Bitcoin Cash (BCH), a hard fork of BTC (Bitcoin) from concerns on BTC's scalability, has spiked by about 20%, suspected to be a result of a scheduled network tweak on the 15th of May.

Analysis

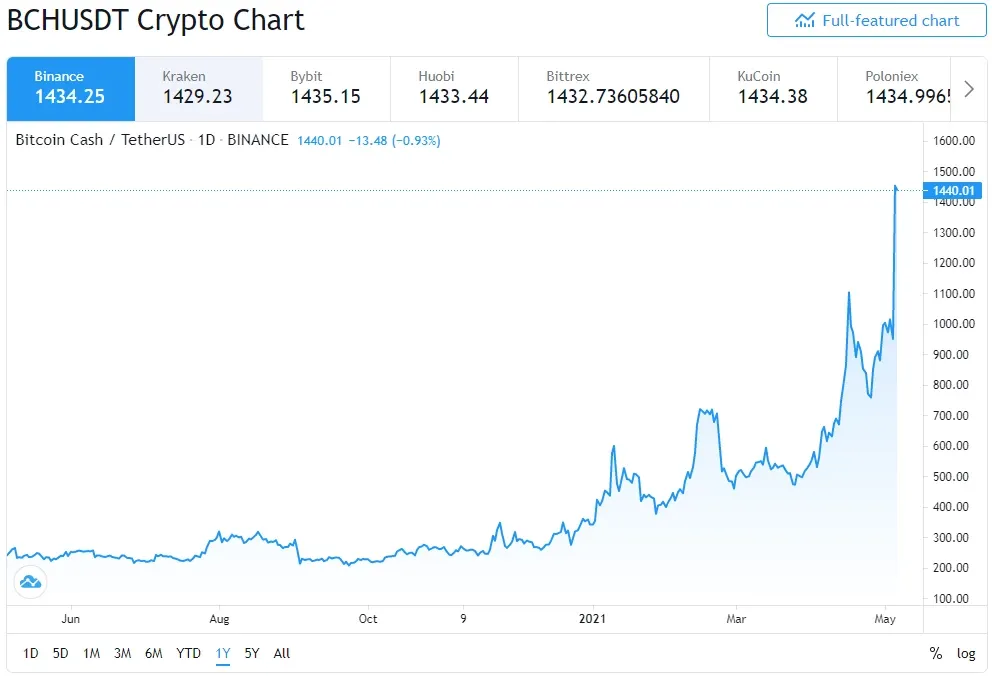

Over the 1 year term, the spike currently occurring for BCH becomes instantly visible. It is simply a straight vertical line upwards, though at its tip there appears to be a resistance to the line, flattening downwards. Going back to the start of the range, BCH is relatively stable at this scale, a bumpy road travelling through time. It comes across a bump rise in August, falling midway between August and October, continuing its previous bumpy road. Towards the beginning of 2021, BCH begins to pick up momentum, swinging back and forth in higher and higher jumps. At the start of April, one of its highest jumps occurred, swinging from a bit over $500 to a peak of $1100. BCH crashed with the recent market crash a few weeks ago and now has spiked to where BCH at the moment is.

Zooming into 1 month, BCH appears much more dramatic, filled with spikes up and down across the entire timeframe. It remains quite stable at the beginning, rising over the next few days, hits a peak, and falls to its previous position that it had stabilised at. Next, it slowly increases once more, suddenly spiking over recent days for the place where BCH is.

Going even more in-depth with a range of 5 days, the spike of BCH becomes another visual feature, more spread out than the previous ranges. Once again, there is the rocking road at the beginning, some small changes through the road that soon recovers, then the great pump upwards. Notice that three peaks are occurring here: two closings packed just towards the end of the 5th of May, and the current position from now. From this peak trend, it can be expected for BCH to continue falling for the next few hours, either following the trend or breaking further upwards.

