BlockFi is one of the many platforms that allow you to earn interest with your Bitcoin. You always want to be careful with your cryptocurrency because it can easily disappear in the event of a scam. That's why in this BlockFi review I'll go into great detail to explain: How does BlockFi work?

BlockFi allows you to earn interest on your Bitcoin and several other cryptocurrencies just by holding the coins in your BlockFi wallet. Interest is paid out monthly, but there's much more you will need to know.

| BlockFi Review | |

| Sign-Up Bonus | $10 after depositing $100 |

| Sign-Up Requirements | Identification and Social Security Number (US Residents) |

| Other Promos | Occasionally there are better sign-up bonuses through BlockFi directly |

| BTC Interest Rate | 6% on holdings up to 2.5 BTC |

| Stablecoin Interest Rates | 9.30% |

| When is interest paid? | 1st of every month |

| How is interest paid? | Interest is paid in BTC |

| Insured? | Yes, through Gemini |

| Trust Level | 5/5 Looks very legit |

| Sign-Up Link | https://try.blockfi.com/oct-btc-offer/ (Great offer available until 11/7) https://blockfi.com/?ref=5f179a8a (super weak $10 referral bonus) |

Signing Up For Block Fi

You can sign up for BlockFi on their website or via app. I'm all about signing up using a computer just because it's easier and faster to type. As well as saving sensitive information. You will be required to set up 2-Factor Authentication to protect your account which is something you should always do anyway. The entire sign-up process should take less than 10 minutes and you will need to provide documents to prove your identity like a picture of your driver's license. For US citizens, you will also need to provide your social security number.

Can I trust BlockFi with my Social Security number? It doesn't matter. There have been so many data leaks of people's personal information that the chances your social security number has already been leaked is very high. I really don't mind giving out my social security number to sign up for these things because I freeze my credit report. With a frozen credit report, people can only check your credit for verification purposes and can't open any accounts that would be an actual liability to your finances.

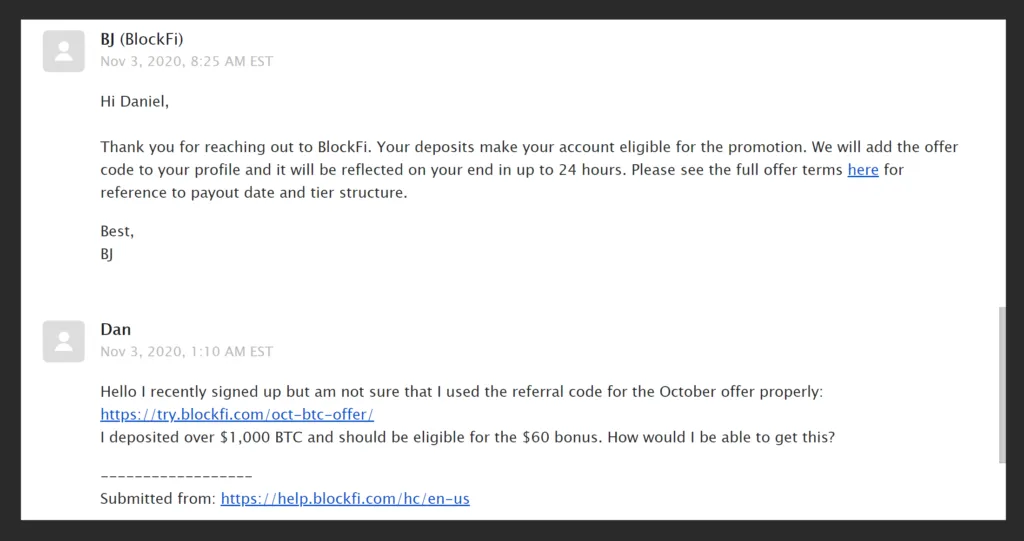

I signed up for BlockFi but didn't use a referral code. This is common if you sign up after downloading the app or if you just forget. BlockFi provides a sign-up bonus for all new customers. I have a referral code for $10 which is pretty weak, so look out for higher BlockFi promotions. In October 2020, I signed up for BlockFi during a special promotion.

