Dear reader, I know that when you read the word “tax” in the title, you immediately had unpleasant thoughts. Talking about taxes is never pleasant and it’s often considered as something not due or excessive.

Anyway, today, I would like to bring you something positive about this topic.

I want to share something that will be able to help you simplify some things of what the topic of taxes is about. If you follow me here on Publish0x, you will most likely be interested in topics related to the world of investing, cryptocurrencies, NFTs, DeFi (Decentralized Finance), trading, and why not, maybe even crypto-mining.

Especially if you live in Australia, you probably know that we are close to the end of the financial year. The financial year is a time period of 12 months used for tax purposes.

The Australian financial year starts on July 1st and ends the next year on June 30th.

At the end of fiscal year small business owners wrap up their books and begin finalizing their tax time paperwork and accounting. From July 1st through to October 31st individuals and businesses submit their tax return to the Australian Taxation Office (ATO), who use the information to determine how much tax you owe.

You too may have noticed that the topic of cryptocurrencies, along with everything surrounding it, has attracted increasing attention in recent years. Even between 2021 and 2022, a lot of new people have entered this field, both as long-term investors and as traders.

When we talk about investing our money, we should address attention taxes as well. Whether it is capital gain or capital loss, keeping track of all transactions is very important, especially if we want to avoid nasty surprises from authorities dedicated to tax control.

The ATO (Australian Taxation Office) released a statement ahead of the end of the 2021-2022 financial year on June 30, 2022, stating that cryptocurrencies are their key priority for the tax season. Making crypto assets one of its top priorities this financial year, the ATO said it will ensure the right reports are properly audited. Since crypto aspects are among the ones where the ATO sees taxpayers making the most part of mistakes, it makes it the area where more attention is paid.

This isn't the first time the ATO focuses on cryptocurrencies. They issued a crypto tax reminder letter to around 100,000 taxpayers in 2021. Many taxpayers will likely see similar letters after EOFY (End Of Financial Year) this year.

Here is where Koinly can help you!

Koinly can really simplify your taxes! And when I found it out, well, it was a nice surprise.

