(image source evilenglish.net)

The Situation

The canary has been showing signs of sickness. The Fed has to decide whether to raise rates in a few weeks or not. Raising rates in a meaningful way will wreck the country due to the debt load and economic conditions. Not raising rates is a de-facto admission the economy is in dire straits and attempts to correct course have failed. If they raise rates in any meaningful way, and possibly in an insignificant way such as a .25 rate hike, it may just start the beginning of the end as the bubbles begin to pop.

Weaker countries that don't have the luxury of cranking up the money printers when it suits them have already begun to partially/totally collapse or default (Greece, Venezuela, Ukraine, etc). Most of these developing countries still possess the means and mindsets to survive the challenges. Long standing developed nations... not so much.

The number of alarms and warnings going off increases every day no matter where you look. We are essentially at record highs for the DJIA, SP500, and NASDAQ as companies report customer order collapse, announce layoffs, scale down or close facilities, and fail to meet earning expectations. Various bubbles appear to be formed and prime to pop at this point. Car loan bubble, another mortgage bubble, higher education loans, etc. For example:

Update Last week one of the world's biggest shipping lines, Hanjin Shipping, declared bankrupcy stranding $14 BILLION in cargo at sea. A major canary for the state of the global economy.

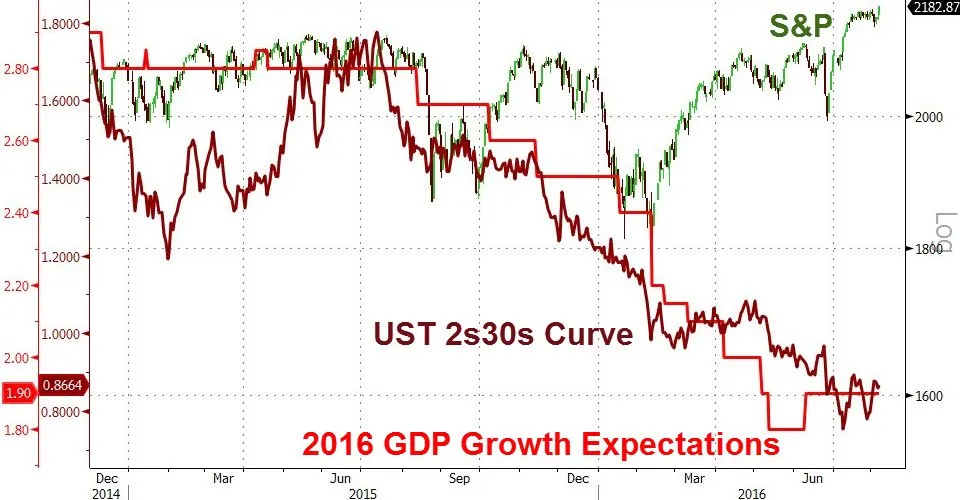

- Markets seem completely detached from reality

(sourced from zerohedge.com) - Take ratio of total market cap of top 5000 publicly traded companies divided by gross national product. $21.4T / $18.4T = 1.2. The ratio has only been this high in 1929, 1937, 1966, 2000, and now. Current P/E ratios are equally unsettling. (credit Marco Santarelli)

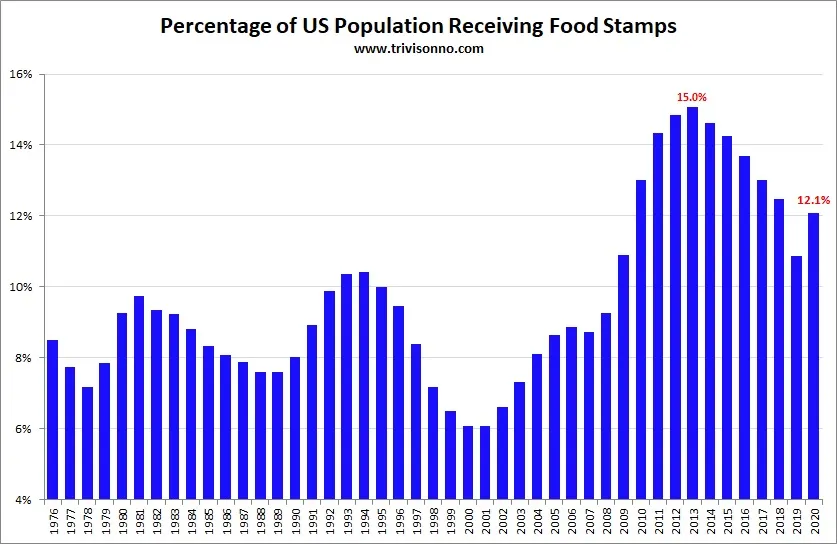

- Percentage of population receiving welfare is at record highs.

