By the end of this Venmo debit card review, you'll learn why it's a very limiting account. I only got the Venmo debit Mastercard because I was curious to see what kind of rewards they had to offer. After signing up and seeing the Venmo rewards, I immediately regretted wasting my time.

The rewards system isn’t as generous when compared to Venmo’s biggest rival, Cash App. When compared to the standard cashback you earn on most credit cards, there seems to be little no value to the Venmo cashback program. The Venmo Debit Card Checking account can only be managed from the App. There is no option to access your Venmo checking account information n the desktop website. In fact, the Pay and Charge functionality will only be available on the app.

| Card Details: | Venmo Debit Mastercard |

| Account Fees/Minimums: | None |

| Sign up Bonus: | None |

| Credit Pull: | Soft Pull |

| Benefits: | Venmo Rewards (also available through Dosh for free) |

| ATM Fees: | $0 MoneyPass ATMs $2.50 out-of-network +$3.00 if a signature is required |

| Daily Withdrawal Limit: | $400 |

| Card Type: | Mastercard Standard |

| Recommendation: | Don't get it. There are better free checking accounts. Venmo Rewards isn't worth it. |

| Limitations: | Card can only be used in the United States and cannot be used for foreign transactions. |

| Sign Up: | Via Venmo App |

Venmo Checking Account Fees

Your free Venmo debit card creates a free checking account that you can use with the Venmo app with no monthly fees or minimums. The only fees you will incur using your Venmo checking account are ATM fees.

Venmo Debit account page in the Venmo App

Venmo Debit Mastercard ATM Fees

Where can you withdraw money for free with the Venmo debit card? You can withdraw money from an ATM for free with your Venmo debit card from any MoneyPass ATM location (link). Common locations include 7-Elevens and any ATM with a MoneyPass logo on it.

What are the ATM fees on the Venmo card? The Venmo debit Mastercard has no ATM fees when using a MoneyPass ATM in the United States. Out-of-network ATMs will incur a $2.50 fee in addition to any other fees that ATM may charge.

Venmo Daily withdrawal Limits: The is a $400 daily withdrawal limit on the Venmo debit card and if you are trying to withdraw the maximum $400, be sure to account for any ATM fees that you might incur.

Can you use the Venmo debit card internationally? You cannot use your Venmo debit card outside the United States. That includes making a transaction with merchants that operate outside of the United States, but still ship products to the United States.

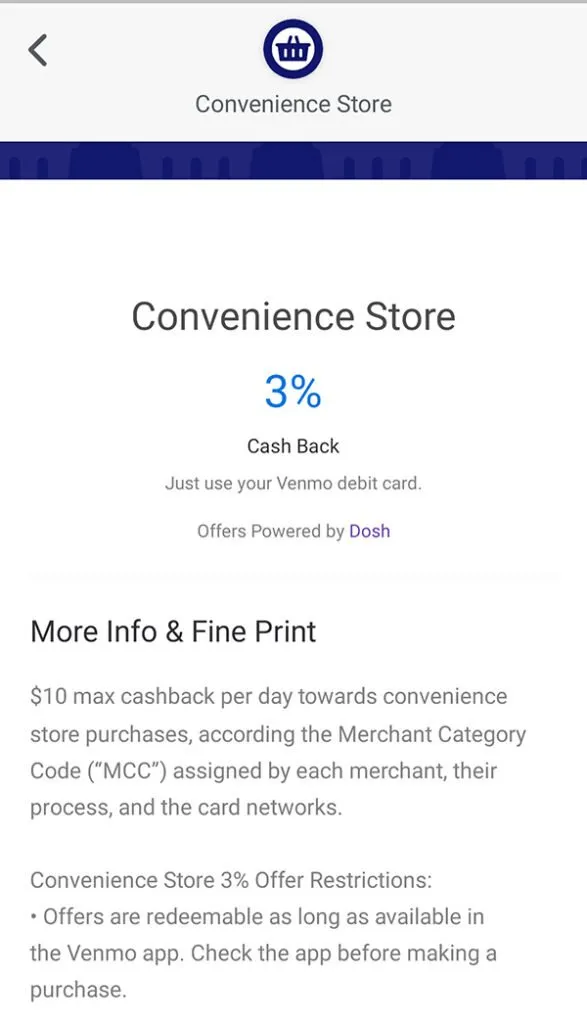

Venmo Rewards in the App

Venmo Rewards

Venmo cashback relies heavily on the cashback relationship through Dosh. Which is why, Venmo works with Dosh to get you cashback. I feel a little cheated though because Dosh is free to use and I had to sign up for a Venmo debit card to see the Venmo rewards page.

