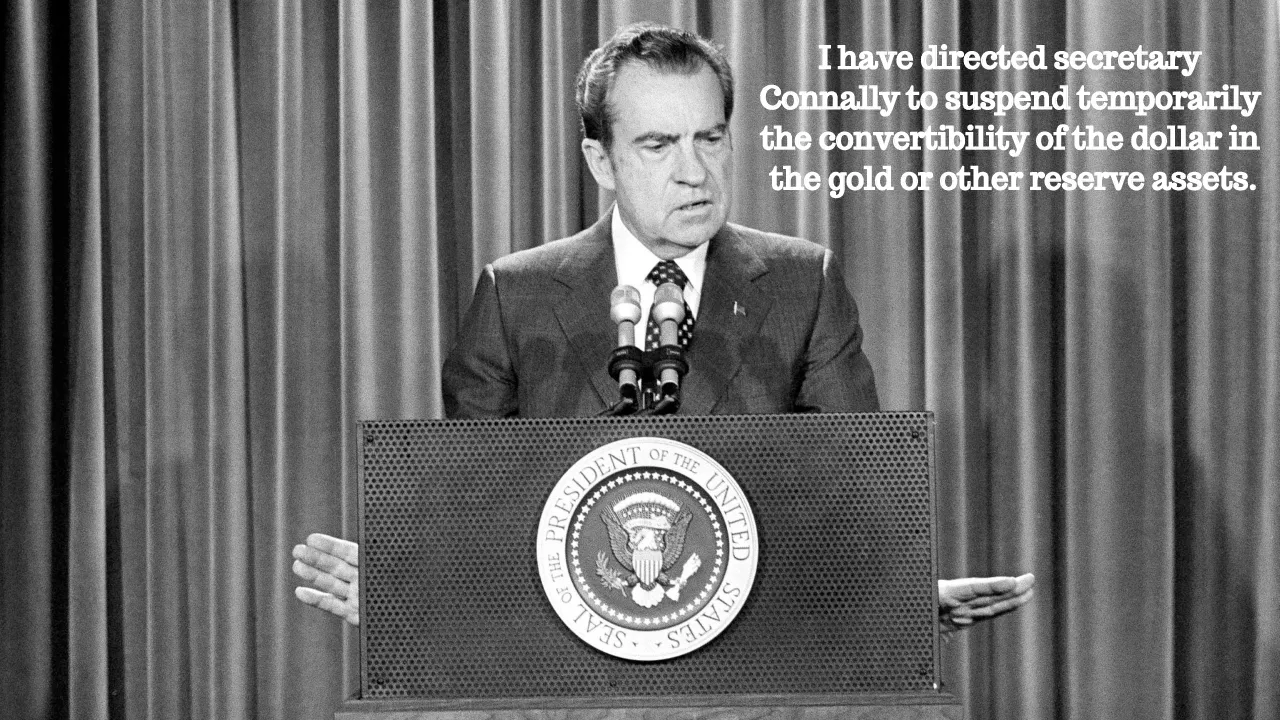

Unfortunately in 1971 due to a falling US dollar international capital flows into gold and the funding of the Vietnam War President Nixon took the U.S. dollar off the gold standard.

Now the dollar was floating and backed by nothing and has been ever since.

Okay so let's think a little if the US dollar is backed by nothing but the world reserves are backed by the US dollar intrinsically since 1971 doesn't this mean that all currencies are now backed by nothing tangible only trust in the American Government, well this is correct money backed by nothing is known as "FIAT" currency. Fiat in Latin means "let it be done", in other words, the government says it is money so it is.

A consequence of having money backed by nothing is that whenever the Federal Reserve creates money it dilutes the currency supply of all other nations because their reserves are backed by the US dollar. All countries reserves are worth less each time money is created. In the past few years the Federal Reserve has printed trillions of dollars and countries like Russia and China have noticed this as a reaction to the money printing these countries have been selling U.S. dollar reserves and buying gold over the same period, but wait a second some of you clever thinkers out there may have asked yourself if every currency on earth is backed by nothing how am I able to pay for things? Well as it turns out the whole economic system today is running because of the backs place faith. Faith that you can exchange your unit of currency for goods or services, in a way part of that faith comes from the fact that not many people actually know where the money comes from. We're about to find that out in this article.

A central bank is essentially the entity that manages a nation's money supply and it can loan money to the government with interest. In the United States and most other countries it works like this.

When the government needs more money than they received from taxes they ask the Treasury Department for money, the Treasury then receives an IOU or bond from the government the Treasury through the banks gives this IOU to the Federal Reserve. The Fed then writes a check for this IOU and hands it to the banks at this exchange at the bank's money is created and it can be used to pay government bills.

So hang on where does the Fed get the money to be able to write this check?

They get this money from nowhere. They literally just invent it. Here's a quote from the Boston Federal Reserve.

"When you or I write a check there must be sufficient funds in our account to cover the check but when the Federal Reserve writes a check there is no bank deposit on which that check is drawn when the Federal Reserve writes a check it is creating money."

So, in essence, they're writing a check and creating money from an account that has no money in it. The money the Federal Reserve creates can be used as legal tender to buy things and eventually makes its way into the real economy. If you and I did that would go to jail for fraud but they can do it because they invented the system. This is the same system used throughout the world today.