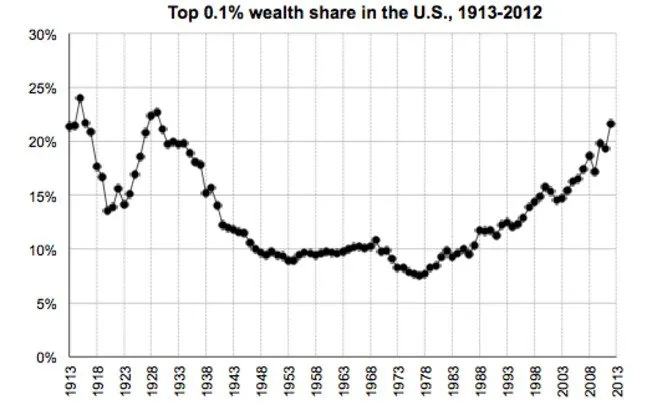

(sourced from zerohedge.com) - Wealth distribution is nearing all-time highs last seen preceding the Great Depression

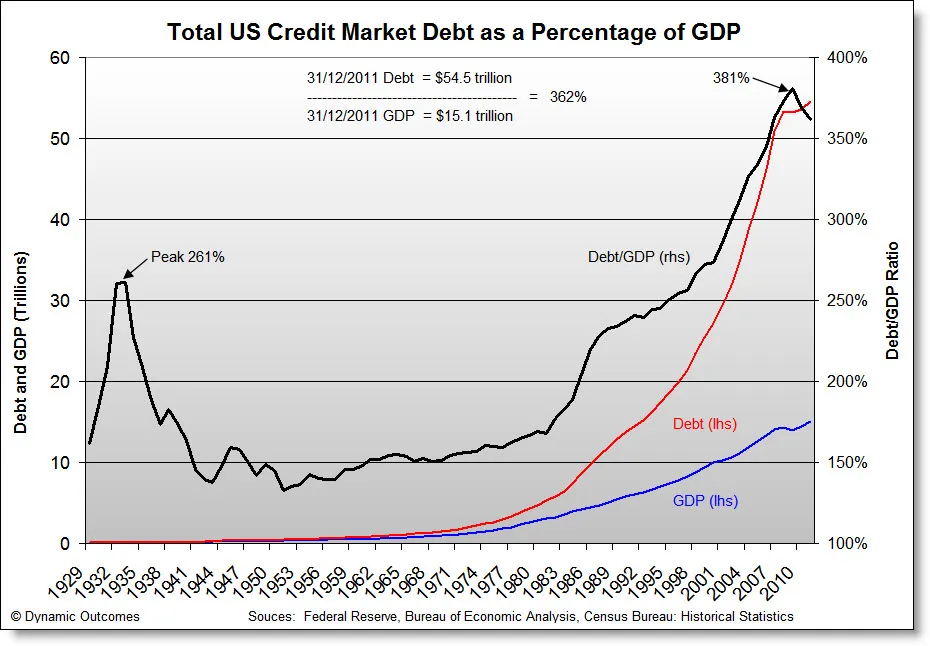

(sourced from zerohedge.com) - US Credit Market Debt is insane and unsustainable

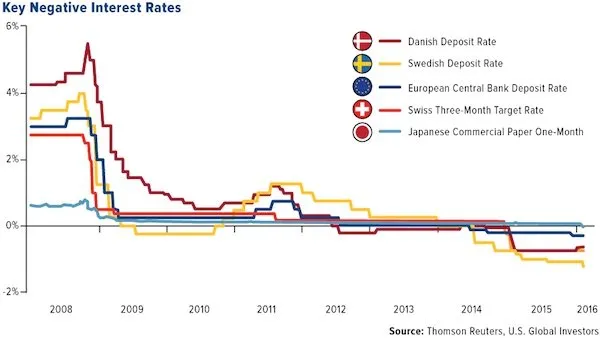

(sourced from zerohedge.com) - Negative interest rates... Zero rates for almost a decade didn't help and central banks are now sailing into the great unknown in a sign of outright desperation to address the mess they made themselves.