Accessing Venmo Rewards: Venmo Rewards is only available in the Venmo mobile app and is not available on their desktop site. To be able to see the current Venmo rewards, you’ll need to have a Venmo debit card.

Four Venmo Rewards Sections: To make Venmo’s rewards program seem more robust, there are 4 sections of Venmo rewards that you’ll need to check for offers. Almost all of the offers can be found in the “Online Debit Card Offers” sections, but I found the Convenience Stores discount was only in the Featured section. These are the Venmo Rewards offered in November 2020:

- Featured Debit Card Offers

- 3% Convenience Stores

- 5% Adidas

- 4% Anthropologie

- 5% Vitacost

- Offers You Might Like (Editor note: You won’t like these offers)

- 2% Office Depot

- 5% Adidas

- 4% PetSmart

- 2% Staples

- 3% Advance Auto Parts

- Online Debit Card Offers

- 5% Columbia Sportswear

- 3% Advance Auto Parts

- 5% Finish Line

- 4% Anthropolgie

- 2% Staples

- 5% 5 Star Nutrition

- 4% PetSmart

- 2% OfficeDepot

- 5% Adidas

- 7% Casper

- 2% Express

- 3% Lands’ End

- 5% Maurices

- 5% Ollie

- 8% Philosophy

- 5% Purple

- 5% Schwan’s Home Delivery

- 4% Shoe Carnival

- 10% Tarte Cosmetics

- 5% TOMS

- 5% Warby Parker

- 2% Arhaus

- 3% BaubleBar

- 5% Charlotte Tilbury

- 4% Clarks

- 3% ELEMIS

- 2% Lacoste

- 5% Tile

- 8% 1-800-Baskets

- 8% Simply Chocolate

- 4% American Girl

- 5% Nuuly

- 5% U.S. Polo Assn

- 8% Plow & Hearth

- 5% Leather and Light Co.

- 4% Loot Crate

- 7% SkinStore

- $12 back Shaw Academy

- 5% Vitacost

- 20% EZ Lifestyle

- New Debit Card Offers

- $12 back Shaw Academy

- 5% Vitacost

- 20% EZ Lifestyle

- 7% SkinStore

- 4% American Girl

- 5% Leather and Light Co.

- 4% Loot Crate

- 5% Nuuly

Venmo Rewards Fine Print for the non-Dosh perks

I really wish it was online so I could have just copied and pasted this information. But hey, this will help give you an idea of what they have to offer. Anything at 2% shouldn’t really matter since the PayPal credit card (owner of Venmo) gives you 2% back on all purchases. The majority of Venmo rewards are very retailer specific. I know my shopping style is limited to just searching for what I want on eBay or Amazon instead of searching directly with a retailer.

The only thing I find convenient is the 3% back at convenience stores, but that’s not worth it. I don’t think the Venmo debit card is worth getting unless you want 7% off a Casper mattress. The overall cashback you could get from a credit card is far superior and you can get a checking account (with no fees) that includes a cash sign-up bonus in the process. See my Charles Schwab review for reference, because that’s the best checking account you’ll ever get.

Using Venmo Rewards

A majority of the Venmo Rewards offers are available through Dosh, a cashback app. That means you can go directly to Dosh if you don’t want to get a Venmo debit card. In fact, Venmo Rewards works with Dosh so you are really getting Cashback through Dosh!

The only Venmo reward that wasn’t available through Dosh was the 3% back at Convenience Stores. That is done directly through Venmo and they will automatically give you 3% back whenever a transaction is processed as a Convenience Store through the transactions merchant category. That means, just use your Venmo debit card and the cashback will be reflected in your account.

