It is just a little before noon on Florida's west coast.

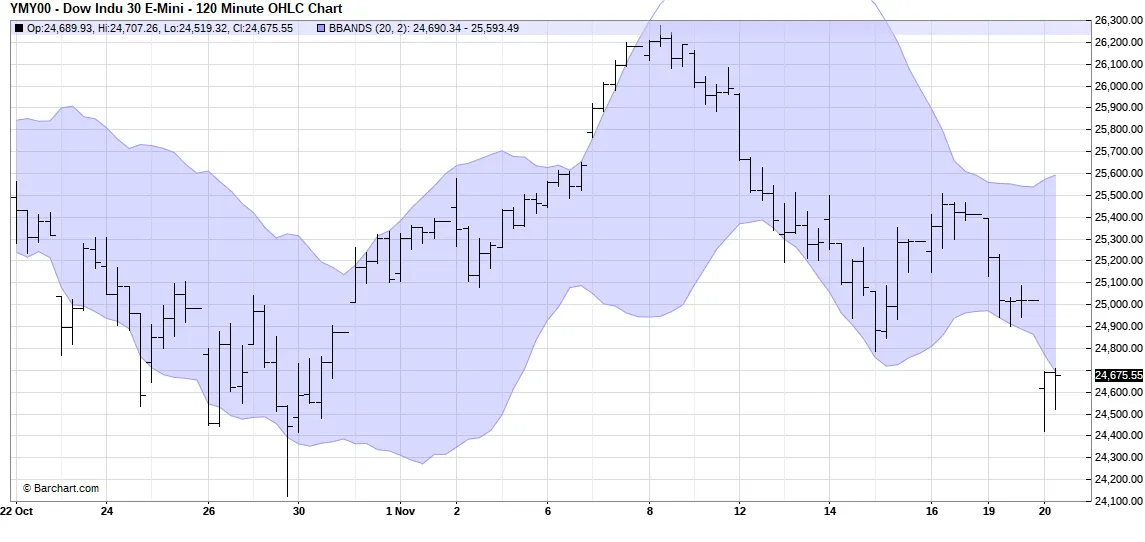

With the Dow Jones down near 500 points to AGAIN the 24,500 level, there is support and SENTIMENT has improves enough so we'll mount a tradable rally but we are not buying it!

This one (see chart above) is one I would have taken way back I like the "action". We're very oversold and to me a risk on day trade...take 200 points and run. We don't play that game anymore! My last recommendation (with tight stops) was late Oct. at 24,500 again and we took about 600 points (thank you) and out and at the 1000 point mark I wrote "the johnny come lately's" are back...make sure you have tight stops!!.

I now look much more long term, but do enjoy keeping the eye on things. SENTIMENT is just a beautiful thing to understand. I learned from emotional mistakes in 40 years in the game. You'd never have been long BTC at 15,000 or the DOW over 26,500 in September, etc., etc.

You are witnessing one of the biggest "con" jobs in history. The Tariffs will put the USA in a severe recession. They are not the only reason. See the charts below.