(sourced from zerohedge.com) - Some of the bubbles are beginning to pop such as the utter crash of the Vancouver housing market.

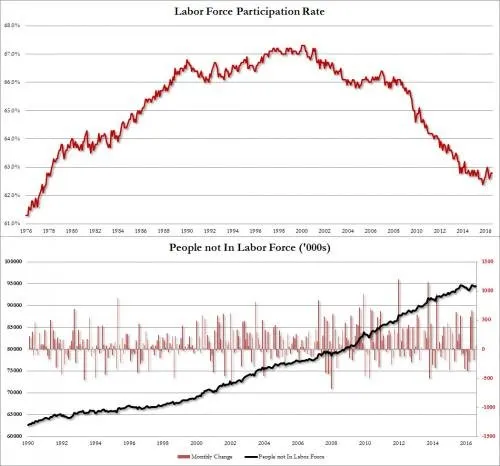

- Many economists have pointed out unemployment rates are much higher than the "official" 4.7% when accounting for those groups excluded from the official metric... more around 9.6% (credit zerohedge.com)

(sourced from zerohedge.com) - Labor participation rates are at never before seen lows

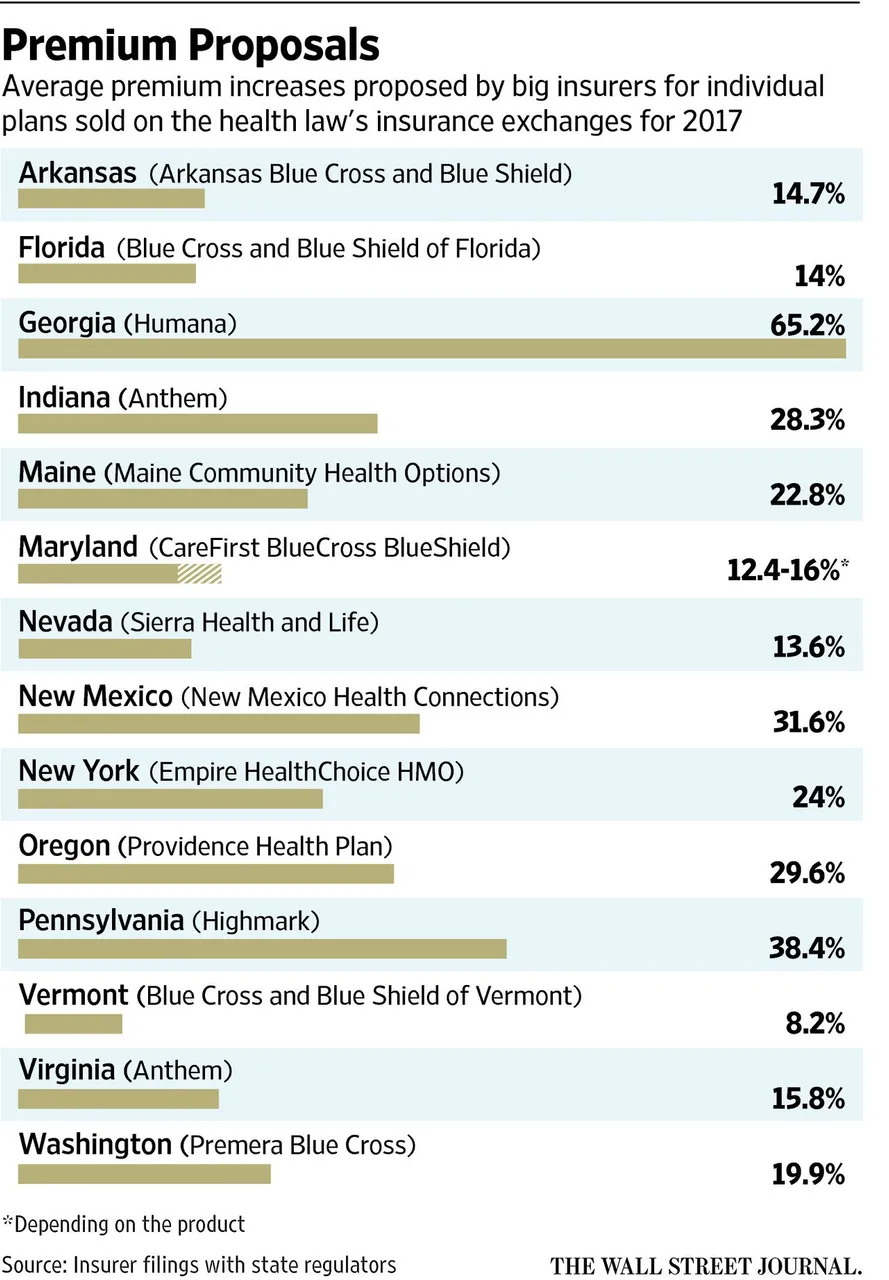

(sourced from zerohedge.com) - I've personally watched health insurance rates (which I pay in full for all my employees) rise 9%-10% year over year for at least the past 4-5 years. It is approaching the point where I may not be able to pay for my employees' insurance in the future

(sourced from zerohedge.com) - US government and services jobs continue to expand while US manufacturing jobs continue to collapse. We would no longer possess the ability to make what we need. One of the primary reasons we protect (must protect) countries like S. Korea, Japan, and Taiwan is we require their technology exports to run the military machine as well as our digital lives.

(sourced from zerohedge.com) - Global trade continues to collapse... shipping is