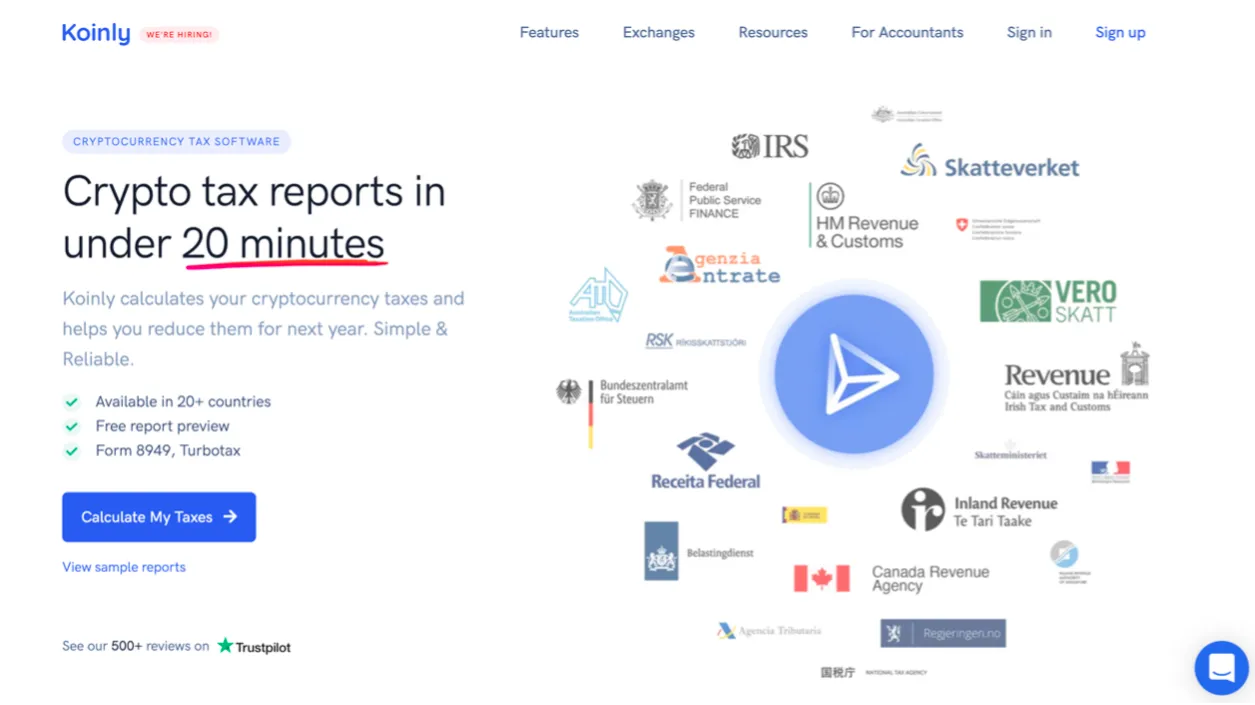

Koinly is a crypto-focused tax reporting app that can help you calculate all the taxes related to your crypto activities and even help you learn how to save some money on those tax obligations.

Koinly really seems to be what we need in this moment! This app helps cryptocurrency users manage taxes in over 100 different countries, and the software can generate a complete tax report for your cryptocurrency portfolio in less than 20 minutes.

Here a screen from the app!

These are the most common countries Koinly supports, but if your country uses any of their supported cost basis methods (such as FIFO, LIFO etc.) then they can help you with your crypto taxes! Their Comprehensive Tax Report is suitable for anyone looking to declare taxes, no matter which country.

It’s very easy because users can import their trades from the exchange to fully automate their tax calculations and even estimate capital gains tax for the entire fiscal year. That is what makes Koinly one of the most used and efficient software for beginners in its field.

First of all, let’s start from understanding how cryptos are taxed in Australia.

In most countries cryptos are classed as an asset for tax purposes. The Australian government does not consider Bitcoin and other cryptocurrencies to be currencies or foreign currencies. Instead, the ATO classifies cryptocurrencies as assets for property and capital gains tax (CGT) purposes. But depending on the specific transaction, cryptocurrencies can also be considered additional income and taxed as income tax.

Keep in mind that the ATO can track cryptocurrencies. If you have an account with an Australian Cryptocurrency Designated Service Provider (DSP) then the ATO most likely already has your details.

In Australia, you are required to pay capital gains tax and income tax on your crypto investments. The percentage of capital gains tax you pay is equal to your personal income tax rate, starting from income over $18,201. If you hold them for one year, you can reduce your capital gains tax on crypto gains by 50%.

You should also take into consideration which kind of investor you are since tax behavior will be different if you are a Long-Term Investor or a Trader:

- Long-term investor: the goal is to gradually increase the net worth over time through buy and hold of a portfolio investment instrument including cryptos. These kinds of people will pay capital gain tax and sometimes income tax. They usually buy crypto for themselves, rarely trade crypto and they expect a return over an extended period of time.

- Trader: the trader is the person who frequently buy and sell assets to make returns that outperform buy and hold performance. They take advantages of daily movements of the market to open and close positions. They usually pay Income tax, mostly.

How to get started with Koinly?

