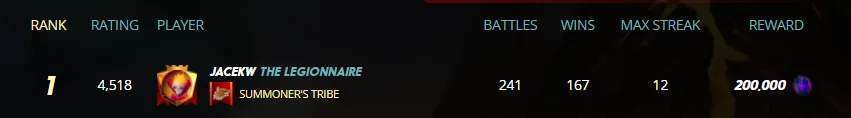

There are currently 20 players in the Champion 2 League and zero in Champion 1 - and there are only 16 hours left to go until the end of the season. But, what is really interesting is that there is quite a "spread" in points between the top 20, with number 1 being on 4584 points and number 20, just scraping in with 4200 points.

This spread is important because when battling the points awarded are affected by the points between players. If the winner is high above they do not score much and the loser doesn't lose much. If the winner is much lower, they win a lot more points and the loser loses a lot more. So, because there is such a large spread between top and bottom of just these 20, there is a high incentive for those lower to play because they can rank up a lot without losing much, but there is not a large incentive for those above to play, because they can lose a lot very fast...

But, there is incentive to go into Champion 1 too of course, because the position DEC prizes are higher there and, last season (for what I hear was the first time ever) no one made it.

Last season:

@jacekw finished top, but was still almost 200 points away from getting into the top League. This is because (I think) while these players have stacked decks and are very good, the competition has increased rapidly with the release of CHAOS LEGION packs and while these players are still reaching the top of all players, they are getting "pulled down" by the competition, making the climb much harder, as there are more random losses to people like me. But, people like me struggle to get up into those leagues, so then there are fewer people for them to climb against, making playing to get up hard, but playing to fall down very easy.

It is a bucket of crabs

As one climbs, the others pulls them back down.

As I wrote last night, I did make it (back) into the bottom of the Champion League for the first time, but I have only just scraped through and have 3724 points at the finish. This leaves me currently in 155th position, but I suspect over the next few hours more people will pass me. I don't drop out of the league though, as I am not playing, so won't lose the qualifying points.

Which means, I can focus on other things.

Like SPS

SPS are a relatively new token for Splinterlands and have so far been used to indicate the VOUCHER drop for the new packs in the presale, as well as for the bonus packs in the general sale. But most importantly, SPS is going to "Feature Heavily" for the efficient usage of LAND, which is like a mining and staking point that will be able to be used to develop new player-driven in-game assets. It is innovative and people are excited.

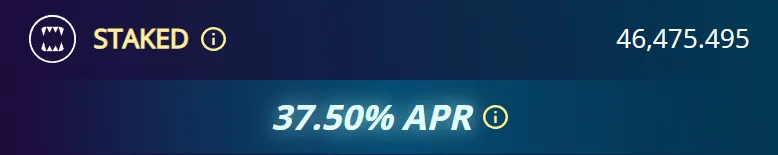

Since these are crypto tokenized assets, they have the same capabilities to stake (needs to be staked to earn vouchers) and earn a yield, like a liquidity pool does. While the yield has been dropping as the staked amount increases, currently it sits around 37%, meaning that if there is 1000 PS earning at the start, by the end 370 more will have been earned. But of course, this can be affected by compounding what is earned by rolling it back in too.

