Hey All,

We are currently seeing a blood bath in crypto market and as per coinmarketcap - The global crypto market cap today is $1.03T, a 3.56% decrease as compared to Yesterday i.e. 2nd March, 2023. All the major crypto coins has taken a hefty beating and are trading in red down 4 to 5% and even more. Is it safe to say that this crypto crash has something to do with the recent news around where U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler chairperson put forth/proposed rule around Crypto Exchanges not necessarily are 'qualified custodians'. "If a crypto trading platform claims to be a qualified custodian doesn’t mean that it is a qualified custodian. And we need to be wary about it.

What is does it mean to be Qualified Custodians?

According to Paxos Qualified Custodians are those entities or institutions that are approved by regulators to HODL assets on behalf of their clients. A simples example would be - Bank which are classified as qualified custodian.

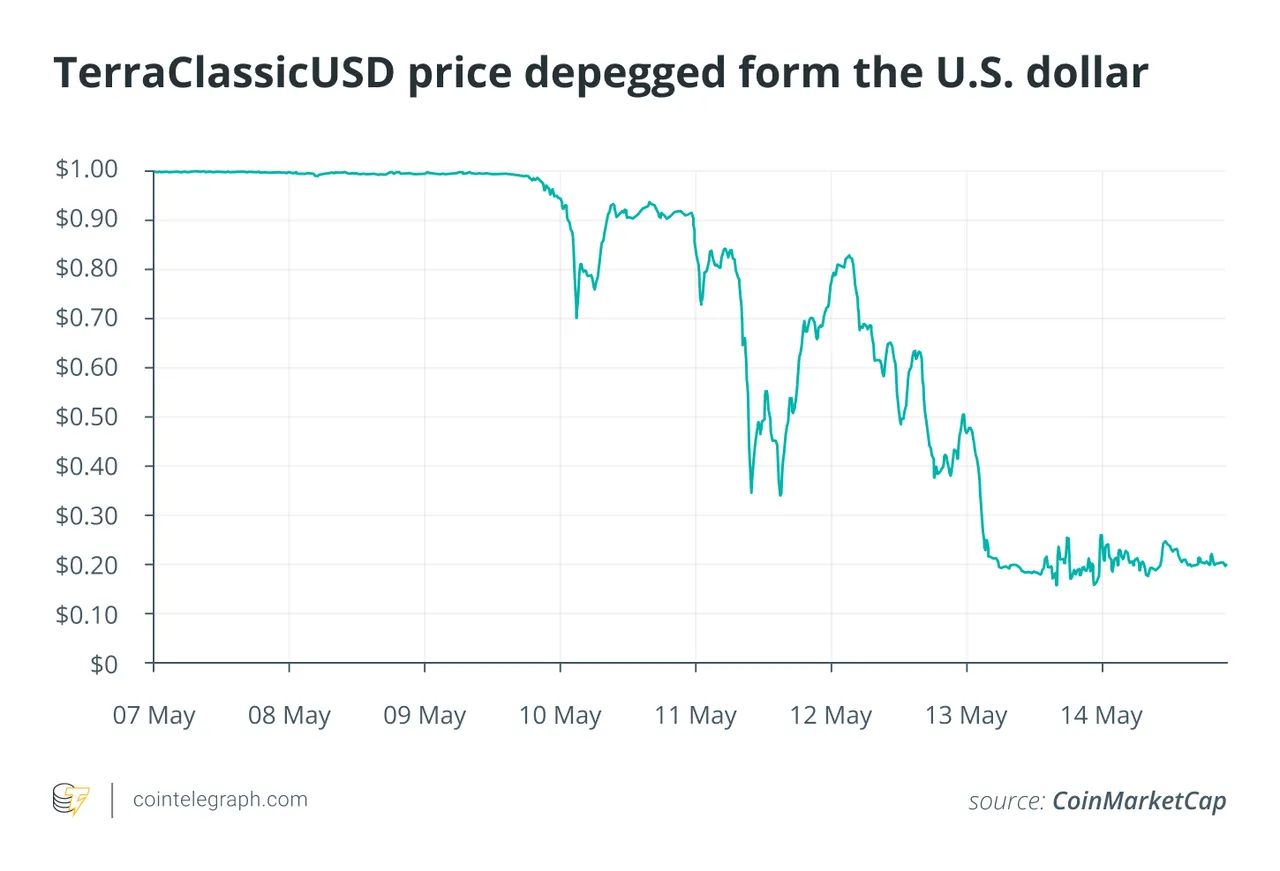

This news of Crypto exchanges not necessarily being Qualified Custodians brought all the negative sentiments in the market and hence we are seeing all this chaos and panic selling across the major coins. Gary Gensler goes on to further attack how the crypto trading and lending operates generally today and are not favorable for investment advisers and they cannot rely on them as qualified custodians. This all is coming from around the recent crypto bankruptcies i.e that happened in 2022 - Collapse of cryptocurrency exchange FTX, TerraUSD/LUNA collapse and many others to follow. Biggest crypto collapses of 2022 that the industry would like to forget - check here.

No doubt, 2022 was a bumpy ride for the entire cryptocurrency market but then we cannot deny the fact that this space is an emerging technology associate to Blockchain and as time progress we could see things streamed lined. We cannot just go out there pushing for Rules and making it complicated for people who are pushing for these emerging technologies for mass adaption. Users very well know - How to safe guard and manage their funds. We can ask this same question for Banks as well. What is the implication if a Bank goes bankrupt? We have seen in past Banks going Bankrupt and the governments coming out with the rescue packages for them. For examples the bad debts which are in Billions of dollars.. And the users can also say that why are Banks given the stamp of Qualified Custodians - when they themselves are causing Billion of dollar losses in the form of bad debts etc etc.. I would like to close this post on a note that governments should be open to understand the technology and see how we can adapt it in our current systems as opposed to making it complicated for technology to be mass adopted... cheers

SEC- Crypto Exchanges not necessarily Qualified Custodians

#sec #gary #qualifiedcustodians #custodians #crypto #cryptoexchange

Image Credits:: twitter,

Best Regards