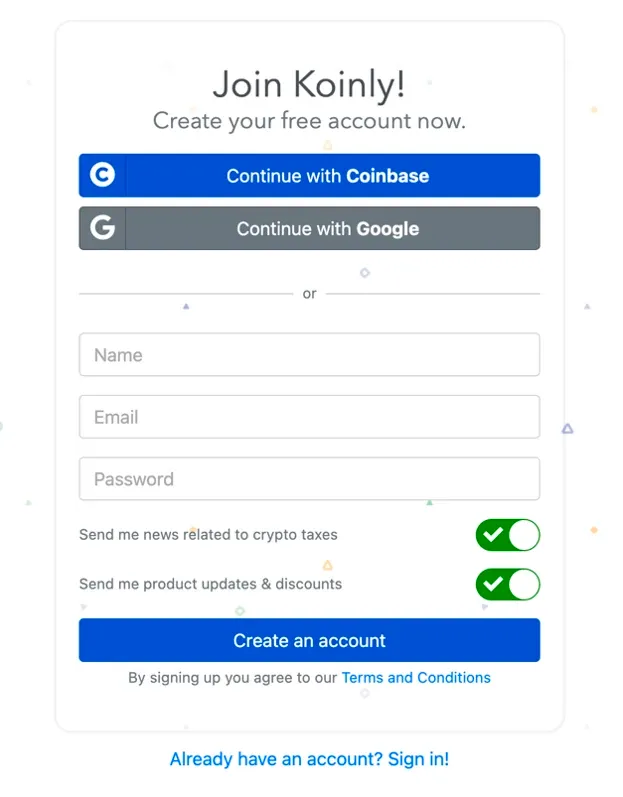

At first, visit their website Koinly and click on “sign up”.

We can sign up with Coinbase account, Google account or once we enter in our name, email and passwords, we will access the following page:

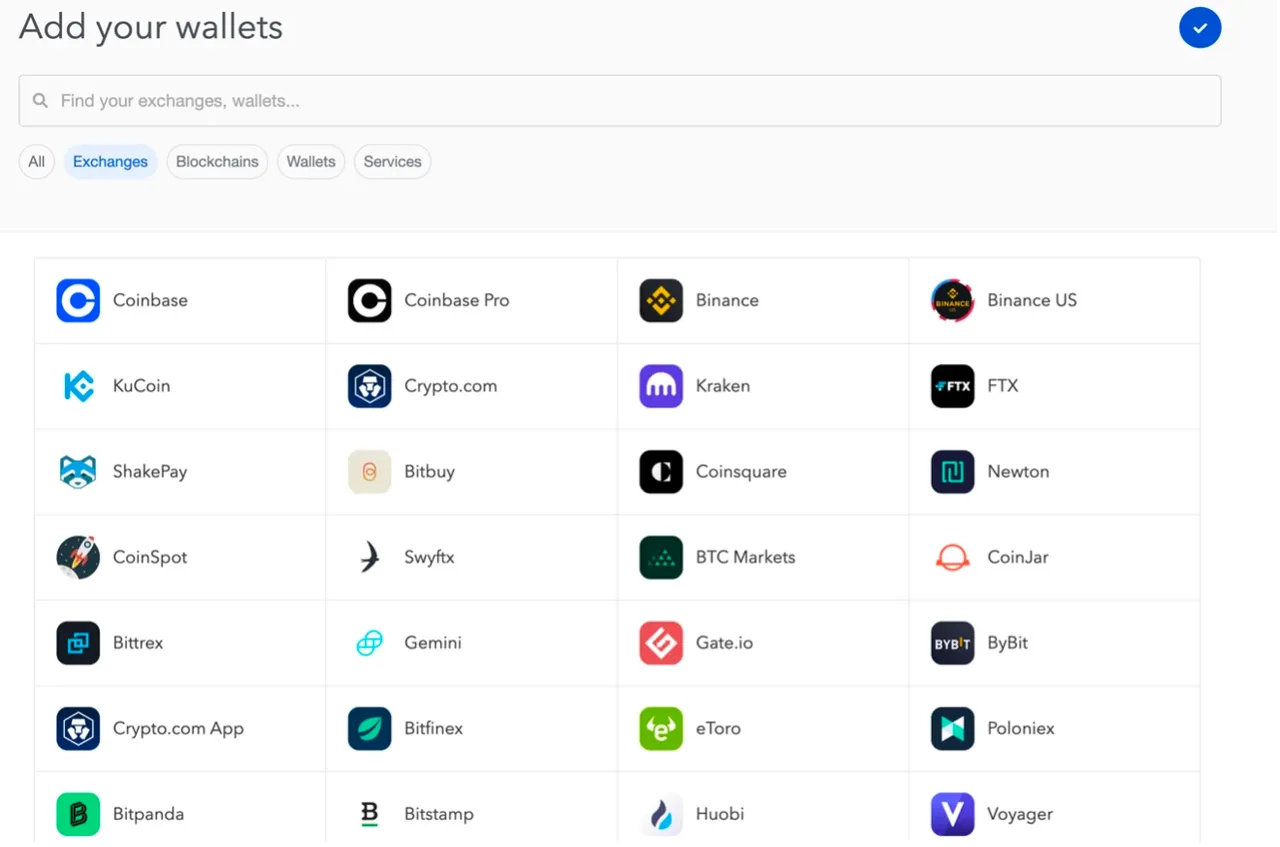

As you can see it asks us to enter which exchanges, wallets, blockchain or services we use and wish to connect. They support over 350 exchanges, 90 wallets and 20 services.

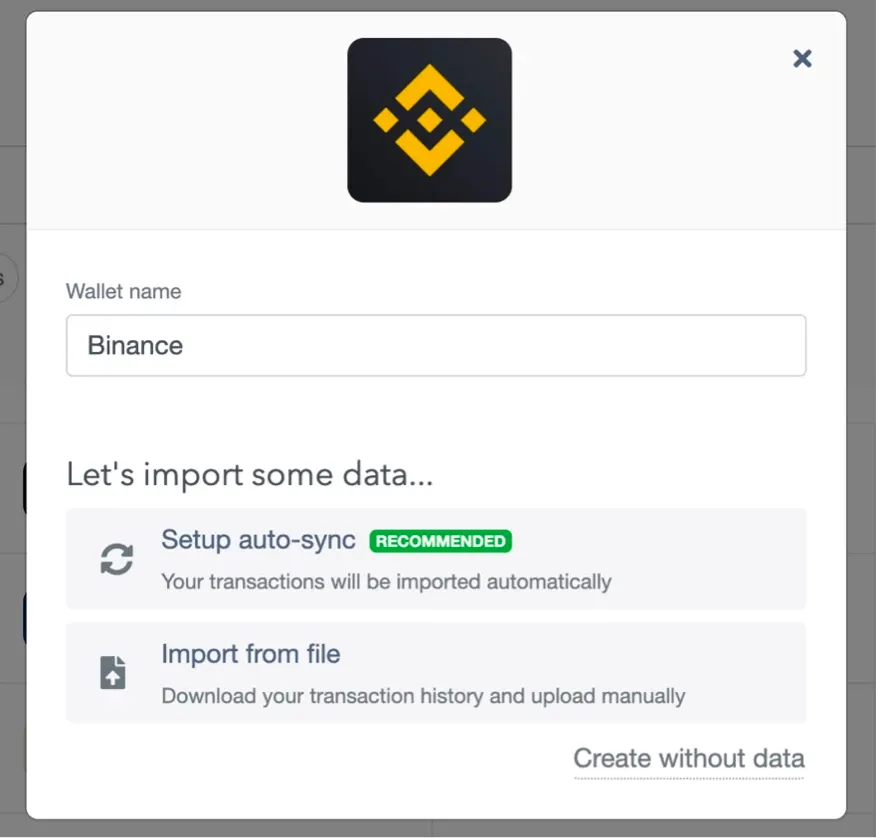

When you select the exchange or wallet you want to connect, Koinly will ask you to import the data. it is recommended that you select "setup auto-sync" to connect the exchange to Koinly via API and have the software automatically fetch all the transactions made.

