KEY FACT: The United States Securities and Exchange Commission (SEC) has approved the Grayscale Ethereum Mini Trust and the ProShares Ethereum ETF to list on the New York Stock Exchange’s Arca platform. The SEC reportedly gave preliminary approval to at least three issuers to begin listing spot Ether ETFs as soon as July 23.

Image Source

SEC approves Grayscale, ProShares Spot Ethereum ETFs for Trading on NYSE Arca

The United States Securities and Exchange Commission (SEC) has approved two spot Ethereum exchange-traded funds (ETFs) — Grayscale Ethereum Mini Trust and ProShares Ethereum ETF. The ETFs are to be listed on the New York Stock Exchange’s (NYSE’s) Arca electronic trading platform.

The approval filing dated July 17 came through a Form 19b-4 which authorizes NYSE Arca to initiate trading these funds. The filing provides that the issuers must await final comments on the ETFs’ respective S-1 filings before the spot products can officially commence with the listing. A part of the document reads thus:

“Grayscale is excited to share that the [SEC] has approved Grayscale Ethereum Mini Trust’s (proposed ticker: ETH) Form 19b-4,” a Grayscale spokesperson said in a statement. “The Grayscale team continues to engage constructively with SEC staff as we seek full regulatory approval for US spot Ethereum ETPs.” Source

Unveiling Grayscale Ethereum Mini Trust and ProShares

The Grayscale Ethereum Trust is a well-known crypto investment manager launched in 2017 and was among the first institutional investment vehicles for spot Ethereum. Grayscale will be converting its legacy spot ETH fund, the Grayscale Ethereum Trust (ETHE), into an exchange-traded fund. The Grayscale Ethereum Mini Trust will launch alongside other Ethereum ETFs, seeding with 10% of ETHE’s assets. Grayscale received SEC approval in May after filing a Form 19b-4. On July 17, Grayscale announced plans to distribute shares of the new Mini Trust to holders of the ETHE fund.

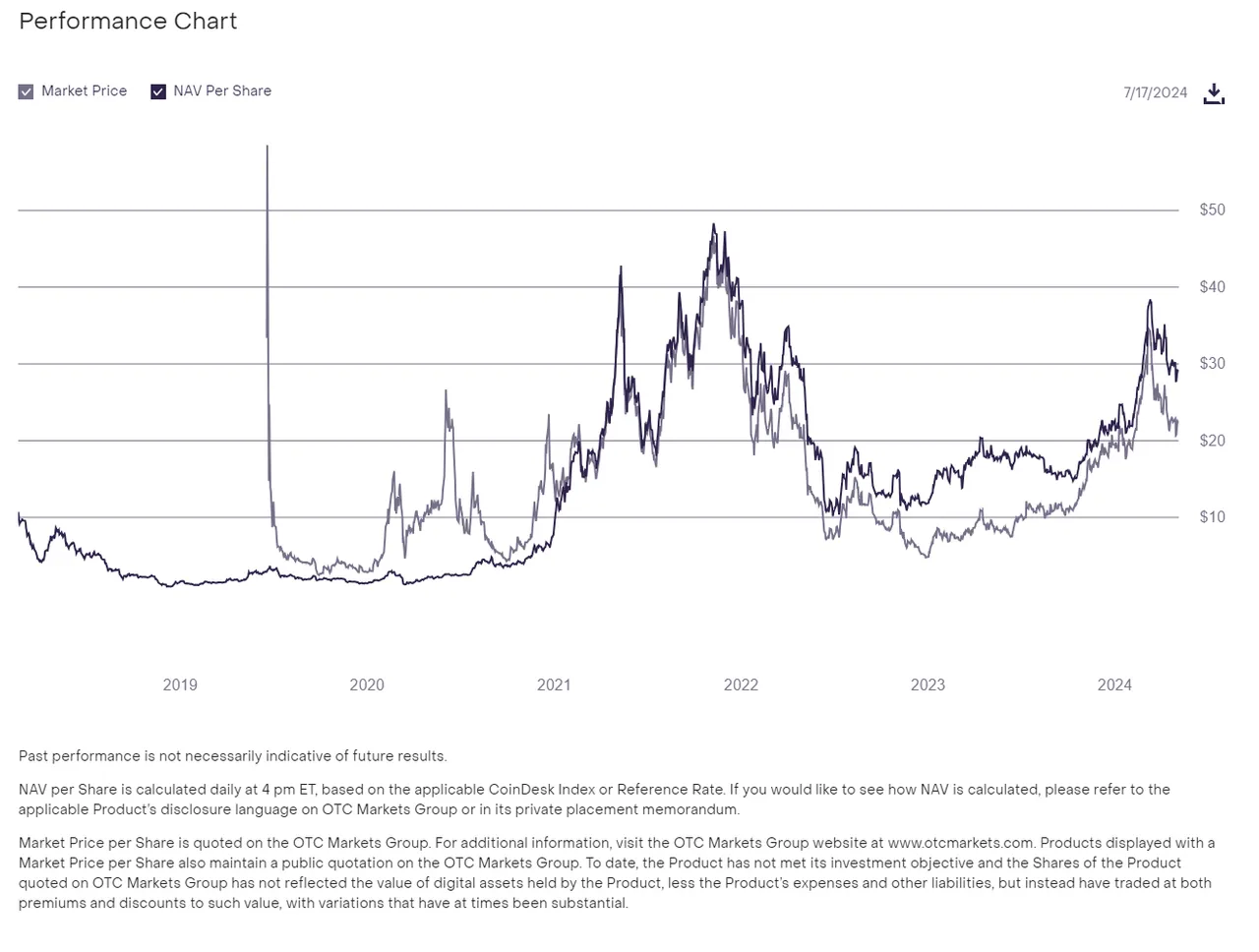

Historical performance of Grayscale Ethereum Trust (ETHE). Source: Grayscale

ProShares got into the Ethereum ETF scene slightly later filing its Form 19b-4 roughly three weeks after its peers had already received approval. However, it is part of a broader wave of similar products hitting the market. A total of eight spot Ethereum ETFs are poised for imminent listing, pending final SEC approval. The ProShares fund is not among the eight expected to be listed next week.

The SEC reportedly gave preliminary approval to at least three issuers to begin listing spot Ether ETFs as soon as July 23. Bloomberg ETF analyst James Seyffart noted that this strategic allocation aims to provide stability, and cushioning against potential outflows as the product launches.

With Ethereum ETFs in sight, what are your projections for the crypto markets in the coming weeks?

If you found the article interesting or helpful, please hit the upvote button, and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO, What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's Built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application: Inleo.io allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966