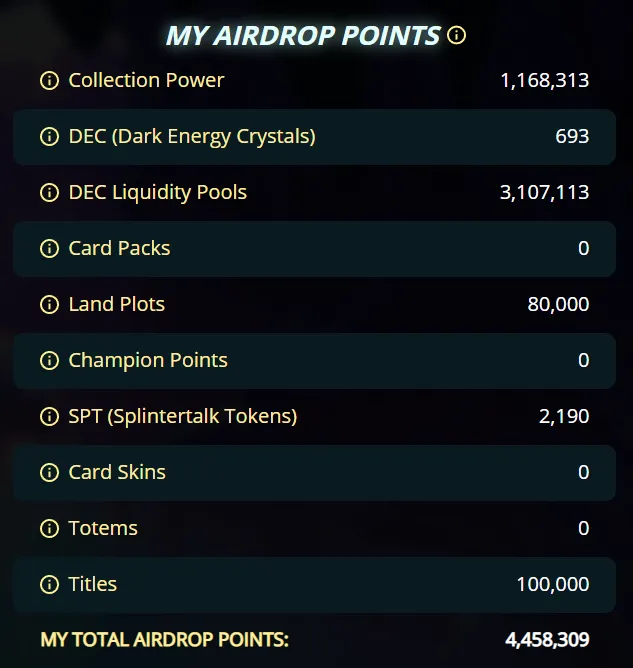

But on top of this, there is the potential to earn from an airdrop and that is determined and can be affected by many other factors. For example, the quality of the cards held (Collection Power), how many champion points have been earned in total, other assets like Land and Totems held, or where I earn a lot of my points, the Liquidity Pools where I combine DEC with some HIVE to earn twice the amount than what I would if I only held the DEC, which collects also. I hold about 1.5M DEC and earn a bit more from playing and renting daily, but I paid a lot more for it than it's current value. Still, I am getting something back.

Which is what I am looking at today.

Based on the assets hold and the way I manage them, every day from the airdrop I am getting around about 450 SPS and about 40 SPS as APR - which means that my current SPS growth is an incredible 1% a day!!

Yield means nothing though, unless the token getting yielded has value. I bought SPS at around 25 cents before it went to a dollar, but right now, it is sitting around 16 cents. However, I did sell some of my yield in the 90s, 80s and 70s, before I started buying back in the 30s and 20s. While the total value of the SPS I hold is about half of what it was, I actually hold about 3x as much as I did at that time.

Shoulda sold?

Well, not necessarily, because while the token price is low, we are not quite halfway through the year-long airdrop. This means that there are still 193 airdrops to come and while it is affected by total stake (which is climbing still), it means that I could get another 95,000 SPS, but during that time, I will also be increasing the stake a little, so that will translate into perhaps an average of perhaps another 5000 SPS on top through yield. This means that in less than 200 days from now, I should have around an additional 100K SPS. Plus if I get a buy opportunity that I can take, like I have been doing the last month or so.

At current price of 16c, that means the holdings would be worth around 20K. But, is that where the final price is going to be? I do suspect that it is going to drop a fair bit further than where it is, but once the LAND announcements start to roll on how much will be needed to optimize the farming possibilities, the FOMO sets in and it again starts to climb.

As always, the dynamics behind all of this are quite complex, because there are so many moving parts, but I think that this is also why there can be a lot of value, because staking and providing liquidity are so valuable. For example, holding DEC earns, but combining DEC with HIVE will earn twice as much, but will be subject to the market fluctuations of both. However, in order to combine with HIVE, you need HIVE - that is okay for me, because HIVE is something that I have been stacking for a long time. This means that in terms of "Airdrop points" my liquidity pools earn almost 3x as much as my held cards, even though the combination of the DEC and HIVE is a fifth of the value. However, while people are concerned about the value of cards sliding, DEC is going to likely decrease in value too and at some point, those cards could increase significantly as scarcity starts to set in.

Lots of variables, lots of risks.

But this is the case for everything these days as there is no "risk-free" anything in life, especially in investments in the current economic climate. However, what needs to be factored into the risk profile is, the potential for reward too. Currently, the risk of pretty much every asset class is increasing, but the potential ROI is often decreasing. For example, houses used to be the "go to" for stability, but when you are paying 40% more than you were two years ago for it and now interest rates are going to rise, the potential loss could be huge. Sure, it will recover eventually, but it could literally take decades before it is on par with the initial purchase price.

Currently, I think there is a bit of the same problem for most people in the world, where there is little to gain, but a lot to lose in terms of investment strategy. However, we are not designed to have an intuition for things like compound gains but perhaps more importantly, compound losses either. All of these factors of the economy are coming together to a head to affect the risk profile, but we are unable to pay attention and optimize all of them, so many are going to slowly be bled dry until one day there is nothing left and it all sinks into the awareness that, we got played.

But, this is part of the game and it always has been, so all we can really do is the best we can and hope that in the best case scenario, we got all we want and need and in the worst, we don't lose more than we can afford.

Taraz

[ Gen1: Hive ]