So the year is almost over and it's time for a short recap of what happened and some goals for 2022.

You can read my 2020/2021 post HERE.

Source

While 2020 was good for me, it can't even compare to the success I had in 2021. The year started with GameStop short squeeze which started the mainstream interest in "meme" stocks/coins, and while I personally wasn't positioned well in any of them, I think it still helped to fuel this year's bull run.

The trade I'm most proud of is 18,011% on Koinos (KOIN), from $0.009 to $1.63 (I haven't sold everything at ATH, and my average price is higher than 0.009, but that was my first purchase). I had a strong conviction in KOIN ever since I started mining it started in late 2020, and it's no surprise it's my largest holding (at 41.5%).

The best trade percentage-wise was Auto Farm (AUTO), from $30 to almost $14,000 at ATH (46,466%). Of course, I didn't time the top perfectly, so I made ~150x on it. But it was the first large win of 2021 and it gave me enough free capital to do more degen trades later.

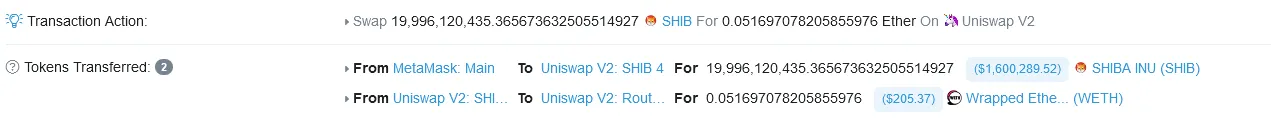

The worst trade was selling 19B SHIB for around $70. At ATH, it would be worth $1,600,000.

I was very lucky and didn't have any major losses (I lost a lot of unrealized gains, but not my actual capital), I had a few bad days, but I think all losses were under $10k. My biggest loss was probably not even trading related, but bad calculation when I tried to "hunt" front-running bots, and one arbitrage bot took all my money (it was only a few % of the overall portfolio, but it was still hurtful).

In total, I made a 1,519% gain on my portfolio. One of my goals from 2020 was to make 250k and buy a house, and while I still don't have a house, I'm happy to say I reached (and exceeded) the goal.

You can find more of my investment theses here: https://github.com/fbslo/investment-theses

While I wasn't very active on Hive (only 3 posts), I was working for/with a few of the largest dApps (LeoFinance, Splinterlands...). I also focused more on yield farming and other multichain DeFi strategies.

So on December 31st, 2021, my crypto portfolio looks like this (coins worth more than 1%):

| Coin | Amount | Price (USD) |

|---|---|---|

| Koinos | canz5Ir6yXXJHVr0acvM3g== | 0.768079 |

| Hive | /V3NeddeKbRaY6xI1XiTOQ== | 1.57 |

| Delta neutral positions | cpHZC7ZpwK84c2hOxbMRGQ== | 1 |

| TerraUST | fknnI24Unw+ruMJdt6ZHNA== | 1 |

| ThorChain | iC/SgdKsvv89Ld1qcjaFww== | 5.97254 |

| AlephZero | 5UDtI0X/xPbrVP4WGF4zNQ== | ~0.85 (OTC only) |

| WooTrade | zaCNN5Dv5RNlAkBdRN8kSQ== | 0.899759 |

| LeoFinance | ndUQkbEoB0kMVke5irhf2w== | 0.242231 |

| Nexus | 7+Sk5eTPUiObQwWN1ROvHQ== | 61.37 |

| USD Coin | Do0v/6TuxudRUPGnXJHSjg== | 1 |

| Splintershards | bUCugt9008uLC4EGKJAY7g== | 0.240124 |

| Binance USD | 84gbAncRLSrRL6Q/qK92uA== | 1 |

| Polkadot | bSkUSdYyMtLWt7+xJIvVNg== | 27.7 |

| Alice | h6JBG1Jy4rw7ZClWhuRN5w== | 12.87 |

| Bitcoin | AxHn01JMq+GAcxD0ap7b8w== | 48060 |

| Monero | tG8gIeKQhM0+0vs/9j8E8A== | 232.88 |

Amounts were encrypted with https://aesencryption.net/, and are for used my personal accounting (decentralized backup, if my excel spreadsheet fails)

You can see my last years portfolio here.

While crypto is 97% of my investments, I hold the remaining 3% in gold (and some silver and cash).

I would like to improve my trading infrastructure (better arbitrate & trading bots, trade execution...)

P.S. My HIVE price prediction of $2.5 was hit, while LEO didn't perform as well as I expected.