BitMEX Guilty Plea

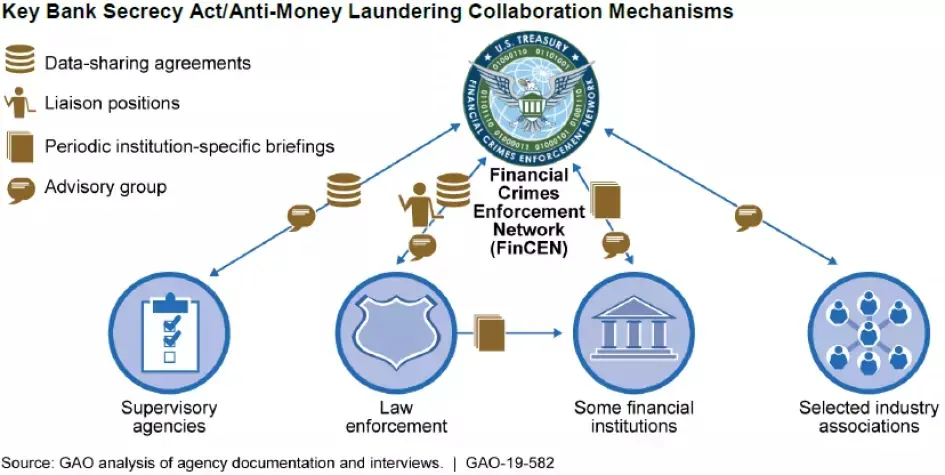

BitMEX, a prominent crypto and derivatives exchange platform, admitted on Wednesday to violating the Bank Secrecy Act (BSA). The BSA, established in 1970 and also known as the Currency and Foreign Transactions Reporting Act, aims to combat money laundering from illegal activities, including drug trafficking and terrorism financing, alongside other forms of financial crime.

Failure to Implement Adequate Anti-Money Laundering Program

According to the U.S. Attorney’s Office for the Southern District of New York, BitMEX willfully failed to establish an adequate anti-money laundering (AML) program, thus breaching U.S. regulations. This oversight allowed the platform to be exploited for illegal activities such as money laundering and sanctions evasion.

U.S. Attorney Damian Williams stated:

"From 2015 to 2020, BitMEX operated as one of the world’s leading cryptocurrency derivatives platforms without a significant AML program as required by federal law. This omission turned BitMEX into a conduit for large-scale money laundering and sanctions evasion, posing a serious threat to the financial system's integrity."

BitMEX’s Response

A BitMEX spokesperson told Cryptonews that the charges are old and the platform has since restructured its operations. They clarified:

"These charges relate to actions up to September 2020, already addressed by our founders who were sentenced in 2022. BitMEX has since overhauled its operations, and there is nothing new in these charges."

The exchange also mentioned accepting the charges and plans to request an expedited sentencing hearing, arguing that no additional fines should be imposed.

Legal Consequences for BitMEX Executives

BitMEX has faced significant legal challenges in the U.S. since 2022. By the end of 2022, prosecutors sought a 12-month probation sentence for Greg Dwyer, the former head of business development, for violating the BSA. Earlier that year, co-founder Arthur Hayes received a six-month home confinement sentence following his guilty plea, while fellow co-founder Ben Delo was sentenced to 30 months of probation. As part of their plea agreements, each co-founder was required to pay a $10 million fine, equating to their financial gains from the offense.

Violation of AML and KYC Regulations

The Department of Justice stated that BitMEX and its executives were mandated to implement an AML program with a Know-Your-Customer (KYC) component for their U.S. operations. However, they deliberately ignored these requirements, only requiring an email address for access to exchange services.

The indictment detailed that from November 2014 to at least September 2020, BitMEX continued serving thousands of U.S. customers despite claiming to have exited the U.S. market in September 2015 to avoid compliance with U.S. laws. The executives knew their policies to prevent U.S. users from accessing the platform were ineffective or easily bypassed, prioritizing revenue over legal compliance.

The executives took deliberate steps to exempt BitMEX from U.S. regulations, including AML and KYC, despite being aware of their legal obligations due to their U.S. operations. To circumvent AML laws, BitMEX altered the stated purpose and nature of a subsidiary, presenting it as a bank to move millions of dollars through the financial system.

Pending Sentencing

BitMEX’s sentencing is still pending under the jurisdiction of U.S. District Judge John G. Koeltl in the Southern District of New York (SDNY).