My personal favorite bank account is the Charles Schwab Checking account. I’ve had an account open with them since 2014 and have only experienced top notch service, no fees and a lot of benefits. That’s why in this Charles Schwab checking account review, we’ll go over why Schwab has the best checking account in the world.

There are a few names for a Charles Schwab account so don’t get confused by the names. When you open a Charles Schwab account, you’ll have a Schwab Brokerage account (for investing) and a Schwab Bank High Yield Investor Checking account. From here, I’ll just refer to it as a Schwab account or Checking account.

Here’s the deal:

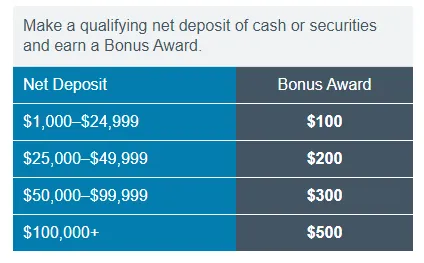

- Sign Up Bonus: $100 to $500 (based on deposit amount)

- Bonus Terms: After depositing $1000 (minimum) into your brokerage account within 45 days and you will receive $100 bonus after 60 days from opening the account.

- Duration: $1000 need to stay in your Schwab account for 12 months (less any market losses) otherwise Schwab will chargeback the bonus award.

- Credit Pull: Soft (Hard pulls stopped in July 2020)

- Monthly Fees: None

- Monthly Minimums: None (after the bonus is met)

- Expires: Ongoing offer

- Household Limit: Anyone in the same home can get the bonus

- Fund with credit Card? Not available

- Can you get the bonus more than once? Yes. Nothing in the terms says it’s limited.

- Sign Up: Referral Link

Key benefits:

- No foreign exchange fees

- No ATM fees from anywhere in the world (all fees reimbursed monthly)

- Interest checking at 0.03% (variable rate and subject to change without notice)

- The Schwab Debit card is a Visa Platinum and comes with extended warranty, purchase protection, price protection and more

Charles Schwab Checking Account Bonus

The Charles Schwab checking promotion is ONLY for friends and family. There is no public offer to get the $100+ application bonus. But luckily you found this post and I can link you with my referral. It really doesn’t matter if you use it or not because there is no referral bonus with Schwab. It’s just an insider code that gets new account a bonus and the referrer gets the good deed of signing up.

Charles Schwab Checking Sign Up Bonus Process:

- Sign up for the Charles Schwab Checking Account bonus through a referral code (here)

- Within 45 days of opening your account, deposit at least $1000 to qualify for the bonus

- At about 60 days after opening your account the Charles Schwab sign-up bonus will appear in your account.

It doesn’t matter when you deposit your money, as long as it is deposited within 45 days. The Charles Schwab sign up bonus will only appear in your account if you make the minimum deposit within that 45 days and will appear when your account is 60 days old. Yeah, that’s a little weird but it’s the process.

The Charles Schwab checking account bonus requires you to deposit at least $1000 to get the $100 bonus. That $1000 does not need to be a direct deposit. You can simply link up another bank account and transfer that $1000 to your Schwab account.

You’ll also need to keep your net deposit amount (less any market losses) in your Schwab Account for the first 12 months. That means if your deposited $1000, you’ll have to keep that $1000 in your Charles Schwab brokerage account.

Charles Schwab Bonus Structure

Charles Schwab Bonus Structure: I recommend depositing the minimum amount of $1000 to qualify for the bonus award of $100. That’s a 10% return on your money within 2 months. If you calculate it as APR, that’s like getting 60% APR on your money. If you deposit $100,000 or more, you’ll be eligible for the maximum $500 bonus award. At $100k, that’s a 0.5% return on your money. The 10% return on your $1000 is overall 20x better.

Is there a hard pull or credit check? As of July 2020, Doctor of Credit reports that Schwab removes the hard pull requirement for new checking customers. There will still be a soft pull on your credit (like all other checking accounts) but it won’t impact your credit report or your credit score.

Account Minimums and other fees: None. Charles Schwab has no account minimums and no monthly fees. If you want to keep $0 in the account, then you just have $0 in the account. But you’ll have to remember to maintain the net deposit amount (less any market losses) for the first year otherwise the bonus will be forfeited.

Charles Schwab Checking Account Benefits

Interest Checking

The Charles Schwab High Yield Investor Checking account gives you 0.03% APY on your Checking account balance. That is not a lot of money, but it is significantly more than the 0% that other checking accounts provide.

Unlimited ATM Fee Rebates Worldwide

The Charles Schwab Platinum Debit card has no ATM fees and no foreign transaction fees. That means, if you are in another country and use an ATM that has high fees, you can withdraw money at the bank rate and you WON’T be charge any fees. You won’t get charged the ATM fee, the out-of-network fee or a foreign currency fee.

I’m sure you’ve seen privately owned ATMs (non-bank owned) that charge $5 to withdraw money. If you use your Chase debit card, you’d also be in for a non-Chase ATM fee and get hit with another $5. Just for you to get the minimum of $20 to withdraw will cost you $30. That’s outrageous.

The Charles Schwab checking unlimited ATM fee rebates worldwide feature is extremely generous. To the point where I kind of abuse it. Sometimes I just take out $20 from the ATM if I need $20. That’s even if the ATM comes with a fee. This is especially helpful when traveling because you don’t want to have too much cash on you:

- It’s incredibly risky to be holding a lot of cash (just because you are avoiding bank fees)

- If you leave a country with too much of their currency, it will lose 10-15% of it’s value when converting it into another currency or depositing it back into your bank account.