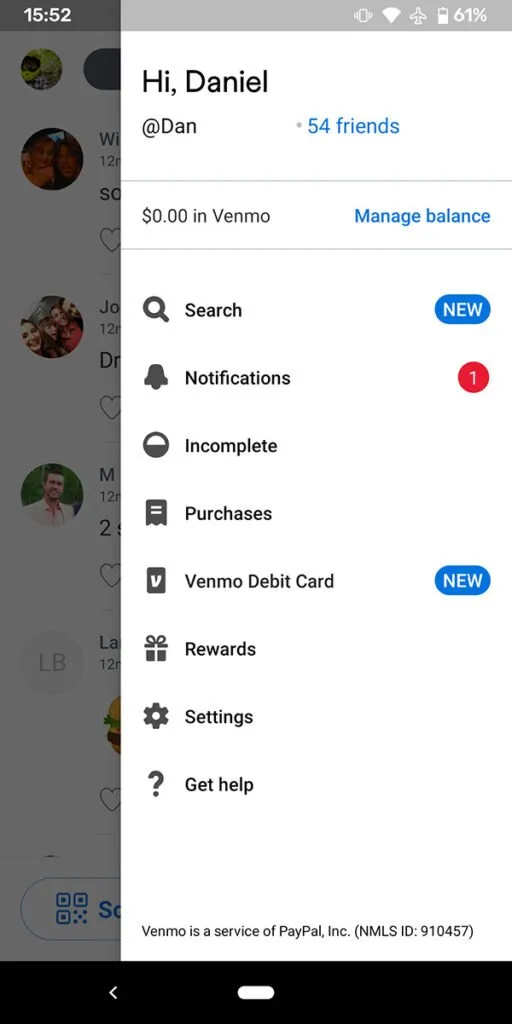

Venmo Debit Card App Menu

Venmo Debit Card User Experience

Signing Up for the Venmo Debit Card

To apply for the Venmo debit card, you'll need to sign up through the Venmo App. The application is pretty straightforward and takes less than 10 minutes. Since this is a checking account, your social security number will be required but it will not result in a credit inquiry on your credit report. It will be a soft check against your SSN to make sure you haven't been overdrafting accounts and running off.

Venmo App Review

For most of my reviews on credit cards and bank accounts, I don’t really think too much of the user experience. But that’s much different with the Venmo debit Mastercard. Your Venmo debit card checking account is completely managed through the Venmo app. There isn’t much of a difference from the normal Venmo app, which already provides a poor experience. Overall, the experience was poor and didn’t get better.

I searched around the settings and couldn’t find a way to hide the transaction history of me, my friends or the global users on Venmo. I really don’t want to see that. Preferably, a clean home page with my account balance and RECENT transactions would be nice. Not a history of every transaction by everyone in the world.

All of your Venmo checking transactions must be done through the app. Venmo no longer supports a desktop site for managing your account. If I’m doing any banking, I really prefer to be on my computer. I get that Venmo is a great way to send money to friends or split a bill, but for banking I want to use a full desktop site. Maybe I’m still too old school. I just don’t want to have an app for everything on my phone.

Venmo Vs Cash App

Venmo’s main competition in the “splitting bills” and “sending money to friends” space is Cash App. I actually prefer Cash App’s debit card, rewards system and interface much more than Venmo. Although sending money to friends is much better with Venmo because you can see their picture, scan a QR code or find a friend with their phone number.

Sending Money: Venmo wins because you can easily send money to the wrong person on CashApp. There isn’t much support on CashApp and there are a lot more scammers.

Rewards: CashApp’s CashBoost system is simple and covers places you actually shop at! The rewards system with CashApp is actually far superior than a credit card and if you shop at places like Target, Walmart, Starbucks, Traders Joes, Taco Bell, Dominos and other big brand establishments, CashApp is worth getting (CashApp review)

User Experience: As I mentioned earlier in this Venmo debit card review, I hate the user experience with Venmo. I like things looking very clean with just the information I need. When you put up the experience of Venmo vs Cash App, Cash App is far superior.

TLDR

Don’t waste your time getting the Venmo debit card. Sure it has no fees, but most banks have no fees. There’s a lot of free checking accounts. I HIGHLY recommend Charles Schwab for a quality bank, no fees, and no ATM fees anywhere in the world. It’s like having a magical cash card.

As for Venmo rewards, they mostly use Dosh and don’t have many original offers to provide. From what I saw it was a paltry 3% back at convenience stores. You’re better off with a quality credit card or CashApp.

When it comes to sending money to friends, I am much more comfortable using Venmo than CashApp. It’s easier to confirm your friends against a phone number and picture. That’s all for this Venmo review, browse some of the other good stuff here.

Posted from my blog with SteemPress : https://slycredit.com/venmo-debit-card-review/