Bitcoin has been around since 2009, and its recent sky-rocketing valuations and the speculative market around it have motivated many to try and mimic its success by creating and offering alternative cryptocurrencies

As we all know, the time when cryptocurrencies become first-class citizens of the digital economy is fast approaching — the question is not “if” but “when” this will happen. When that time arrives, the need to provide financial services for this emerging economy will be critical to fuel its growth.

Cryptocurrencies are moving into everyday commerce . However, crypto exchanges offer only the ability to exchange one’s holdings between currencies (fiat/crypto and crypto/crypto) which serve only a small part of the financial needs of a growing crypto-economy. Therefore, the appearance of the Bitex crypto-banking platform will offer the most accessible crypto-banking solution on the market for our society.

1.THE ROLE OF BITEX AND WHAT CAN IT DO?

Bitex can make the greatest impact on society by working at the local level, and ensuring that the benefits of this new cryptocurrency-based digital economy can also be felt by those under-served or left out of the current banking system.

It aims to provide financial services to the cryptocurrency based digital economy that is relevant and useful to the local customer base in each region where it operates, while being available globally.

Bitex will provide cryptocurrency-based banking services for digital customers through a licensed technology platform available to local partners.

Bitex is conducting an Initial Coin Offering of its utility token, the Bitex Coin with symbol XBX, to promote the use of the Bitex crypto-banking platform.

XBX will be used for access to the services offered by the Bitex platform.

After the ICO, the token will be available for purchase from other XBX token holders at Bitex’s exchange as well as other well-known crypto exchanges.

2.WHAT IS THE MOTIVATION OF BITEX?

a. Restoring faith in banking

- When creating a crypto-banking solution, Bitex has been motivated by the need to go back to the original purpose for a bank, namely an institution that helps the economy function and grow by providing a way to manage savings, provide means for payments and money transfer, and facilitate loans.

- By sticking to these basic functions, Bitex believes that crypto-banks can restore the public’s faith in banking for this new cryptocurrency-based digital economy, and remove the image of greed and profitseeking that current commercial banking has unfortunately propagated by moving into speculative assets and markets.

b. Serving local needs

- Bitex believes that it can make the greatest impact on society by working at the local level, and ensuring that the benefits of this new cryptocurrency-based digital economy can also be felt by those under-served or left out of the current banking system.

- Thus, instead of starting out immediately as a global bank, Bitex wants to ensure that its solution has a local impact.

- Bitex has structured itself so that its core banking platform is operated by local franchise holders in various countries/regions that comply with local laws and regulations, and understand the local context best so as to tailor localized financial services that positively impact the local economy.

