In this article, we will investigate and assessing a Cryptocurrency group like how a Venture Capital or Start-up hatchery program assesses singular Start-ups.

About

Introduction is a BI (Business Intelligence) framework for the members of off-plan improvement – manufacturers, financial specialists, home buyers, banks and different operators. Introduction IT items give access to cutting-edge showcase examination for industry experts and additionally for private homebuyers. The enroll of underdevelopment items and financial specialists' agreements are put away in the blockchain, which thusly gets information from official state sources. This takes into account successful market examination without damaging the proprietors' rights to individual information insurance. Introduction framework clients will have the capacity to locate the most alluring off-plan properties in many nations and put resources into the continuous development under keen contracts. The blockchain guarantees the unwavering quality of the data about the building plan and exchange security while maintaining a strategic distance from expenses of intermediation by land representatives, legal advisors or profiteers. Shrewd contracts empower the clients to set aside to 30% on property speculation.

Issue

Introduction has compactly depicted the issues that they're planning to fathom with their items which is imminent. The following are the issues that they have distinguished in their whitepaper :

No bound together enroll of underdevelopment properties

Information on off-plan property bargains in state registers isn't organized

No enroll of condos, parking garages and business properties under development

No control systems for phases of off-plan development

Off-plan financial specialists need access to the speculation records that impact their interests

Engineers frequently endure income holes amid the development cycle

Issues 1, 2, 3 and 5 are huge issues for speculators with less assets, as they will be uninformed or unfit to put into properties that they either don't approach as well or are unwilling to go for broke because of an absence of data. This data asymmetry has, by and large, brought about numerous property financial specialists just putting resources into properties that are close to their neighborhood, straightforward salary records, or properties that have exceptionally respectable designers. The issue of data asymmetry is the one I'm most inspired by, in light of the fact that if INTRO can expel this issue for their clients, they will have a critical market advantage as more worldwide speculators will buy properties through their administrations.

Issue 4 in laymen alludes to the issue where there is no simple method to deal with the measure of venture that is given to an engineer. This is an issue in light of the fact that if an engineer comes up short on stores given by speculators before completing their development either because of carelessness or ineptitude, the financial specialist will either need to give more supports which brings down their potential returns or desert the venture inside and out. Financial specialists know about this hazard, and this is the reason some possibly lucrative property venture openings are simply too high hazard if the designer's notoriety is sketchy.

Issue 6 is more direct. Because of the capital expenses of development extends, a few engineers essentially can't stand to complete their venture without auctioning off properties or getting responsibilities from speculators to purchase those properties previously they are finished. While it's now workable for engineers to auction the arrangement structures before they are finished, the measure of the time it takes to discover purchasers could postpone or put a development venture into risk.

Arrangement

Gratefully, INTRO has set their answers for the issues directly under the issues expressed in their whitepaper. The following are the answers to the issues that they have recognized in their whitepaper :

Our framework incorporates a dynamic database of the off-plan properties.

The mechanized phonetic examination is utilized for information tokenization. At that point, the property possession records are coordinated with building designs with the utilization of AI innovation. Along these lines, the framework distinguishes and revises blunders caused by the human factor or changes in building plans.

The framework investigations floor designs of underdevelopment structures. Each off-plan property can be found in the arrangement and set apart as "sold" when its designer surrenders property rights to the financial specialist. This takes into account the moment observing of sold and stock properties.

A unique module in INTRO checks the connection between venture volume and development stage.

Introduction clients can get to the anonymized state records on off-plan advancement assertions. It causes financial specialists and homebuyers to locate a dependable engineer and beneficial property.

The module for private property barters enables designers to rapidly offer of properties and close income holes without harming the general deals plan.

On the off chance that these arrangements are effectively executed, they will generally address the issues relating to data asymmetry, awful development engineers and the designers need to rapidly offer of properties.

The principal concern I have is about whether and how INTRO would implement consistency with regards to engineers who defy the norms, or if a financial specialist doesn't pay what is owed to the designer. On the off chance that an engineer or government organization gave mistaken data coincidentally or eagerly and the financial specialist endures or the other way around, what might be the repercussions? Furthermore, if there were to be a legitimate question subsequently, how might INTRO intervene this issue? In the event that INTRO has a powerful method for taking care of such debate, at that point I think they'll have the capacity to effectively procure both development engineers and universal financial specialists who stress over this potential issue.