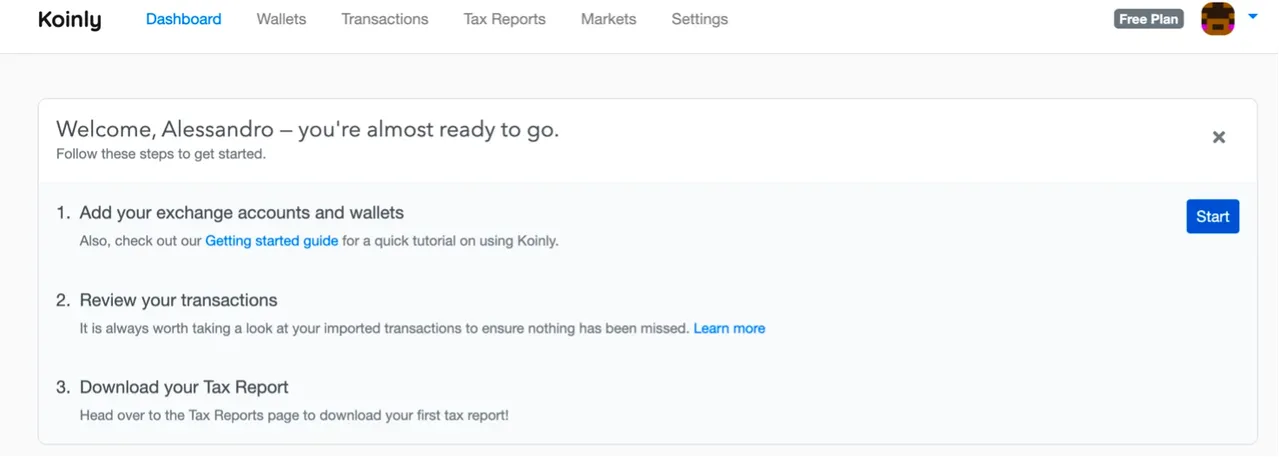

When you join Koinly for the first time, you can see a quick step by step guide into your dashboard.

On Koinly you can literally find any exchange or platform. All the major exchanges such as Binance, FTX, Kraken, Coinbase, KuCoin, Bittrex and many, many more are already listed here. Also the most important wallets are already listed such as: Metamask, Ledger, Trezor, TrustWallet, Exodus, MEW, Phantom. In addition, given the popular usage, many leading crypto service providers are supported and Koinly also integrates with crypto lenders such as Nexo and BlockFi. You can also use the platform to keep track of your portfolios by linking your Blockfolio, Delta, and CoinTracking accounts.