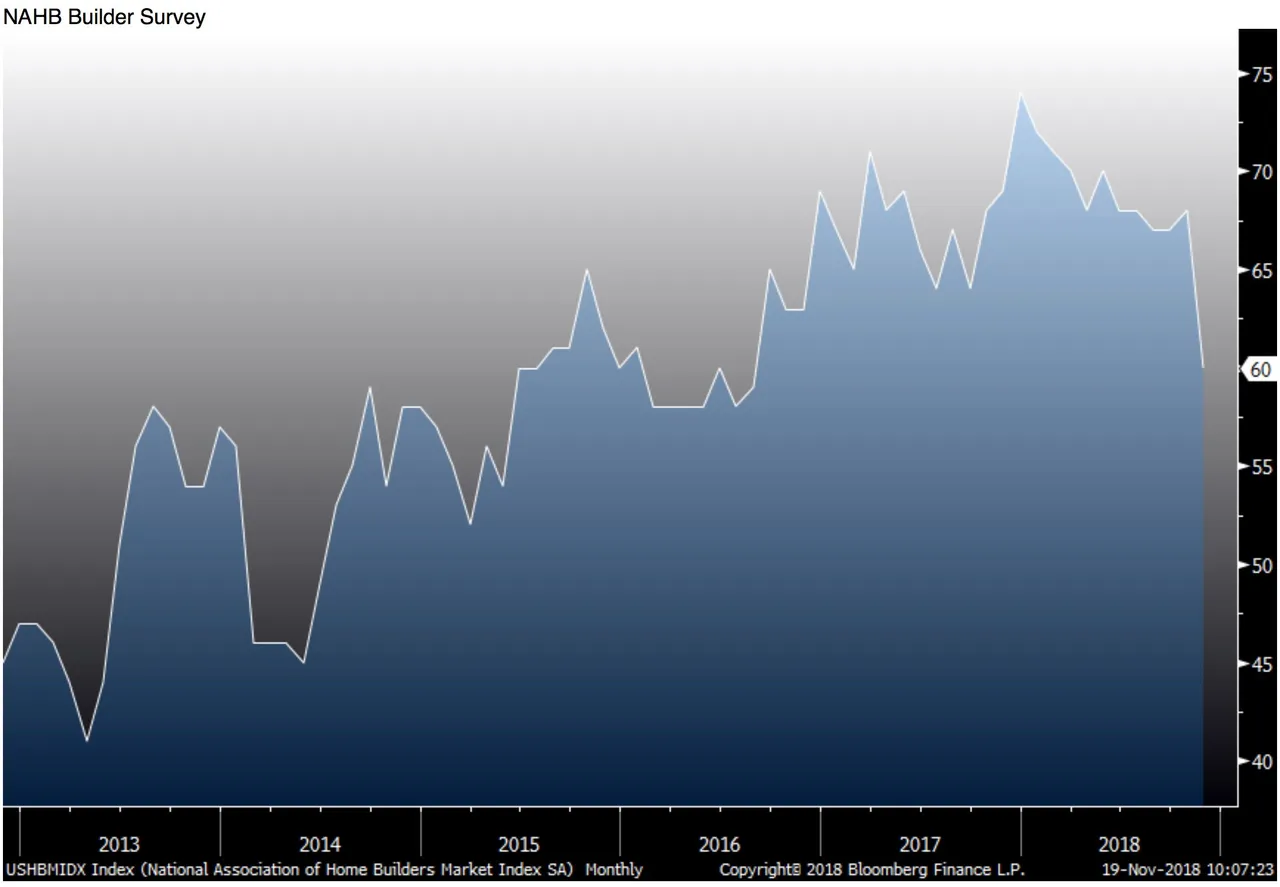

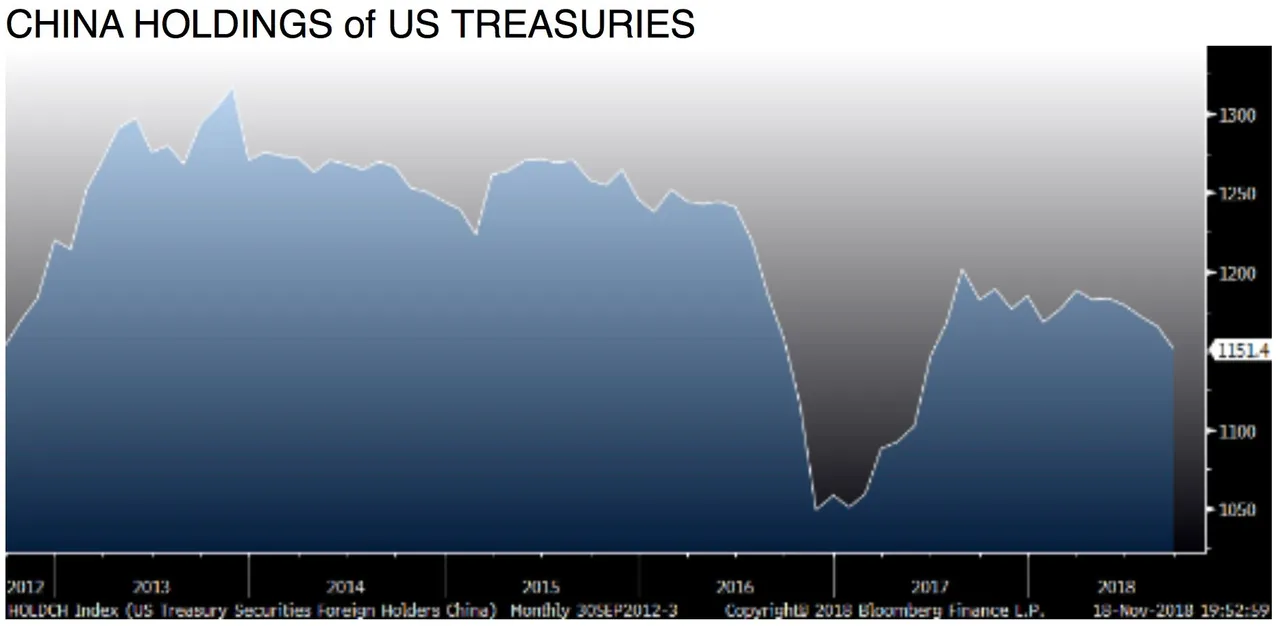

Home builders are in a big decline and China is dumping (Japan as well) US treasuries. Russia has unloaded all US treasuries for gold.

Here's the call: There will be emergency measures to drop rates. Yes I know the consensus is the opposite. I love it. Gold takes off. The Dow Jones next year touches 20,000 or less and and we'll have at least a 30 per cent "correction".

Mr. Trump has a real mess on his hands. Not all his fault of course, but time is gong to show he made a HUGE error with China.

Enjoy the action. It is going to get more interesting.