Schwab High Yield Investor Checking

Charles Schwab Platinum Debit Card benefits:

I didn’t think that a debit card could be so useful. Many people pay PREMIUM credit card fees to get these types of benefits. The Charles Schwab Platinum Debit Card has all of these benefits included for free:

- No ATM Fees

- No Foreign Transaction Fees

- International Emergency Services

- Auto Rental Insurance

- Purchase Protection (up to 90 days after making a purchase)

- Price Protection (up to 60 days after your purchase)

- Extended Warranty (doubles warranty up to 3 years)

- And more…but I didn’t think they were as useful

Extended Warranty Key points:

- Extended warranty is only available for products that have been purchased entirely with your visa debit card

- Computer software, medical equipment, and used items are not eligible for extended warranty.

- Purchases in the US and abroad are available for warranty. But the item must have a valid original manufacturer U.S. repair warranty

- You will need to provide copies of the store receipt, visa card receipt and the original manufacturer warranty

- File a claim can only be done by calling 1-800-551-8472 or online at https://www.cardbenefitservices.com/

- You do not need to register your purchases for this benefit

Purchase Protection Benefit Key Points:

- If in the first 90 days of your purchase you item is stolen, damaged due to fire, vandalism, dropped in water, and other weather conditions, your item is eligible for a claim

- Claims can be made for a maximum of $500

- Maximum coverage of up to $50,000 per cardholder

- You do not need to register your purchases for this benefit

Purchase Protection and Extended warranty applies to purchases made anywhere with the exception of:

- Cuba

- Syria

- Sudan

- Iran

- North Korea

- Crimea

- And other countries listed on OFAC

Because it you wake up in one of these countries, you might say OFAC, how did I get here? That’s a real mystery. But that’s something anyone could say. I would say OFAC if I went to sleep at home and woke up somewhere else too. I just think that’s a very functional acronym.

Price Protection Key Points:

- If you buy an item with your card in the United States and see a printed advertisement in any retail store within 60 days of the original purchase, you can file a claim and Visa will refund the difference for up to $250 per item.

- The benefit is limited to $1000 a year

- You have 10 days to file your claim after the printed advertisement is received

- Claims can be submitted by calling: 1-800-553-7520

- Claims will need to provide the original sale receipt, original visa card receipt, original printed advertisement showing the sale price and date

WOW! This is actually really generous. I haven’t filed a claim before but having up to 60 days to find a lower price is great especially during the holiday sales. My only concern is that the Schwab page listing these details was updated in 2011 and keeps mentioning “printed advertisement.”

Replacing Your Charles Schwab Platinum Debit Card:

The Charles Schwab Platinum debit card does come with an Emergency Card Replacement Service through the Platinum Visa system. This is supposed to provide an emergency replacement Visa card while the cardholder is home or traveling in another country.

Although this benefit did not work for me. I actually lost my card while traveling…I just left it in the ATM and walked away. I was in a rush and wasn’t paying attention. Of course I don’t know what my card number is, but I do know my online Schwab online account information.

I logged into my Schwab online account with my computer (I don’t use the app) and went to their online secure chat system. I told them that I lost my card and then they gave me a number to call to speak with a representative because I needed to confirm my personal information.

After going through the replacement process, I would only be able to get my Charles Schwab Platinum debit card replacement at my home address. This was due to security reasons which I could appreciate and this was in 2017. I’m not sure if things have changed. But it wasn’t an emergency and I always carry an extra debit card from a different bank (That’s a pro-traveler tip).

Refer a friend to Charles Schwab Checking

To refer a friend to join a Charles Schwab you’ll need to visit this page. To generate a Schwab checking referral code you’ll need to be logged in to your Schwab account. It will provide you a link you can share otherwise you can use the referral code to call a Schwab customer representative to sign up.

Referring a friend to Schwab helps them get the bonus but just know that there is no referral bonus for the person who did the referring.

Charles Schwab Pros/Cons

Pros:

- No ATM fees

- No Account minimums/fees (after the bonus requirement)

- Top notch customer service

- Visa Platinum debit card benefits

Cons:

- Keeping your money locked in Schwab for a year for the bonus is very limiting. This is an extremely long requirement compared to other bank bonuses

- No referral bonus for the person making the referral

FAQ

How do I refer someone to Charles Schwab? To generate a Charles Schwab referral code visit this page.

Is a Charles Schwab Account Free? A Charles Schwab account is completely free with no monthly minimums.

Does Charles Schwab have a referral Program? Charles Schwab has a referral program that only offers the person signing up a bonus. There is no referrer bonus with Charles Schwab.

What is the minimum to amount to open a Charles Schwab account? There is no minimum to open an account with Charles Schwab.

How much interest does a Charles Schwab checking account pay? A Charles Schwab High Yield Checking account provided 0.03% APY on your checking account balance.

TLDR:

With no minimums or fees, the Charles Schwab offers a lot of generous benefits. I would even consider getting no cashback for a purchase just to have some of the warranty or price protection. That’s where some credit cards like American Express can be worth the annual fee if the purchase is big enough. For anyone who doesn’t have many credit cards (or can’t get them), getting a Charles Schwab account provides a lot of savings and value.

Posted from my blog with SteemPress : https://slycredit.com/charles-schwab-checking-account-review/