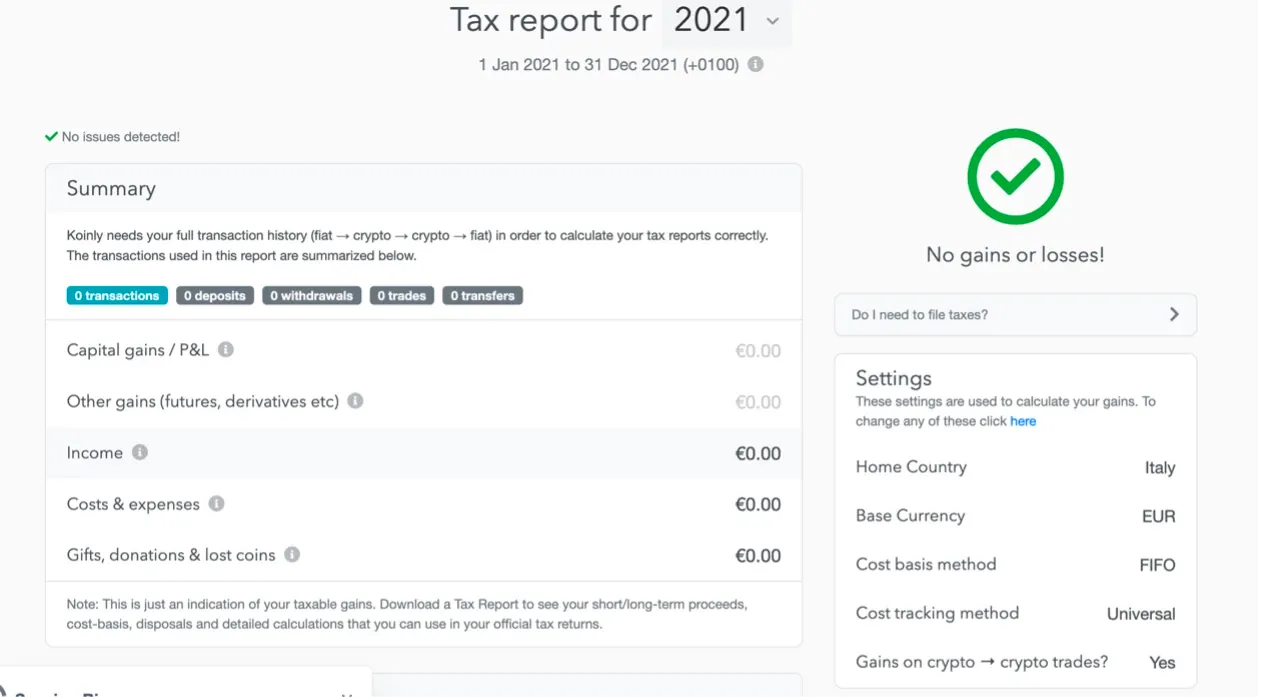

Tax Report

On this tab, we can see how it all looks simply and clear. There are all the info you may need, without filling the page with same old info that could be tricky to be found and identified correctly.

You may be wondering now: Mike, but I have never done these things, can Koinly be easily used by me as well? The answer is: sure!

The platform is primarily aimed at people who are already actively involved in different crypto related activities, like trading, staking, and lending. Therefore, Koinly may not cater to people who are just starting their crypto journey. However, the platform is useful for beginner or veteran crypto users and allows anyone entering the crypto field and start tracking the activity from day one. Koinly allows you to track gains and trades over the past five years, allowing more experienced traders to come back and easily report on what they've done so far.

The resources section helps educate users, and the Crypto Tax Guide is a convenient way to stay up to date on what's going on in your jurisdiction. Localized tax reporting also comes in handy, and error-matching features like automatic balance checks and negative balance warnings can help those less familiar with paying taxes.

How much does Koinly cost?

