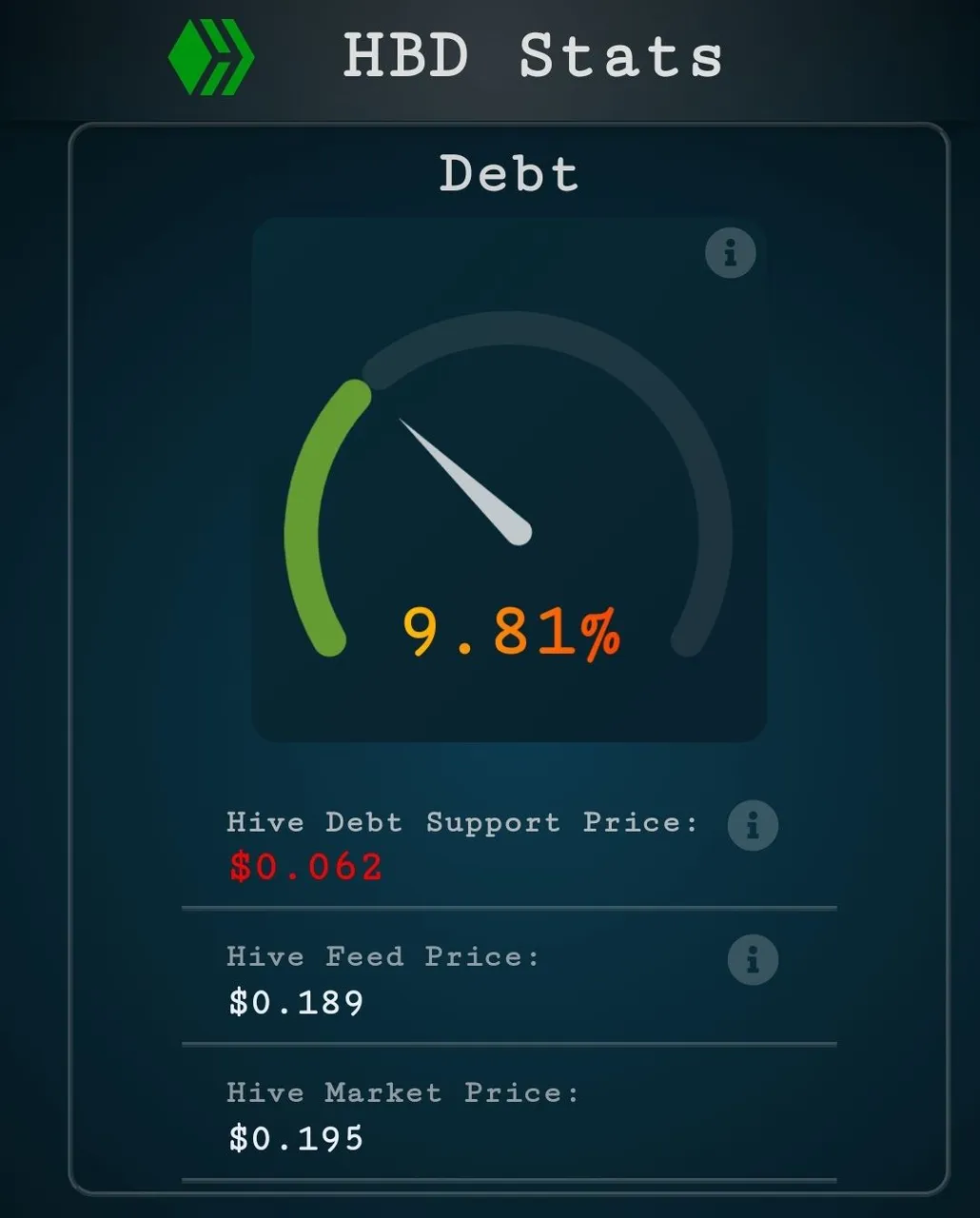

I have screenshoted this few days ago when the market tanked, looking closely will the 10% debt be reached, as a psichological limit. It is also the previous debt limit, meaning if we didnt raise the debt limit, to 30%, at 10% HBD would have been devalued.

We are now at 20 cents, and the debt is around 9.5%, meaning it dropped meanwhile.

Another thing that was obvious is that more HBD has been destroyed when the drop in the HIVE price happened, pushing the support price from 7 cents down to 6 cents. But this has resultied in inflating the HIVE supply, for additional 0.5%. I guess the ones that converted are not in a hury to dump the HIVE, becouse they have basicly taken the oportunity to buy HIVE trough conversions.

The thing with conversions though is they dont affect the market, dont create buy pressuer but are sort of OTC deals that the chain itself provides for participants. This is the case in both directions, when the HIVE price is up as well, users can convert from HIVE to HBD and wont affect the market and wont create sell pressure.

Another thing that has been destroying HBD is the stabilizer who have been buying HBD slightly bellow the market price during this period.