Peg or Not Peg? Explanation of the Dollar Peg and Why Is It Important to STEEMIT Ecosystem by an ex Market Maker

Logo credit goes to @deepsynergy

Hi Steemians,

It's @jasonmcz again. Recently, I've seen users asking in the chat channel as well as in some posts about the SBD dollar peg issue and I thought it'd be beneficial to write an in-depth analysis on this issue and what's really causing the issue. Perhaps, #devs and contributors to the its github can think of ways to resolve some of the issues I bring up in this blog.

A Quick Recap of the 3 pillar:

1. Steem is volatile token that can be freely traded against other currencies

2. Steem Power is steem tokens that's locked up to give you voting power to have impact on your bandwidth and on other users post

3. Steem Dollars are awarded for your post, votes and comments.

What's Steem Dollar Anyways?

According to the white paper:

[SBD] are created by a mechanism similar to convertible notes,which are often used to fund startups. In the startup world,convertible notes are short-term debt instruments that can be converted to ownership at a rate determined in the future,typically during a future funding round...

and some of you may have heard from other members in community about another definition that Steem Dollar or SBD (SMD) should behave like a dollar so authors can be paid from the payout dollar to dollar without having to worry about conversion rate.

Put it in a simpler term:

Dollar Peg! 1 SBD should be approximately worth, if not equal, a U.S. dollar.

However, we all know from EC101 class that pegging in FX market can be expensive to achieve, a fixed exchange rate is usually used in order to stabilize the value of a currency by directly fixing its value in a predetermined ratio to a different, more stable or more internationally prevalent currency (or currencies), to which the value is pegged.

In doing so, the exchange rate between the currency and its peg does not change based on market conditions, the way floating currencies will do.

Typically there are two types of pegging:

Hard Peg:

Hard peg regimes are the exchange rate systems in which the national currency is either fixed to a respectable foreign currency or the government completely gives up its national currency and start to use a strong one.

Soft Peg:

The Soft Peg regimes which are still working under peg mechanisms are more flexible than hard pegs which were explained in the above section. These regimes can be summarized in four different subtypes. These are; crawling narrow band, crawling peg, pegged within bands, crawling broad bands and fixed peg.

[click here if you wish to learn more]

What Should I Care?

I apologize for throwing all the econ and finance terminologies around. If you ever travelled abroad, you should be able to grasp this concept really easily because whenever you are trying to make a purchase in a foreign country using their currency you always do a quick calculation either in your head or on your calculator to figure out how much that would be in your home country, and then you compare and contrast to see if you are over paying or not.

Try to imagine now since the FX rate is pegged to a level( it's 1 to 1 peg or 5 to 1 peg), you will no longer have to check the current FX rate because you know the FX rate is fixed and you will always have an idea what the price denominated in the currency of you home country is going to be!

It's similar situation for STEEMIT!

Now try to think STEEM Token is the product we just mentioned from the example above and think exchanges like @poloniex, @bittrex and @blocktrades are like foreign countries. They have their rate for the very same product and so do we. Our Internal Market and price feeds. When you want to buy or sell on those foreign markets, now you need to think about the FX rate. What would that be on our domestic market!

Why Does 1 SBD Not Equal $ 1.00?

