Good evening my friends. Another interesting day at the market. All the news is OIL down to 55.00 per barrel. I do recall that not so long ago it was 39.00 per barrel and so out of favor that we bought! That is of course before starting to post here. And the Dow up earlier tanked.

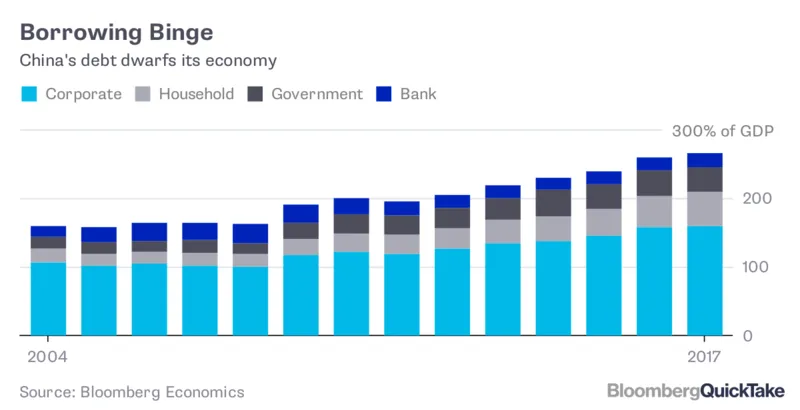

China is in a mess of massive proportions and will have worldwide impact. Their debt is 3 times their GDP. This is unsustainable and they claim they will not devalue the yuan to help exports. The market will do it for them. But wait! Who holds more US debt than any nation in the world? China. Russia incidentally unloaded all US debt and bought gold.

Therefore the US and our rising interest rates are an enormous problem. We can talk about Italy, Germany and the rest of the world later.

We are in a trade war with China. The US can't tolerate rising rates and a strong dollar. Things will get very, very interesting soon. Don't let this last bought of Gold and silver slip buy. My bet is you'll not again see prices like this maybe bot ever. They are going dramatically higher and we believe it is very late November and possibly from the lower 1100's.

The London Bullion Market Assoc. (LBMA) consensus just out is for gold 1532 one year out. My take is that's conservative.

The Dow-Jones hit 25,200 today (down about 200) before a slight recovery. AS far as we are concerned we are in a bear market that will have traps along the way as you saw recently. We said sell about two days before the major selloff in October at the top, so far only about 9 per cent. I personally sold out and wrote it mid September at 26,500. While this market will hold up a bit longer towards the end of 2018, I believe 20,000 Dow will be seen in 2019 and possibly considerably lower beyond '19. That's when gold reaches beyond the old highs as soon as 2020. Let's see if we're right. Since posting in early January, we've called every market "on the nose". Gold (and silver) has been the most frustrating, but not for long. We'll have to just see.

Thank you for the support and have a great Wednesday.