There’s a lot of value in getting credit card sign up bonuses because they come with a lot of free money and potential travel. The biggest challenge is spending money on your credit card without wasting money. That got me wondering, can you buy stocks with a credit card?

You can buy stocks using a credit card with Stockpile but that includes fees that can range from 3% to significantly more. Besides Stockpile, no other trading platform or investing app allows you to use a credit card to purchase stocks.

First off, I don’t like using Stockpile due to the very limited trading features. Compared to Charles Schwab and Robinhood, using Stockpile is the same difference between gourmet meal and street food. You’re missing out on a quality experience and necessary features if you want to seriously invest. With that said, I love using Stockpile because of the credit card spend because you can use credit to buy stocks.

Key Points: Trading With Stockpile

- You can buy shares using a credit card for a 3% fee. Debit cards also incur a 3% fee but at that rate you might as well just transfer in your money from the bank.

- No fee for transferring money to/from your bank

- $0.99 fee every time you buy or sell a stock.

- All trades happen at the close of the market. That means, you have no control over the buy or sell price. You can’t buy/sell stocks at the current price or set a price.

- Stocks can only be purchased in transactions between $1 to $2000. If you want to buy more than $2000 worth, you’ll need to make multiple transactions

How does Stockpile work?

Stockpile is a super basic trading platform that allows you to use a debit or credit card to invest in stocks. There are different types of fees on Stockpile depending on if you’re buying stocks for yourself, gifting them directly to another person or buying a physical Stockpile gift card.

The one unique feature that Stockpile has is that you can gift someone a stock. Although in reality, you’re just getting a cash gift card to redeem for stocks. The gift card only holds a dollar amount value for you to redeem towards a specific stock. That gift card holds 0 shares and only a cash value to be redeemed. But that’s not why I’m interested in using Stockpile, it’s because it’s the only stock broker that accepts credit cards. This is one of the easiest ways to manufacture spend.

Before you jump in headfirst with your credit card to invest in stocks, you should know the risks. Credit cards typically have big fees on Cash Advances and very high APR rates. I don’t know if your credit card will charge you a Cash Advances, but you can get these fees waived if you call the bank and explain you didn’t know there would be a fee.

Buy stocks with a credit card

Buying Stocks: When you place a buy order for a stock with Stockpile you can only set the amount of money you want to spend buying the stock. You cannot do an immediate market buy or set a limit price. You pay the price per share at the close of market. That means, if you want to buy $2000 of Ford stock, you'll pay the market price at the close of market 4pm EST.

Selling Stocks: When you place a sell order for a stock with Stockpile, that order is triggered at the market closing time. That means if you placed on order at 11AM EST, your sell order will appear as PENDING until it is triggered at 4pm (market closing time). The stock is sold at the market rate. You have no control over the sell price and you don't have any control over the time the stock is sold.

When your stocks are sold, your funds will appear as "unavailable cash" for 1 business day and the next day your cash will be available to buy more stocks or to be transferred to your bank.

Unavailable Cash Glitch: Whenever you complete the sale of a stock, those funds turn into unavailable cash for 1 business day and then convert to cash. I noticed there's a pretty serious glitch in Stopckpile that converts all of your available cash into unavailable cash when you sell a stock. This makes it very challenging if you're actually using Stockpile to buy and sell stocks. I HIGHLY recommend using Charles Schwab or any real stock broker app to buy stocks.

Sell Stocks: Transaction are triggered at 4pm EST

Banking and Transfers: There are no fees to move money in or out of Stockpile. I have never moved money into Stockpile because I’ve only been using it to buy stocks with a credit card. Money only flows out of my Stockpile account back into my bank account so I can pay the credit cards. Transfers from Stockpile to your bank account will appear as an electronic deposit from “Apex Clearing”. The transfer for me completed in 2 business days which was faster than I expected.

Finding Stocks: The stocks available on Stockpile are not limited to just the ones you see on gift cards and on there homepage. They just give you a curated list of the most popular stocks on the homepage but you can actually buy stocks just like the ones available on Robinhood.

Cash Advance Fees: Depending on your bank, you might be charged a cash advance fee when using a credit card to invest in stocks. You can minimize the risk of being charged a cash advance fee by calling your credit card company and asking them to change your cash advance limit to $0.