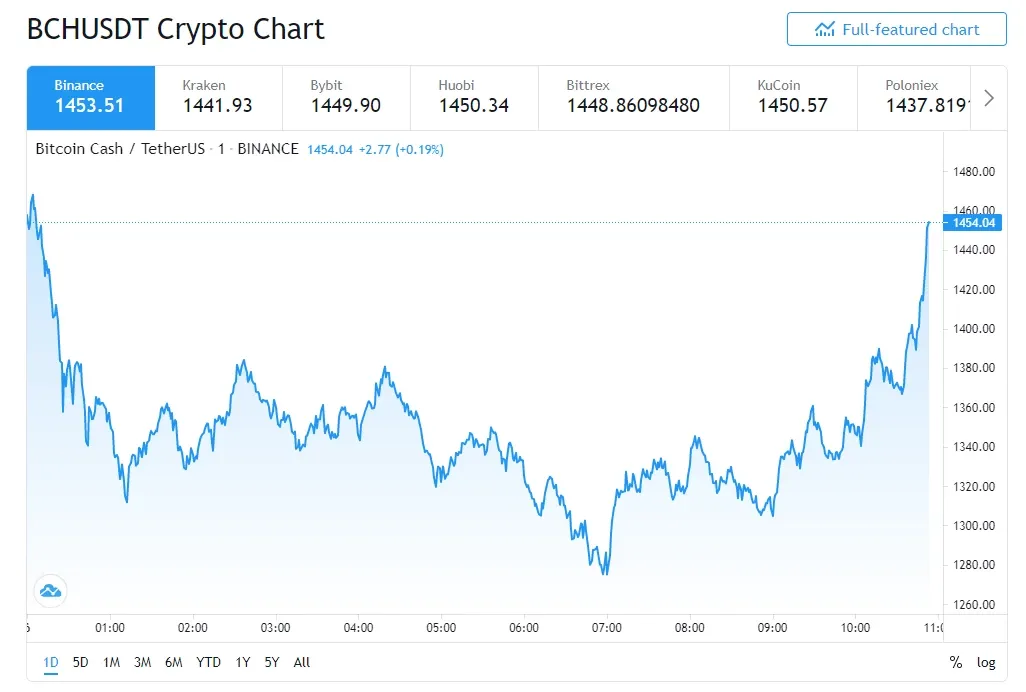

Becoming more detailed in the BCH trend from a 1-day range, its unpredictable nature is revealed. At the beginning of the trend comes a smooth slope downwards, having some small recovery spikes, but to no avail. Next, come some ups and downs, falling even more down to its lowest for the day's range, before quickly recovering from the great spike currently held.

The current statistics of BCH are as follows:

- Price - ≈ $1440

- 24h Price change - $226.50 (+18.75%)

- 24h low / 24h high - $1,169.61 / $1,474.29

- 24h Trading volume - $15,039,759,206.77 (+102.17%)

- Market dominance - 1.08%

- Market rank - 9th

- Circulating supply - 18,729,175/21,000,000 (89%)

Reasons For BCH's Spike

Various reasons are out there plausibly reasoning the recent BCH spike, but the most likely one is the hype for BCH's network tweak scheduled for next week on the 15th of May.

BCH blocks are currently mined every 10 minutes with the old unconfirmed chain limit standing at 50 transactions, meaning that 50 simultaneous transactions can be made before needing a confirmation within a block. This will become removed from the new network update for BCH. What does this mean? I guess that either each transaction now needs to become verified, no matter the transaction volume or as many transactions can be done as possible in any short of time. The former guess sounds more plausible and would mean a greater fee income on BCH miners, which can link to another cause for BCH's spike.

BCH's other significant update for the upcoming network tweak is the introduction of multiple "OP_RETURN" outputs. What this means is that the BCH blockchain will allow numerous pieces of miscellaneous data (e.g. text, images and other data types) to become sent in one transaction, bringing more variety into the mix. Currently, only one "OP_RETURN" can be attached to a transaction, so it is a bit of an increase.

Both of these updates allow BCH to have better scalability and more suitable with crypto trends like NFTs (Non-Fungible Tokens), thus making a BCH hype to bring up the price.

Another reason for the spike is the common occurrence of the herd of crypto investors following into the BCH market. When the price goes up, more people buy, bringing the price even more up, and so the cycle goes on. A great example is DOGE, pretty much reliant on Elon Musk's tweets to pump with people following Elon Musk's tweets.

Further Reading

Supporting article (CoinTelegraph - Bitcoin Cash price jumps 68%: Looming hard fork to boost BCH user base?) - https://cointelegraph.com/news/bitcoin-cash-price-jumps-68-looming-hard-fork-to-boost-bch-user-base

BCH Network Update Docs - https://upgradespecs.bitcoincashnode.org/2020-11-15-upgrade/

CoinGape - Bitcoin Cash (BCH) Shoots 28% to Re-Enter Top-Ten Spot, Network Upgrades Drive Optimism - https://coingape.com/bitcoin-cash-bch-shoots-28-to-re-enter-top-ten-spot-network-upgrades-drive-optimism/

Investopedia - Bitcoin vs. Bitcoin Cash: What Is the Difference? - https://www.investopedia.com/tech/bitcoin-vs-bitcoin-cash-whats-difference/