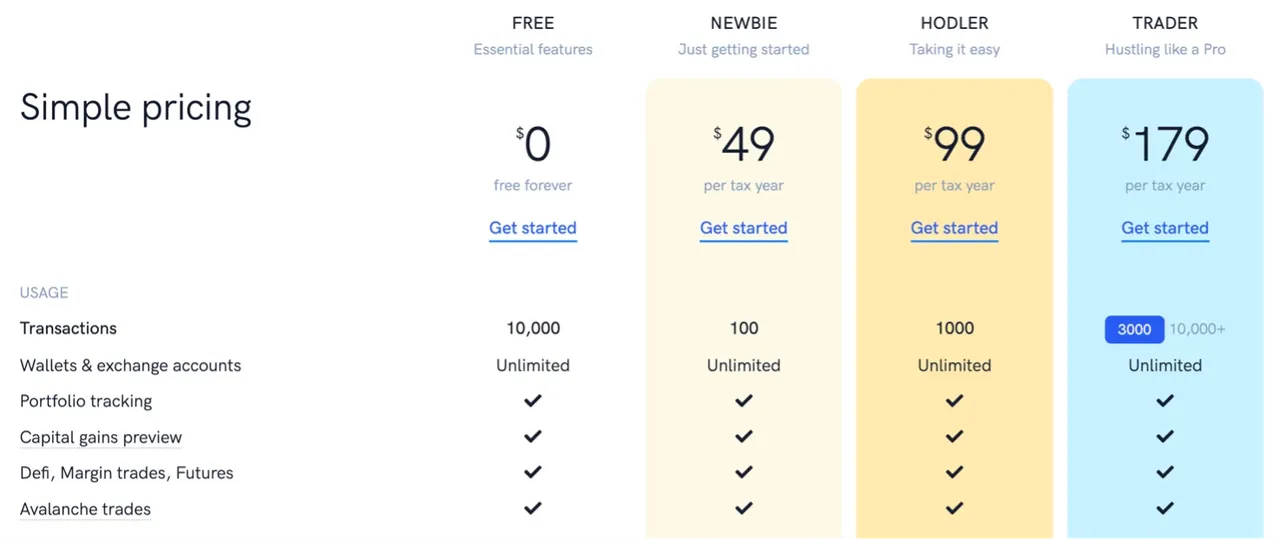

At Koinly we have a choice of 4 different plans with different features. Whether you are a beginner or a professional trader, you can find the plan that suits you best. Let’s look into them!

- Free Plan: everything you need for essential features. Of course, Koinly's free tier doesn't require any payment. The free version of Koinly still has access to most of the app's features, however, the main problem for free users is that the app doesn't allow them to generate tax reports. While you can import your entire cryptocurrency portfolio from all the different exchange accounts and wallets (up to 10,000 trades), there's not much you can do with the capital gains preview generated by the app. The free version of Koinly can often be used to estimate how much you will owe in taxes.

- Newbie 49$/year: The base paid version of Koinly costs $49 per year. The main additional feature you get with this entry level software is the ability to report your taxes from within the app. However, compared to the free version, your limit for tracking crypto transactions is reduced to just 100. Two additional features you get with this paid version are custom file imports for your crypto portfolio and a more in-depth cost analysis on how Koinly calculated your taxes. Best plan if you make only few trades per year!

- Hodler 99$/year: is basically the same as the Newbie tier, with the only exception being that you can import up to 1,000 crypto transactions rather than just 100. The Hodler version of Koinly costs $99 per year.

- Trader 179$/year: the trader plan is the top level and what you need if you are a pro trader with 3000 trades per year. You gain access to a huge number of transactions for tracking and full customer support available via email. The Trader version of Koinly costs $179 per year and will be most useful to traders who are moving in and out of different cryptocurrencies on a regular basis.

- Pro 279$/year: this top plan basically has the same features as the trader version. The only difference is that the transactions can also be more than 10.000.

If you want to see every single feature of the plans and choose the one that suits you best, you can find all the details on this page: https://koinly.io/pricing/