(sourced from zerohedge.com) - Even what we do "well", producing our own food, is unsustainable as the land is depleted, the soil dead, and things only grow when they are genetically modified and the land sprayed with petroleum derived fertilizers.

- Speaking of petroleum, though the price has collapsed and that is crushing economies in and of itself, its getting so hard to find that we are using drilling rigs offshore in waters as deep as 10,000 feet to drill a further 10,000 feet into the earth.

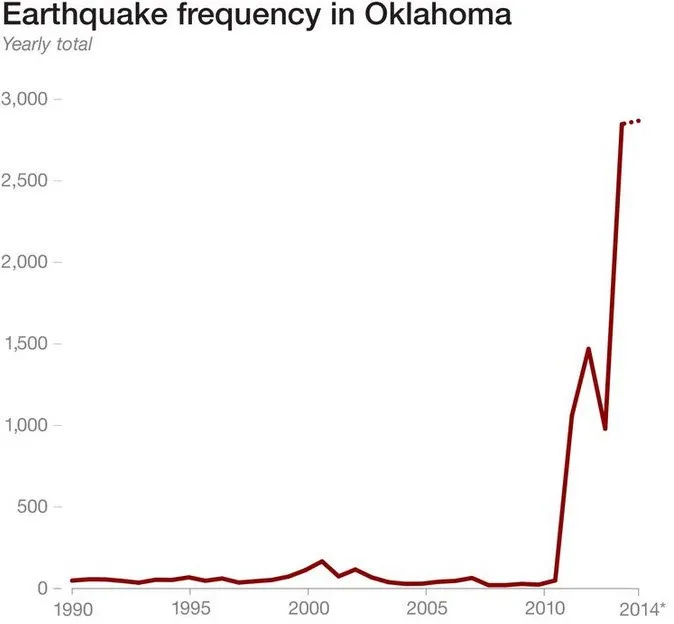

- Fracking... pumping carcinogens into the earth to fracture it and suck out the last bits of oil like a straw in an empty McDonalds super sized drink, has now been confirmed by the USGS to be the cause of the startling rise in earthquakes in areas like Oklahoma normally associated with a lack of earthquakes.

(sourced from zerohedge.com) - All around the world US influence and power is waning as our traditional adversaries began testing the waters with incidents of provocation on the rise worldwide.

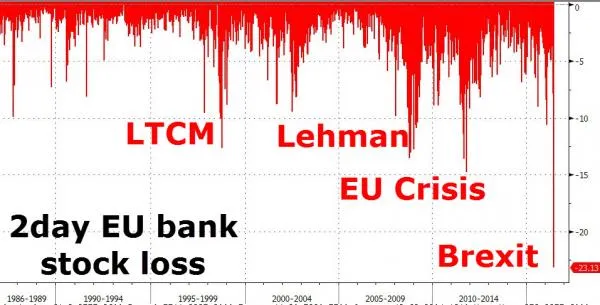

- Our traditional allies are collapsing under the increasing pressure of hostile migrants, crushing debt loads, collapsing trade, and weakening/fracturing strategic/economic alliances.

