Hey folks, so if you’re crypto-twitter feed looks like mine, you’ll know that we’re very much in airdrop season. Many companies have been waiting to finally release their airdrops for when the market has been ramping up, and so since the market has finally been ramping up, it comes to very little surprise that one of the most anticipated airdrops, LayerZero’s $ZRO, was finally teased this past week:

I’ve written about several different strategies last month about different ways to engage in LayerZero tech that might help you qualify, but out of the several dozens of different protocols you can engage with, in today’s article I’m going to go through the different reasons why I think Altitude and their native token $ALTD has potentially one of the biggest upsides to gain from what might be one of the biggest airdrops of the 2024.

Let’s dive in shall we?

Altitude still has some of the highest APRs out there:

As you can see from the graphic above, Altitude has literally dozens of pools that are offering double-digit returns on blue chip assets. To note, these rates are relatively high due to low levels of liquidity, but one of the reasons why liquidity is so spread out is because it utilizes isolated chain paths which increase security.

My take: The rates on Altitude are incredible, but one of the primary reasons is due to low liquidity. As the bull market continues to ramp up, I would keep track of the APRs, as you may be getting a smaller slice of the pie once liquidity comes rushing in.

Altitude’s liquidity pools have no impermanent loss

In a normal liquidity pool when two or more different assets are paired, if one of the token’s price appreciates while the other one remains stagnant (or decreases) the LP holder experiences impermanent loss because they miss out on the gain they would experience had they solely held the appreciating-price token.

On Altitude, all of the liquidity pools are paired apples-to-apples, or in other words, because there’s only a single asset that can be transferred throughout each isolated chain path, LP holders would experience the full price-appreciation (or loss) of the asset that they are supplying.

Low Fees and 100% going back to $ALTD stakers

Apart from rebalancing and reward fees (which help rebalance respective sides of different pools), Altitude has only a 0.05% (5bps) fee for transfers, all of which go back to $ALTD stakers. If you take a look at some of the other biggest LayerZero bridge competitors, Altitude has one of the lowest rates out there:

AltitudeDefi — 5

Stargate.Finance — 6

PancakeSwap — 25

SushiSwap — 30

My take: If you really are considering to start accumulating a bag of $ALTD for the next bull market, currently you can only stake $ALTD on Ethereum Mainnet, so assuming that we’ll see exponentially high gas fees in the next coming months, I would only consider staking your $ALTD if you have a significant amount to do so.

Low Marketcap = Great Potential for price appreciation

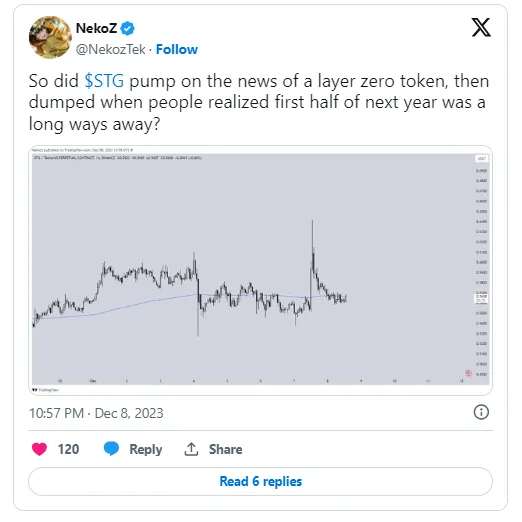

Once news came out from LayerZero about a token coming out in the first half of next year, we saw a significant pumping $STG (Stargate Finance’s native token and LayerZero’s flagship bridge) going from around $0.55 cents to around $0.65:

In other words, $STG’s Fully Diluted Valuation increased by more than a $100 million dollars in a matter of minutes. If the same were to happen to $ALTD, considering that the FDV of $ALTD is currently only at $1.12 million, even a $10 million dollar pump in liquidity could do a 9x to $ALTD’s coin price.

Of course on the other side of that coin, a low marketcap also means that price action could also swing wildly down, but looking at $ALTD’s current price at nearly all-time lows, I would say that we’re most likely at the floor now:

Conclusion

Getting into any low marketcap coin is risky, and $ALTD is no different. However given the fact that (at the time of writing) it appears that $ALTD has bottomed out, I imagine that we’re down to the hodlers now that are waiting for adoption to finally gain some traction.

And as always, thanks for taking the time to read this and be sure to follow me on twitter (https://twitter.com/CryptosWith) to get all my latest updates. Also, looking for a gift for your Crypto-loving/hating friend? Give them a REKT journal to cheer them up!

Disclaimer: And as a final reminder, this is not financial advice and this is for educational and entertainment purposes only. Please as always, do your own research and find what investments are best for you. Cheers everyone!