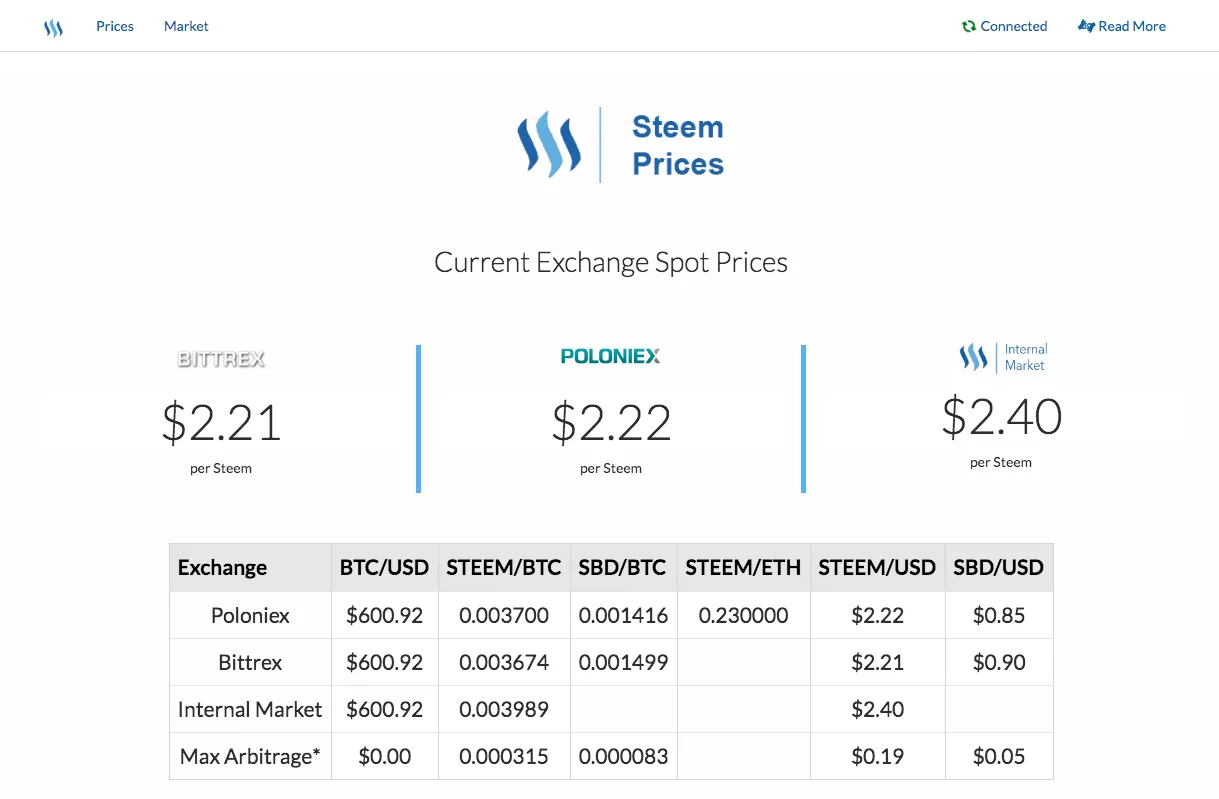

As you can see from price feed provided by SteemPrices.com:

The implied STEEM Dollar to USD rate is at $0.85 at poloniex and $0.90 at Bittrex.

(derived from BTC/USD rate)

You might be wondering how did that happen? Why are prices different?

The answer is in this simple and elegant graph that brought you back to your first EC101 class:

Supply and demand.

The supply and demand dynamics are different on these 3 countries for the same token (STEEM)!

Simply put: when more people buy STEEM that pushes the price up and more people sell STEEM that pushes the price down.

But now you might be wondering how does that affect the dollar peg?

It turns out the methods of acquiring STEEM dollar is very limited since the liquidity isn't great on those foreign markets ( about 5-10% of the what STEEM token are traded each day volume wise) but it's fairly easy on our domestic market because SBD is the currency that authors are getting paid with.

So naturally, you have a bigger supply of fresh STEEM Dollar on domestic market than foreign which shifted the price curve up per STEEM token on our Internal Market.

Thus,

If STEEM/SBD > STEEM/USD:

....then SBD must < USD

Thus, the < 1.00 exchange rate between SBD/USDWhy This Could Be Bad?

A weak SBD against USD could potentially hurt authors payout and ecosystem in the following ways:

1. SBD payout have less buying power on domestic market against STEEM

2. Point 1 could invoke further price upward movements on STEEM/SBD rate and deviation from foreign market

3. Authors, if use the convert function then power up, might get worse deal due to point 1 and 2

4. Authors might prefer to sell at foreign market of their STEEM and SBD causing further downward pressure on the FX rate.

Conclusion & Outlook

Before the hardfork and the end of infamous liquidity reward, SBD was pretty much strong against USD at all time (around $1.10 - 1.30, thanks to @complexring and @abit's great wall. Authors and arbitrage traders were able to get good deals off internal exchange, and volumes were great (although a big chunk was provided by wash trading activities).

After the liquidity reward ended, we experienced larger daily vol due to thinner orderbook on internal market also subsequently drove the price of STEEM against SBD up quite a bit. Ultimately created this -20% peg on SBD against USD.

Could we see a strong SBD and go back to the Peg? The short answer is yes; the long answer is not in the short term unless STEEMIT grow its user base to the next level where STEEM and SBD become more liquid.