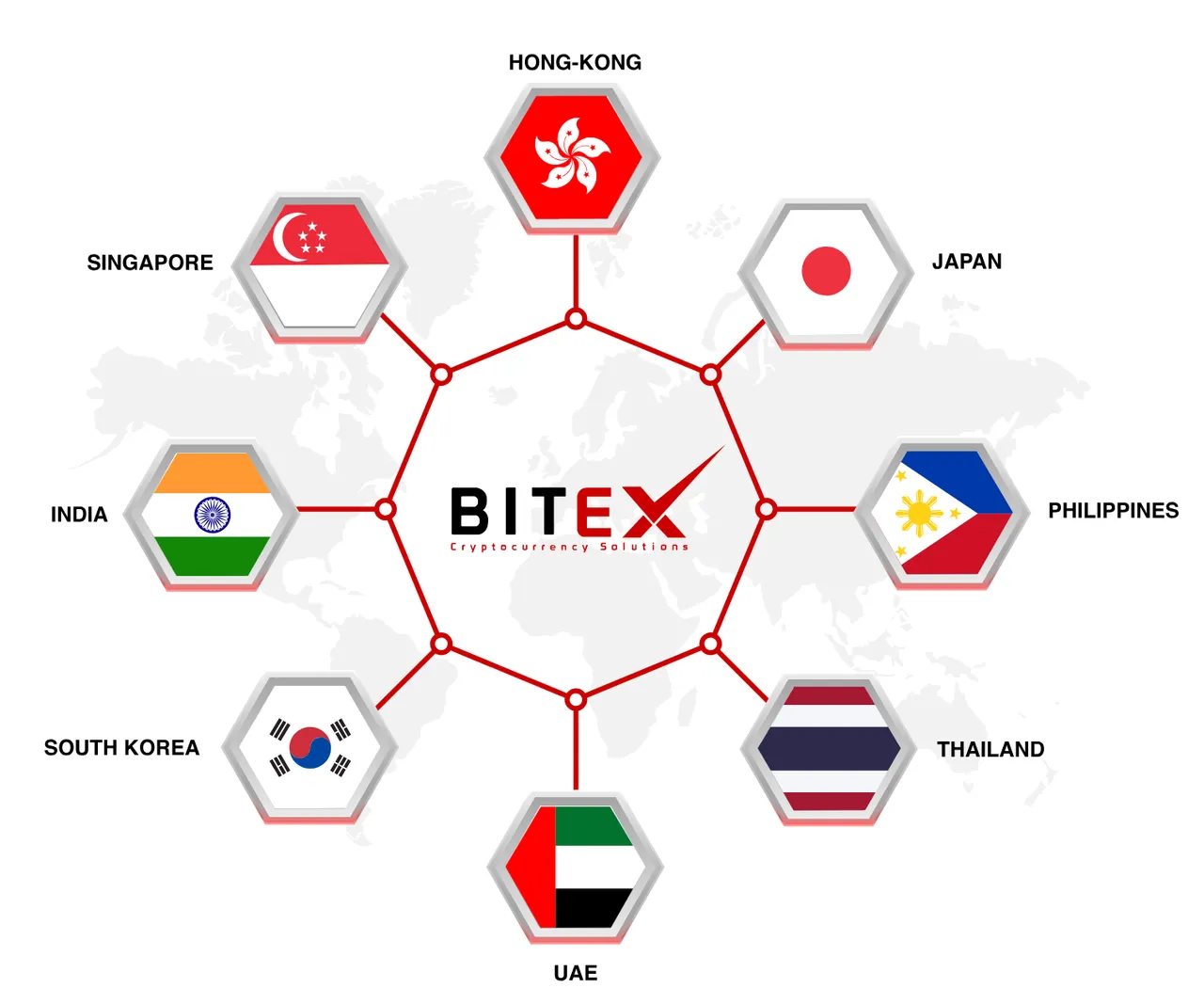

c. Go to Market in Asia and the Middle East

Bitex believes that the best way to deliver significant local impact quickly is to focus on regions where mobile connectivity dominates, and where traditional banking/financial services do not adequately serve the majority of the population.

All pointers therefore indicate that Asia and the Middle East are the regions most likely to need and welcome a robust crypto-based financial system, and where Bitex’s local impact will best be demonstrated. Bitex will demonstrate the local impact it will have in each country where it is licensed, by offering a relevant localized financial service bundle, and redefining how financial services for this new cryptocurrency-based digital economy can be delivered.

3.WHAT BITEX PROVIDES THEIR CUSTOMERS?

Bitex customers will be able to avail of bank-like services (payments, currency exchange and transfers, debit card, and personal loans) that will be offered in 8 countries initially: Hong Kong, India, Japan, Korea, Philippines, Singapore, Thailand and the United Arab Emirates.

Specifically, consumers will be able to take advantage of the following services:

a. Payments to Merchants using BitexPay

BitexPay represents the service offered by Bitex to consumers and merchants for payment of goods and services using cryptocurrencies.

Merchants will be able to accept payments in cryptocurrencies or fiat currencies of their choice.

Consumers who sign onto the BitexPay solution will be provided with ERC-20 compatible wallets that contains their cryptocurrency holdings.

A consumer’s wallet, maintained on her ubiquitous mobile device, is called the Holding Wallet and will be under her complete control.

b. Trading:

- Consumers that wish to trade in cryptocurrencies using the crypto-exchange services of the EZBitex platform will populate a Trading Wallet associated with their account.

c. Currency Exchange:

Consumers can populate their Trading Wallet for purposes of cryptocurrency buying/selling by:

- Transferring fiat currency from their bank accounts to their account on the EZBitex platform, which can then be converted into cryptocurrencies of their choice and used for further buying/selling;

- Using a credit or debit card to purchase cryptocurrencies offered on the EZBitex platform.

Furthermore, to encourage use of the Bitex banking platform, consumers will be rewarded for holding XBX tokens. The amount of XBX tokens maintained by the consumer on the EZBitex platform will be held in a Staking Wallet. Besides, Consumers that wish to obtain loans from Bitex by offering a cryptocurrency as collateral will be provided with a Loan Wallet.

