No longer a news that the crypto market is indeed running bearish run bitcoin still struggles to rise above the 30grand in June. This move led traders to buy the dip hoping the sharp decline would be followed by a bullish movement. Although there has been a quick retrace, with the coin trading close to $40k, bitcoin is still failing to meet most traders’ and investors’ expectations (experts and noobs) altogether.

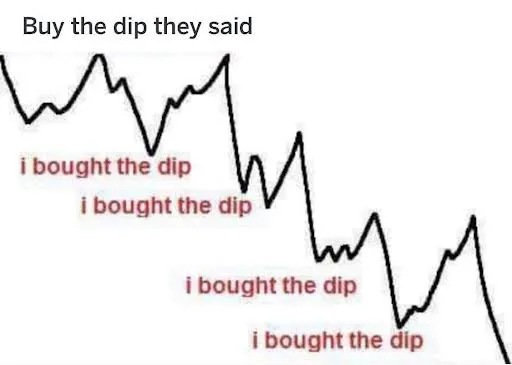

Many who bought bitcoin when the price dropped in May would have made a slight seeming profit on their investment as at the time when the price traded at a threshold of $40k. However, a sizable amount of these traders would have decided to hold on to the coin with strong hopes that it is embarking on a journey to its glory days. Seeing that the dip is continued, many crypto investors and traders are in a panic mood as bitcoin is still witnessing setbacks at this point. The big question in the hearts of many is; do we buy the dip? Or just cut the losses?

Buy The Dip, What Does This Mean?

Buy the dip, a term used when a trader decides to accumulate more of an asset when it is experiencing a price fall. Take an example, buying bitcoin now because the value has dropped almost by half of its all time high (ATH) value, this is “buying the dip”. It is quite believed that this term is only unique to a bearish market, it is not.

The highs and lows in a bullish market also presents its dip. Some traders even believe it is better to buy the dip in a bullish market when the trend is experiencing an ‘upward’ movement. Bear in mind the profit from buying the dip in a bullish market is not always as huge as when you buy the dip in a bearish market.

Buying the dip has its risks such as not being able to predict if the price decline or bearish trend is about to end in the current price or not. Entering the market at the wrong time might just lead to a loss.

Buying the dip seems to be a strategy to introduce newbies into the market because now that the price of the asset has dropped massively from its all-time high price. The bear market is the best time to also learn how to buy bitcoin.

Cut Your Losses

Cutting losses is a term that means selling an asset at time when its prospect are no longer feasible or futuristic to protect your portfolio and avoid losses. A decision to sell some bitcoin holdings because of the drop in price is referred to as cutting your losses. To most investors whose minds are pegged on long-term, cutting losses isn’t the best thing to do in a bearish market, they believe holding (Hodling) is the best way to accumulate more assets hence they are prone to buying the dip.

However, selling might just be the move to save you from skinning your portfolio or even losing all your investments on a coin on its way to being extinct.

Diversification

Diversification is a term used when exploring other options in the cryptosystem. The bear market offers you the option to explore other options by diversifying your crypto investment portfolio and buying altcoins known for solid used case with great growth potential. Now instead of putting all eggs in one basket, you can decide to increase your chances by buying these altcoins.

Instead of selling your bitcoin due to the price fall, you can sell part of your hodlings to acquire other assets. By doing this, you are reducing potential losses bound to happen when the price of bitcoin dips even further.

Prior to the bear run, a lot of businesses were beginning to adopt as well as people learning how to buy bitcoin. This meant the interests in the assets increased sporadically. However, the dip has in some ways discouraged newbies who found them loosing in their new found interest and just newbies but frustrated traders had to sell their assets and cut losses.

To some of these folks who experienced losses, buying bitcoin at the now might be a dumb decision but those long-term Hodlers know better due to their firsthand positive experience of buying the dip. The value of Bitcoin could still dip further down, but a good history of price recovery makes buying the dip a venture that could pay off.

Once upon a time people bought the dip in 2018 now, they have a good story to tell about the asset. Not a financial advice but now is the best time to buy the dip as well as regard other options of altcoins.