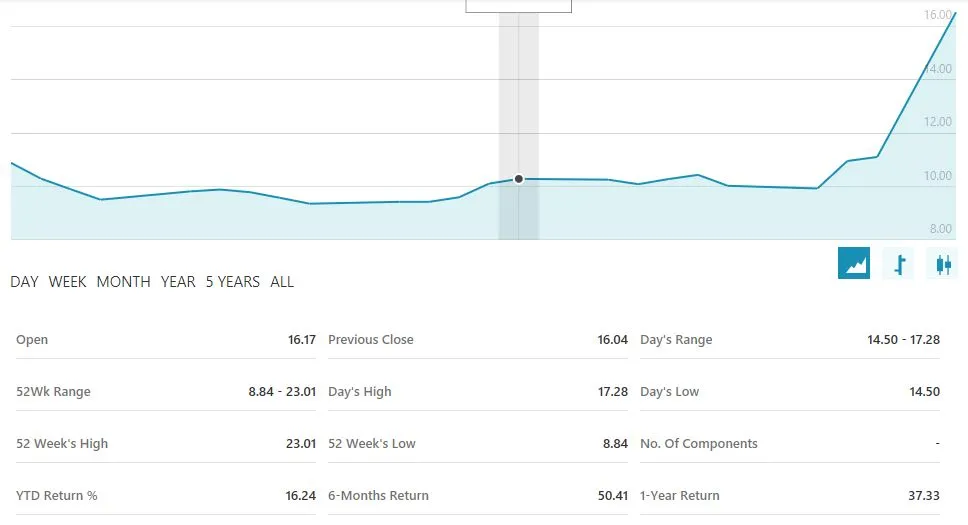

After hitting all time lows (8.84) just a few short weeks ago, the CBOE S&P 500 volatility index has taken off (17.28 was the high as of the writing of this article). The VIX is commonly referred to as the fear index because many of the larger firms use it to hedge against the long positions in S&P 500 they hold. Simply put, instead of balancing complex portfolios stock by stock, firms and individuals can buy the VIX futures to protect their holdings against a downturn in the markets.

So what does this mean? A sustained move in VIX signifies that investor sentiment has changed, thus a need for rebalancing. When VIX hit all time lows a few weeks ago, it would seem to indicate that there was the lowest demand for downside protection since the creation of the index. This no longer appears to be the case, a move of 95% in a few weeks is entering crypto territory. Not exactly a glowing endorsement for a major index that relies on futures contracts (Volatility is the worst enemy of sellers of derivatives). Billions of dollars will have changed hands with a move this large, which always makes me wonder...

P.S. Gold, silver and bitcoin are all up this week. These are all signs of rebalancing toward downside protection. And again I have no licenses, this is not market advice in any way. Just things I've noticed.