Even though I signed up during the special promotion, I didn't use the sign-up to attach the BlockFi sign-up bonus offer to my account. I deposited enough to qualify for the $60 bonus and yes, I wanted that $60 in BTC. At this point I contacted BlockFi customer service.

Customer Support 5/5

My experience with BlockFi customer support was very fast and they gave me the exact answer I wanted. I signed up for BlockFi without using the promo code and they helped me get the sign-up bonus. They answered the email fast and made sure I received the BlockFi bonus.

Reply received in 7 hours! Really good considering the time I sent the request

BlockFi Fees:

Buying/Selling on BlockFi

BlockFi markets themselves as having no fees, there are of course going to be some fees. There's about a 1% difference in the buy and sell rates using BlockFi since everything is processed around the market rate. BlockFi fees to Buy/Sell 1 Bitcoin:

| Market Price | $13,645.61 | Sampled value |

| Buy Price | $13,798.44 | 1.11% over market |

| Sell Price | $13,514.64 | 0.96% below market rate |

Even though BlockFi says there are no fees to buy and sell, those fees are rolled into the buy and sell price. But at the same time, that's only if you want to secure your assets by trading between the available coins on BlockFi.

Can I buy Bitcoin from BlockFi? Yes, you can buy, sell, and trade Bitcoin on BlockFi against their eligible coins and by wiring money to BlockFi. BlockFi does not allow you to transfer in money directly from your bank as an ACH transfer and BlockFi does not allow you to buy Bitcoin with a debit/credit card

How do I buy Bitcoin using USD from BlockFi? Go to the "Deposit" menu and select "USD (as a Stablecoin)". You will then have an option to wire money to BlockFi and you will be provided very specific instructions that you will need to follow. More info here.

How do I avoid trading fees with BlockFi? You can avoid fees on BlockFi by doing all your trading on a cryptocurrency exchange that has fees lower than 1%. A few examples of exchanges with low fees are Coinbase Pro, Binance, Kucoin and Hotbit. If you need to buy Bitcoin with money from your bank, you can connect your bank and transfer money in through Coinbase Pro.

How do I avoid withdrawal fees with BlockFi? BlockFi allows you 1 withdrawal per calendar month from your BlockFi wallet at no cost. Every withdrawal after that is subject to a fee based on the type of currency. The fees for withdrawing BTC from BlockFi are very high, considering if you have a small amount you'd like to withdraw, it would be worth it to convert your BTC to stablecoin at a 1% fee and then you can withdraw your stablecoins from BlockFi for a $0.25 USD fee.

BlockFi Interest Rates:

Your BlockFi interest rates begin as soon as you deposit the eligble currency into your BlockFi wallet. I think it's interesting that BlckFi limits the Bitcoin earning interest rates to 2.5BTC. Yes, that is a lot of money, but this limitation is not seen on other Bitcoin interest earning platforms.

| Currency | Interest Rate (APY) |

| BTC (2.5 BTC or less) | 6% |

| BTC (Amounts over 2.5 BTC) | 3.00% |

| ETH | 5.25% |

| LTC | 5.00% |

| USDC | 8.60% |

| GUSD | 8.60% |

| PAX | 8.60% |

| PAXG | 5% |

| USDT | 9.30% |

How does earning interest work with BlockFi? To begin earning interest on your bitcoin with BlockFi, simply deposit BTC or any of the eligible coins to your BlockFi account. You will begin earning interest immediately. Your BlockFi account will show you

When does BlockFi pay out the interest? BlockFi pays the interest you accrued on the first of each month in Bitcoin. Your balance from the "Accrued Interest" section will be added to your "Total Interest Paid" balance. That balance appears in USD, but can fluctuate because payments are made in Bitcoin.