The Competition

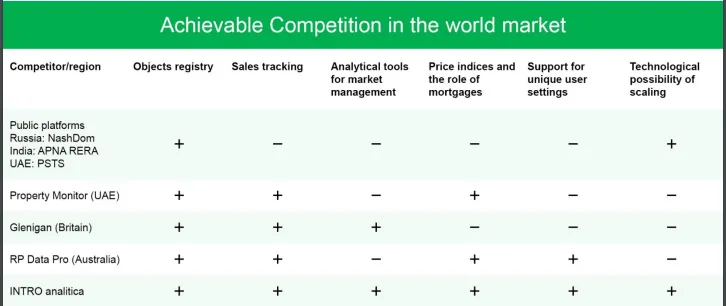

Introduction recognizes their potential rivals in a simple to peruse table which indicates what includes every contender does and does not have.

On the off chance that INTRO's aggressive investigation was intensive, at that point INTRO will have a noteworthy upper hand that will just increment as they scale their tasks all around and gets further supports to expand their innovative lead contrasted with their rivals.

The Market

In the event that INTRO's Off-plan improvement advertise estimate figures are precise, the 'Residential market' is esteemed at $25.89 billion EUR and the 'Achievable markets' are esteemed at $142.89 billion EUR in 2016. That is a critical market which ought to give INTRO a lot of chance to acquire the piece of the pie required to keep up and extend their tasks. Given that 20 designers, 3 land offices and more than 1000 early endorsers among Russian home-purchasers are sitting tight for the arrival of INTRO's future items, it appears to be likely that there will be interest for INTRO's administrations when they start extending internationally.

The Team

Introduction's group comprises of numerous people who have a considerable measure of involvement in land, contract loaning, nearby government and IT.

A portion of the colleagues include:

Kirill Badikov, Founder and Management Board Chairman at Gosstroy, JSC. In 2015, Kirill was delegated for the situation of the Director of the state Mortgage Housing Lending Agency's in Ufa. In 2012, Kirill was chosen to the Ufa Municipal District Council, and in 2016, re-chose and named as the Deputy Chairman of the Municipality Council. In 2016, he established INTROTECHNOLOGY RUS, JSC.

Denis Vechkanov, Executive with 13-year administrative involvement in different fields: Business Valuation, Online Sales, Production and Retail. Since 2015, the Executive Director in the retail chain 'Network' (44 neighborhood shops in Russia and online shop). An alum of the Hult International Business School (MBA, 2016). In 2017, he helped to establish INTRORUS.

Oleg Oboloensky, Over 15-year IT involvement In 2005/2012, he worked in Yandex, the main Russian internet searcher, where he regulated a few programming advancement divisions. In 2012/2015, he was the Development Director at Rambler. In 2016, Oleg turned into a fellow benefactor and the Chief Technical Officer at INTRO RUS, where he is presently dealing with the advancement office programming items.

Jason Hung (Advisor), he a serial business person and creator in versatile innovation, blockchain environment, computerized advertising, AI and ERP related business. He is the prime supporter of Treascovery, Chidopi, TimeBox and CoinArt. What's more, help on in excess of 25 ICOs as counselor.

Amarpreet Singh (Advisor), he is one of the main supporters and contributing individual from Global Blockchain people group, senior Advisor of Global Blockchain Foundation and is an Advisory Board Member of numerous Blockchain extends far and wide.

Introduction seems to have the vast majority of the skill required to make INTRO a fruitful and supportable start-up. A minor concern is the absence of blockchain involvement in the colleagues profiles separated from Amarpreet. Be that as it may, given its level involvement in the group, it very likely won't be a noteworthy issue as they ought to have the capacity to pick up those capabilities rapidly.

The Business Plan

Introduction has an awesome strategy for success which moves certainty. They as of now have a working item as INTRO Analytica and INTRO Sale which is as of now utilized by more than 20 huge Russian development possessions (9). This proposes they have officially approved their items and that they've just counseled key partners, for example, engineers and speculators with respect to whether their items are required. COINvest is required to be finished in July 2018 and INTRO Restate at some point in 2018. In the event that INTRO can adhere to their moderately quick advancement plan, speculators in their ICO should see rather speedy picks up on their tokens on account of INTRO's accomplishments.

Decision

Introduction has made a Start-up which can possibly essentially address huge numbers of the issues related with purchasing Off-plan improvement properties universally. Because of their extremely experienced group, existing administration contributions and client base, they have an OK opportunity to acquire a sizable check.

Some Links:

Website: https://introa.io/en/

Telegram: https://t.me/introa_EN

Whitepaper: https://introa.io/files/%D0%98%D0%9D%D0%A2%D0%A0%D0%9E%20WP%20en.pdf

My Telegram Username: saugat dahal