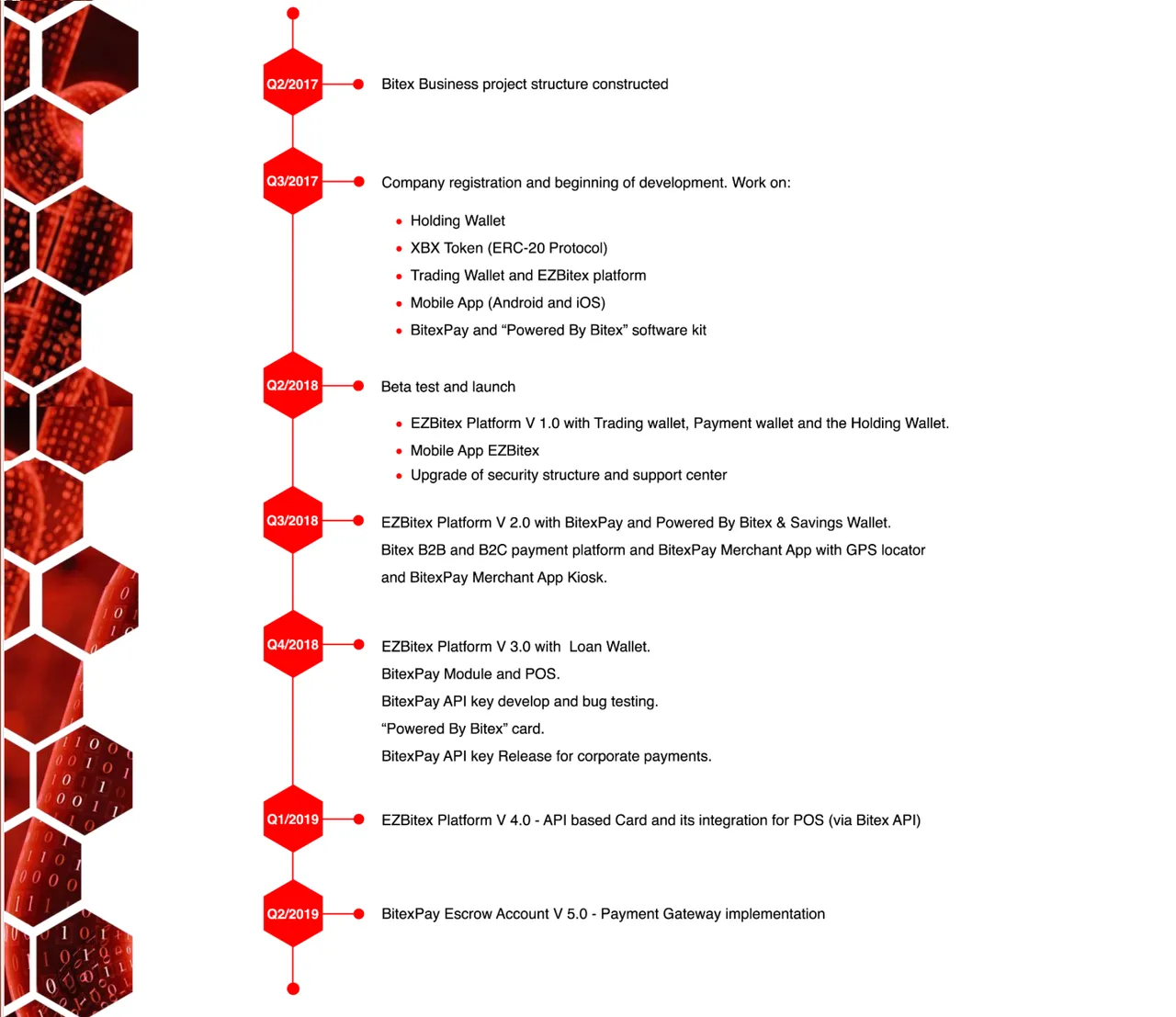

4.ROADMAP

To illustrate more about Bitex's plan for the future, I'll show you their technical roadmap:

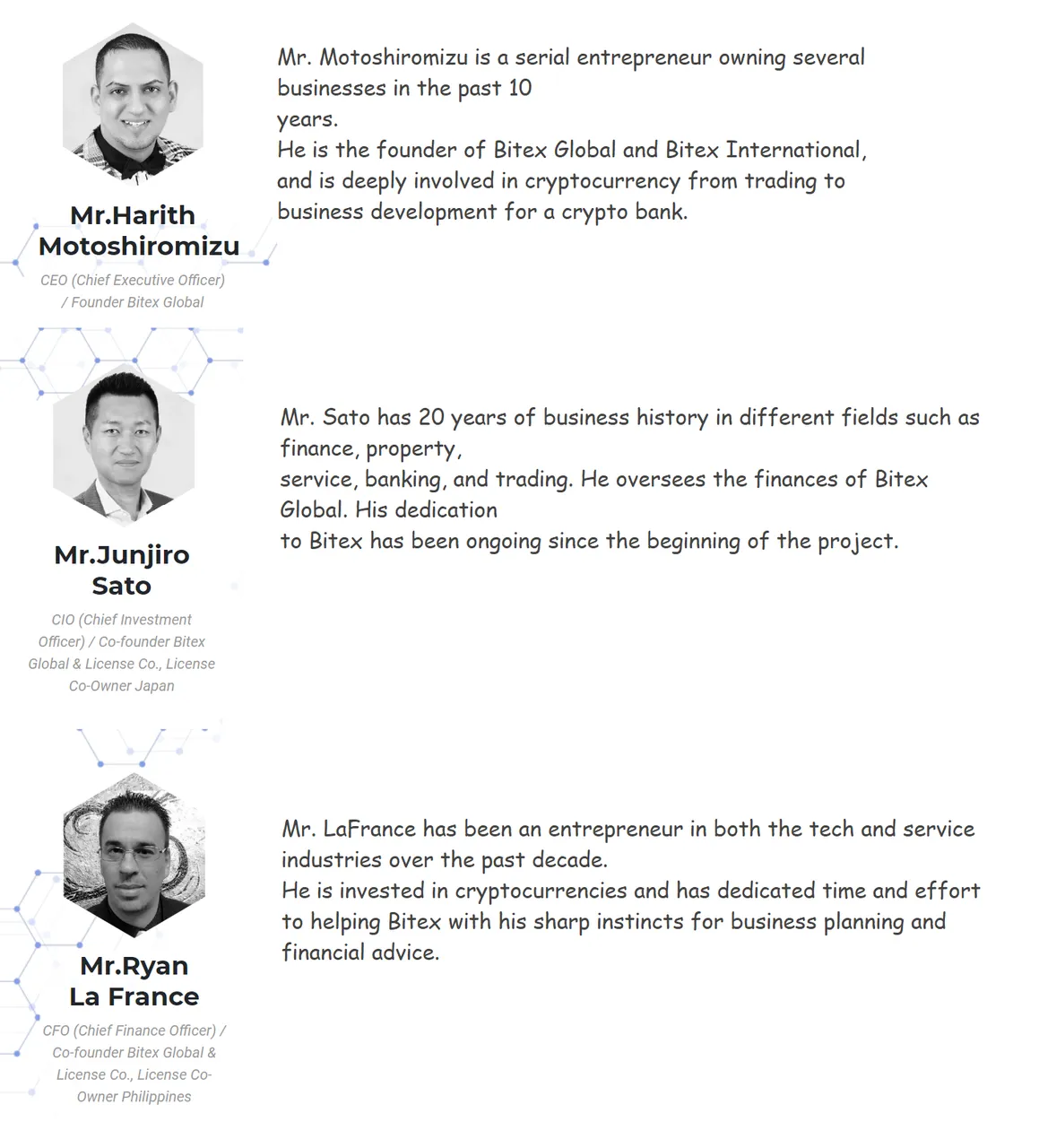

5.THEIR TEAM

To sum up, I believe this project may become a revolution, which can change the face of nowaday banking and give more opportunities for cryptocurrency users.

Thanks for reading my review. Have a nice day!

For more detailed information about Bitex, please click here:

Website: https://ico.bitex.global

Whitepaper: https://ico.bitex.global/docs/XBX-Token-WhitePaper.pdf

ANN Thread: httрѕ://bіtсоіntаlk.оrg/іndеx.рhр?tоріс=3651047

Twіttеr: httрѕ://twіttеr.соm/bіtеx_glоbаl

Tеlеgrаm: httрѕ://t.mе/jоіnсhаt/IV2і4Q6llH7ttm5n9hԛT5g

Fасеbооk : httрѕ://www.fасеbооk.соm/bіtеx.glоbаl/

Inѕtаgrаm: httрѕ://www.іnѕtаgrаm.соm/bіtеx.glоbаl

Author: Khuongcute2503

Bitcointalk profile: https://bitcointalk.org/index.php?action=profile;u=2080664