How does BlockFi pay out interest? BlockFi provides interest payments in BTC (Bitcoin). BlockFi will show interest accrued in USD but will pay you in Bitcoin. Since the price of BTC will fluctuate, your "Total Interest Paid" balance may also fluctuate.

How does BlockFi stack up against it's competitors? BlockFi allows you to earn up to 6.5% in interest on your Bitcoin without having to own any other platform tokens. In addition to the safety and confidence seen from other major investors, this makes BlockFi the best crypto interest earning platform.

Withdrawal Fees on BlockFi:

BlockFi offers 1 free withdrawal per calendar month. The free withdrawal seems nice with BlockFi, but you should know when to use it. Otherwise, you can drown in fees! I really think that their fee structure needs to be updated to be more reasonable in accordance with the amount needed to complete the transfer. Most cryptocurrency exchanges and wallets ONLY charge the rate for transferring the coins. I don't like being charged to get my own money back and of course, there are bitcoin transaction fees to get the money moving. With that said, I find it strange that BlockFi charges 0.0025 BTC for a withdrawal. These are the BlockFi Withdrawal fees:

| Withdrawal Type | Withdrawal Fees | Fee Conversion |

| BTC Withdrawals | 0.0025 BTC | $33 USD when BTC is $13600 |

| ETH Withdrawals | 00.15 ETH | $0.58 USD when ETH is $385 |

| LTC Withdrawals | 00.025 LTC | $0.14 USD when LTC is $54 |

| Stablecoins | $0.25 USD | $0.25 USD |

| PAXG | 0.0025 PAXG | $4.72 USD if PAXG is $1890 |

BlockFi Crypto-Backs Loan Rates:

To borrow money from BlockFi, you'll need to put at least double that amount in an eligible cryptocurrency. So if you want to borrow $1,000USD, you'll need to put up at least $2,000 worth of BItcoin as collateral. BlockFi rates are subject to change and the most up-to-date information can be found at the BlockFi rates page here.

| LTV | Interest Rate | Origination Fee |

|---|---|---|

| 50% | 9.75% | 2% |

| 35% | 7.9% | 2% |

| 20% | 4.5% | 2% |

How do loans work with BlockFi? To get a loan with BlockFi, you'll need to deposit your cryptocurrency as collateral. The interest rate can vary based on your LTV (loan-to-value).

Example: You will need to deposit $10,000 in BTC to take out a $2000 loan at 4.5% interest. If you take out a $5000 loan, that's a 50% LTV so you will be charged a 9.75% interest rate.

What happens if Bitcoin plummets while holding a loan? In the event that the price for Bitcoin drops while holding a loan to a 70% LTV, you will receive a margin call and will have 72 hours to deposit more funds into your account. If you do not meet the requirements, BlockFi will liquidate your collateral to pay for your loan.

What happens if Bitcoin skyrockets while holding a loan? In the even that the rising price in Bitcoin changes your LTV to a lower loan rate tier, BlockFi will adjust your loan rate accordingly.

How do I take out a loan through BlockFi? To get a loan from BlockFi you will need to deposit funds in your BlockFi account as collateral. Then you will be eligible for a loan for up to 50% of the collateral value.

Why would anyone take out a loan? Additional leverage. Cashing out cryptocurrency has the risk of losing the potential upside in the event that the crypto markets skyrocket. You don't miss out on the funds. But on the flip side, you do risk losing your assets if the crypto markets tank.

| BlockFi Loans | |

| Minimum Loan Amount | $5,000 |

| Acceptable Collateral | BTC, ETH, LTC, PAXG |

| Loans received as | GUSD, PAX, USDC, USD (sent directly to your bank account), |

| Changes Credit Score? | BlockFi loans do not appear on your credit report |

Withdrawing your coins from BlockFi:

It's not instant. Most withdrawals are subject to a security hold and processed the next business day. That means they operate during specific business hours Monday to Friday. BTC and ETH withdrawals can also take up to 7 days to process. Stablecoins can take up to 30 days of processing.

