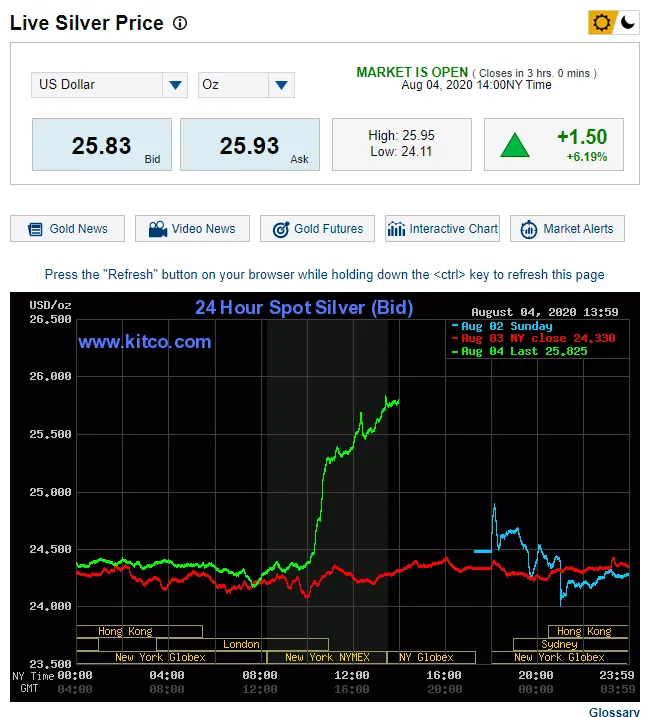

Silver is without a doubt one of this year's best performers.

https://www.kitco.com/charts/livesilver.html

Of course, gains are not the primary reason for owning precious metals. They really don't lose or gain intrinsic value, they simply go up in price when the value of currency goes down - and fiat currency always goes down in value over time. If you were buying silver years ago you're probably clicking your heels right now, but even so the metal is still extremely under-priced.

One of the benefits of owning physical silver is peace of mind. Gold as well, but given how far back the proverbial drawstring has been pulled on the silver arrow, This run is probably just beginning.

Personally I'm hoping we do have a large pull back in price, if only to buy a bit more. You make your money when you buy, not when you sell, and silver is real money - as real as you can get. Of course, I speak of the real thing and not paper derivatives that are supposed to be redeemable for the real thing.

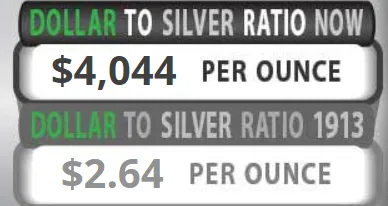

check out usdebtclock.org to see the game of musical chairs:

Thats over 171 paper ounces of silver for every real troy ounce of silver out there. If you were playing a game of musical chairs and there were 171 people per chair, would you stand a chance when the music stopped?

There are now over $4000 US Dollars created for every 1 ounce of real silver being produced globally. That's double compared to just a few months ago. What's scary is that this is nothing. Check back in another year and it might be $20,000 USD per 1 ounce of silver produced. In fact, I'd bet on it.

It's never a good idea to have all your eggs in one basket, but its also foolish not to have some of them in precious metals.

Stay safe. Thanks for dropping by.