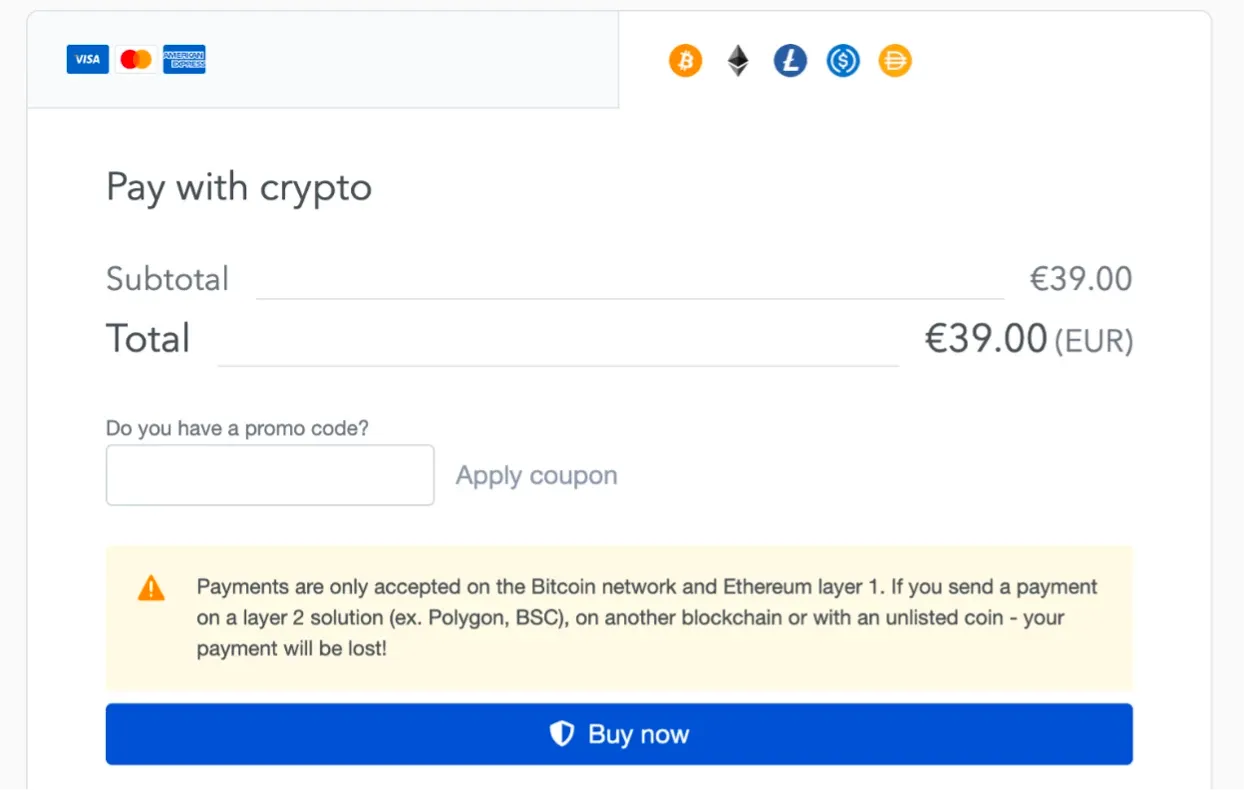

How to Pay

Koinly offers the possibility of making payments with cryptocurrencies, in addition to classic credit cards.

Here below a sample of payment (in Euro, since I am based in Europe).

Referral Bonus

When a friend purchases a Koinly subscription for the first time, you will receive a credit of $20 and they will get $20 off on their subscription. You can redeem credits on future purchases. To qualify, your friend must sign up using your personal referral link.

Is Koinly safe to use?

Yes. Koinly discloses security measures and best practices on its site that include:

- Product security: for passwords, Koinly allows authenticating via Google or Coinbase in which case no password is ever stored on Koinly. Users may also sign up via email in which case passwords are stored using a PBKDF function (bcrypt). API Keys & Blockchain Keys: all API/blockchain keys are encrypted using with aes-256-gcm before being stored in their database. Additionally, Koinly does not require any private keys or access to the funds on your exchanges.

- Application security: Koinly services and data are hosted on Heroku. Heroku is a cloud application platform designed to protect customers from threats. Access to customer data is limited to authorized employees who require it for their job. Koinly is served 100% over https service providers.

- Additional Security features: All employee complete security training and their contracts include a confidentiality agreement.

Koinly Support

Here is how you can contact Koinly for any question:

Email: hello@koinly.io

Open a live chat through the site.

Koinly offers an excellent service suitable for beginners and more experienced traders. One of the problems I often encountered in tracking my trading and all the various crypto investments, was precisely the problem of not having software that allowed me to have all the transactions of the various accounts brought together. The beauty of Koinly is that I can connect all my accounts, bring everything together in one place and already have a report ready to use at the end of the tax season, so I can avoid nasty surprises from the government.

That is why I would recommend Koinly especially to all people with no experience in tax management who want to have a tax report in few minutes.