understanding turning point in the market is very import, especially to making a well informed trading decisions. Imagine catching every big moves in the market before it even begin. Imagine making every of your entry and exit with green. If that is what you want, then stay calm and read this to the end.

WHAT IS MARKET TURNING POINT ?

Market turning points are areas where we see market move from bearish to bullish and from bullish to bearish. Although these areas are not quickly notice by some people { beginner traders } and sometimes becomes very difficult making some good trading decisions. Most of the time, you find yourself entering the market only to find out that the market is moving against you, and you begin to reason if you are always unlucky or if the market/ your broker intentionaly move prices against your direction. No! the thing is; people don't pay attention to what is happening in the market per time. people don't care to know what we call MARKET CIRCLE. we will discuss more on this, and how to picture out weaknesses and strength in the market. We might not cover all the areas with this single piece, but we will discuss much more subsequently. For now, grab a cup of coffee, sit tight and read on.

UNDERTSTANDING MARKET CIRCLES

Am not a mind reader, but I know the question on your mind now might be; what market circles are ? well market circles are pattern and structures that prints or emerges during each market phase. understanding the the market phase/ condition you are, can help a lots in determining your trading decisions.so when you get to understand these, you no longer trade randomly or think the market is making random movement.

I will leave aside the normal understanding of the basics on consolidation, expansion and retracement. We will discuss the two major phases of the market you need to understand. And giving recognition to the understanding of the principles of supply and demand. therefore if you have known or been thought of the principles of supply and demand at any given time, { I won't stress myself discussing in details since its a common premise }. Utilizing the supply and demand model, we incorporate it into the concept of accumulation and distribution and we take it to our market recognition to the adjusting of our trading decision making approach.

ACCUMULATION AND DISTRIBUTION

the concept of accumulation and distribution is a game charger among many ways to analysing the financial market. this concept has a wider range which we will take into consideration as we will point them out in details in my next writing. But for now, I will make a brief explanation on accumulation and distribution.

accumulation and distribution is a concept where we can picture / catch a selling phase or buying phase. in other word, a demand phase and a supply phase. lets take a close observation of the example on the figure below;

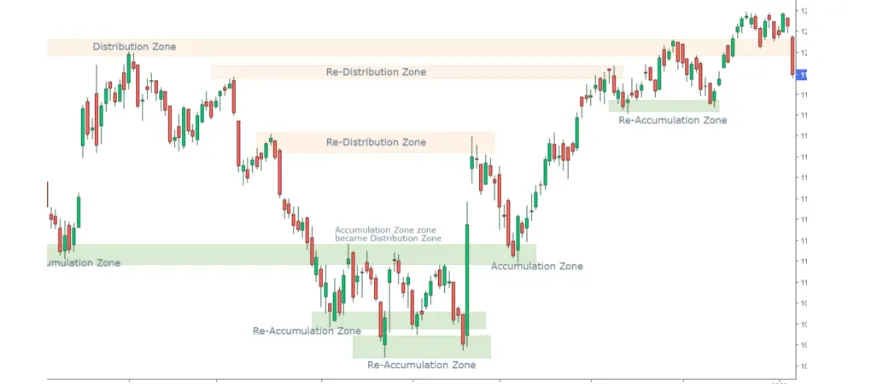

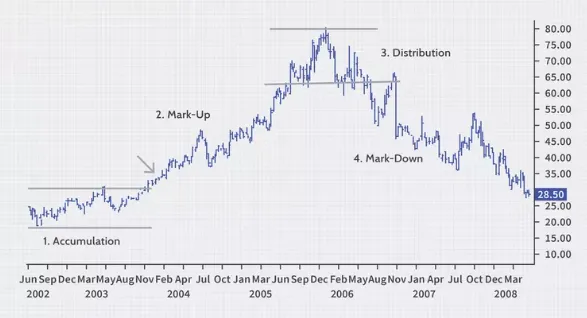

you can notice how the market moves from the accumulation phase by a quick rise in price moving into new territory. now lets discuss it clearer. The area annotated with green long rectangular shapes, are the accumulation/demand areas. During this phase, the market moves in a sideway direction, signaling lack of interest to either sides for a long period of time. the longer it takes, the stronger the moves will be. we can see how strong these moves took up with momentum to the upper new territory, signaling a change in market structure. the last lower candle was a quick signal to the market turning point. ok now lets examine the bearish structure;

you can see from the figure above how the distribution phase engineers a top that looks ranging. you can picture the signs of weakness from the next move up after a quick drop, the candle failing to break the previous highs. YOU can also picture a build up around these areas. and after when the distribution process is completed, and the market begins to drop in price with a long candles having wider spread, signaling a selling pressure, moving into a new downside territory. So guys with these I think you can figure your common mistakes when trading the market. In our next lesson , I will be outlining in details how to capture and master the market turning point with deeper delve into accumulation and distribution, with some trading strategies and sniper entries.

If you like this lesson and you want more of this, can I have your support with an upvote ? See you in our next lesson.