https://steemit.com/speculation/@edicted/makerdao-raises-dai-stability-fee-to-record-breaking-7-5

https://steemit.com/ethereum/@edicted/maker-and-dai-still-looking-strong

https://steemit.com/maker/@edicted/maker-will-reign-supreme-above-the-other-stable-coins

https://steemit.com/news/@edicted/makerdao-doubles-debt-cap

https://steemit.com/maker/@edicted/figuring-out-makerdao

https://steemit.com/ethereum/@edicted/binance-coin-and-dai

https://steemit.com/dai/@edicted/dai-stability-fee-increased-and

I've been notoriously bullish on Maker over the past year, but it's time for a change. The stake holders of this platform are getting way too big for their britches. The "stability fee" of Dai has been raised to 19.5%! WTF?!

Worse interest than a credit card.

Not only is this interest rate not even competitive with credit cards, you have to secure the loan with at least 150% collateral. If you want to take out a 1000 Dai loan you better be ready to lock up $2000 worth of Ethereum.

The ten accounts that basically own Maker have announced their 'success' that the 'stability fee' is working:

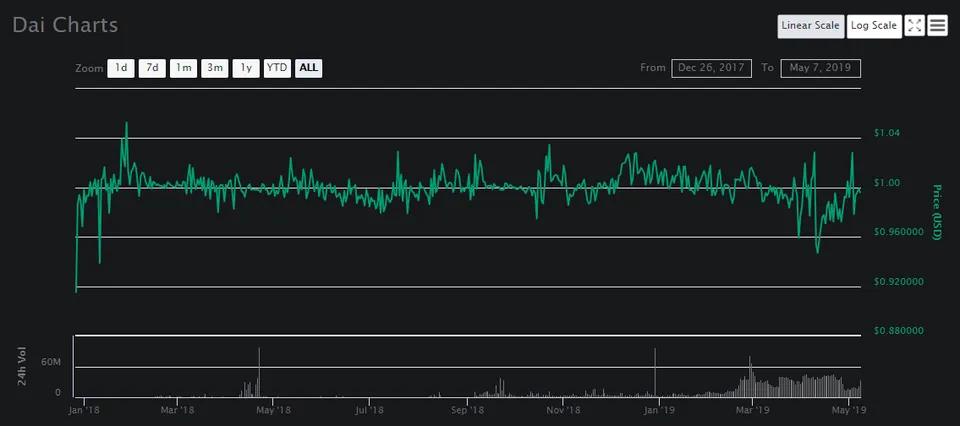

So Stable right now.

You'll notice that Dai has never been this unstable in its entire existence. The market is trying to tell us something.

What is the market trying to tell us?

Something big is coming. 82 million dollars worth of Dai makers are willing to pay 19.5% interest on a loan they've already secured by 200% or more. I am one of these people.

I still have an $800 loan that I used to buy more Ethereum when ETH was trading at $140. Even if ETH was flat for the rest of the year I'd still be up money on that trade, but we all know that isn't going to happen, one way or another.

Why?

You'll notice from early December to March, Dai was consistently trading slightly above one dollar. Did the MakerDAO lower interest rates below the 0.5% default? No. They only seemed to flip their shit when Dai was trading slightly less than a dollar during March and they constantly upped the ante on interest rates.

The claim here is that raising interest rates decentivizes margin trading. They want Dai makers to make less Dai so less of it gets dumped on the market when value is low. However, the conflict of interest here is that loan interest is paid off in Maker and destroyed forever.

Therefore, it was never the best idea to put Maker holders in charge of interest rates, because when they raise interest rates they automatically create short term gains for everyone holding the coin (in the form of actual deflation).

I feel like everyone identified this problem a while back, but no one was really worried about it because it hadn't happened yet and there were plenty of opportunities to do so.

The problem with making the claim that interest rates are equivalent to stabilizing the price action is that this is obviously not the case. There is little reason to hold Dai and every reason to dump it on the market for more crypto during this reversal from bearish to bullish market sentiment. Instituting a near 20% inflation rate on a service that was previously half a percent looks really bad for the community as a whole.

Real stability

If MakerDAO truly wants to stabilize their coin I hope they learn from this mistake and take steps that make users actually want to hold their coin. The point of a stable coin is to avoid volatility. Therefore Dai needs to be on as many exchanges as possible.

Thus far I've only been able to trade Dai using decentralized Ethereum-based exchanges, which are quite unpopular in the grand scheme of things. Coinbase added Dai but it's only paired with USDC, which is Goldman-Sachs' stable coin Circle. This seems very shady. In order for to Dai to have real value on an exchange it needs to be paired directly to USD fiat.

Another way to make users hold their Dai coins is through retail. If Dai is accepted at vendors those vendors have an automatic incentive to hold the currency for various reasons.

Oops!

Inflation hikes are not a good way to stabilize Dai, and that will become far more evident in the near future. What happens when crypto spikes and everyone cashes out their Dai loans because they are still sitting at 20% inflation? The value of Dai is going to spike up to $1.10 in an instant because no one is going to want to over-collateralize their severely overpriced loans anymore. The MakerDAO shows that they move too slowly on these matters, and their reaction ironically creates even more volatility.

What would I have done?

Personally, I would never hike the interest rate higher than 5%. Anything higher than that is an insult. This is especially true considering very little time was given to see if the market would stabilize itself. It shows a severe lack of experience from the MakerDAO "community" (10 accounts?).

In any case, Dai was approaching its 100 million debt cap. All they had to do was allow Dai to hit that debt cap and no more Dai would have been able to be created and dumped on the market. Problem solved. Hopefully the MakerDAO will realize that modifying the debt cap is a smarter solution than trying to suck down short term gains with an inflation hike. If you want Dai value to increase... stop printing Dai... DUH!

Conclusion

Doing nothing would have been better than what was done.

I'm still extremely bullish on Maker but this was a nice reality check.