From my experience, I did not incur a cash advance fee using American Express, Barclays and Capital One. Those are the only banks I've tried and have been not charged any additional fees to buy stocks with a credit card. If you do get hit with a cash advance fee, call your bank and tell them you made the purchase not knowing it would be a Cash Advance. “Now that you know,” ask them if they could waive the fees as a one-time courtesy. I’ve successfully used this tactic many times and have a detailed post on how to waive bank fees.

Everything is fractional: All stocks purchased on Stockpile are fractional. That means when you buy or sell a stock, it doesn’t have to be a full (1) stock trade. It can be 0.00001 shares of a stock. This allows you to invest into companies that you would normally not be able to afford. It also makes it easy for you to purchase stock in any amount from $1 to $2000. That means you can buy exactly $2000 of TSLA and it would give you something like 5.35215 shares (example numbers).

Purchase Limits: You can use cash or a debit/credit card to buy stocks with Stockpile for amounts between $1 and $2000. For any purchases higher than $2000, you will need to create separate transactions.

No Price Control: Stockpile does not have any options to set a limit price for buying/selling and doesn’t include the option for stop losses. By no means should you consider this a trading platform and you should really do your investing with more substantial banks like Charles Schwab.

What happens with dividends? If a stock issues a dividend, it will appear in your Stockpile as cash and you will have additional buying power. You can also choose to set up your dividends to automatically be reinvested into the same stock.

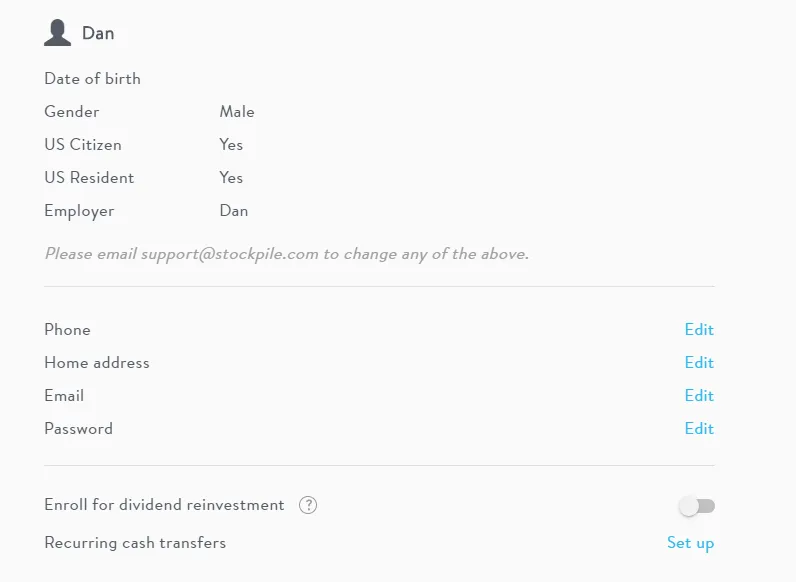

Reinvesting Dividends with Stockpile: You can choose to reinvest your dividends with Stockpile, but it’s all dividends or none. In your profile settings, there is an option to reinvest your dividends. This setting impacts all your stocks with Stockpile so you can’t individually choose by stock.

Stockpile Gift Cards: Don’t bother buying any gift cards from Stockpile because you might as well just give someone cash. Gift cards cost money and have no actual stock value (just cash value).

A Very Extreme Example: Let’s say it’s 1999 and I got you $100 gift card of Amazon stock. Amazon is trading for like $4/share. It’s now 2020, if you didn’t redeem that “Amazon gift card” you can still do it today. But the value is still $100. That means you would have had 25 shares of Amazon in 1999 if you redeemed it where as today you would have less than 1% of 1 share.

Dividends are on/off for ALL your stocks

Stockpile Fees:

In 2020, I actually don’t know of any brokerages that charge monthly fees or minimums. Trading platforms want your money so of course they don’t charge any money for you to open and maintain an account. Although, Stockpile is probably one of the only stock brokers that accepts credit cards. “Cash” according to Stockpile, is money that is sitting in your account. This can be money you have after selling a stock. Alternatively, you can get cash in your Stockpile account by connecting your bank account and transfering money which can take 3-5 business days.