(sourced from zerohedge.com) - And the alarms go on and on and on and on...

The end game appears to be approaching. I don't think we are able to kick the can further down the road. It may be finally time

What the Hell Do We Do?

(sourced from airliners.net)

Keeping your wealth under the mattress is dangerous and difficult to use in a digital world. Keep it in an account and FDIC/NCUSIF insures the cash (up to $250k per person or business entity) in our banks and credit unions, respectively, but where would that money come from in an anything-larger-than-trivial banking sector collapse?

Keeping your wealth in real property insures you'll get property tax which is another way of big brother saying "on a long enough timeline, all your wealth is mine". Even if property tax is a necessary evil, governments are known to take what they want when they wish and there is no means to stop them from doing so as a community much less a common man. Underlying causes and contexts aside, the last time seven US states declared they'd had enough and would take no more it resulted in the bloodiest conflict in US history.

Keeping your wealth in cryptocurrency is obviously an option, however it is volatile and dependent on a functioning infrastructure. Governments all already trying to crack down and control crypto currencies. If things went really south bitcoin wouldn't do me much good to buy some tomatoes from my neighbor.

What I've Done

Here is a brief summary of what I've done to prepare for economic strife or other difficulties.

Wealth Preservation

(sourced from nsbank.com)

Preserving wealth is critical. But how? Every method of doing so has it's own pro's and con's.

Cash on Hand

For me this subject must be broken into two parts: personal and business. My personal cash holdings I keep quite low. Enough cash to function without income for 3-6 months. Nothing more. I don't even bother with a savings account as whats the point when the interest rate of return is so pitifully low?

With my business I'm in a pinch. My business requires a great deal of working capital to function as we have large swings in the course of business. I could leverage debt (line of credit, loan, etc) instead of actual capital to shift the risk and protect that capital in the event of a bail-in, banking collapse, or outright seizure. Morally/Ethically I wish not to do this as I am a big believer in capitalism... my primary business has never borrowed a cent or had a loan.

401(k) & Financial Markets.

I have moved my 401(k) balances into money market for the time being. Its mathematically demonstrable that in the long term it is more important to preserve 10% you'd have lost rather than make 10% playing more risk. Because of my personal situation (own the company) I do max out my 401(k) only because of the tax implications.

Debt

Every personal loan I have has been refinanced to the lowest rate possible. 2.4% on student loans. 2.7% on mortgage. 1.9% on vehicle, etc. Why not pay them off? In the event of a serious economic collapse I'd rather default on everything and preserve my capital than pay it all off when the loans are near free thanks to zero interest rate policy (ZIRP).

Precious Metals

I've been accumulating physical metal for many years. Probably don't need to explain why to this crowd.

Real Estate

I've purchased high value land and continue to look for more opportunities to store wealth in real estate when it makes sense, where value is available, and if I have the capital on hand to pull it off.

Stock Market

I totally exited the markets for the time being. Its been proven time and again how quickly fortunes are made and lost here. It isn't a method of preserving wealth anyway.

Other Preparations

In case it gets really, really bad. Maybe the wealth is gone. Maybe the wealth just doesn't matter at that point.

Hard Assets & Goods

I've steadily accumulated anything I can think of that I might need should the economy tank and goods we must import become unavailable. Food, equipment, tools, medical supplies, clothing, shelter, seeds, etc. At this point I have what I would need to truly go off-grid indefinitely, albeit with a drop in lifestyle and standard of living. Most importantly, I can make my own potable water, make or gather my own food, make my own electricity, etc.

Intangible Preparations

I've worked to educate myself... on money, gardening, health, first aid, mechanical skills such as engine repair, trade skills as plumbing/electrical/construction/etc, refresh and expand my skills on self defense . I've worked to keep my body and mind strong and prepared for what may come. I've worked to help others prepare themselves in all the above ways as the success of the network of community members, friends & family is a safety net, mutual benefit, and threat reduction to me.

Please Use The Comment Section To Share Your Thoughts

What am I doing right & wrong?

- Am I wrong on any assessment of the state of things? Did I miss anything major?

- Do you disagree with any of my preparations?

- Am I falling short or omitting entirely anything in any of my preparations?

Tell me what you've done, are doing, or are going to do.

- What are you waiting for? The fasten seat belts sign is lit!

- Not feeling the need to do anything? Why?