BlockFi says the withdrawals take a long time due to manual verification to reduce the risk of fraud. I can appreciate that there are some protections. But, if it takes me more than 1 day to get my coins, I would be concerned on any platform. I expect coins to arrive in 1-2 hours when transferred. The good thing is, you know what to expect since you're reading my BlockFi review.

| Transfer Type: | BlockFi Bitcoin wallet transfer to Nexo Bitcoin wallet |

| Transfer Initiated: | 10/31/2020 Saturday 03:15am EST |

| Estimated Arrival: | 11/2/2020 Monday 08:00pm EST |

| Arrivate Date: | 11/2/2020 Monday 05:06pm EST |

How long do BlockFi withdrawals take? BlockFi withdrawals can take between 2 to 7 days. Withdrawals through BlockFi are only processed on business days and can be subject to a security hold.

In my specific experience, it took 62 hours to withdraw bitcoin from BlockFi on a Saturday. The transaction was completed Monday afternoon (a business day). Since there may be manual reviews, as more people sign up for BlockFi they will need to have additional support to review the increasing amount of withdrawals, otherwise expect longer withdrawal times.

How does BlockFi Make Money?

It's VERY hard to believe that the interest rate for just "holding" (aka HODLing) your cryptocurrency in a wallet can generate you money. But it's pretty common for crypto lending platforms to provide interest by lending out your cryptocurrency. What doesn't make sense to me is that the rates for loans are lower than the interest rates.

According to BlockFi, they make their money through these three ways:

- Traders and investment funds: arbitrage trading opportunities

- Over the counter (OTC) market makers: connecting buyers and sellers who do not want to transact over public exchanges

- Businesses that require an inventory of crypto to provide liquidity to clients: Companies like crypto ATMs

The exact details to how BlockFi makes money look vague and use confusing language. I do understand that if they are using trading bots for price arbitrage, then it's very likely that's how they make money. That's something they do in the stock market too. I'm not going to pretend like I fully understand the process, but from what I can tell I trust BlockFi with a small portion of my crypto holdings.

I do understand that BlockFi does make money from loans. They loan out money anywhere from 4.5% to 9.75% in interest. So when BlockFi pays out 6% on your Bitcoin it makes sense. As for stablecoins, BlockFi can provide 9.3% in interest so they would still make a profit. I don't think they are operating at these razor thing margins though, but maybe the volume is enough.

Is BlockFi Safe?

BlockFi is safe. I was able to deposit and withdraw my cryptocurrency through BlockFi without any problems. I looked up the company on LinkedIn and reverse Google searched a few of the images. Everyone is real and BlockFi is a real company that is actually growing and hiring people.

Cryptocurrency isn't insured and it's hard to implement any legal action if your cryptocurrency is stolen. As you probably know, you could easily lose cryptocurrency by forgetting your keys or sending coins to the wrong type of address. There are many ways for your money to be lost or stolen which is why you should know where a company like BlockFi is safe.

Who are BlockFi's investors? BlockFi has 19 large investors and that includes many of the big names in crypto like Winklevoss Capital (creators of Gemini), SoFi, Coinbase and many more. Full list here. It's actually very difficult to question a company about where they are investing their capital. I guess that's difficult if you're a small-time blogger researching the trustworthiness of a company. But BlockFi says they are working with these large investors and so far I haven't found a reason to not believe them.

Can I invest in BlockFi? I could not find any information about investing in BlockFi as a shareholder. That's some top-level discussion from people with a significant amount of money. For now, I'll humbly hold my small amount of money to earn interest with BlockFi.

Due Diligence: Is BlockFi a scam?

BlockFi looks legit but it could be a scam. It is possible that BlockFi is lying about everything they are doing. This goes for all companies that provide earning interest on your Bitcoin. BlockFi can really say whatever they want on their website. If BlockFi says they are insured and has big investors in the crypto world, it's very difficult to verify that.