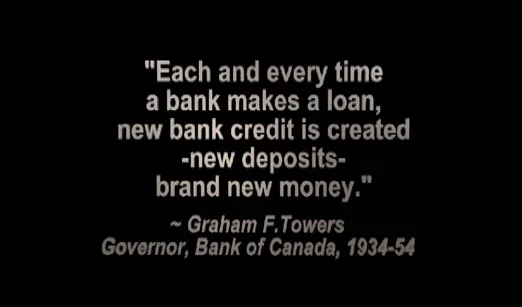

Another part of this money creation happens to the commercial bank side. Every time you take out a loan to buy a house car or TV banks create money out of nowhere to give you this loan and you still have to pay interest on it and don't just believe me when I say that hear it for yourself from the horse's mouth the people running the system Graham Towers former governor of the Central Bank of Canada states

Paul Tucker Deputy governor of the Bank of England

"Banks extend credit by simply increasing the borrowing customer's current account."

What they're basically saying is that each time the bank makes a loan the bank doesn't use other people's deposited money and give it to you. It creates new money. In modern times this means typing digits into a computer. 97% of all money is digitally created like this, only 3% is the physical cash and coins that we carry.

Another crazy thing that commercial banks can do is lend out 10 times more money than they actually have in reserves. This is called "fractional reserve lending".

So who wrote this ridiculous system into law? For the United States it was part of the Federal Reserve System drafted in 1913 and again this is the same system used throughout the world. So what's the issue why should I even care? All this consequences when more loans are given out more money is created and the rest of the money in circulation is worth less and less as the years go on, this is known as "inflation".

In a way inflation is basically a tax that we all pay for the fraud of money printing. Easy money now in exchange for a tax on our future generations. It's also a way, in 1950 a house used to cost $7,000 and a car $2,000 obviously, this is no longer the same today. Things will always keep getting more expensive as long as this system is in place. This was actually kind of ok because wages grew in relation to inflation until about 2008.

So things are ready pretty crazy but they get even crazier the more you look into it the stranger things become. So remember how we're talking about how central banks and commercial banks can create money out of nothing. This procedure actually does create something, it creates "debt". Let me explain, when you take out a loan it's written down as an asset in the bank as a negative form, kind of like a negative value of money or otherwise known as debt. Under this system debt is actually money and again don't just listen to me Marriner Eccles former governor of the Federal Reserve states

So, in essence, instead of gold being the backbone of our economy is now debt. The system we are under now is sometimes referred to as the debt based monetary system. It requires that debt always grows, countries and people must become deeper in debt so that there's more money in the system because remember debt is money. If people and government stopped borrowing money and pay back loans. The debt doesn't grow, the money supply shrinks and the system falters. It truly is bizarre but we all live in this system each and every day.

The Federal Reserve and other central banks control money by adjusting its supply and how much it costs to borrow money otherwise known as the interest rate. With these tools and as a consequence of human group psychology central banks can create booms and busts in the economy at will and also to store and derail an economy by messing with it.

Let's take a quick case study.

In the year 2000 Federal Reserve Chairman Alan Greenspan cut interest rates to 1%. He did that to try and fight off a recession from the dot-com bubble and encourage people to borrow money. When interest rates are low, if you're borrowing money you save a whole lot on repaying mortgages. Since the 1% interest rate hadn't been seen at the time since the 1950s it was a pretty good deal. Greenspan's idea was that he could create a wealth effect, people would start to buy houses the prices would go up and the people would feel wealthier and spend more money in the economy and stimulate it. Greenspan's sure succeeded in getting people to borrow money to buy houses but they borrowed too much and the results was the 2008 housing bubble. This is a prime example of what can go wrong when central bank's mess with an economy. Yes, corrupt bankers have a lot to answer for on their role in the 2008 crisis but the Fed has a far bigger long-term impact.

Even crazier things are happening in Japan. Their central bank is buying so many stocks that they were the number one buyer of Japanese stocks in 2016, so they have part ownership of companies with money that they created from nothing. So, in essence, it is the central banks that control our economy and the central and commercial banking system together that control all of our money.

The difference is central banks can create money at will while commercial banks need loans to create money. To give you an idea of people's views of central banking when people actually knew what central banks were, here's a couple of examples

In 1881 then President of the United States James Garfield states

Benjamin Franklin in his autobiography stated that the prime reason for the American War of Independence was a battle over who actually controlled and issued the money of the new colonies.

Moving on to more modern times Nobel Prize-winning economist Milton Friedman states

"The Federal Reserve definitely caused the Great Depression by contracting the amount of currency in circulation by one-third from 1929 to 1933."

So with all this being said some would argue that central banks are not inherently a bad thing they just need to be part of the government and not privately-owned. The government should be able to issue its own money for the benefit of the people and shouldn't have to pay a massive interest on its own debt. This was tried at least once in the United States by President Lincoln he stated this

Abraham Lincoln then issued his own government money it was called the "greenback". No further comments on that story.

So I think we'll end the article there. There is so much more that I can cover about what central banking decisions led to what revolutions around the world. Pretty much when you look at it all revolutions and all wars when you dig through everything it all boils down to money.

I could also have talked about the new global movement of those who are rejecting the debt based economic system people are starting to move their currency into gold silver and cryptocurrencies like Bitcoin so there is a light at the end of the tunnel that's a whole nother story for another day.

Anyways if you've read the whole way through this article congratulations.

You're one of the few who have found out the hidden truths about who controls all of our money. I think I have met only met about four people in real life that have been aware of a debt-based economic system. It's strangely unknown but is this true is anything. I haven't showed you all the quotes of the bankers and the former heads of the Federal Reserve telling you from their own mouth how the system actually works if this is your first time hearing all of this I encourage you as I said before to do your own research and then you'll start to see the bigger picture and the world today will make a whole lot more sense.

So anyway I think I'll wind up now thanks for reading.

This isn't the stuff I normally make but I think you'll like the other stuff anyway I really hope you learned something from this article and I'll see you again soon for the next article.

Cheers guys have a good one.