As a political science student I decided to give an insight on Central Bank Digital Currencies (CBDCs)

Introduction:

Introduction:

Central Bank Digital Currencies (CBDCs) have taken the financial world by storm, sparking conversations about the future of money. In this write-up, we will explore the transformative potential of CBDCs, their impact on monetary policies, financial inclusion, and the technological challenges that lie ahead.

Understanding CBDCs: Breaking Down the Basics

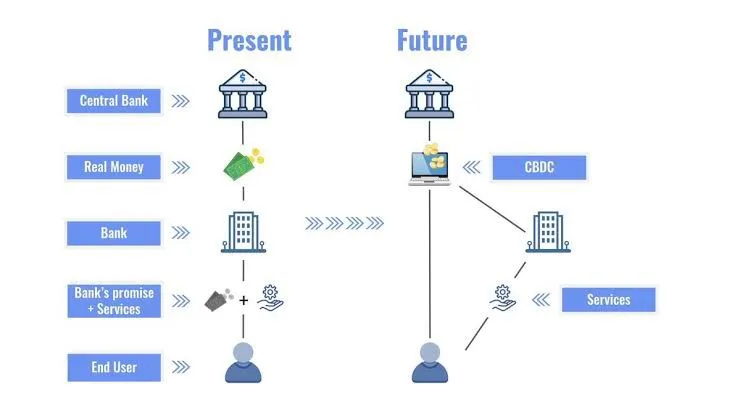

At the heart of this revolution are CBDCs, digital versions of fiat currencies issued and backed by central banks. We'll delve into their unique characteristics and how they differ from cryptocurrencies like Bitcoin.Designing CBDCs: Balancing Accessibility and Security

Creating a successful CBDC requires a delicate balance between accessibility for the public and robust security measures. We'll discuss the various design considerations that central banks must grapple with during implementation.The Promise of Financial Inclusion: Empowering the Underserved

One of the most exciting aspects of CBDCs is their potential to bring financial services to the unbanked and underbanked populations. We'll explore how CBDCs can bridge the gap and foster greater financial inclusion.Advancing Payments Innovation: Redefining Transactions

CBDCs have the potential to revolutionize payment systems, making transactions faster, cheaper, and more efficient. We'll examine the innovations that CBDCs can bring to cross-border payments and peer-to-peer transactions.Impact on Monetary Policy: Navigating New Avenues

The integration of CBDCs into monetary policy presents both challenges and opportunities for central banks. We'll discuss how CBDCs can shape economic stability and respond to financial crises.Ensuring Financial Stability: Addressing Potential Risks

As CBDCs become a reality, it's crucial to address concerns related to financial stability. We'll explore the risks associated with CBDC adoption and the measures needed to mitigate them.Collaborating in a Digital World: The Global Perspective

In a world increasingly reliant on digital currencies, international cooperation becomes essential. We'll examine how central banks can collaborate to establish common standards and foster interoperability.Learning from Early Implementations: Gaining Insights

Looking at early adopters of CBDCs, we can learn valuable lessons from their experiences. We'll analyze the successes and challenges faced by countries that have already launched their digital currencies.Embracing Technological Challenges: Overcoming Barriers

Implementing CBDCs is not without technological challenges. We'll discuss the hurdles to overcome, such as cybersecurity, scalability, and user experience, to ensure a seamless transition.The Road Ahead: A Digital Monetary Future

As we conclude, we'll reflect on the future trajectory of CBDCs and the transformative impact they can have on the global financial landscape. Embracing the potential of CBDCs can lead us toward a more inclusive, efficient, and resilient digital monetary future.

Conclusion:

Central Bank Digital Currencies represent a groundbreaking shift in monetary systems, promising greater financial inclusion, efficiency, and innovation. By addressing challenges and collaborating on a global scale, we can navigate the path to a digital monetary future, revolutionizing the way we transact and engage with money. The journey ahead is exciting, and CBDCs have the potential to shape a more inclusive and prosperous financial world for all