At this point, I haven't found any information to lead me to believe that BlockFi is a scam, which is why I trust them with a small amount of my cryptocurrency. Most of the crypto interest-earning platforms started becoming available in 2018. None of them insure your specific account for loss and some of them are insured if the platform is hacked. BlockFi does say it is insured through Gemini (another big crypto platform like Coinbase).

I'm always VERY skeptical when it comes to my money, especially cryptocurrency. I've been scammed before for most of my crypto holdings (the 2017 bubble) and now I'm skeptical about any cryptocurrency other than Bitcoin and Ethereum. Even the big institutional investors don't always do their due diligence. General Motors (GM) partnered with Nikola for their EV tech. It later turned out that everything about Nikola was a scam.

From what I've seen and experienced with BlockFi, everything looks very legitimate. But since you are sending money to a platform that can easily pull an exit scam (all platforms can do this), I would invest with caution.

What makes me trust BlockFi? When I see that a company has good reviews, stable growth (actually hiring people), real LinkedIn Profiles, and a competitive product I feel more comfortable trusting them. After doing a surface level research of BlockFi, I can trust them with some of my crypto. I didn't talk to their insurers or investors to verify they are actually working together though. No one would take my calls.

Would I put 100% of my crypto in BlockFi? I would never put 100% of my crypto in any platform. Even if BlockFi looks safe and is legitimate, it's best to diversify were your money is otherwise cold storage (keeping your coins offline) is the best way to protect your money. Your crypto won't accrue interest, but there is no risk of losing your money.

How much do I trust BlockFi? Compared to the other crypto lending and crypto earning platforms, I really like BlockFi. I would trust them with 5% of my cryptocurrency which is a lot. Because 5% is the most I'm willing to lose in the event that things turn bad. For some of the other Bitcoin interest earning platforms I wouldn't invest more than $100.

FAQ

Is BlockFi a DeFi? BlockFi is not a DeFi (Decentralize Finance) platform. BlockFi is a centralized platform with the specific purpose to manage finances and serve clients.

I signed up but forgot to use a promo code, what do I do? In the event that you forgot to use a promo code, you can contact BlockFi support and provide them the promo code offer that you would like to use for your new account.

How long has BlockFi been around? BlockFi has been a functioning Bitcoin interest earning service since August 2018.

How often is BlockFi Interest paid out? BlockFi pays out interest monthly on the first day of each month.

Is BlockFi legit? Yes, although BlockFi is not FDIC insured (no crypto currency is), they do provide insurance against their platform being hacked. BlockFi has actual offices around the world, they are growing as a company by hiring people, and BlockFi has investors from Winklevoss Capital, SoFi, Coinbase and many more.

Recap

Blockchain and cryptocurrencies are still relatively new technologies. Most platforms that let you earn interest on your Bitcoin were established in 2018 which makes them all pretty young. BlockFi is not FDIC insured if their is fraudulent activity on your account, you risk losing all the money in the account. This goes for all platforms that allow you to earn interest on your cryptocurrencies. Before you invest in BlockFi, you should know all the risks.

After assessing all the risks, I can see myself investing up to 5% of my crypto in BlockFi. That's pretty much the highest I'm willing to risk for any platform which means I trust BlockFi. When comparing BlockFi to the other companies in the space, my trust in BlockFi is very high.

BlockFi is superior to other interest earning platforms because you can earn 6.5% on your BTC without being required to have platform tokens. Other services like Crypto(com) and Nexo require you to hold their platform tokens to earn additional interest on your cryptocurrencies.

As for the BlockFi platform, it's very simple with very limited information. Your home page when you log in provides you very little information. You'll need to "expand" the data which brings you to another page and gives you a better experience. See my YouTube BlockFi review for a better experience.

Posted from my blog with SteemPress : https://slycredit.com/blockfi-review/