- There are no monthly fees or account minimums to create and maintain your stockpile account. It's absolutely FREE to own an investment account at Stockpile.

- Cash trades: $0.99 per trade. You are charged $0.99 every time you buy or sell.

Stockpile Credit Card Fees:

Debit card and credit card transactions incur a 3% fee when buying a stock in addition to the $0.99 buy stock fee. If you know how to get full value, I’m sure you know to never use a debit card whenever a fee is associated. Credit cards get cashback and have big sign-up bonuses if you achieve the level of spend required. To buy stocks with a credit card using Stockpile, you will pay a $0.99 trading commission fee and 3% of the total purchase. You can buy anywhere from $1 to $2000 in one transaction:

- $1 of stock = $1.02 fee (102%)

- $25 of stock = $1.74 fee (7%)

- $200 of stock = $6.99 fee (3.5%)

- $2000 of stock = $60.99 fee (3%)

Stockpile E-Gift Card Fees (for Printable or Email):

- $1 gift card = $3.02 fee (300%)

- $25 gift card = $3.74 fee (15%)

- $200 gift card = $8.99 fee (4.5%)

- $2000 gift card = $62.99 fee (3.15%)

Stockpile Physical Gift Card Fees:

The physical Stockpile gift cards are absolutely the worst value you can get. Do not bother buying these unless you don’t mind wasting money. You can purchase the Stockpile gift cards online or at certain office stores. I still think with the 5X rate, there isn’t enough value to justify buying these cars:

- $25 of stock = $4.95 fee (20%)

- $50 of stock = $6.95 fee (14%)

- $100 of stock = $7.95 fee (8%)

Physical gift cards are ONLY available in increments of $25, $50, or $100. If you consider the fee a percentage of what you’re spending, the $25 gift card would need to be redeemed for a stock and that stock would need to increase by 20% just to break even from the fee! Even though you can buy these stocks with a credit card, that fee isn’t worth it.

Getting a discounted loan through your credit card

If you happen to have a 0% APR no interest credit card, that’s a free loan for as long as 18 months (depending on your credit terms). With Stockpile, you can indirectly get cash from your credit card for a fee (3% + $0.99) because you can buy stocks with a credit card. With this, you can get loans from your credit card indirectly (video).

There is some risk of course, you risk the stock changing in price. You also don’t have any control over the price when buying or selling, because stockpile initiates all their trade orders at the closing time of the stock market. You are buying and selling at whatever that closing price is.

FAQ

Where can I buy stocks with a credit card?

You can use Stockpile to buy stocks with a credit card. Stockpile is one of the only stock brokers that accepts credit cards but that does come with credit card fees. Although the fees may seem high, this can be offset with a good credit card sign-up bonus and cashback.

Can you use a credit card to purchase stocks?

Almost all brokerages do not allow you to purchase stocks with your credit card with the exception of Stockpile. Buying stocks with a credit card on Stockpile adds-on a 3% fee.

Can you buy stocks with a credit card on Robinhood?

You cannot buy stocks with a credit card on Robinhood. The only way to buy stocks with Robinhood is by transferring in money from your bank account.

Last Thoughts

Stockpile allows you to buy stocks with a credit card and to gift stocks to other people. For anyone that is actually interested in investing, the platform isn’t designed to support that. Since all transactions are based on the market price before the market closes, your only control is Buy/Sell/Do nothing. It’s a super basic way investing platform and they have fees for buying/selling. There are no fees to buy/sell with most investing platforms as of 2020.

To get friends of family into investing, Stockpile is a pretty good way to get them started with their gift cards. Unfortunately, the gift card only holds a dollar value and not an actual stock value, which makes it the equivalent of holding a cash based gift card.

To manufacture spend on my credit card, Stockpile is amazing. It’s super easy and I pay 3% + $0.99 for each transaction. This is one of the laziest ways to achieve those credit card sign-up bonus spend requirements. You can also leverage your credit line for a discounted loan. I will continue to use Stopckpile to buy stocks with a credit card for manufactured spending.

Posted from my blog with SteemPress : https://slycredit.com/use-your-credit-card-to-buy-stocks/